Equity Essentials Solution Set

Software designed to help emerging VC and PE firms grow

FIND OUT MOREWe help private capital managers simplify how you work so you can effectively scale your business via integrated, cloud-based solutions.

Request a Demo Watch Case Study

Our award-winning fund accounting software, portfolio monitoring solution, and out-of-the-box investor portal help GPs of all sizes streamline back-office processes.

Learn More

Our accounting and reporting solutions allow fund administrators to more efficiently service and better communicate with their clients.

Learn More

Our industry-leading credit investment management solutions can handle even the most complex of needs for private debt GPs, CLO managers, banks, and others.

Learn MoreAllvue’s solutions eliminate the boundaries between systems, information, and people, helping decision makers get the information they need – when they need it.

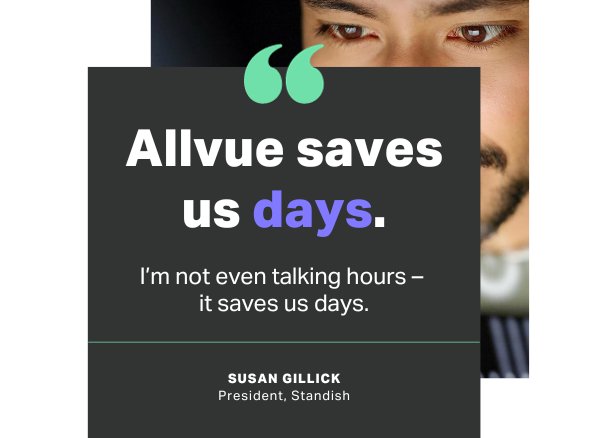

See ProductsJoin the group of investment industry leaders reaching new heights with Allvue, including ...

Fill out the form below and we’ll reach out to talk more about how Allvue can help your business.

Allvue’s industry-leading solutions can help your business break down barriers to information, clear a path to success, and reach new heights in alternative investments.