By: David Lazar

Product Manager - CLO & Public Credit

February 15, 2022

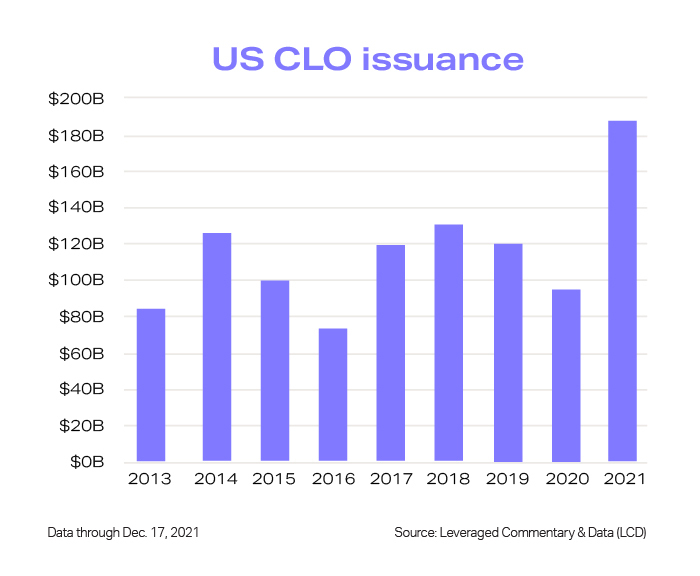

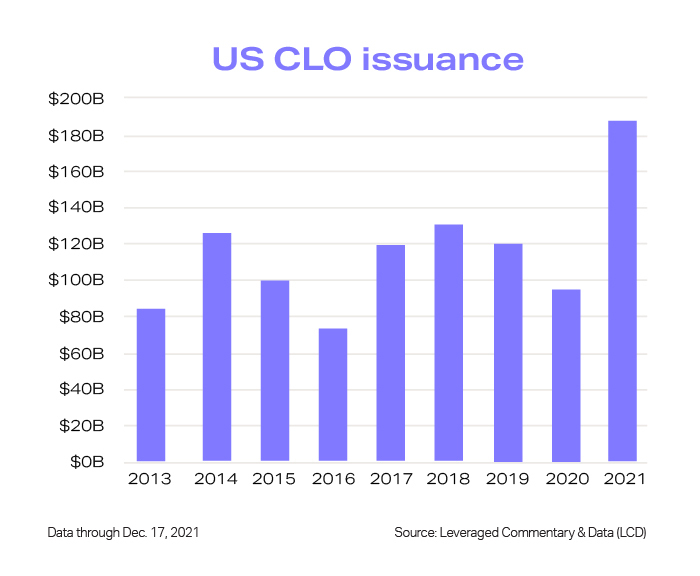

In the last few years, the collateralized loan obligation market, or CLO market, has come of age and developed into the mature entity we see today. In 2021 the global CLO market claimed its $1 trillion milestone, split roughly between 80% U.S. and 20% European CLOs. Despite naysayers pessimistic outlook after 2020 challenges, CLOs have continued to grow, now reaching a size where investors can no longer ignore it as an investment grade asset class.

In this guide, we’ll dive into collateralized loan obligations, exploring their meaning, structure, function, the pivotal role of CLO managers, the historical context, risks, returns, and much more.

What are Collateralized Loan Obligations?

Collateralized Loan Obligations, or CLOs, are complex financial instruments that play a vital role in the world of finance, especially for those investors keen on investment opportunities in the CLO debt and CLO equity market. They represent a significant part of the structured credit market and have garnered immense attention over the years. But why are CLOs so important?

CLOs are the financial vehicles that transform various types of loans, including leveraged loans and bank loans, into securities. These securities, often divided into CLO tranches, including debt tranches and equity tranches, are then sold to investors, making the CLO structure a critical bridge between borrowers and investors.

Structure, Components, and Purpose of CLOs

CLOs are not just financial jargon; they have a well-defined structure, consisting of various components with a specific purpose.

- CLO Assets: These are the underlying assets, primarily loans, that form the core of the CLO. They include a mix of leveraged loans, often categorized as senior secured loans, and may span various industries and sectors.

- Debt Tranches: CLOs are divided into different tranches, each with its own risk-return profile. The tranches include senior, mezzanine, and equity tranches, offering CLO investors varying levels of risk and potential returns.

- Equity Investor: Equity investors are at the bottom of the payment hierarchy. They bear the first losses but also have the potential for higher returns if the CLO performs well.

- Cash Flow: The cash flows generated from the underlying loans are distributed to CLO investors in a specific order, starting with senior tranches and moving down to mezzanine and equity tranches.

Responsibilities of a CLO Manager

CLO managers have multifaceted responsibilities that revolve around the effective management of the CLO portfolio:

- Asset Selection: They carefully select the underlying loans that will become part of the CLO’s collateral. This decision impacts the CLO’s risk-return profile significantly.

- Portfolio Management: CLO managers actively manage the CLO’s portfolio, making decisions about buying, selling, or restructuring assets to optimize performance.

- Cash Flow Management: They ensure that cash flows from the underlying loans are distributed correctly to the different tranches of investors, following the payment hierarchy.

- Risk Mitigation: CLO managers play a crucial role in monitoring and mitigating risks within the portfolio. Their decisions can impact the overall risk profile of the CLO.

- Compliance: Compliance with regulatory requirements and adherence to the CLO’s governing documents are paramount. CLO managers ensure that the CLO operates within these guidelines.

3 Habits of a Successful CLO Manager

CLO managers contributing to this expanding market rely on scalable, integrated platforms and outsourced operations to make this growth possible. But resources are only part of a great manager’s success story – it’s also about their management strategy.

Here are three highly valuable habits that set the average CLO manager apart from the milestone-makers.

Habit 1: Secure Equity funding for issuing new CLOs

The surprising success of 2021 and the early market challenges of 2022 has left bank analysts pessimistic about CLO volume for the remainder of the year. Projected new-issuance ranges between $155B – $160B, a drop of 14-17% YOY but still an increase of 52-55% compared to 2020’s $90.23B.

The CLO market is highly tiered based on track record and perceived manager skill; the best and largest managers have much greater access to equity investors, which is a key constraint and driver of CLO issuance growth. New managers who have built a strong platform and track record have seen tremendous growth. Other managers have taken a different approach by engaging in strategic partnerships with lenders to raise equity to support significant growth.

Habit 2: Gain Operational efficiency and profitability via outsourcing

As CLO managers are entering (or re-entering) the space and launching new CLOs, many are encountering the challenge of scaling their accompanying loan operations.

CLO management is very labor-intensive, requiring setting up complex assets and accruals, managing notices and pay-downs, reconciling cash and positions, and settling loan trades. For each of their CLOs, managers will typically also tie out compliance results and the underlying positional information against a trustee report on a monthly basis – an incredibly tedious process.

Because of this, many CLO managers are starting to recognize the strategic benefits of outsourcing loan operations/middle-office functions. Outsourcing is an attractive alternative to the large footprint of hiring and growing an in-house team of loan operations staff. As hiring costs and overhead increase, many managers I speak with are increasingly viewing loan operations as a commodity, finding it more cost-effective to outsource this part of their business. This P&L equation has received increased scrutiny since a CLO platform requires significant scale to be profitable.

CLO managers also see a clear benefit in the flexibility of an outsourced model as their scale and corresponding business needs change. An outsourced loan operations model frees up managers to focus on alpha-generating decisions and hiring to climb the CLO manager rankings and thereby attract investors and lock in favorable liability spreads.

WATCH Allvue in Action: Simplifying Data Collection

Habit 3: Invest in scalable, well-integrated CLO management technology solutions

To reach the scale necessary to achieve profitability, CLO managers of all sizes are increasingly recognizing a need for applications that are well-suited to the nuances and complexities of their business. Many managers with existing proprietary systems are recognizing the advantages of buying versus building by embracing the trend towards cloud-hosted vendor applications, which includes the added benefit of expensing vendor fees to their funds.

CLO managers with vendor systems that are not well-suited for the needs and complexities of the CLO space are seeing major bottlenecks and the need to invest in applications that can handle their growth.

Streamline collateralized loan obligation management with Allvue

Allvue’s powerful CLO software was specifically built to cover the full investment lifecycle needs of CLO managers. Key features include support for streamlined loan trading (including integrations with leading execution venue and settlement systems), modeling interest and principal waterfall payments, and a robust CLO compliance calculation engine with native support for pre-trade, post-trade and hypothetical trade scenarios. Our investment accounting and loan servicing offering were designed specifically for the nuances of CLO loan accounting and trade settlement and is seamlessly integrated into the front-office – a gap in the offerings of many of our competitors.

Managers have also realized the added benefits of having a single well-integrated solution that can handle their front-, middle-, and back-office operations. A single solution streamlines increasingly core functions like data management and reporting, eliminating the inefficiency and redundancy stemming from poorly integrated disparate systems.

Building on our success with the largest managers (19 of the 25 largest CLO managers currently use Allvue for their CLO business) we have recently launched new solution offerings specifically targeted for the needs of start-up, small, and mid-sized managers. Growing managers can take advantage of offerings aimed at their specific needs with confidence, knowing that our modern technology can handle their expected growth.

More About The Author

David Lazar

Product Manager - CLO & Public Credit

David Lazar is Product Manager for CLO and Public Credit at Allvue, managing the product roadmap for the business line. David was on the Professional Services team at Black Mountain Systems for 7 years, which included overseeing the Portfolio Compliance Implementations team. Prior to joining the company, he spent two years as a Business Consultant at Eze Software Group. He is a CFA Charterholder and holds Masters of Arts and Bachelors of Arts in Economics degrees from University of California, Los Angeles.