By: James DiCostanzo

Sales Director

November 6, 2023

Private equity, as a whole, experienced a rough year in 2023. As is often the case, that effect was largely compounded for emerging managers.

While enterprise-level GPs were able to use their sheer size as a shield against some of the macro-economic headwinds, emerging managers weren’t as lucky.

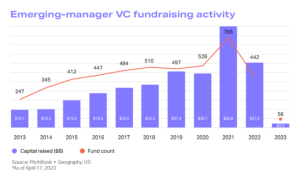

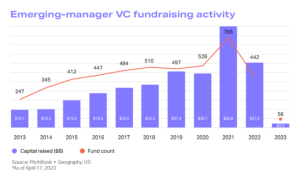

This theme can perhaps best be epitomized in the major drought in fundraising emerging managers saw in 2023 – a broader theme across private capital and asset management industry for the year, but especially pronounced in earlier-stage smaller funds.

There are a few early indicators, though, that suggest 2024 might hold more promise for emerging managers. While we’re not necessarily forecasting a whole-scale swing back to the heyday of 2021, we see a few promising signs on the horizon – and have a few predictions for how fund managers will be positioning themselves to make the most of these opportunities.

Here, then, are the key trends we expect to see for emerging fund managers in 2024.

#1: Prepare for the return of fundraising

While it is too early to say definitively, fundraising looks like it could finally begin to climb out of the deep hole of 2023.

Evidence has so far been largely circumstantial, but our team noticed a definitive change between H1 2023 and H2: fundraising started to come up a lot more in conversation with prospects and clients. More importantly, those client conversations about fundraising are really all about 2024 planning. So while fundraising numbers might stay low in the short term, a number of emerging managers seem to be positioning themselves for fundraising opportunities across the course of 2024.

#2: APAC drives an increasingly global marketplace

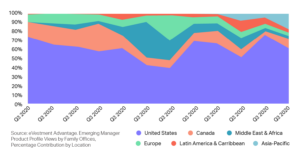

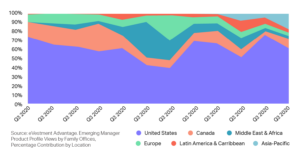

While the US still represents the most engaged player in the emerging manager space, the last few quarters have seen a shift back towards a more global marketplace.

This shift represents a substantial contribution from across the globe, but with the biggest increase netted by the Asia-Pacific region.

This diversification could prove to be an especially essential bulwark against one of the biggest challenges facing emerging managers, and what, unfortunately, looks set to continue into next year – and thus is our third trend . . .

#3: LPs will likely still be hesitant to invest with emerging managers

Even if fundraising swings back up across the private equity industry, emerging managers will still have their work cut out for them. The broader macro-economic headwinds facing the private capital space will make investors more skittish. As such, rightly or wrongly, it will make them less likely to invest with emerging managers and more drawn to established, enterprise players.

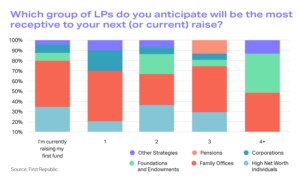

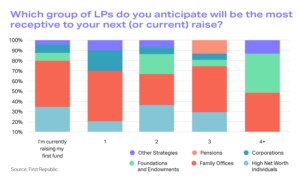

Managers will, therefore, have to shift to different LP types in order to find new commitments. One big area of opportunity seems to be family offices. Per a survey from First Republic, family office are expected to be an especially receptive group across emerging managers of all sizes.

Pivoting to new asset classes of course comes with its own unique set of challenges. As Pitchbook notes, while family offices are a good match for emerging managers given their long-term investment horizon, many of them, given the current climate, are also exercising a healthy amount of scrutiny and extending out the evaluation stage before making commitments. This slower pace, obviously, can prove challenging for emerging managers desperate for new commitments.

#4: Value creation, and therefore data collection, will be key

Here’s a simple formula that can go a long way towards explaining the current environment: High rates make for low valuations which make for poor exits. As a result, more managers are holding investments on their books for longer, leading to a record $3.7 trillion in dry powder sitting around.

But, now that the broader market is facing more headwinds, simply holding onto those assets isn’t enough. The market won’t lift them up on its own, as it did during the previous boom. Instead, managers need to have a clearly defined value creation plan. And to be able to assess the progress and accuracy of that plan, they need to have strong data collection processes in place.

Being able to easily pull in a wide variety of data from disparate sources and condense it onto a single platform, where it can be sliced and diced and fed directly into other aspects of the lifecycle, is increasingly essential. Investment managers need to be able to quickly and easily dig into their data in order to tell what is working and isn’t and respond in a timely fashion.

Finally, here’s another formula that could go a long way towards explaining key 2024 trends: a substantially higher amount of assets being held for a significantly longer time makes for an IRR killer. As such, it’s likely a number of fund managers and investors alike will move away from IRR as a pure measurement of success in the year ahead. DPI could easily become more relevant, and, undoubtedly, the flexibility to put DPI next to IRR, or next to unrealized gain/loss, and filter by asset or security or fund, will be essential when making the case to investors for why they should consider a commitment.

Prepare for the challenges and opportunities of 2024 with Allvue.

Allvue’s Equity Essentials solution set is designed specifically to help emerging venture capital and private equity managers supercharge their growth. We’ve taken the same award-winning accounting, reporting, and investor communication solutions leveraged by some of the leading GPs in the industry and made them available to emerging managers.

Reach out today to learn how Allvue can help you simplify your data collection processes, simplify fund accounting workflows, and more.

Want to know more about what to expect from private capital in 2024?

Check out our other 2024 trends content:

More About The Author

James DiCostanzo

Sales Director

James DiCostanzo is a global sales leader with over 20 years of experience in the financial, private equity and SaaS industries. He is currently the Global Head of Growth Equity Sales at Allvue Systems, a leading provider of investment management solutions. He joined Allvue Systems in March 2020 as the Head of Sales for the East Region, after working at Thomson Reuters for nearly two decades in various roles, including Head of Solution Specialists, Data & Analytics and Global Business Director. He has a bachelor’s degree in Business/Managerial Economics from SUNY Oneonta. He is based in the New York City Metropolitan Area and can be found on LinkedIn at https://www.linkedin.com/in/jamesdicostanzo/.