By: Kamil Godlewski

Product Manager

April 22, 2022

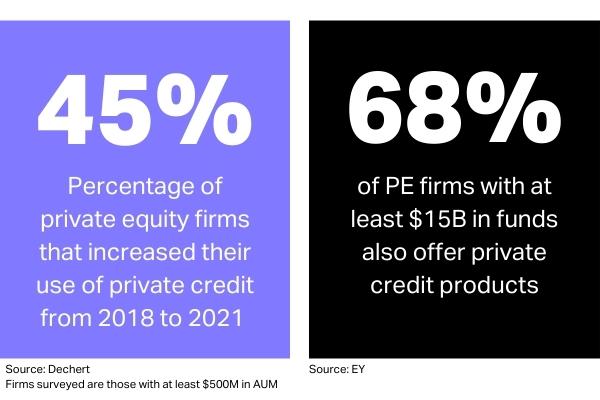

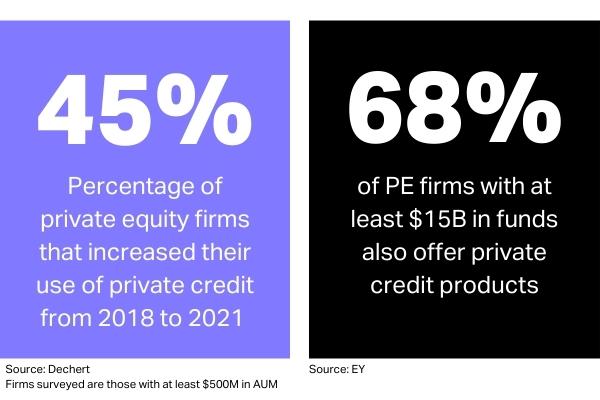

Private markets overall have been gradually expanding over the past decade, and the growth isn’t limited to the equity space. In fact, the private debt market – now the third-largest private capital asset class – has surged by a factor of 10 since 2011. And the equity and credit markets aren’t exclusively siloed; more private equity firms are expanding into credit.

Today’s increasingly complex private capital industry requires sophisticated, multi-purpose tools that enable general partners and fund administrators to manage private debt and private equity portfolios in one consolidated back office.

To address that growing need, we designed the Allvue platform so that our Credit Investment Accounting subledger integrates seamlessly and securely with our Fund Accounting general ledger. Here’s a look at the key benefits of our solutions – the only platform that can allow private capital managers to manage their credit and equity portfolios in a single environment – and how Allvue helps reduce risk and add hours back to your day.

A fund accounting solution built on a true general ledger

Allvue’s Fund Accounting platform serves as the cornerstone of your back office.

Our platform combines several powerful features: partnership accounting, detailed financial statement reporting, a true dual-entry general ledger built to support multi-currency transactions, and workflow standardization. The software also automates complex processes, from waterfall distributions and equity pickups to partner transfers, debt interest accruals, and more.

Other features include:

- Investor-level allocations: Fund- and investor-level books and records maintained in one system

- Comprehensive and customizable reporting: Detailed Financial Statement reporting and investor reporting (e.g., PCAP), available via out-of-the-box reports or customizable dashboards and reporting templates

What makes Allvue’s Fund Accounting solution different?

Allvue’s Fund Accounting solution stands apart from the competition due to three key features:

Our true general ledger system includes subledgers, giving you greater detail. Our fund accounting system is built on a true general ledger, giving you a powerful platform designed to meet the needs of your workflows, but where we stand above our competitors is with our subledger capabilities. Our cash and vendor subledgers allow you to see a truly detailed view of your data, at a level other competitors can’t provide. And by offering a fully-integrated system with a single source of true data, we can help ensure data accuracy so that you spend less time scrubbing data and worrying about avoidable errors and more time acting as a partner to your clients.

Our technology is built on Microsoft’s enterprise framework. This allows us to leverage Microsoft’s continued R&D investment to build a platform that keeps you on the cutting edge. Rather than requiring our clients to go through cumbersome and costly upgrades, our cloud-based software keeps you at the forefront of technological progress – even as the forefront continues to evolve.

Our platform is capable of handling every private capital asset class. We know that private equity managers are building more complex portfolios to stay ahead in a competitive marketplace. Our system allows them to freely evolve their investment strategy while still maintaining simple workflows.

READ MORE: In Conversation with Lionpoint Group: The Future of Fund Accounting

Investment Accounting software for today’s sophisticated investments

Allvue’s cloud-based Investment Accounting solution is designed to ensure proper accounting checks and validation for every transaction while providing the ability to calculate accruals, cash flows, and P&L at the lot level. The platform supports multiple asset classes – including private debt, broadly syndicated loans, multi-currency revolvers, unitranche loans, and delay draw terms loans, among others – and is regularly reviewed to ensure the inclusion of new asset types.

Other features include:

- Operational control for complex assets: Processes for loans, restructures, paydowns, rollovers, and more

- Agency support: Flexible statement generation and management tools for loan agents

What makes Allvue’s Investment Accounting solution different?

Our reporting capabilities turn data into insights. Flexible reporting options are integrated directly into the platform, and open architecture allows you to input and export data from the system more easily. And the pre-calculation and storage of this data at the time of entry instead of during report generation means users can generate reports more quickly.

Our platform is robust and scalable. Built from the ground up to be real-time and transaction-oriented, the solution supports proper accounting validation in place on every transaction. It’s also designed to grow with your firm, so deployment, scalability, and maintenance are simple, as is real-time integration with our other solutions.

Our technology is designed for accuracy. Dual-record accounting provides natural cross-checks – preventing benchmarks such as outstanding receivables from going unnoticed, which can result in realized lost revenue.

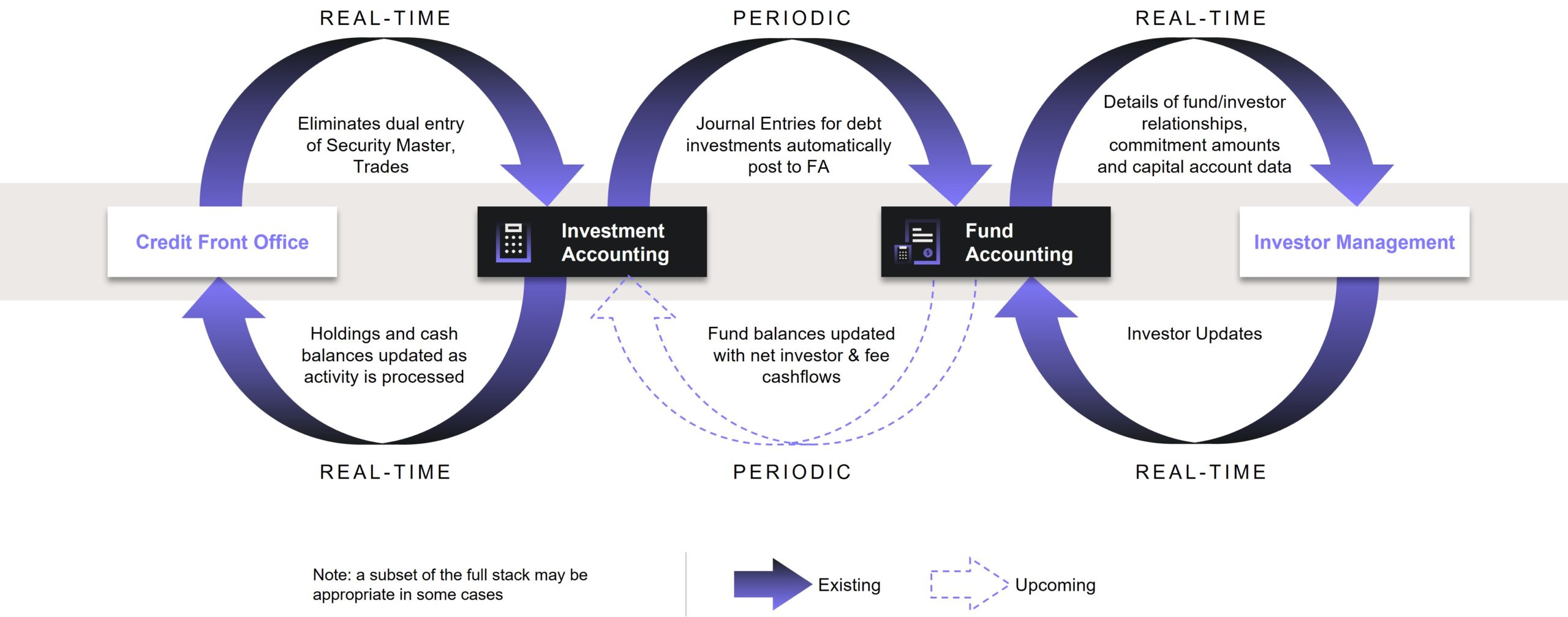

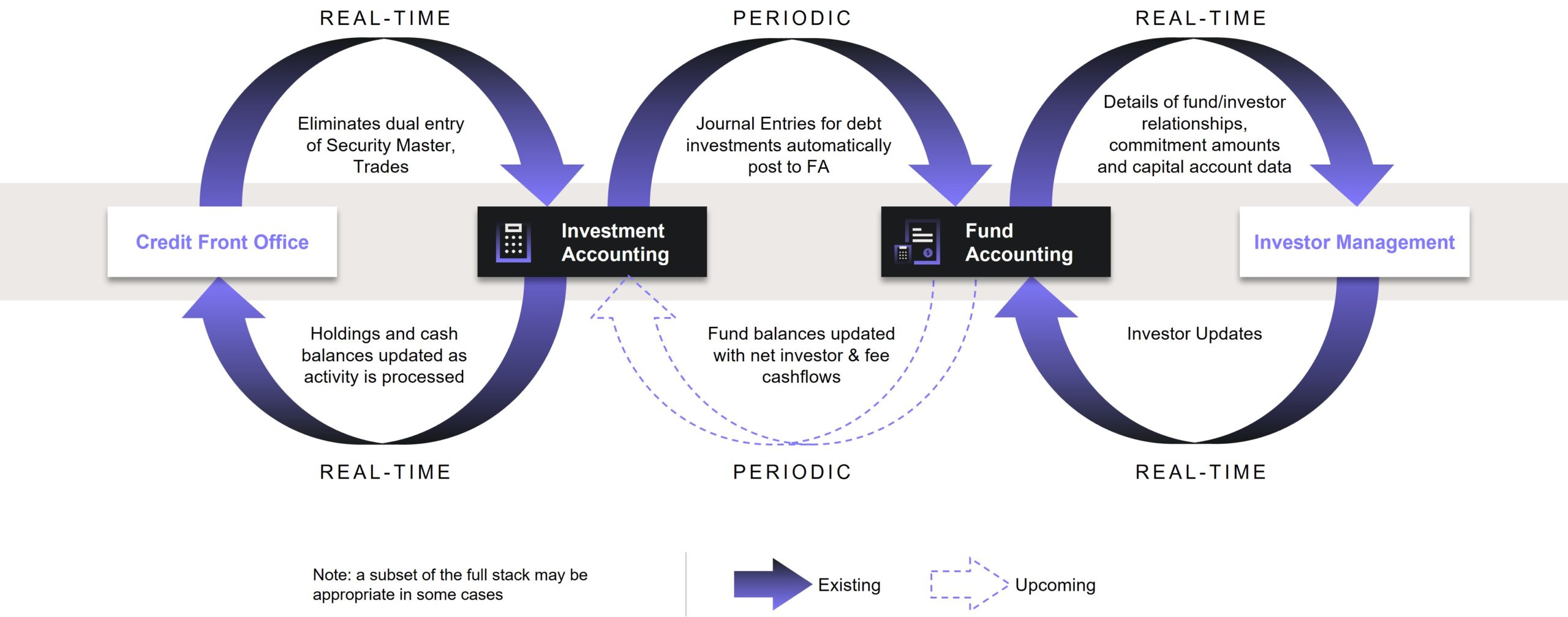

How the platforms work together

When a client uses both the Investment Accounting and Fund Accounting software solutions, data is systematically integrated between the tech stacks as needed for the functioning of the overall solution.

Details of fund/investor relationships, commitment accounts, and capital account data can move between systems in real time. As needed, journal entries for debt investments automatically flow into the fund accounting system. This workflow provides a seamless chain of information from the credit front office through investor management.

READ MORE: Best Practices for Upgrading Private Equity Software

Allvue allows you to have operational control over complex assets like Multi-Currency Revolvers, Unitranche Loans and Delay Draw Term Loans, PIK interest loans, and more. Our customizable dashboards let you create reminders and view detailed position history to better manage your assets. You can also automatically generate subledger entries, which then get integrated into your chart of accounts and general ledger in Fund Accounting.

In addition, our Investment Accounting solution provides the opportunity to offer agency support with notice generation functionality, facility and contract level details in the user interface, and push-button reporting directly into Excel.

Finally, the consolidated back-office is good for your team’s productivity and peace of mind. The cross-functional solution allows us to maintain the same security master, portfolio information, and transactions across portfolios. By keeping these in sync, we’re reducing any risk of duplicate entry or mismatched data.

If you’re interested in learning more, request a full platform demonstration or reach out with questions.

More About The Author

Kamil Godlewski

Product Manager

Kamil Godlewski is a product manager at Allvue Systems, a leading provider of investment management solutions. He has over 15 years of experience in finance and sales, working with various clients in the alternative investment space with an emphasis on private equity. He has a MBA in finance from Indiana University's Kelley School of Business and is a previous CPA license holder.