By: James DiCostanzo

Sales Director

September 7, 2021

For many new and emerging venture capital fund managers, 2020 was a challenging year. The initial market turmoil brought on by the pandemic saw many LPs retreating to their corners and trusting old habits rather than taking new risks.

Similarly, the new virtual environment did emerging managers no favors. Venture capital is, largely, a business built on trust. For many first-time fund managers, those in-person fundraising meetings have historically been key opportunities to establish that trust with potential investors, show their passion and capabilities, and build a lasting connection. Zoom calls, while easier to schedule, are often less impactful.

The good news is that, for a variety of reasons, 2021 is shaping up to be a banner year for emerging managers.

The move to a hybrid workspace means that many managers are starting to conduct some of those in-person meetings again. And, even more importantly, the current fundraising environment is starting to open some new and exciting doors for first-time and emerging managers.

We’ve collected four charts below that help highlight a few of those factors.

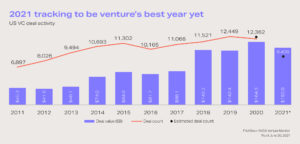

#1: 2021 is tracking to be venture capital’s best year yet

The venture capital market is hot and getting hotter. In fact, according to Pitchbook, VC fund performance has outperformed all other asset classes globally when looking at 1-year and 3-year horizon IRR.

This has led to more and more investors piling into the space – and looking for funds to invest with. Undoubtedly, established funds are still seeing the lion’s share of these inflows, but the volume is such that it’s created one of the most competitive environments for LPs in the history of venture capital.

That’s pushed LPs to look beyond the big, established names and to take a bet on new and emerging managers.

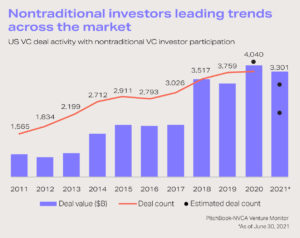

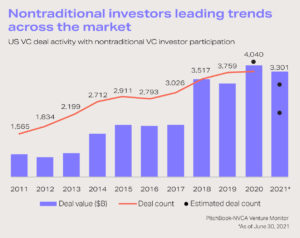

#2: Nontraditional investors are pouring into the market

The other side-effect of all that outperformance is that investors who might have previously been uninterested in VC are now turning their attention towards it.

As the above chart shows, nontraditional investors have participated in almost as many details at the end of 2Q21 as they did for all of 2020. This is a boon for emerging managers for two reasons. One, it helps foment that competitive environment mentioned above. And two, nontraditional investors are often interested in nontraditional managers, as detailed more below.

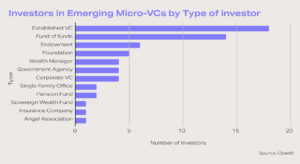

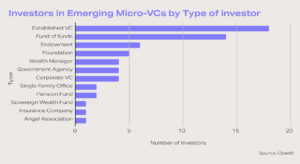

#3: Introducing a new class of LPs

“There is a broader set of asset allocators that have entered the LP market in venture over the last three to five years,” Alex Nwaka, principal at Touchdown Ventures, told Venture Capital Journal.

That broader set of investors will have a different investment appetite than traditional investors, pushing them to look beyond established firms in order to meet their needs.

Ultimately, as Nwaka explained, this trend “presents a real opportunity for a lot of emerging managers and new managers to participate.”

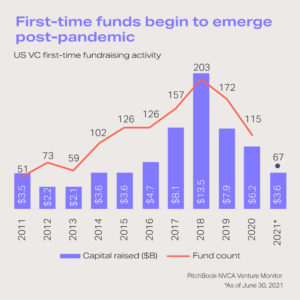

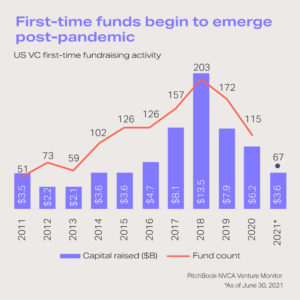

#4: First-time funds are starting to gain traction

All of this adds up to a compelling opportunity for first-time and emerging fund managers, as is being borne out by the data. The above chart shows how, after a pandemic-induced slump in 2020, first-time funds are set to return to an upward trajectory by the end of 2021.

Even with the right market conditions, though, these new and emerging funds have a challenging climb ahead of them. It’s not easy to grow in such a fast-moving marketplace, where they have to keep up with ever-increasing investor demands and stay competitive with established firms leveraging only a fraction of their resources. Managers need tools that can help support their goals.

Supercharge your growth with Allvue

At Allvue, we’ve created a set of accounting, reporting, and investor communication software solutions that’s specifically designed to help new and emerging venture capital firms grow. Discover which Equity Essentials solution set is right for you.

More About The Author

James DiCostanzo

Sales Director

James DiCostanzo is a global sales leader with over 20 years of experience in the financial, private equity and SaaS industries. He is currently the Global Head of Growth Equity Sales at Allvue Systems, a leading provider of investment management solutions. He joined Allvue Systems in March 2020 as the Head of Sales for the East Region, after working at Thomson Reuters for nearly two decades in various roles, including Head of Solution Specialists, Data & Analytics and Global Business Director. He has a bachelor’s degree in Business/Managerial Economics from SUNY Oneonta. He is based in the New York City Metropolitan Area and can be found on LinkedIn at https://www.linkedin.com/in/jamesdicostanzo/.