Equity Essentials Solution Set

Software designed to help emerging VC and PE firms grow

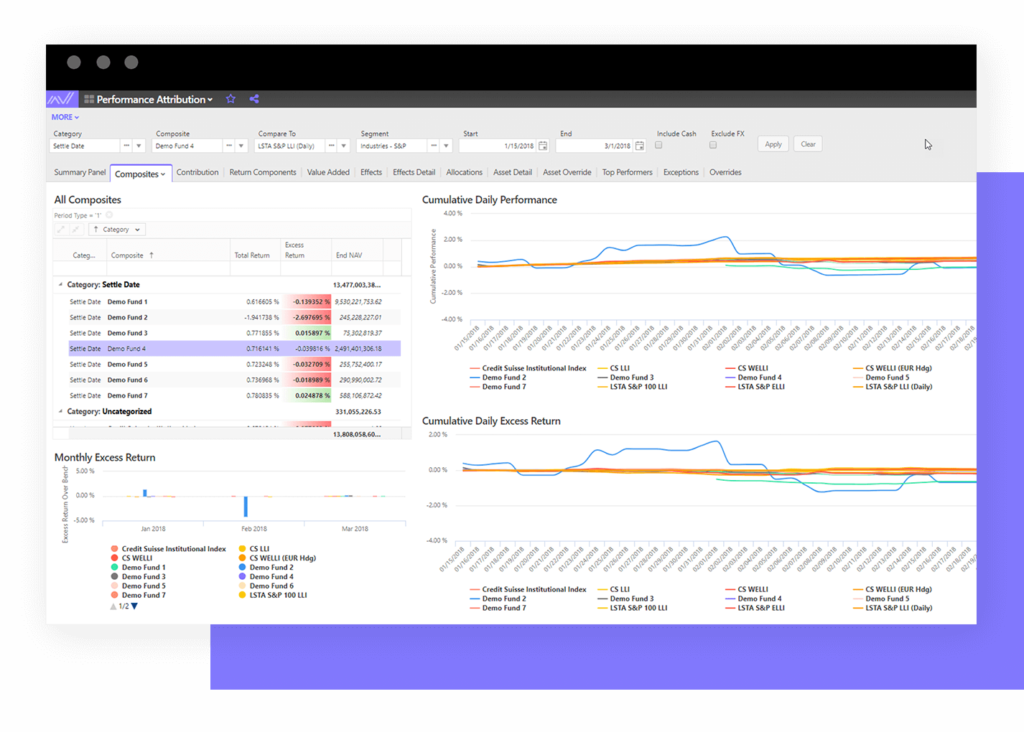

FIND OUT MOREInvestment performance attribution calculations based on allocation and selection effects

Learn MoreOptimize asset performance by measuring efficiency based on allocation and selection effects, using GIPS-compliant and industry-standard methods. With Allvue’s performance attribution software, you can get a better view of overall ROI and increase the consistency of your investment strategy. Offered only with our Investment Accounting solution for your portfolio performance attribution needs.

With Allvue’s solution, you can enhance your investment performance attribution process for high level supervision of investments at lot level.

With seamless integration with our Front Office solution and third-party systems you will:

Handle loan nuances, including paydowns before settlement, unfunded positions and other activities not handled by traditional attribution systems

Automatically highlight data gaps that would cause inaccuracies in return calculations

Geometrically link returns in real-time to allow custom date range or period analysis

Compare composites and indices across any number of dimensions

Access out-of-the-box support for slicing by asset, issuer, strategy, asset class, Moody’s/S&P industry & rating, and country

Calculate daily hedged and unhedged performance for any investment grouping

As an extremely flexible workflow and rules engine built using the .Net framework, Allvue’s Credit platform excels at communicating with other systems and technologies, storing and operating upon disparate data within its abstracted security master and data warehouse, and automating the workflow and bespoke processes that add operating efficiency and reduce risk.

Fill out the form below and we’ll reach out to talk more about how Allvue can help your business.

Allvue’s industry-leading solutions can help your business break down barriers to information, clear a path to success, and reach new heights in alternative investments.