By: Kamil Godlewski

Product Manager

March 3, 2023

Our primer on co-sourcing explains why the new fund manager and fund administrator relationship structure is stirring up so much attention.

What is Co-Sourcing?

In private equity, co-sourcing is an operating model between fund managers and fund administrators where a fund administrator executes its client’s accounting and reporting workflows through that client’s software system instance. The client is able to then keep their data in-house, while still outsourcing the administrative burden.

Co-sourcing: A hybrid fund administration model

Traditionally, many private equity fund managers have approached administration as a binary choice – something that they either do in-house or that they outsource entirely. The debate between the two is well-known within the industry, with the pros and cons of each firmly established. Doing work in-house can be cumbersome and manual, but it gives funds control over their data. Outsourcing lets fund managers focus on portfolio management and building client relationship, but they lose easy access to their back-office data.

A new option, though, has been becoming increasingly popular in recent years: co-sourcing. With co-sourcing, a GP still outsources to a fund administrator – but the fund administrator executes its client’s accounting and reporting on that client’s software instance.

This means that funds can maintain control of their data while accessing the best technology, practices, and staff from third-party administrators.

In this in-depth primer, we examine the differences between the various administration models, explain why so many fund managers are starting to adopt co-sourcing, and discuss the future of private equity fund administration.

DOWNLOAD WHITEPAPER: CO-SOURCING: A WIN-WIN FOR FUND MANAGERS

Watch: Co-Sourcing Explained

What is the difference between in-house fund administration, outsourcing, and co-sourcing?

In-House Fund Administration:

- The data stays within the fund manager’s organization

- But so does the administrative burden

For many GPs, In-house administration begins as the default model. New and emerging fund managers often start by leveraging Excel and QuickBooks – quick tools for a start-up to launch with, but ones that quickly introduce risk and become unsustainable as a business grows.

As private equity firms launch new funds and grow their AUM, one of the biggest challenges they face is that their back-office operations become increasingly complex. As Joachim Satchwell, Associate Director at Polaris, an industry-leading private equity firm based out of the Nordics, explained to us, “A back-office system is increasingly valuable once you begin to have numerous funds and strategies.”

“A back-office system is increasingly valuable once you begin to have numerous funds and strategies. The first fund can be supported by the few back-office resources you will have anyway, but soon there will be a trade-off between adding more people or implementing an IT system. However, the latter has the added benefits of automation, high data security and consistency, and minimizing key man reliance.”

-Joachim Satchwell, Associate Director, Polaris

This is the reason why many managers, burdened by legacy systems and manual, error-prone processes, look to bring on enterprise-level fund accounting software as they grow their business. Others, wanting to focus time and resources on portfolio management instead of accounting and reporting, turn to outsource instead.

Outsourcing Fund Administration:

- Fund administrators hold and manage the back-office data on behalf of their GP clients

- But, as a result, GPs lose control of and easy access to that data

By outsourcing, a fund manager turns its back-office operations over to an outside fund administrator. This frees the manager from the administrative headaches and the administrative burden – one of the reasons why there’s been a trend toward outsourcing in recent years.

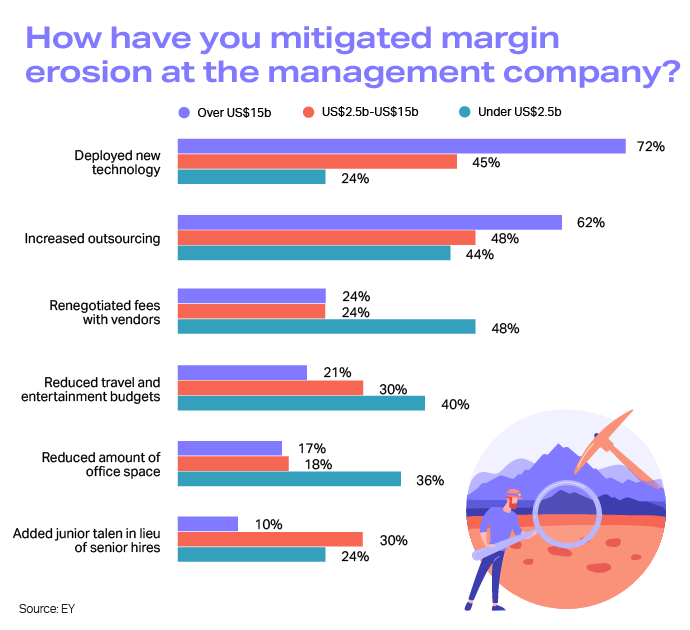

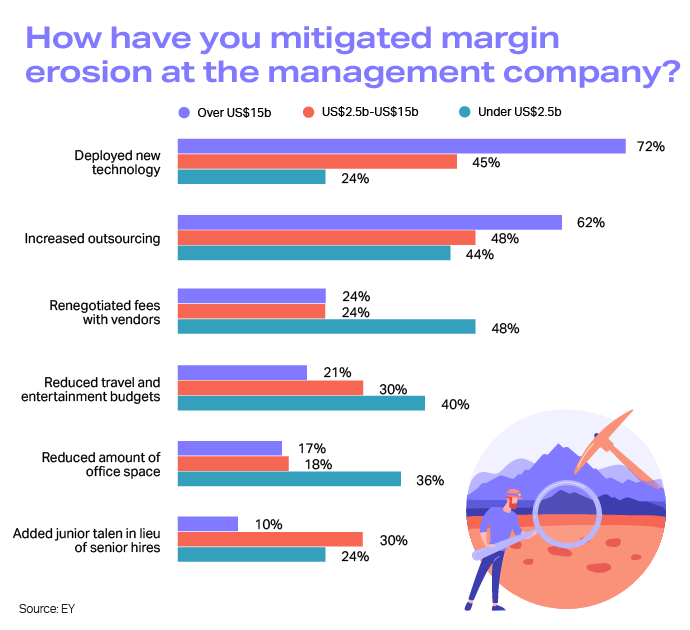

In fact, in a recent survey by EY, nearly half of all firms surveyed and 62% of the largest organizations said that the primary way they were mitigating margin erosion at the management company was by increased outsourcing – second only to the deployment of new technology.

Outsourcing, however, can also limit the access that the fund has to its data, making it difficult to quickly respond to investor queries or conduct in-depth data analysis.

This is, of course, where the power of co-sourcing comes in.

Co-Sourcing Fund Administration:

- Data stays within the fund manager’s system

- Fund administrators have direct access to the fund manager’s system and manage the data within it

Co-sourcing offers a third path to the traditional two. With co-sourcing, a fund administrator executes a GP’s accounting and reporting processes directly on the GP’s software platform. This way, the fund manager’s data stays with the fund, but the back-office responsibilities are still handled by the fund administrator.

How co-sourcing compares to in-house and outsourced fund administration

Why is co-sourcing gaining in popularity?

In large part, we can attribute the recent rise in popularity of co-sourcing to one ever-growing and increasingly overwhelming pain point: data management.

Data, in many ways, is the building block of the private equity industry. And, as such, data management has become central to GPs’ workflows.

But the challenges of data management are only becoming more complex.

“The biggest challenge facing a GP today is data,” Mike Trinkaus, CEO and co-founder at 4Pines Fund Services, told us. Increased regulation and emerging trends like ESG require GPs to capture more data and at a greater level of complexity. Additionally, the increasing number of stakeholders that often need immediate access to that data – both internal and external, from auditors to lawyers, compliance teams, investors, and service providers – has turned “the data path” into “the data delta.”

“The biggest challenge facing a GP today is data.”

-Mike Trinkaus, CEO and co-founder at 4Pines Fund Services

Historically, fund administrators have been one more channel on that delta. They are a crucial one – not only executing essential tasks for their GP clients but also managing back-office data that is crucial to client relations and other core operations – but still another instance where data flows away from a GP.

Co-sourcing gives fund administrators an opportunity to remove a channel from their clients’ data delta – to simplify their clients’ data management processes – while still providing their services with the same level of expertise and precision

READ MORE: 4PINES ON WHY CO-SOURCING IS THE FUTURE OF FUND ADMINISTRATION

What are the benefits of co-sourcing for GPs?

By providing data access to GPs without returning the administrative burden, co-sourcing provides manifold benefits to fund managers. Simplifying “the data delta” may be among the most significant of these, but it is far from the only one:

Co-sourcing streamlines data entry

Because co-sourcing allows fund administrators to administer financial activities directly on the fund’s accounting system, it meaningfully streamlines the data entry process.

Co-sourcing significantly reduces the need for shadow accounting

Shadow accounting, a common practice in private equity where the GP will keep a shadow book of records mirroring their fund administrators, is no longer necessary with co-sourcing, as the GP and fund admin are working off the same general ledger.

Co-sourcing allows a “golden record” to become a reality

Because co-sourcing eliminates the need to pass information out of the system and back in, it allows for a single flow of data across a manager’s fund lifecycle, even when working with third-party fund administrators.

Co-sourcing simplifies LP access

With co-sourcing, when GPs receive inbound performance inquiries from their LPs, they no longer need to reach out to a fund admin and wait for the answer. They can leverage dashboards within their system to answer those questions themselves, or, better still, they can allow LPs to self-service via an investor portal.

Confidential data remains inside the fund

With co-sourcing, all confidential data remains safely inside the fund’s domain – an especially important benefit as cybersecurity becomes an increasingly prevalent risk – rather than needing to be shipped between administrator, GP, and client.

Co-sourcing offers GPs flexibility

Another major advantage of co-sourcing is the flexibility it offers GPs. As Jonathan Broch, Executive Director at Lionpoint Group explained to us: “The co-sourcing model offers GPs maximum flexibility as it relates to fund administration. While it requires the GP to make an up-front investment in technology and take ownership of how its data is structured, the firm is rewarded with the long-term flexibility of always being in a position to leverage the most effective servicing arrangement (e.g., insourcing or outsourcing) at a given point in time, which naturally may change as the firm grows and explores launching different products or operating in different geographies. Furthermore, with the co-sourcing model the GP can make this servicing decision for specific fund, GP and management company entities while still maintaining its data centrally and avoiding the very painful challenge of having to aggregate data from different systems.”

“The co-sourcing model offers GPs maximum flexibility as it relates to fund administration.”

-Jonathan Broch, Executive Director, Lionpoint Group

DOWNLOAD WHITEPAPER: CO-SOURCING: A WIN-WIN FOR FUND MANAGERS

What are the benefits of co-sourcing for fund administrators?

Co-sourcing has a number of advantages for fund administrators as well, which, ultimately, share a common theme: By allowing the fund client to maintain the data, it overcomes a key fund manager objection to outsourced back-office services, deepening existing client relationships and meaningfully opening up more opportunities for revenue.

Co-sourcing helps fund administrators deepen client relationships

Some fund administrators are hesitant to embrace co-sourcing because they feel that it can make it simpler for clients to switch administrators. Others, though, see co-sourcing as a way to deepen relationships.

As Mike Trinkaus at 4Pines puts it, ““We’re not afraid to put co-sourcing out there to our prospective clients because we believe it puts them in a better position for success.” By simplifying data management for their clients, fund administrators can deepen relationships and, therefore, build longer lasting ones.

Co-sourcing opens up new revenue opportunities for fund administrators

For many GPs that were, for one reason or another, reluctant to consider outsourcing fund administration in the past, co-sourcing can be an appealing alternative. By allowing GPs to keep their data in-house, co-sourcing can lower the barrier of entry for fund administrators, and thus open up prospecting avenues for fund administrators that were previously closed to them.

Co-sourcing can provide fund administrators with a competitive edge

Because co-sourcing is still a burgeoning relationship model, fund administrators that offer it are able to gain a competitive advantage over those that don’t. This can be especially powerful for growing fund administrators – and necessary in the active fund admin M&A landscape.

Allvue’s technology is helping build the future of fund administration

Co-sourcing takes some of the best aspects of the outsourcing and insourcing models and combines them, overcoming fund managers’ concerns about controlling their data while creating a new revenue stream for fund administrators.

But to make co-sourcing work effectively for both parties, it is essential to implement the right technological solution.

Allvue’s Fund Accounting system has long been a best-in-class software solution in the private equity industry – for enterprise and emerging managers alike. Because Allvue’s true general ledger was built specifically for the private capital industry and because it offers single source of truth data within a robust, flexible platform, Allvue has been able to lead the industry in facilitating co-sourcing engagements.

Our platform provides:

- A truly integrated system that ensures data accuracy, so that our clients can spend less time scrubbing data for errors and more time serving their clients

- Cutting-edge technology that stays current, because we are built on Microsoft so that, without costly upgrades, we can keep you on the forefront even as the forefront evolves

- A best-in-class solution that services every private capital asset class so that our clients can build complex portfolios while maintaining simple workflows.

Learn more about why Allvue is the ideal platform for co-sourcing.

Learn more about co-sourcing

Looking to dive even deeper on co-sourcing?

More About The Author

Kamil Godlewski

Product Manager

Kamil Godlewski is a product manager at Allvue Systems, a leading provider of investment management solutions. He has over 15 years of experience in finance and sales, working with various clients in the alternative investment space with an emphasis on private equity. He has a MBA in finance from Indiana University's Kelley School of Business and is a previous CPA license holder.