By: Ryan Burger

Senior Vice President - Product Strategy and Client Delivery

March 5, 2025

Alternative Investment Firms are Improving Transparency by Digitizing Carried Interest, Co-investment, and Compensation Plans

In recent years, alternative investment firms have invested in deploying technology solutions across critical business areas, such as investor relations, accounting, and portfolio management. These firms are now seeking to gain the same type of improvements to controls and efficiencies within the compensation function that they have accomplished in the other areas. They are doing this through the digitization of alternative investment carried interest, co-investment, and compensation plans to provide improvements to the reporting they provide to employees and partners.

Private equity, venture capital, credit, real estate, and other private capital firms have many complicated compensation arrangements. In addition to standard salary and bonus details, employees are compensated through unique profit-sharing programs (referred to as carried interest plans), co-investment plans where employees invest their personal capital, and ownership in the management company.

Historically, this highly sensitive compensation data has been managed in spreadsheets, but the industry is now turning to technology solutions. Outlined below are four recurring themes and trends across private capital firms:

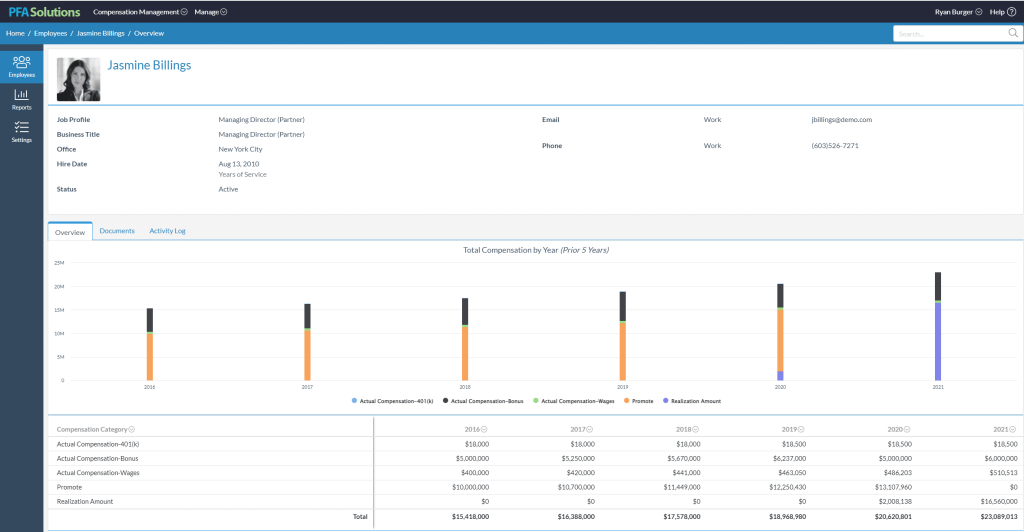

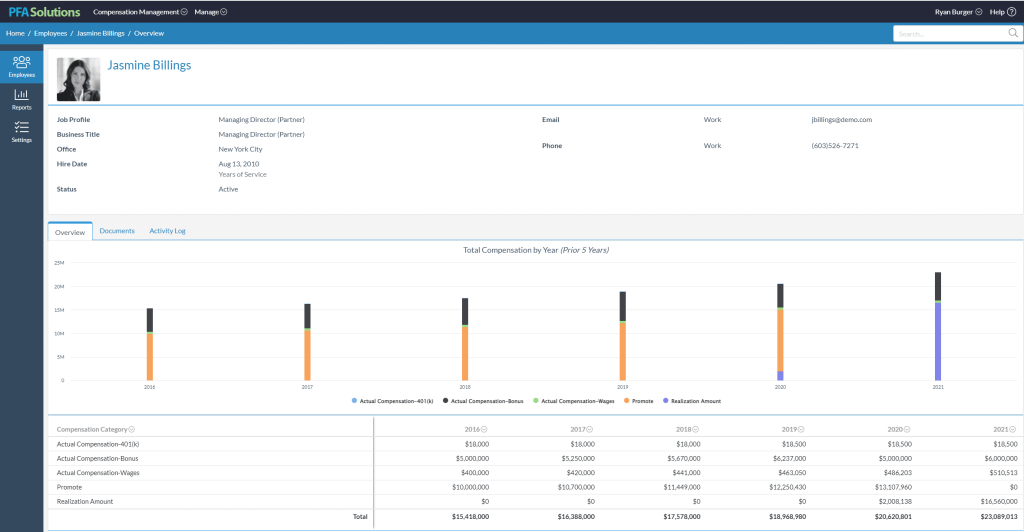

1. Aggregated Compensation Reporting is Being Produced to Provide Transparency to Employees

Firms are providing statements to employees that deliver holistic details across individuals’ standard compensation (i.e., salary, bonus, etc.) along with carried interest awards, co-investments, health care reimbursements, and management company ownership. The market for top talent is competitive, and firms are improving the reporting for employees, allowing them to easily see their overall compensation.

Given the common opacity of carried interest awards in private markets, some firms also include forecasts of projected earnings in their standard reporting. Forecasts allow employees to view their future earnings potential and their vested and unvested carried interest awards. Forecasts offer greater transparency and can be a helpful tool to retain key employees.

2. Participant Portals Offer Easier Access to Documents and Data

Before COVID-19, managers met with their teams in person to communicate bonus and other compensation figures. While some firms are back in the office, others operate extensively online and there is a growing trend to offer digital portals where employees can easily access their documents, data, and analytics. Additionally, employees can digitally sign and acknowledge their receipt of different employment documents and compensation statements.

Figure 2: Example of Online Compensation Analytics (via FirmView® Carried Interest, Co-Investment, and Compensation Platform)

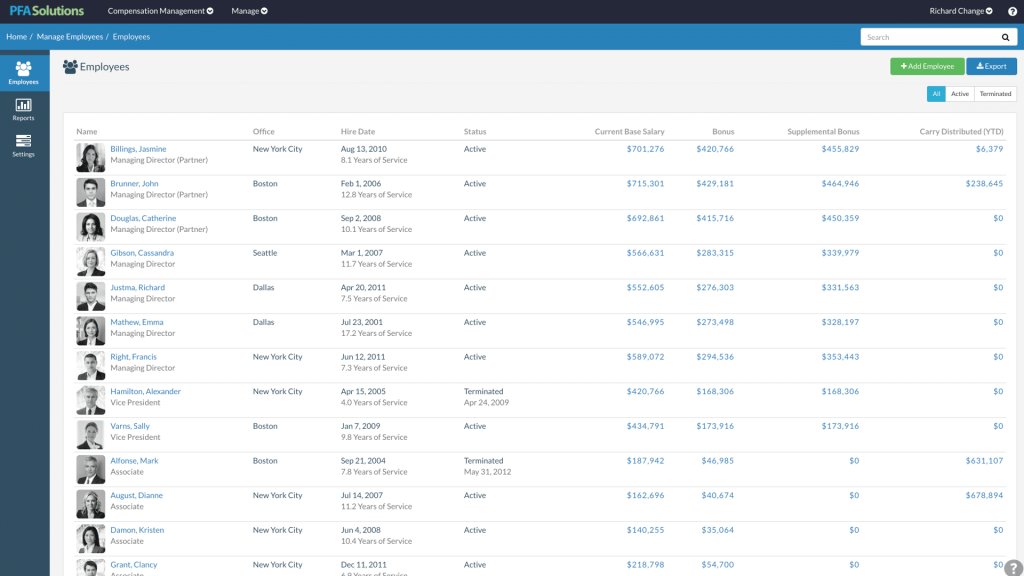

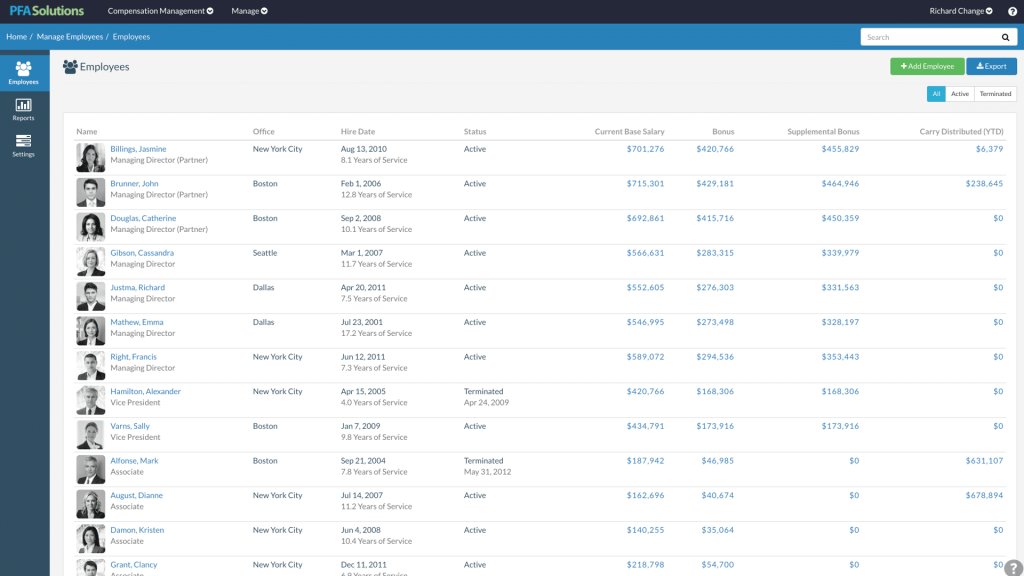

3. Firms are Improving Firm-Level Analytics to Assess Overall Awards and Manage Joiners and Leavers

Fund raising is at an all-time high and as new funds are launched, employee carried interest awards need to be structured for these new entities. Companies conduct scenario analysis and reporting to ensure that they fairly compensate their existing and future employees. At the same time as firms are raising funds, the overall economy is faced with “the great resignation,” which the private funds sector is not immune to. With these market changes, management of carried interest and compensation activity comes with challenges for the already lean teams that manage this data. “Push-button analytics” on carried interest balances and scenario analysis on distributions are areas that firms are focused on as they improve their overall technology usage for private funds’ compensation.

Figure 3: Example of a Managers View of Firmwide Compensation Data (via FirmView® by PFA Solutions)

4. Transitioning to a Carried Interest and Compensation Platform Improves Transparency

To address the above three trends, software applications are necessary to store, calculate, and report on employee compensation and carried interest allocation data. While spreadsheets offer familiarity, flexibility, and ease of use, they invite the risk of errors, inconsistencies, and functionality limitations. Many companies reach a breaking point when spreadsheets can no longer be the tool to effectively manage and report on compensation data, and they turn to systems to solve their challenges.

There are varying degrees of system use, with natural phases to iterate over long-term desired functionality and reporting. Most firms begin with migrating carry allocations, vesting schedules and carried interest reporting. After the foundation is laid, they add an employee portal, carried interest forecasting, co-investment tracking (from their core accounting), and base and bonus compensation to produce aggregated reporting and analytics.

Private Capital firms are growing rapidly by launching new funds and many face attrition at the same time, while also operating remotely. These factors have led to a tipping point of complexity and operational burden, leading to improvements to the management of compensation and carried interest allocations. Companies are deploying more comprehensive employee statements, better management analytics, and providing online

FirmView® Compensation and Carry Management for Alternative Investment

FirmView® is comprehensive carry and compensation software solution to manage allocations, joiners, leavers, vesting, forecasting and reporting with a dedicated employee portal. FirmView® Carry and Compensation also includes management of co-invest obligations, and full compensation including, salaries, bonuses, and retirement, to provide enhanced management and employee reporting.

Reach out to the Allvue team to learn how you can leave simple carried interest forecasting models behind.

More About The Author

Ryan Burger

Senior Vice President - Product Strategy and Client Delivery

Ryan is responsible for Product Strategy and Solution Delivery over FirmView at Allvue Systems (formerly PFA Solutions). Since joining PFA in 2018, Ryan has helped a diverse array of Finance and HR alternative investment leaders digitize and automate processes and reporting related to carried interest, employee co-investments, and compensation. Ryan has extensive experience and knowledge in alternative asset operations, consulting, and software implementation, enabling him to lead the successful delivery of solutions that meet the complex and evolving needs the alternative investment industry.