October 1, 2025

Compensation and carried interest (carry) are central to how real estate fund manager employees are rewarded. The goal is clear: align the interests of general partners (GPs) who manage the fund with those of limited partners (LPs) who provide the capital. But the structures, rules, and reporting requirements behind these incentives create extraordinary complexity for real estate firms.

Carry Management is Complex at Any Firm

There are “universal complexities” in managing incentive plans at private capital firms (real estate, buyouts, growth, secondaries, etc.). Based on our experience working with alternative asset managers, these include:

- Joiners and leavers. Joiners and leavers complicate carry management because calculations can have various factors such as vesting arrangements and accretion and dilution rules (and one-off subjective reallocations). Firms that issue grants in funds where there is positive accrued carry must manage hurdles (also referred to as watermark or notches) and catch-up provisions where applicable. Each change in personnel shifts the carry pool allocations, forcing updates to carry allocation registers and internal reporting.

- Fragmented data. Fund accounting data, incentive allocations, and HR data often live in separate data sources, forcing firms to reconcile information manually and increasing the risk of errors in carry calculations.

- Talent retention. Senior leaders expect meaningful economics, but firms also need to reward juniors enough to keep them engaged long-term, making allocation decisions both strategic and sensitive.

- Reporting and transparency. Carry participants increasingly want visibility into accrued and forecasted carried interest values, yet reporting relies on forward-looking assumptions, which can create tension and skepticism if not managed thoughtfully.

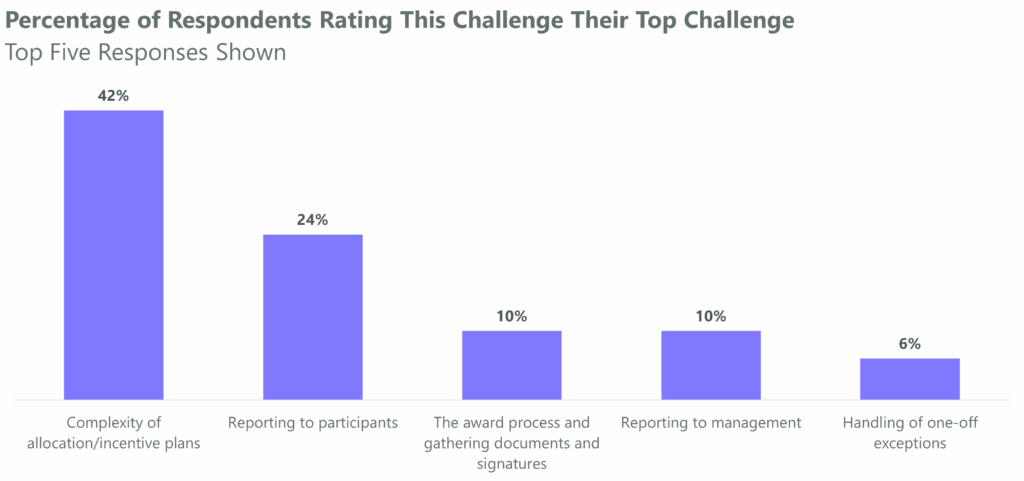

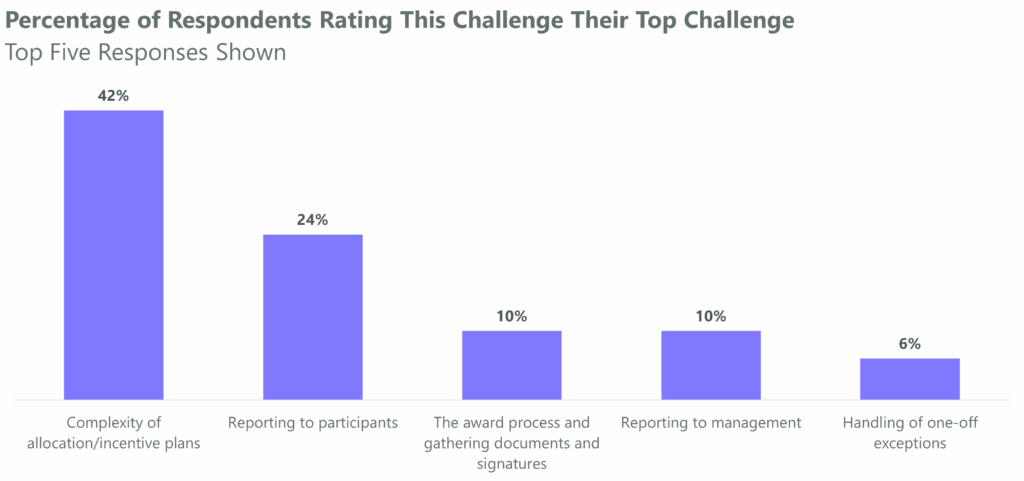

To make matters worse, plans are becoming more complex. Compensation and carry management are increasingly complex due to the diversification of incentive structures, growth and evolution of each firm, and evolving employee expectations. Clear steps in compensation management are essential to keep pace with this complexity. Factors contributing to this complexity include the adoption of varied carry methods, including dollars-at-work, jump ball programs, creative vesting arrangements, deal-level incentives, and hybrid structures. Moreover, firms are incorporating synthetic carry and deferred bonuses to broaden long-term incentives. This complexity was highlighted in Allvue’s 2025 FirmView survey, with more than 40% of firms citing allocation and incentive plan management as their top challenge.

It’s Even More Complex for Real Estate Firms

Carry management in real estate private equity comes with a set of challenges that are distinct from other areas of private equity. The structures are often more fragmented, involve broader teams, and require tracking across numerous vehicles and deal structures. Key complexities include:

- Deal-level vs. fund-level compensation: Real estate promote structures are often deal-by-deal or joint venture–based, with separate allocation registers per deal / SPV. Tiered splits are common, adding layers of complexity.

- Broader pool of participants: Unlike traditional PE, where carry is concentrated in deal teams, real estate carry frequently includes acquisitions, asset management, and capital markets professionals. Asset managers, in particular, expect economics due to their role in driving operational value.

- Forecasting Since real estate income can often be forecasted, many participants expect a view on potential future distributions.

- Fragmented allocations: Professionals may have carry across dozens of joint ventures, funds, and accounts, forcing firms to balance allocations and reporting across multiple vehicles simultaneously.

What’s Behind A Leading Real Estate Firms’ Shift to FirmView

A leading real estate private equity firm specializing in servicing commercial and industrial markets sought to address significant operational inefficiencies as it managed millions of square feet of commercial spaces and offices across North America. The firm, which counted major tech companies and retailers among its high-profile client base, faced challenges such as relying on manually sending PDFs back and forth, which hindered their workflow. Additionally, they struggled to produce accurate statements due to the complexity of managing a large number of carry participants, which included asset managers and deal teams that were often involved in multiple transactions. They particularly appreciated the integration of DocuSign for seamless approvals and the ability to implement pre-designed templates that were both easy to use and aligned with their specific business processes. Transitioning to a comprehensive solution was critical for the firm to enhance scalability and operational efficiency.

FirmView Overview

FirmView was designed to bring clarity and control to this challenge. For real estate firms, it provides:

- Granularity: Track carry registers and incentive structures across every fund and professional.

- Automated calculations: Eliminate spreadsheet risk with a rules-based engine that handles accretion and dilution logic, vesting, dollars at work forecasts, and distribution calculations.

- Scenario modeling: Forecast how future performance assumptions affect compensation outcomes.

- Audit-ready reporting: Generate accurate, defensible reports for partners, employees and management stakeholders.

- Transparency for staff: Provide professionals with clear visibility into how compensation is calculated and when it will vest.

The Bottom Line

In real estate, compensation is a strategic lever, not a back-office function. But the mix of carry plan structure complexities, vesting, distributions (profit and tax), and co-investment structures makes manual tracking unsustainable. To learn more visit Allvue’s website.