By: Allan Parks

Product Manager, Portfolio Monitoring

January 7, 2022

Between 2010 and 2020, alternative investments skyrocketed in popularity, with private markets ultimately seeing AUM more than double within the decade. In that time, many institutional investors who turned to private markets in search of higher yields became more confident with these highly illiquid and complex investments, scaling up their allocations while learning what opportunities were best for them.

Now, with a seasoned crowd of LPs eager to perform complex analysis on their growing alternatives allocations, many GPs are finding themselves awash in LP requests for data and custom reporting. For some GPs, the influx of requests has been confounding and hard to manage while also keeping LPs satisfied.

So, what’s behind this uptick in LP requests and what can GPs do to meet those evolving data needs?

Why do LPs want more data than ever before?

This phenomenon can be attributed to several interconnected causes.

LPs may find themselves attracted to the returns that private investments provide, but considering their past heavy reliance on exchanged-traded assets that offer data transparency on a minute-to-minute basis, the inherent lack of transparency that accompanies private market investments can be hard to stomach. Plus, certain large LPs like pension funds may receive pressure from government bodies to provide more detail as their allocations to a non-transparent asset class grows.

Many LPs are also increasing their commitments to ESG goals and benchmarking – activities for which data is essential. As they grow their allocations to private investments, they are finding themselves with significant blind spots in their portfolio analysis.

In a world where we’ve all become accustomed to having all kinds of data at our fingertips – from our daily steps to our monthly personal spending – sorting through GP email communications in search of static data reports (often delivered a full quarter in arrears) feels especially lacking to many. And our increasingly distributed workforces, thanks to the Covid-19 pandemic, have made automated and transparent data collection processes table stakes for any value creation strategy. As the number of private asset managers continues to grow, causing competition to ramp up, GPs will find data access and transparency to be an increasingly important differentiator in attracting investors and motivating them to reinvest after the current fund winds down.

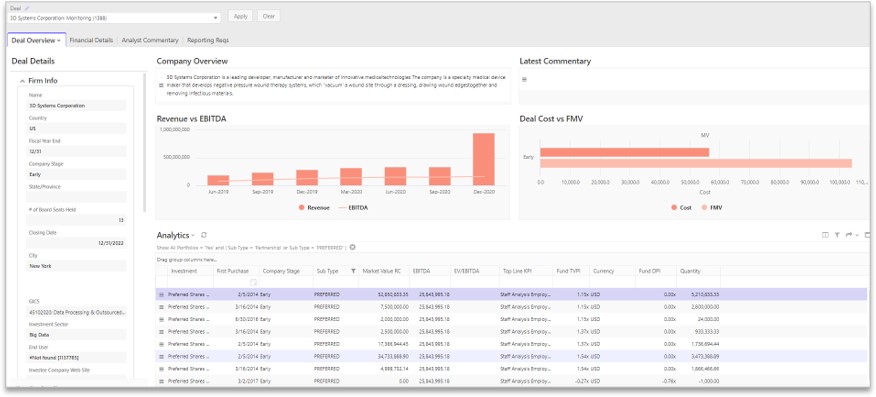

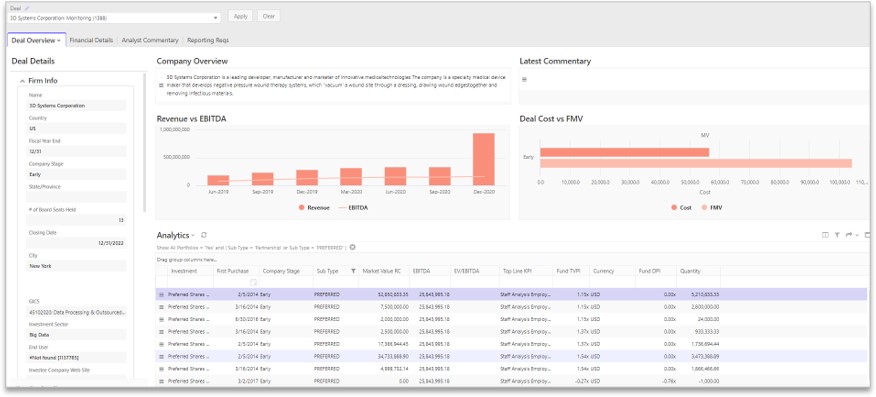

Given LPs’ increasing sophistication as well as growing manager competition, GPs can turn to capable portfolio monitoring software built around keeping all stakeholders in the know. Allvue’s Fund Performance and Portfolio Monitoring solution enables GPs to collect disparate streams of data across the front, middle, and back office, bringing them together in one place for analysis and private equity reporting. From there, it enables simple distribution to stakeholders of all kinds, notably LPs.

Let’s look at the solution’s features that answer to LPs’ evolving needs for more data and insight into their private investments.

READ MORE: Why an Integrated Back Office is Now Essential for Meeting Investor Demands

#1: Customizable LP reports to enable data self-service

Besides bringing all fund and Port Co data together in one place for GPs’ own benefit, Allvue’s Fund Performance and Portfolio Monitoring solution also allows GPs to configure automated reporting levels for investors. As opposed to fielding endless requests for bespoke data from LPs, GPs can empower them to self-serve their data needs with the help of the solution’s customizable reports delivered through Allvue’s Investor Portal.

In this case, both the LP and GP save time and avoid manual work since LPs have proactive access to fund and Port Co data and dynamic reporting filters. With this access, they can quickly pull down the reports they need at a moment’s notice and bring that data into their own platforms to analyze with their broader portfolios.

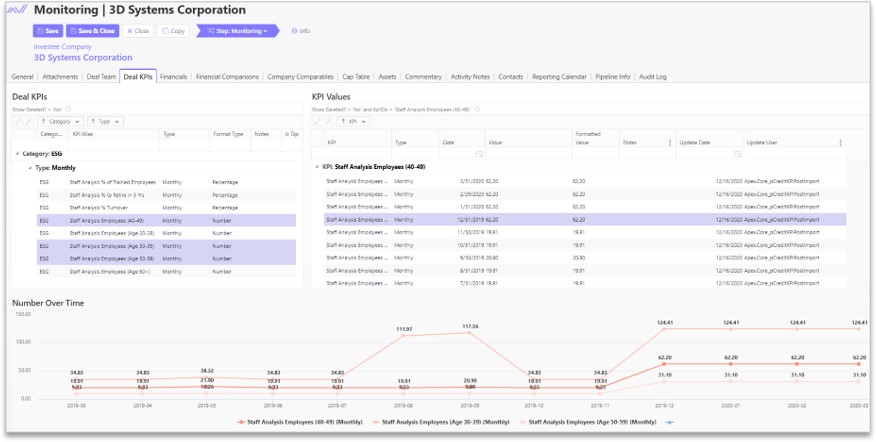

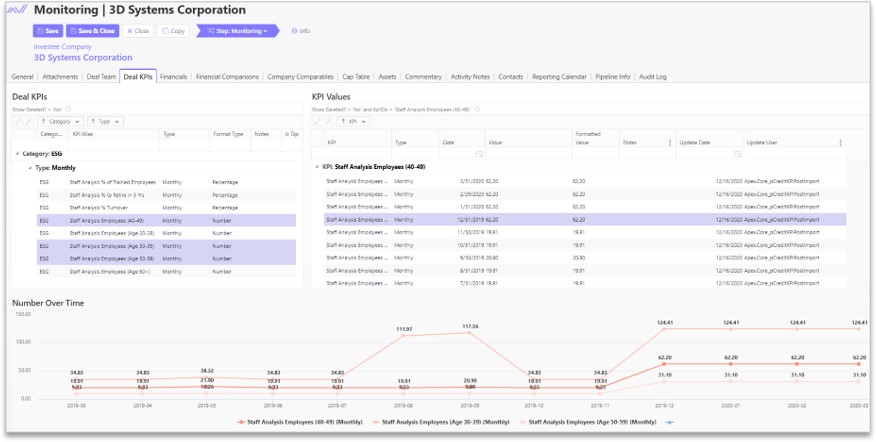

#2: ESG KPI Tracking to support LPs’ responsible investment benchmarking

While the idea of ESG investing has existed for a long time, industry awareness and adoption of ESG has surged in the last few years, including in private markets. For many LPs, ESG is not just a matter of investing responsibly — it’s also a matter of ensuring better performance. According to Private Equity International, 74% of LPs believe adopting a strong ESG policy will lead to better long-term returns in their private markets portfolios.

Investing with ESG values in mind requires reliable data streams and constant access to that data. Allvue’s Fund Performance and Portfolio Monitoring solution allows for ESG KPI tracking and reporting, enabling LPs to create and collect an unlimited number of metrics and pull reports on a Port Co and fund level to conduct reporting on ESG-specific metrics in their own portfolios, tracking how these KPIs ideally improve over time.

DOWNLOAD: A COMPLETE LIST OF ESG KPIS BY INDUSTRY

#3: Streamlined data distribution via seamless portal integration

Designating a central location for all LP communications is an essential part of setting your LPs up for success. It can be challenging for LPs to keep up with the many email communications sent from GPs – from capital calls and distributions to quarterly statements – especially when considering they receive these communications across all the GPs they’ve invested with.

As part of Allvue’s fully integrated platform, GPs can share custom dashboards via the Investor Portal solution, providing LPs with direct access to all the benefits of Fund Performance and Portfolio Monitoring — including the ability to access securely shared documents, download any fund or Port Co data, and bring that data into their systems for their own analysis.

Enhance your LPs’ experience with portfolio monitoring software

Allvue’s Fund Performance and Portfolio Monitoring solution is designed to empower you to marry data across the front, middle and back office, bringing it together in one place for analysis and distribution to stakeholders both internal and external.

As you feel the competition in your field heat up, nailing the data and performance transparency angle in LP relationships is an important way to set yourself apart. Not only do you equip investors with access to all the fund and Port Co data they could need, but you can do so in a way that requires no manual work, freeing up your teams to focus on more strategic tasks.

More About The Author

Allan Parks

Product Manager, Portfolio Monitoring

Allan Parks, Product Manager of Fund Performance and Portfolio Monitoring Solution joined Allvue in 2021. Previously, he was a Product Manager of Portfolio Construction Services at Capital Group, and prior to that, a Portfolio Advisor at Merrill Lynch’s Private Banking and Investment Group where he led Private Capital (Alternative Assets) portfolio allocation for a $5Bn AUM team serving foundations, family offices and UHNW. He is a graduate of University of San Diego, he holds an MBA from Thunderbird School of Global Management (ASU), and he is a CFA Charterholder.