By: Allvue Team

January 18, 2022

The concept of ESG (environmental, social, governance) investing has been on the radar of many large asset owners for decades. But in recent years this awareness has reached a whole new level and has even bubbled over into action as some institutions have begun to set their own ESG policies and goals.

Some regulatory bodies are leaving asset managers, institutional investors, and firms across all industries with no choice but to act thanks to impending regulations, particularly in the European Union. Still, for many, this emphasis on ESG in private equity has stemmed from the idea that not only is responsible investing the right thing to do for society and for the planet, but the right thing to do for performance as well. By screening for ESG factors, investors can spot elements that could bring long-term risk to their portfolio’s returns. In fact, according to Allvue’s 2022 ESG in Private Equity survey, 90% of LPs and GPs believe incorporating ESG considerations will lead to better long-term returns in their private equity portfolios.

Fund managers are reacting to this demand by taking steps to prioritize responsible investing and launch ESG products. To ensure that, as ESG in private equity grows, these multiplying opportunities for ESG investing meet their own responsible investing frameworks and avoid greenwashing, institutions investing in private equity must build proper ESG due diligence steps into their asset manager vetting processes.

DOWNLOAD: Allvue’s 2022 ESG in Private Equity Survey

What is ESG due diligence?

ESG due diligence is the act of vetting companies or asset managers for the ways they account for environmental, social, and governance risk in their organizations or within their portfolio companies.

Does a manufacturing company that uses a large amount of energy balance its footprint with carbon offsets? Does a clothing retail organization pay its factory workers a fair wage? Does a technology startup ensure it keeps an equitable gender balance on its board of directors?

Increasingly, institutional investors are hoping to know the answers to questions like these before making an investment in a private equity manager or an individual company. To do so, they’d need to have the right ESG due diligence approach in place to vet how a potential private equity investment target takes these categories into account.

ESG is a broad concept, and responsible investing goals and benchmarks likely vary greatly by institution and by asset manager. Every investor or private equity firm’s ESG due diligence process will also vary based on their own defined ESG policies and what issues are important to them by category and by industry.

DOWNLOAD: InfoStory: 5 Drivers of ESG Growth in Alternative Investments

Specific steps of ESG due diligence

To deepen our understanding of ESG due diligence, it’s crucial to delve into specific steps of the process:

Interview Company Stakeholders: Engage with key stakeholders to uncover insights about the company’s ESG policies and practices.

Perform Background Checks: Conduct thorough checks on decision-makers to identify any potential risks or unethical behaviors.

Review Accounts: Examine the company’s financial records to ensure transparency and ethical governance.

Conduct Inspections: Assess physical locations like factories to evaluate their environmental impact and social practices.

Compile an ESG Risk Assessment: After gathering and analyzing all data, evaluate the potential ESG risks and make informed decisions.

How does ESG due diligence work in private equity?

While ESG is often talked about from a stock-picking, public-market perspective, conducting ESG due diligence is just as important to private equity and other alternative investments, especially for institutions that are quickly growing their allocations to private equity.

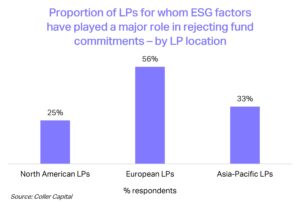

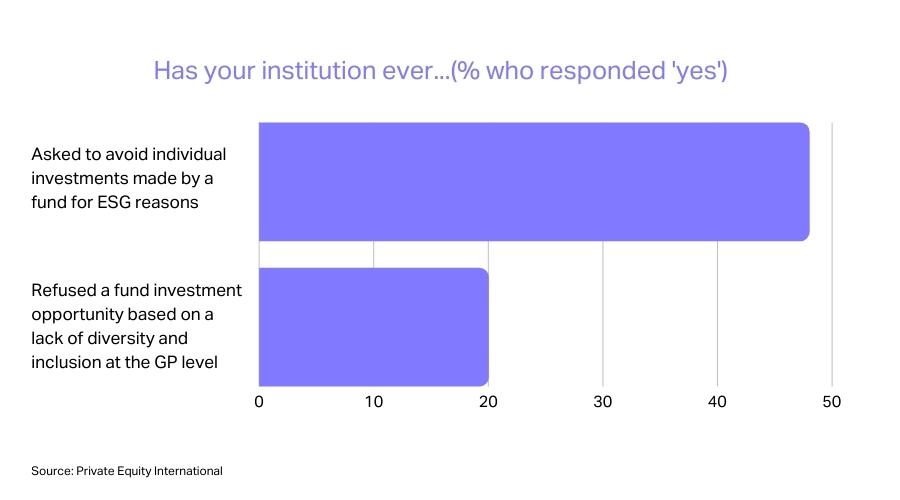

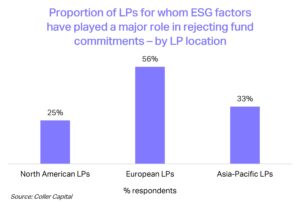

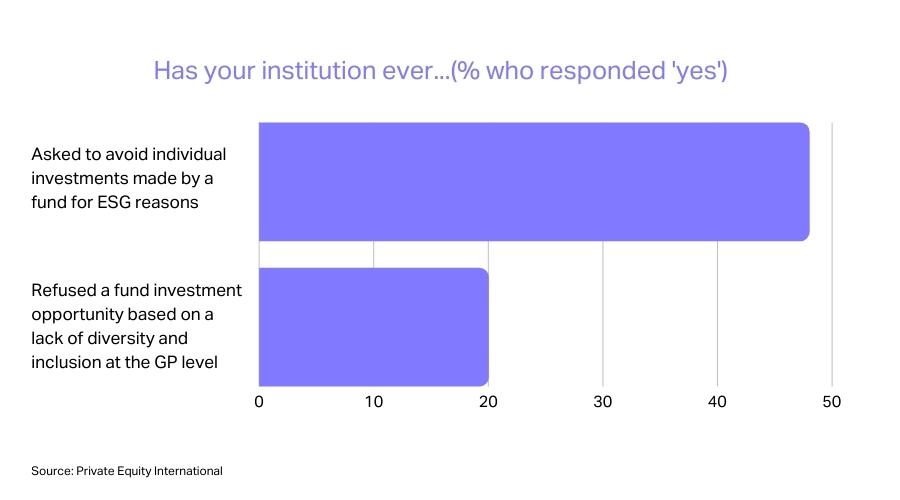

More and more, institutional investors are finding their voices when it comes to their private equity ESG goals. A Coller Capital survey found that 56% of limited partners (LPs) in Europe – the frontier of ESG investing – say ESG factors have played a major role in rejecting fund commitments. And nearly half of LPs have asked to avoid individual investments made by a fund for ESG reasons, per Private Equity International.

DOWNLOAD: ESG KPIs by Industry

True to the asset class, ESG due diligence in private equity can be a bit more opaque, requiring more manual steps on the part of investors. Rather than turning to publicly listed data that public companies are increasingly reporting, investors must request details and data from a private equity manager regarding their portfolio companies. Doing so creates a significant amount of work – investors must gather all information from a variety of different sources, receive it in different formats, scrub it, store it, and then analyze it. The entire process involves a high degree of manual effort – something that should be avoided whenever possible when it comes to data analysis.

Detailed analysis of ESG factors

Each ESG factor – environmental, social, and governance – requires a detailed analysis:

Environmental: Focus on sustainability practices, carbon emissions, and the overall environmental impact.

Social: Evaluate aspects such as worker welfare, human rights, and community impact.

Governance: Assess the ethical framework, accounting practices, and overall corporate governance.

How do I get started with ESG due diligence?

Institutions are increasingly making decisions based on ESG metrics for the sake of their values, reputation, and portfolio performance. In fact, 57% of LPs say evidence and consideration of ESG forms a major part of due diligence, up from 38% in 2021.

But understanding how to get started on screening for such broad concepts can be daunting. For institutions looking for a way forward into ESG investing, it helps to break down the journey into a few key steps.

- Establish your own private equity ESG policy. Determine what qualities across each ESG category mean the most to your institution as well as which qualities you feel pose the most risk to performance or your future portfolio goals. Set standards for where managers you invest with in the future must fall and evaluate where your current portfolio stands with these metrics and how you’d like it to make progress over time. This may involve requesting data from the managers you’re already invested with.

- Adopt an ESG due diligence checklist. When evaluating the managers you’re considering investing with, incorporate questions and data requests into your due diligence questionnaire to evaluate whether the prospective managers meet the ESG goals and standards you’ve established. If you work with a third-party due diligence team, ensure they are on the same page with your ESG expectations and ask them for any best practices when evaluating responsible investing standing during the manager evaluation period. The Institutional Limited Partners Association (ILPA) shares many helpful, free resources to help investors build ESG considerations into their investment decision-making process.

- Use technology to keep track of the data by prospective and current manager. Hold your managers accountable by continuing to track and benchmark the ESG data of your underlying private market holdings. To do so, your tech stack needs to be ESG-ready. A capable, cloud-based portfolio management platform should be able to gather, track, and analyze such data across all of an institution’s underlying holdings. Ultimately, your tech must be flexible so that it can change with the evolving space of ESG. Industry requirements and expectations are changing all the time, and rigid point solutions won’t allow you to keep up with the pace.

To truly master ESG due diligence, LPs will need a solution to track endless data points across all their alternative assets. The right solution should offer data collection capabilities that will help you gather and analyze ESG metrics and responses from your managers and investments. From data request to digestion to analysis, the right approach to ESG due diligence can power your team through the most challenging aspects of portfolio data management and analysis while supporting the fluidity needed in the ESG landscape.