By: Allvue Team

July 5, 2023

Our primer on alternative investments breaks down the basics of this asset class and explains why it has been one of the fastest growing in recent years. Whether you’re a financial advisor or wealth manager looking to guide clients on their options or whether you’re just trying to understand the alternatives space better, this article is for you.

What are alternative investments?

Alternative investments – also known as alternative assets, alternatives, or “alts” – are any investment in an asset class that falls outside of the traditional investments – those being, namely, stocks, bonds, and cash. As a result, alternative investments offer risk/return profiles that differ from traditional investments, thus adding diversity to an investment portfolio.

How are alternatives different from traditional investments?

The most significant differentiator between traditional and alternative assets is that, unlike traditional assets, alternatives are not traded on public exchanges, such as the NYSE, NASDAQ, FTSE, etc.

Instead, alternative investments, or else known as “private investments” have generally been invested through more exclusive channels, such as, private equity and private debt. This gives alternative investments a different liquidity profile than traditional investments, another key characteristic for the asset.

Finally, despite their increased complexity compared to stocks and bonds, alternative assets are also usually less regulated than traditional assets. This, combined with their illiquidity – which often requires a relatively high minimum investment –is why they are generally only held by institutional investors – such as pension funds, endowments, etc. – or an accredited investor such as a family office.

DOWNLOAD: A Complete List of ESG KPIs by Industry

Traditional investments vs. alternative investments

| Traditional |

Alternative |

| Liquid |

Usually illiquid |

| Highly regulated |

Less regulated |

| Open to the general public |

Only open to accredited investors |

| Highly correlated to the markets |

Less correlated |

What are some alternative investments examples?

Alternative assets access a range of unique asset classes and durations. They can be tangible assets or intangible assets. The wide diversity of asset types is part of what gives alternatives its low correlation to public markets.

The following are examples of intangible (or financial) alternative asset classes:

The following are examples of tangible alternatives (also known as “real assets”):

- Real estate

- Art, antiques

- Automobiles

- Aviation

- Coins and collectibles

- Farm and timberland

- Marine

- Precious metals and other commodities

- Wine and spirits

Private equity and debt: Key components of alternatives

Private equity and private debt are prominent segments within the realm of alternative investments, each with distinct characteristics and opportunities that set them apart from traditional asset classes.

Private Equity

Private equity involves investing in privately-held companies that are not publicly traded on the stock market. In this alternative investing strategy, capital is provided to companies with the goal of enhancing their value over time and ultimately generating substantial returns. Private equity investors typically take an active role in the companies they invest in, influencing strategic decisions and operational improvements.

One of the key advantages of investing in a private equity fund is the potential for higher returns compared to public equities. By participating in the growth and development of companies in their early stages or undergoing restructuring, private equity investors can capitalize on significant value creation. Moreover, private equity investments often have a longer time horizon, with capital typically locked up for several years.

READ MORE: WHAT IS PRIVATE EQUITY?

Private Debt

Private debt refers to the provision of loans or fixed income instruments to non-publicly traded entities. Unlike traditional debt instruments, such as bonds or bank loans, private debt is typically sourced from non-bank lenders or institutional investors. Private debt can take various forms, including senior secured loans, mezzanine debt, distressed debt, or direct lending arrangements.

Private debt investments offer several advantages to both borrowers and lenders. For borrowers, private debt can provide alternative financing options outside the traditional banking system, allowing greater flexibility in terms of structure, collateral, and covenants. Lenders, on the other hand, can benefit from potentially higher yields compared to traditional fixed income securities while diversifying their investment strategy and portfolios.

READ MORE: WHAT IS PRIVATE DEBT?

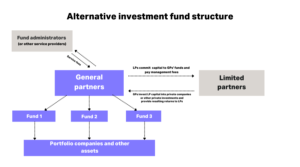

What is an alternative investment fund?

An alternative investment fund is an investment vehicle that allows for institutional investors to front capital and pay management feeds in exchange for having alternative investment fund managers invest their capital via specific intangible investment strategies.

Investors see their capital locked up for about seven to 10 years within the fund while the fund managers invest it according to the specific fund’s strategy, then exit those investments before the fund winds down. The return of a given fund to its investors over its lifetime is defined by the agreement between them and the manager.

Today the alternatives industry includes a multitude of industry participants in distinct categories:

General partners (GPs): General partners are the alternative investment fund managers. They invest and manage asset owners’ capital. The managers generate fees from investors in the form of a management fee and a performance fee that rewards them for strong performance. GPs manage funds which typically follow one or more private capital investment strategies, including private equity, private credit, venture capital, real estate, or infrastructure.

Limited partners (LPs): An LP is a partner in a private company, venture, or high-net-worth individual who receives profits from the business and whose liability toward its debts is legally limited to the extent of the investment. They are also known as asset owners, asset allocators, or institutional investors.

In terms of alternative assets, LPs are the investors – the source of capital. They make capital commitments to alternative funds and undertake due diligence to determine which fund managers to invest with. This process can be extensive and typically includes both quantitative and qualitative analysis, an assessment of fund manager performance track record, and legal compliance.

Types of LPs include:

- Pension funds

- Endowment plans

- Foundations

- Sovereign wealth funds

- Family offices

- Insurance companies

Other parties offer services to help GPs and LPs with their investment operations:

Investment consultants and gatekeepers: Investment consultants assist asset owners with the management and planning of their investment portfolios and provide investment recommendations. They charge a fee that is sometimes linked by their recommendations rather than fund performance.

Service providers: Service Providers cover the various entities that provide services to a fund. They include:

What are the benefits of alternatives?

Investing in alternative assets has many advantages, such as the following:

- Low market correlation: Alternatives typically have a low correlation to the overall markets and are less affected by broad swings in the traditional investment markets, thus providing opportunities for investment portfolio diversification as well as an inflation hedge.

- Lower volatility: Since alternatives are not publicly traded, they generally have lower volatility than traditional assets.

- Ability to target personal interests: Alternatives can go deeper than just building wealth. By allocating investments to niche projects, such as a new film or a start-up venture of your choice, you can directly invest in a cause in a way you wouldn’t be able to through traditional assets.

- Opportunity to profit in falling markets: Some alternatives (such as hedge funds) allow the investor to take a short position on an underlying asset. Traditional assets are long-only, meaning investors profit only when prices rise. By taking a short position, an investor can profit in declining markets.

- Greater tax efficiency: Because of the structure of many alternative assets, where the investor is a part owner, some alternatives are more tax efficient than traditional assets. This, however, is something that is constantly at risk of changing with each election cycle, making it one of the more uncertain aspects of alternatives.

What are the risks of alternative investments?

Just as every coin has its flip side, alternatives also come with their own risks, including the following:

- Liquidity: Because it is usually the case that alternatives are illiquid – as they are not traded on public markets – they tend to be less transparent in terms of pricing and valuation. Their low liquidity can be explained by the absence of centralized markets and the lower demand relative to traditional markets (for example, compare the trading of antiques to a publicly traded stock). Additionally, many alternative assets come with restrictions, such as length of lockup – a provision that restricts an investor’s ability to withdraw capital for some stated period.

- Valuation: Some alternatives come with highly complicated valuations due to the nature of the investment and/or its illiquidity; therefore, they often require skilled teams equipped with the right software to be able to track their valuation and profitability.

- Less regulation: While alternative investing does face some regulatory scrutiny, compared to public assets it is generally less regulated. Alternative investment management firms, nevertheless, are subject to strict operational standards and organizational requirements such as conflicts of interest and conduct rules, protection of client assets, and prudential regulations on liquidity and risk management.

- Increased complexity: All of the above factors, combined with the wide variety of asset classes and durations available, make alternatives a substantially more complicated asset than traditional investments. For investors, this can make them more opaque as an investment opportunity. For fund managers, especially those relying on tools built to support the needs of traditional investments, this can make managing and evaluating them a challenging exercise.

How did alternative investments gain popularity?

The Global Financial Crisis (GFC) of 2008 led to a handful of industry responses and investor reactions that ultimately laid the groundwork for the substantial growth we’ve seen since in the alternative investment fund industry. Among those factors involved:

- Public markets crashed, and, as a result, investors tried to find somewhere else to park their funds. Alternatives, with their low correlation to public markets, immediately became an attractive option.

- Public companies went private after the recession hit, often in order to restructure and rebuild, resulting in more investment opportunities in the private markets.

- Volatility made liquidity less attractive. With the public markets whipsawing daily, alternatives, often valued on monthly or quarterly intervals and with their long lock-up periods, became much more appealing to investors.

As a result, alternatives have become a bigger piece of the portfolio for pension funds, family offices, and everyone in between.

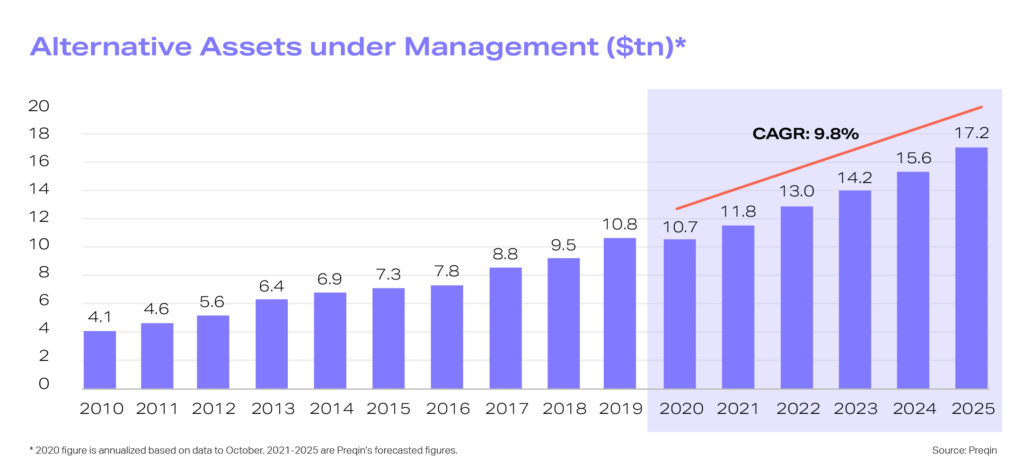

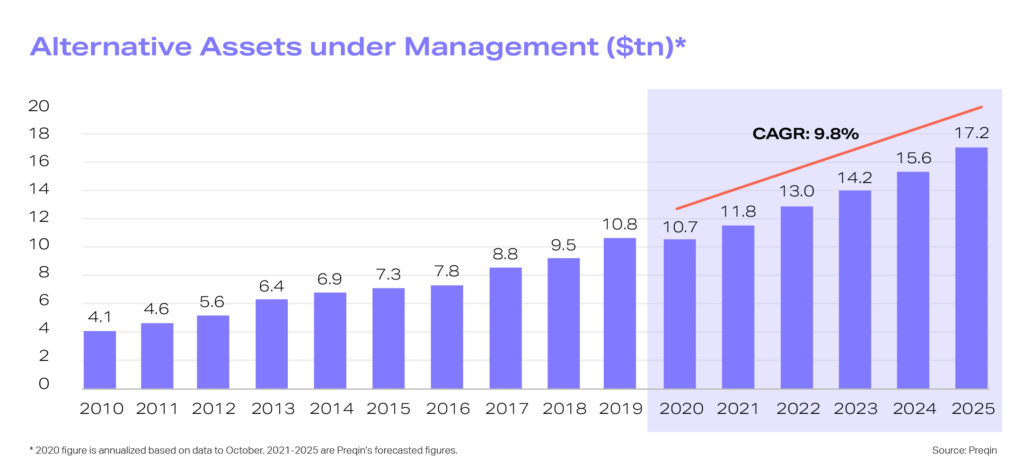

The continued growth of alternatives

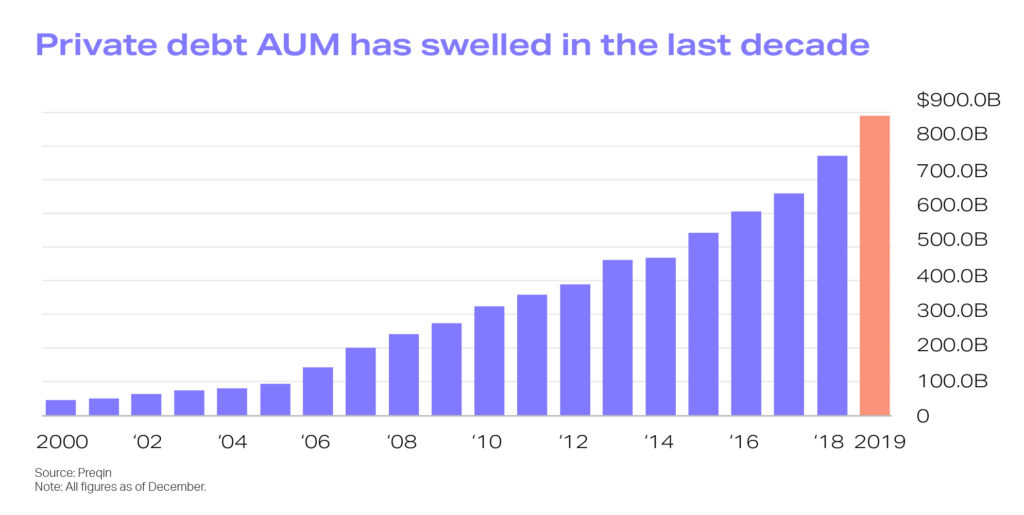

This trend can be seen broadly across the alternatives industry as well as within specific asset classes. As a case study: direct lending.

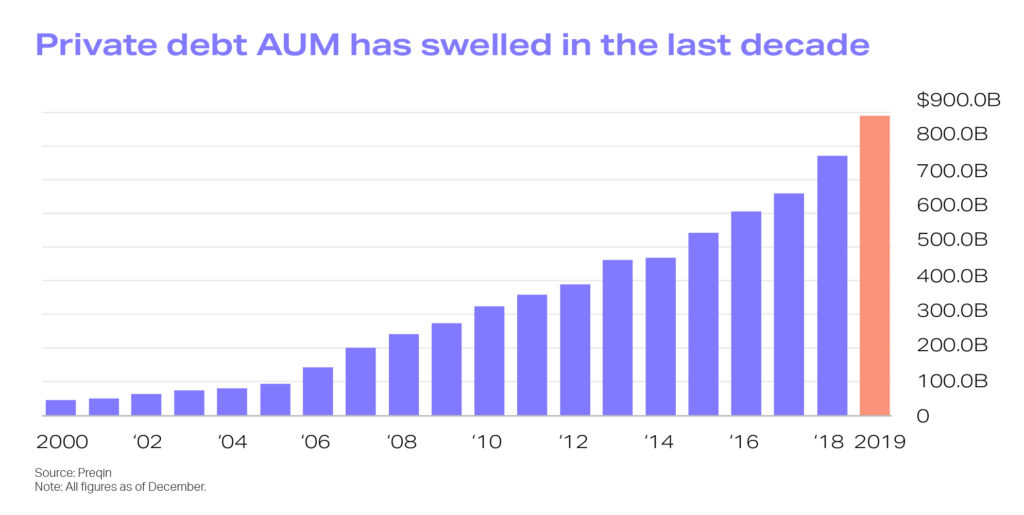

Direct lending was created as an asset class in 2008, as a direct response to the GFC. Since then, it has become the largest area of growth in private investments. Originally focused on small and medium-sized enterprises (SMEs), it grew in importance when banks reduced lending activities to SMEs, and non-bank lenders stepped in to bridge the gap.

Now, with non-bank lenders seeking better returns, direct lending has been expanded to include all types of private and public companies, helping to significantly boost AUM allocated to private debt while also meaningfully increasing the type of loan structures that investors must manage and reconcile.

The rise of private debt AUM

What challenges do alternative investments fund managers face?

Many of the characteristics that define alternative asset classes, and set them apart from traditional assets, also make them more challenging to manage. Among those challenges:

- Managing alternatives requires aggregating a lot of data. While this is true, in part, for managing any investment, it is especially true when dealing with less common, more opaque assets that can be harder to evaluate and assess.

- Aggregating and analyzing that information often relies on manual processes. This is because that information is often coming in from a variety of bespoke sources, in non-uniform formats. And, too often, fund managers are relying on tools that weren’t specifically built for their industry and to address their needs, and so are forced to make up the difference through manual work.

- Distributing that data requires streamlined internal reporting workflows. In order for GPs to be able to act on the data they’ve collected, they need to be able to disperse it quickly, efficiently, and accurately to key stakeholders across their organization. When dealing with a disjointed tech stack and siloed information, that becomes near impossible.

READ MORE: 4 Tips for GPs Facing Performance Valuation and Portfolio Monitoring Challenges

What challenges do alternative fund investors face?

As with fund managers, investors also face unique challenges when dealing with alts. One of the most significant is benchmarking.

As investors expand their allocation to alternative strategies in private markets, benchmarking can quickly become a difficult task to manage. In order to accurately benchmark an investment, investors need to compare their return to benchmarks most relevant to their portfolio. The range of potential benchmarks and methods, from internal rate of return (IRR) and modified IRR (MIRR) to cash multiples (which compare fund value to capital that has already been called) is expansive.

The effort required to benchmark grows exponentially as LPs expand the range of asset classes they invest in, such as hedge funds, private debt funds, and real estate investments. Benchmarking data is necessarily vast: it is calculated every quarter and broken down by asset class, strategy, geography, and other characteristics. In addition, performance benchmarking is not limited to private benchmarks but may also utilize public market data, drawn from the daily closing values of an array of indices.

These figures are then used to calculate public market equivalent (PME) and PME+ benchmarks. Managing such huge volumes of data can easily overwhelm an LP’s resources and increase operational risk, especially if done manually and without the proper tools.

DOWNLOAD WHITEPAPER: Benchmarking Private Asset Portfolios: Technology is Critical as Investors Venture into New Markets

How can technology help alternative investment fund managers?

These challenges, in conjunction with the significant growth the alternative assets market has seen in the last decade plus, have left GPs without comprehensive technology solutions that can handle information from across multiple asset classes and currencies. As a result, GPs often find themselves trying to manually reconcile large amounts of data and information.

While some GPs have implemented a stop gap solution of adding more resources and full-time employees to resolve the issue, this is not a viable, long-term substitute for being able to reconcile, consolidate, and aggregate different asset types into a single multi-asset class solution.

GPs need to onboard technology that can allow them to keep up with increasing investor demands, make quick and accurate decisions based on shifting market information, and continue to grow their business.

Specifically, GPs should look for providers who can offer the following:

- The ability to easily collect and reconcile large amounts of data and information

- Workflow automation solutions that can be customized to meet a GP’s individual needs

- Comprehensive reporting functionality, for both internal and external stakeholders

- Performance and forecasting tools that can easily and accurately quantify risk and IRR and map out exit strategies

READ MORE: Why private capital GPs need to up their technology game

Discover the power of Allvue – software designed specifically for alternatives

Allvue Systems offers both GPs and LPs a comprehensive, end-to-end solution designed specifically for the challenges of alternatives.

Allvue’s cloud-based software is purpose-built to address the needs of private capital investors, facilitating operational efficiency, improved accuracy, and providing a superior investor experience across multi-asset class and multi-currency portfolios.

From smaller start-ups and boutiques to the world’s largest asset managers, from pension funds and family offices to private equity and private debt managers, we provide the tools to manage workflow, integration, and reporting needs.

Learn how Allvue can empower you to make superior investment decisions.