December 6, 2021

The 2021 ILPA Summit, held virtually on November 9-11, 2021, offered an opportunity for GPs and LPs to build relationships within the private equity community. Across the various sessions, numerous one-on-one meetings, and keynote speech by SEC Chair Gary Gensler, we heard multiple themes and ideas about how the LP landscape is shifting and evolving, but four themes stood out from the others:

#1: LPs face a very frothy market.

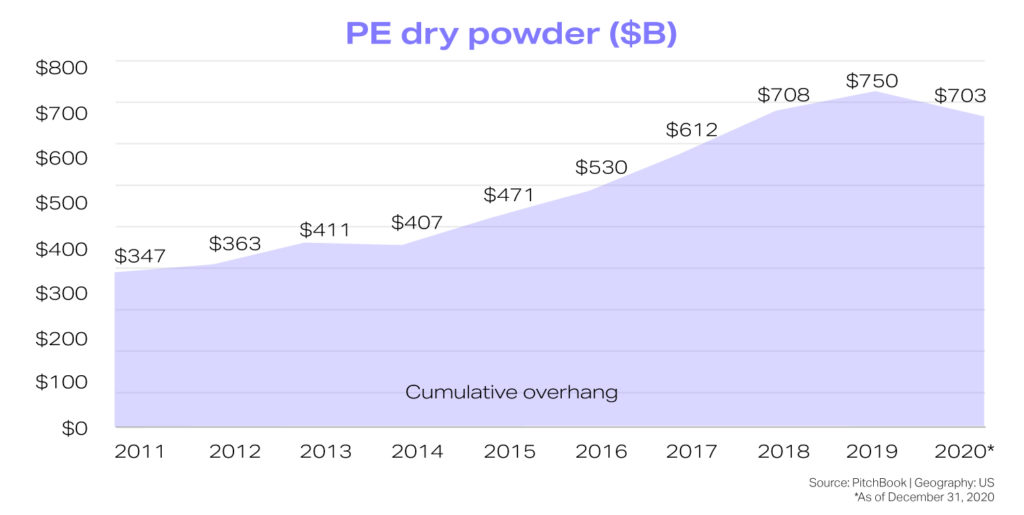

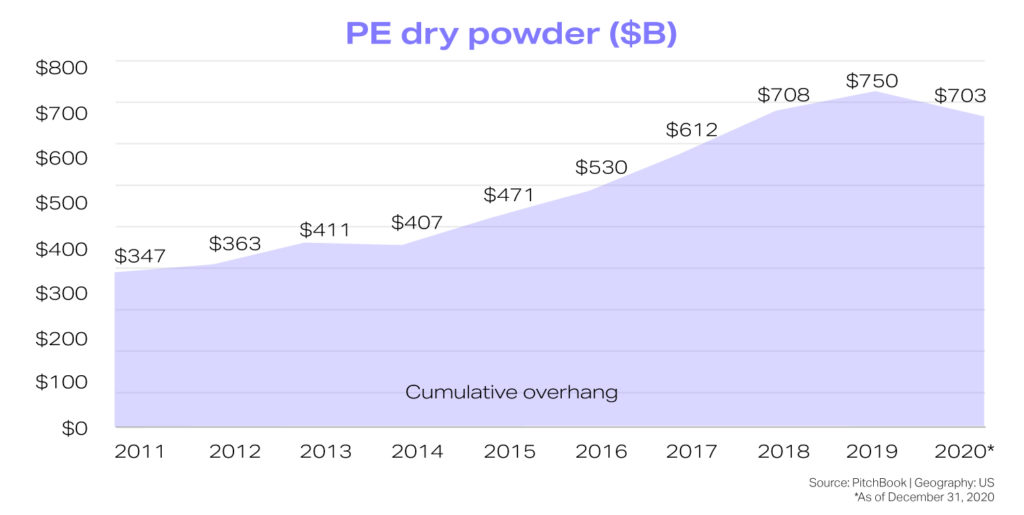

A theme we heard again and again at the conference was that everyone is drowning in funds coming to market, and thus paying high prices. Private equity dry powder still sits and an extremely elevated level, exacerbating pacing challenges for investors and raising concerns that GPs are either holding capital because they don’t know where to deploy it, or are possibly overpaying for investments.

As a result, many investors are left wondering where to put their money and how best to evaluate options, which leads directly into the next theme that kept coming up.

#2: Because of that, investors are sticking with what they know.

For many LPs, it is an overwhelming challenge to source and evaluate new opportunities in such a busy, chaotic market. That means that, as a result, many are simply putting a good portion of their capital into re-ups and sticking with that they know works. Similarly, co-investments are falling through the cracks because teams are barely able to get primaries through the door.

The challenge of accurately executing informed investment decisions came up during Gensler’s keynote address as well.

“I wonder whether limited partners have the consistent, comparable information they need to make informed investment decisions.”

– Gary Gensler, SEC Chair

#3: ESG is an industry essential without an industry standard.

Everyone is experience ESG-related pressure – investors, GPs, administrators, service providers – but no one has clear guidelines on how to move forward. The lack of standardization in the space means that everyone is approaching the topic from a slightly different angle, but now are all doing it with the same level of urgency.

Investors, in particular, are feeling the pressure, as it seems that the onus often falls on them to collect and centralize the ESG-related data. Creating ESG due diligence questionnaires, distributing them, and aggregating and tabulating the answers is becoming an increasingly burdensome task, especially for teams already overloaded with manual data collection challenges.

DOWNLOAD INFOGRAPHIC: 2022 Investor / GP Trends in ESG for Alternative Investments

#4: Cashflow management is a major pain point.

Another product of so much capital flying around is that cashflow management has turned into a significant pain point for many LPs. In fact, many teams expressed being so bogged down that they were struggling just to meet capital call notices on time.

The influx of capital has laid bare the shortcomings of outdated and manual operational processes, slowing down managers who haven’t taken the time to create the proper infrastructure and giving an upper hand to those that have.

DOWNLOAD WHITEPAPER: Benchmarking Private Asset Portfolios

#5: Automation is the future.

Given the above, it should likely come as no surprise that LPs are looking for any way to mitigate bottlenecks in processes, streamline workflows, and generally work more efficiently and with less risk. As a result, we heard again and again how LPs are looking automating any and every process they can, be it secondary trade paperwork, workflow management, or data ingestion and reporting.

Summing up the summit

The Virtual ILPA Summit 2021 provided invaluable insights into the ever-evolving world of private equity. From the discussions on ESG integration and diversity to the emerging trends in technology and data analytics, it is clear that the industry is rapidly adapting to meet the demands of a changing landscape. The emphasis on collaboration, transparency, and investor alignment highlighted the importance of fostering strong relationships between limited partners and general partners. As we move forward, it is essential for private equity professionals to stay informed, embrace innovation, and continue driving positive change within the industry. The Virtual ILPA Summit served as a catalyst for these discussions and left us with a renewed sense of optimism for the future of private equity.