By: Ivan Latanision

Chief Product Officer

October 21, 2025

Private markets are evolving rapidly, and Allvue Systems is at the forefront of enabling innovation. At Allvue Access 2025, held in New York City, we’ve unveiled groundbreaking AI-powered capabilities and strategic partnership integrations to make each step of the private investment lifecycle more transparent, efficient, and connected.

From automating financial data extraction to streamlining portfolio optimization and investor onboarding, these new solutions showcase Allvue’s bold vision to unify data, automate workflows, and empower private markets professionals with actionable insights.

Here’s a closer look at how Allvue is reshaping private capital operations.

Document IQ: Harnessing AI to Turn Unstructured Data into Actionable Insights

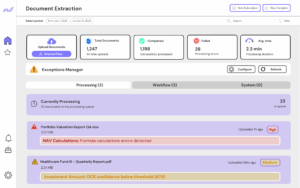

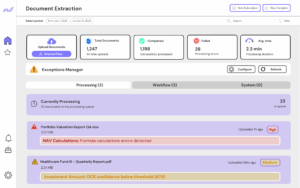

Extracting data and deriving insights from complex financial documentation has historically been a highly manual, labor-intensive activity in private markets. Document IQ is revolutionizing this process by ingesting data from financial documents using AI, structuring it, and populating validated data directly into investment systems, workflows, and templates.

Key Outcomes

- Data Direct to Workflows: Seamless integration with Allvue’s platform via pre-built connectors and schema mapping.

- Advanced Intelligence and Analysis: Embedded NLP interprets complex financial documents and extracts key information.

- Comprehensive Coverage: Supports an expanding range of document types and AI partners, starting with Claira’s solution for credit financial statements.

- End-to-End Managed Services: Turnkey solution for document ingestion, data extraction, and human validation further reduces effort and accelerates time-to-insight.

This capability is powered by best-in-class providers, including Claira, whose AI engine specializes in financial document intelligence. “We’re pleased to integrate Claira’s top-of-the-market AI capabilities into Allvue’s unified platform, powering private market efficiency and deal velocity,” says Eric Chang, CEO of Claira.

Document IQ is part of Allvue’s Agentic AI Platform offering. Allvue will continue to expand its Document IQ offering and use cases with additional AI partnerships.

Portfolio Optimizer: AI-Driven Trade Modeling and Compliance

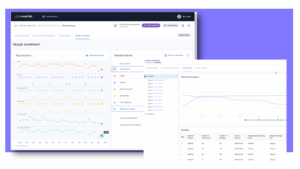

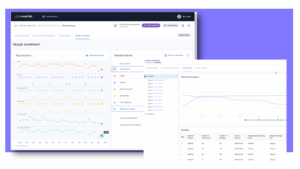

Credit markets are increasingly complex and dynamic, fueled by the rise of electronic loan trading. CLO managers need automated, integrated workflows to shorten the decision-execution cycle, reduce manual effort, and ensure real-time portfolio compliance.

In partnership with fintech innovator Loan Hunter, Allvue launched Portfolio Optimizer, a tool that helps CLO managers make faster, better-informed portfolio decisions throughout the CLO life cycle, from warehousing and ramp-up through to reinvestment and rebalancing.

Key Outcomes

- Unified Data Foundation: Combines market, portfolio, and compliance data with the fund’s bottom-up research.

- AI-Powered Trade Modeling: Simulates trades aligned with portfolio objectives and restrictions and evaluates their impact on compliance and portfolio metrics in seconds.

- Simplified Pre-Trade Compliance: Automates compliance checks against investment guidelines and regulations to reduce risk and eliminate bottlenecks.

- Seamless Workflow Integration: Embeds directly into Allvue’s front-office platforms for frictionless execution.

“As AI increases the velocity of credit research, analysis, and trading, portfolio managers will need to shift from defense to offense by leveraging AI portfolio optimization to assist in generating alpha while ensuring compliance,” says Joe Squeri, Loan Hunter’s Founder.

Portfolio Optimizer further strengthens Allvue’s integrated credit platform, which is trusted by 20 of the top 25 CLO managers.

Streamlined Investor Onboarding with Passthrough Integration

Allvue also announced a strategic integration with Passthrough, a leader in investor onboarding and financial crime compliance. This integration connects Allvue’s Fundraising and Investor Portal with Passthrough’s onboarding technology, streamlining a traditionally fragmented process.

Key Outcomes

- Streamlined Investor Prospecting: Tracks and manages investor outreach directly within Allvue’s fundraising portal. Launches commitment workflows when LPs are ready to invest.

- Accelerated Onboarding Experience: Facilitates tailored subscription documents in minutes, with a process you can track in real time.

- Connected Investor Data: Automatically routes subscription document details into Allvue’s CRM via API, ensuring data accuracy and eliminating manual entry.

“We built Passthrough because we saw fund managers were losing deals at the finish line—spending months cultivating investor relationships only to introduce friction with clunky paperwork at the worst possible moment,” said Tim Flannery, CEO and Co-Founder at Passthrough. “Our integration with Allvue helps us fix that. LPs move seamlessly from evaluating an investment to completing subscription document workflows without ever leaving their portal, while data flows automatically between platforms.”

Allvue and Passthrough delivers a unified, transparent experience for managers and investors alike, so our clients can focus on building trust and credibility and securing capital.

Event Highlights

Document IQ, Portfolio Optimizer, and the Passthrough integration were among the innovations unveiled at Allvue Access. Attendees heard from Allvue’s leadership team, saw hands-on demos, and previewed what’s next on Allvue’s product roadmap.

As the industry continues to embrace AI and data-driven decision-making, Allvue is setting the pace with new solutions and partnerships that enhance private markets transparency, efficiency, and connectedness.

More About The Author

Ivan Latanision

Chief Product Officer

Ivan is an executive leader with 25 years of experience and a proven track record of scaling SaaS organizations and improving operational effectiveness. Before joining Allvue, Ivan served as Executive Vice President and Chief Product Officer at Insurity where he was responsible for the company’s product vision, strategy, and market segments. He previously served as CPO for companies in the insurance, financial services, and life sciences sectors including Tangoe and Medidata. Ivan holds an MBA from Rutgers University and MS and BS degrees from the Rochester Institute of Technology.