By: Allvue Team

February 28, 2022

Private equity and family offices seem like a perfect union. With so much family wealth rooted in entrepreneurial success, it seems natural that they’d gravitate to an asset class where private company value creation is the cornerstone.

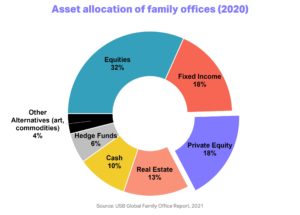

The statistics bear this out: more than 40% of family offices have doubled their private-market allocation in the last five years. And investments in private equity comprise 18% of all family office investments, versus 22% of other alternatives (real estate, art, etc.), 18% to fixed income, and 32% to publicly traded equities.

Family office allocations to private equity, venture capital, and real estate have traditionally been executed via third-party managers. That’s changing though, driven by desires for greater control of underlying investments and reduced managers’ fees. The path of least resistance to this has been the co-investing route. Nearly 43% of the world’s family offices currently co-invest.

What is family office co-investing?

A family office or other LP can co-invest in an investment vehicle by taking a minority stake while a private equity firm takes a larger one. The distinction is that the LP’s investment is made in parallel with the fund manager, but not through it.

Benefits of the co-investing approach

Families can use the co-investing path to minimize the 2/20 structure, wherein the fund manager typically earns a 2% management fee and a 20% performance fee on any profits generated beyond a specific threshold. By co-investing, family offices also have an efficient way of deploying capital into alternatives and can gain insight into their investments.

Additionally, they can also lean on the expertise of their partner PE/VC/RE firm for deal sourcing, resources (tech, legal, accounting), and relationships for exit opportunities. Fund managers, for their part, can tap into additional sources of capital while leveraging the industry expertise a family office might bring to the table.

READ MORE: Investing in Private Equity

Now, however, many family offices are looking to take things one step further by moving away from the fund manager and co-investment model to make direct investments on their own.

They’ll often look at industries where they already have expertise and can add value on the operational side. More strategic investments are also aided by a family office’s “patient capital,” unbound by specific time horizons.

Forging a path to direct investing through technology

For family offices to be successful in such endeavors, though, requires a very different skillset and infrastructure than what is typically found inside the organization. The human capital element is certainly of importance, with in-house talent needed to source, construct, and monitor potential opportunities. Another aspect often overlooked in establishing a direct deal-making program is the required support that’s needed to execute such a process successfully.

What is family office direct investing?

Direct investing is the act of purchasing ownership interest in startups or private companies, without the assistance of a private equity fund or other general partner. The process at family offices has increased dramatically during the last decade; between 2010 and 2015, activity surged by more than 200%.

With family offices beginning to look more like GPs than LPs, considerations on having the right supporting technology will have to be considered. The most obvious need is a system that monitors and manages portfolio companies and reports operating metrics.

Ideally, the private equity software used to collect these metrics is configurable to different industries. Evolving past Outlook and generic CRMs to manage more complex relationships can help with collaboration and communication both inside and outside the office, particularly around the due diligence process.

Last, but certainly not least, attention should be given to the back office. An accounting platform that can manage commingled investing entities and offer reporting capabilities for family members and related parties will be necessary as the family office grows.

Even for families that still allocate through third-party managers, the web of relationships will only become more difficult to manage as new generations come on board. For family offices looking to expand their direct investing capabilities, the right supporting technology can provide substantial value.

Learn how Allvue solutions can help your family office make superior investment decisions.