By: Brandon Meeks

Chief Technology Officer

July 12, 2023

Is the cloud the future of private equity data management?

The general partners managing private capital firms – whether they’re in private debt, private equity, venture capital, or real estate – have long contemplated the benefits of cloud technology. Its importance as a driver of digital transformation, however, has only recently risen to the forefront.

GPs’ experiences during the pandemic, including the increased need for reliable technology, emphasized the growing need for and acceptance of cloud storage. For the relatively few firms that have yet to migrate at least some services to the cloud, it’s no longer a question of if, but when.

IS CLOUD MIGRATION RIGHT FOR YOU? FLIP THROUGH OUR DECISION GUIDE

As GPs recognize the transition from single-point, disparate solutions to an end-to-end solution will be crucial to their ability to compete effectively, they’re beginning to appreciate the benefits of cloud technology. And five key factors are driving this embrace of the cloud for private equity data management.

1. Anytime / anywhere access for easier collaboration

Remote work that began as a necessity during the pandemic has dramatically changed how GPs work and how their internal teams communicate and share information. With team members dispersed across geographies and time zones, GPs need a secure, reliable, globally accessible solution that gives stakeholders access to the same information across business teams and internal functions.

By using the cloud, teams can collaborate easily using real-time data and reporting and accessing information securely from their browser or mobile devices. Having a single repository for files allows teammates to work smarter and faster, regardless of the distance between them.

READ MORE: HOW AN INTEGRATED BACK OFFICE HELPS MEET INVESTOR DEMANDS

2. Enhanced security for financial services data storage

General partners must be confident that the confidential data they work with will be stored in a safe and compliant manner. Historically, it was assumed that the best way to accomplish this was to keep data and systems in-house, and while there is still inherent risk when utilizing any external system, today’s cloud solutions can provide more advanced and comprehensive levels of security than traditional onsite data centers.

Advances in cloud security technologies and overall investment in cloud security controls allow GPs to feel more comfortable trusting their data in the cloud. Controls like advanced encryption technologies for data at rest and in transit, hardened infrastructure, comprehensive security monitoring, integrated threat detections, protection against DDoS attacks, and built-in regulatory compliance provide GPs with the security and peace of mind they need to conduct business and compete in a global marketplace.

3. Easy scalability to respond to business needs

To stay ahead of the competition, GPs must react quickly to fast-changing markets. But absent the advantages of cloud technology, that means keeping track of IT resources, data storage, and security requirements, and updating proprietary and third-party tech stacks to keep pace with the business demands.

After implementing cloud technology, GPs can effortlessly address industry developments and unexpected events themselves or leave it to their service providers to manage for them. The business agility afforded by cloud computing lets GPs fully focus on core competencies instead of allocating limited resources to maintain their IT infrastructure.

For the relatively few firms that have yet to migrate at least some services to the cloud, it’s no longer a question of if, but when.

4. Long-term cost savings and reduced IT burden

While many factors influence a GP’s decision to use cloud technology, the main driver of migration, regardless of firm size, is often cost.

Cloud technology is easy to maintain, as it requires little internal overhead and minimal internal resources to troubleshoot. The costs of internal data centers and the expensive resources required to keep the lights on are traded for cents on the dollar as this once-singular burden is now shared with the entire cloud provider’s customer base.

DOWNLOAD: 5 STEPS TO ACCELERATE GROWTH FOR EMERGING MANAGERS

5. Gaining a critical competitive edge

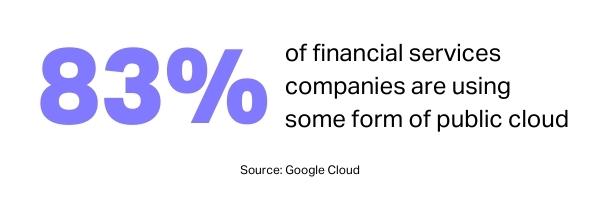

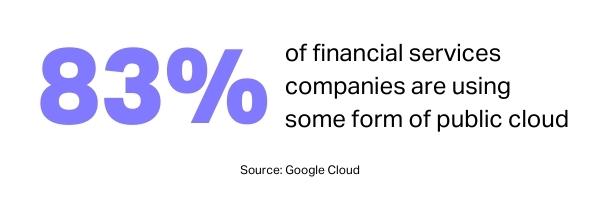

As confidence in the cloud has increased, adoption has steadily grown; smaller firms were early adopters as they recognized the competitive edge provided by cloud technology – in terms of both cost savings and access to state-of-the-art technology that would have previously been reserved for GPs. Recently, larger market participants have also begun to migrate to the cloud for the same reasons.

Overall, GPs that have been able to quickly scale and adapt by embracing cloud technology have found it easier to meet and exceed their competition. With technology that can rapidly respond to roiling markets and unexpected industry developments, GPs can easily scale vertically and horizontally to meet their immediate needs. Due to lessons learned during the Covid crisis, GPs have seen that market sentiment can turn on a dime, and in order to compete for the best private equity deals, they need to adopt a faster time to market and provide better service quality to their stakeholders.

Cloud adoption is now table stakes to compete. Competitive advantage comes from trading the distractions of self-managed infrastructure for the core competency accelerants of cloud services. Big Data, Machine Learning, and deep analytics are all now accessible and relatively cheap with help from the cloud.

How Allvue helps GPs with private equity data management

In years past, general partners may have feared the challenge of overlaying their systems and workflow on top of a cloud provider. But the rapid advancement of cloud providers and the software built on top of them has drastically reduced this barrier.

Allvue provides an end-to-end offering to GPs to manage all aspects of their business while still allowing customizations to address unique workflows, data sets, and external systems. GPs can develop against our platform where competency and needs exist, or they can leave all the adaptation and advancements – including maintenance, monitoring, scaling, and security – to us.

The result? GPs can focus on running their core businesses and maximizing value for their investors.

More About The Author

Brandon Meeks

Chief Technology Officer

Brandon brings over 15 years of enterprise application development to his role as Chief Technology Officer at Allvue. He was the original employee when Black Mountain was founded in 2007 and has architected the Everest solution since its inception. Brandon started and ran the Professional Services group and oversees all product development and internal engineering for the firm. His prior experience includes architecting a loan origination system and developing an automated underwriting engine for Accredited Home Lenders. He holds a degree from the University of California, Santa Barbara in Computer Science.