By: Brian Guarini

Global Head of Credit Sales

January 7, 2024

As we navigate the evolving landscape of private capital, private debt stands out as a resilient and growing asset class. 2024 is poised to see significant shifts in the private debt landscape, influenced by factors ranging from regulation to fundraising dynamics to strategic GP diversifications.

Here, we break down how each of these factors will color the new year in the private debt sphere. Read on for the top trends of this asset class in 2024.

#1: Strong private debt fundraising continues

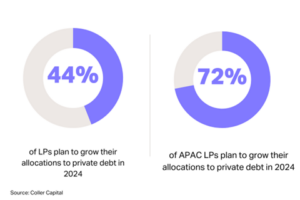

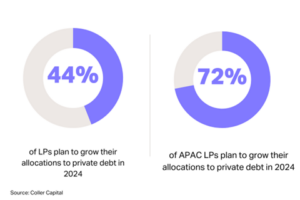

Data from Coller Capital shows that 44 percent of the LPs plan to increase allocations to private credit in the next year. LPs from the APAC region in particular are eager to grow their private debt allocations, with 72 percent saying they plan to increase their exposure to private credit in the coming year.

Private debt has been a particularly attractive asset class in recent years as interest rates have climbed and as valuations on private equity and venture capital assets have fallen. As LPs (and GPs – more on that in our next point) have rushed the private debt space and built it into their long-term private capital portfolios, it’s likely that this embrace and recent impressive fundraising is more than just a phase. This dynamic is bolstered by private debt strategies increasingly stepping into the gap following a pullback in traditional bank lending due to regulatory concerns and choppy credit markets. After a collision of different factors including the economic environment and LPs’ need for higher yield investments outside of traditional vehicles, private debt has entered and remained in the private capital spotlight.

#2: GPs diversify their strategies and expand into private debt

Private capital managers have launched a growing number of private debt funds, providing investors with various options to allocate capital across different types of private debt instruments, such as direct lending, mezzanine financing, and distressed debt.

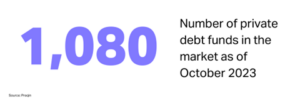

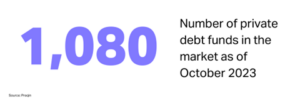

According to Preqin, there are now a record number of private debt funds in the market, growing by 19% from 2022 to 1,080 as of October 2023, indicating that managers are taking steps to meet investor interest for higher private debt allocations. This interest for private debt exposure has grown and remained high due to its potential for attractive risk-adjusted returns, and especially as other strategies in the private capital universe, like private equity, venture capital, and real estate, have fallen on hard times for the past two years.

#3: LPs flock to private debt, and regulators push for more reporting insight

Private debt firms have been adjusting to limited partners’ (LPs) desire for more transparency in response to a broader industry trend toward increased openness and accountability. These LPs have been seeking greater visibility into their investments to better understand risk exposure, performance, and the overall health of their portfolios. Plus, communication on fee structures has become critical. Private debt firms are working to provide clearer explanations of fees, including management fees, performance fees, and other expenses associated with fund management, per LP demands.

And LPs aren’t the only ones demanding this transparency. The U.S. Securities and Exchange Commission adopted new reporting rules for private fund advisers in 2023, and their purview extends to private debt managers too, requiring them to give a more detailed picture of fees and side letters negotiated with their biggest investors. As such, firms are increasingly leveraging technology and data analytics tools to enhance transparency and help them comply with new regulatory standards and offer a better investor experience. This includes using advanced reporting systems and dashboards that provide real-time or near-real-time insights into portfolio performance, risk exposure, net IRR calculation, and other relevant metrics.

#4: Emerging managers find private debt success

It’s a good time to be an emerging manager in private debt. Per Pitchbook, while megafunds (those who have raised $5 billion or more) naturally account for the largest portion of committed capital in 2023, emerging managers (those with three or fewer funds) saw a 5% jump in committed capital in the first half of 2023, compared to 2022. Two of the largest 10 funds closed in H1 2023 are led by emerging managers. Assuming this trend continues in 2024, emerging private debt managers face exciting prospects for further growth in this new year.

Want to know more about what trends to expect in the new year?

Check out our other 2024 trends content:

More About The Author

Brian Guarini

Global Head of Credit Sales