By: Tarek Saleh

Chief Revenue Officer

November 7, 2023

2023 was not the year that the private equity sector hoped for. While some headline-making transactions occurred, and we saw some promising pick up in terms of private equity deals, exits, and fundraising, overall, it paled in comparison to the banner year that was 2022.

So what does 2024 hold for the private equity space? It seems to be a mixed bag, with some promising activity like an uptick in leveraged buyouts, while other areas, like private equity exits, are predicted to experience a more modest uptick, at least for the beginning of the year. Macro trends like geopolitical conflict and industry regulation, will certainly leave their impact on the 2024 private equity investment landscape.

Read on for the top private equity trends and what they mean for the industry in 2024.

Small signs of life in private equity exits

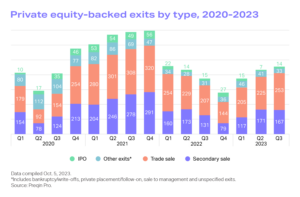

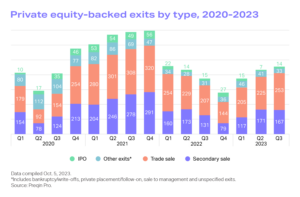

Exits followed a disappointing trend in 2023, remaining low into the final quarter of the year. Initial public offerings (IPOs) in particular, a prime route for private equity firms to achieve liquidity, faced a deceleration. There are no signs 2024 will start off with a bang, but activity does appear to be picking up in a small regard as of the close of Q3 2023.

Private equity exits may be in a downturn, but some key deals, drawing the attention of many fund managers. have taken place. Check out our private equity exits guide, including a list of the biggest PE exits from the last year.

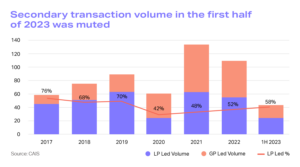

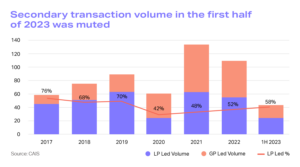

#2: The secondaries market can thrive

PE exits may remain slow, but that could be good news for private equity secondaries space. GP-led secondaries are bound to pick up when firms are ready to exit their portfolio companies – especially if they don’t find the conditions they want in more traditional forms, like the IPO market or strategic sales. Meanwhile, data from Goldman Sachs Asset Management finds that nearly half (48%) of LPs hope to increase allocations over the next two years, behind only co-investments. With these conditions continuing into 2024, we could see a boost to both the LP-led and GP-led aspects of the secondaries markets.

For more about the private equity secondaries market, read our guide.

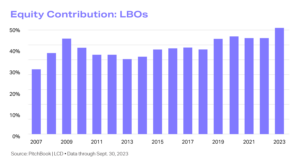

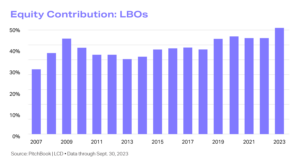

#3: LBOs begin to pick up

Leveraged buyouts have attracted new attention throughout 2023, and we expect it to continue in 2024. According to Pitchbook data, LBO and M&A deal activity climbed to a 17-month high this September, and even though high rates are leaving private equity investors wary of too much leverage, LBO activity is forging forward by leaning more heavily on equity when structuring deals. Major LBO deals in 2023, such as Worldpay and Fogo de Chão, set a fresh and exciting tone for LBO activity as we enter the new year.

Want to learn more about LBOs? Read our breakdown of the history and impact of leveraged buyouts.

#4: The industry adapts to increased regulations

“Private funds and their advisers play an important role in nearly every sector of the capital markets. By enhancing advisers’ transparency and integrity, we will help promote greater competition and thereby efficiency. Consistent with our mission and Congressional mandate, we advance today’s rules on behalf of all investors — big or small, institutional or retail, sophisticated or not.”

– Gary Gensler, SEC Chair

2023 was a huge year for regulation in the private equity industry, most notably due to the U.S. Security and Exchange Commission’s adoption of new rules for private equity fund advisors. This new set of rules provides a crucial tone for regulation in the private fund industry. After fast and furious private market growth in the U.S. over the last several decades, the SEC is now sending the signal that it feels the private capital space has ballooned to a point where it requires a heavier regulatory hand.

As compliance with the rules comes due for private equity managers in 2024, many PE firms have work to do in adjusting their investor relations and back-office processes. Meeting these regulatory requirements will be critical for private equity firms to maintain the trust of their investors and to operate in an environment of growing transparency.

For more about the details of the SEC’s new rules, check out our overview of the rule adoption.

#5: Geopolitical events make their mark

“There may be volatility as investors wait to learn more, but in the long run, geopolitical events generally haven’t had a lasting impact on markets…Most of the time, the business cycle has mattered more for investors, which means that barring a major economic disruption or imbalance, the effect of geopolitics on markets has tended to be short-lived.”

– J.P. Morgan

The geopolitical outlook on 2024 changed dramatically as the Israel-Hamas war broke out in October 2023. To be clear, the real loss lies with the growing number of civilian victims and their loved ones as this crisis plays out.

This intermingling of tragedy, tension, and uncertainty has likely left a short-term mark on financial markets, and will continue to in 2024 if the conflict stretches on. With two ongoing geopolitical conflicts now occurring in the Israel-Hamas war and the Russia-Ukraine war, private equity could see the clearest impacts via a continuation of slow IPOs and exits in general, as well as potentially slowed deals in the geographic areas of the conflicts. However, as J.P. Morgan notes, geopolitical conflicts tend not to leave real impact on financial markets in a long-term, multi-year fashion.

Want to know more about what private equity trends to expect in the new year?

Check out our other 2024 trends content:

More About The Author

Tarek Saleh

Chief Revenue Officer

Tarek brings over 15 years of experience across financial services, enterprise sales, go-to-market (GTM) operations, corporate strategy, and business transformation. He specializes in scaling high-performing sales and marketing teams and building global brands. Over his career, Tarek has gained expertise across financial services and technology with direct experience in investment banking, capital markets, and alternatives. Before joining Allvue, Tarek served on the Intralinks executive leadership team, leading both company GTM Strategy & Corporate Development functions. Before Intralinks, Tarek worked in investment banking at UBS and RBS. He holds a degree in Business and Finance from the University of Connecticut.