By: Nate Eisenberg

Product Manager, Nexius Intelligence

January 23, 2026

This post kicks off Allvue’s Private Credit Monitor – a new blog series grounded in 20 years of private markets data uniquely available through Allvue’s Nexius Intelligence and Nexius Data Platform.

As private credit continues to scale, scrutiny is shifting from headline asset growth to the structures underpinning new deals. Recent high-profile credit events and regulatory commentary have intensified focus on underwriting discipline, transparency, and risk visibility. The key question is no longer whether private credit works as an asset class – but how quickly and consistently investors can identify emerging risk as deal structures evolve.

Loan-level analysis from 2022–2025 points to a clear conclusion: the market is not experiencing a broad leverage spike. Instead, private credit is undergoing a structural mix shift toward larger, sponsor-backed transactions with lighter covenant packages. The implication is not rising fragility, but a greater reliance on data, monitoring, and transparency as contractual early-warning mechanisms narrow.

Covenant Structures Are Simplifying in Newer Vintages

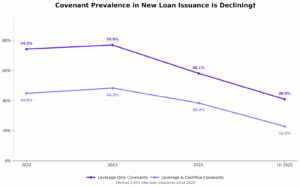

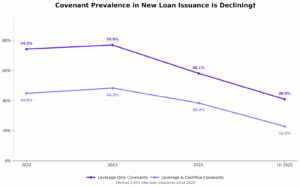

Across recent vintages, the share of loans without observable maintenance covenant evidence has increased meaningfully. Roughly half of private credit issuance in 2022–2023 lacked maintenance covenants. By 2024 – and again through the first half of 2025 – that share rose further, indicating greater structural flexibility for borrowers.

This shift is not an all-or-nothing move away from covenants. Rather, covenant packages are narrowing. In earlier vintages, loans often carried two or more financial maintenance tests. In more recent issuance, when covenants appear at all, they are increasingly limited to Total Leverage Ratio tests. Interest Coverage and Fixed Charge Coverage covenants – historically designed to capture cash-flow stress earlier – have declined materially.

This pattern holds across industries and geographies, though capital-intensive sectors such as Industrials continue to retain more covenant protection. The shift is most pronounced in larger, sponsor-backed transactions where lender competition is strongest.

Leverage Is Stable – But Risk Is Becoming More Concentrated

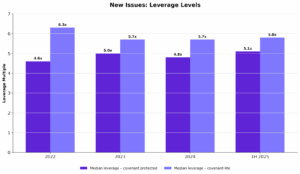

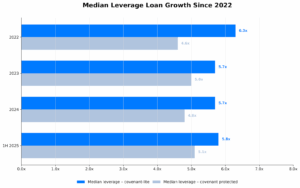

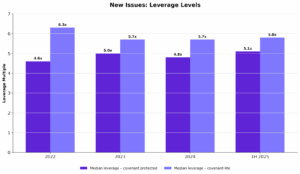

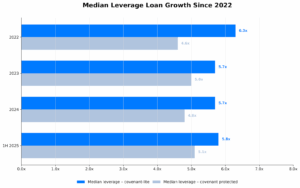

At an aggregate level, leverage in private credit has remained relatively stable over the past four years. However, that stability masks an important intra-vintage dynamic.

Across every year in the dataset, covenant-lite loans consistently carry higher median leverage than loans with observable covenant evidence. That leverage differential persists even as overall averages appear unchanged. In other words, risk is not rising evenly across the market – it is becoming more concentrated within structurally lighter deals.

This matters because covenant-lite structures are most prevalent in larger transactions that account for a disproportionate share of deployed capital. Stable averages can obscure where risk is actually accumulating.

Why Visibility Matters More Than Ever

Recent bankruptcies and stressed loans – many rooted in fraud, opaque asset-based financing, or off-balance-sheet complexity – have amplified concerns around transparency rather than leverage alone. Notably, many high-profile defaults have occurred in public or syndicated credit markets, not private credit. Where private credit losses have emerged, they are often tied to data gaps and limited visibility rather than traditional covenant failure.

As covenant packages narrow, early-warning responsibility shifts away from legal documentation toward continuous monitoring and analytics. Coverage covenants historically provided real-time signals of operational stress before leverage deteriorated. Their removal compresses the window in which lenders – and private credit investors – receive formal warning signals.

In a private market that remains less standardized and more opaque than public credit, this heightens the importance of timely, granular loan-level data and consistent performance monitoring.

What Investors Should Do With This Information

For private credit managers, investors, and allocators, the implications are practical:

- Invest in data foundations. Fragmented, manual data processes delay insight precisely when visibility matters most.

- Re-evaluate monitoring frameworks. As coverage covenants decline, ensure alternative performance indicators and borrower signals are captured and reviewed consistently.

- Prioritize early-warning analytics. The ability to detect subtle changes in performance is increasingly critical as contractual protections narrow.

This shift toward structurally lighter deals is exactly where benchmarking and asset-level visibility become essential. For private credit managers, Allvue’s Deal Intelligence analytics enables loan- and deal-level benchmarking across leverage, covenant structures, and performance trends – helping GPs contextualize underwriting decisions and monitor evolving risk concentrations as portfolios scale.

For lenders providing fund-level leverage, the challenge is compounded. As NAV and other fund finance facilities rely on pools of underlying private credit assets, visibility into covenant structures, leverage dispersion, and borrower performance becomes critical to facility monitoring. Allvue’s Fund Finance Intelligence offering extends asset-level benchmarking and monitoring to fund finance lenders, supporting risk oversight, borrowing-base analysis, and ongoing facility management.

In a market where transparency and monitoring matter as much as structure, Allvue’s data, analytics, and automation capabilities help market participants move from static documentation toward continuous, evidence-based risk insight.

Learn more about Allvue’s Nexius Intelligence offering for private credit.

More About The Author

Nate Eisenberg

Product Manager, Nexius Intelligence