By: Manuel Villavicencio

Consulting Director

November 1, 2023

The Significance of Private Equity Waterfalls

In private equity, distribution waterfalls define the economic relationship between the private equity fund managers (GP) and the investors (LP). It is the fundamental thread that bridges the entire profit cycle of the private equity fund together and, therefore, the most crucial component that a PE fund looks at in terms of fund accounting.

At its core, a private equity waterfall is a structured method for distributing cash flow profits from an investment fund, typically in a hierarchical manner. The name “waterfall” is quite fitting, as it describes the cascading flow of profits down a predetermined path.

The Components of a Private Equity Waterfall Model

To understand how a distribution waterfall model works, let’s break it down into its core components:

Return of Capital (ROC): This is the initial step where investors receive their initial investment or invested capital back. It’s paramount that they recoup their stake.

Preferred Return: After the ROC, limited partners (LPs) receive a preferred return. This is the return hurdle or hurdle rate, usually stated as a percentage of their capital.

Catch-up Provision: The catch-up provision is where the general partner (GP) catches up to the LPs in terms of profit distribution. Once the preferred return is met, the GP takes a larger cut of the investment returns until a certain threshold is reached.

Carried Interest: Also known as “carry,” this is the portion of profits that goes to the GP. It’s their reward for generating returns beyond the preferred return and the catch-up provision. Carried interest is often a significant motivator for GPs to maximize returns.

American Waterfall vs. European Waterfall Models: Choosing Your Path

Now that we’ve dissected how a private equity waterfall operates, let’s explore the key differences between American waterfall and European waterfall models. The two primary models differ in their distribution patterns. Whether you’re an investor or a fund manager, understanding these can guide your investment strategies.

American Waterfall

The American waterfall model is like a straight path down the mountain. Here, the GP starts receiving carried interest as soon as the preferred return is met, even before the catch-up provision. This means that GPs can earn their share of profits sooner.

Advantages:

- Provides GPs with earlier access to carried interest.

- Can be more appealing to GPs as it accelerates their profit participation.

Disadvantages:

- LPs may receive less profit before the GP starts earning carried interest.

- Can be perceived as less favorable to LPs.

European Waterfall

The European waterfall, on the other hand, is a more gradual descent. In this model, the GP only receives carried interest after the preferred return and the catch-up provision have been satisfied. This ensures that LP investors receive a larger share of profits before the GP takes a cut.

Advantages:

- LPs receive a larger portion of profits before the GP starts earning carried interest.

- Often seen as more LP-friendly.

Disadvantages:

- GPs must wait longer to access carried interest.

Calculation Methods: The Science Behind Profit Distribution

Now that we’ve covered the structural differences, let’s delve into the nitty-gritty of calculating distributions in private equity waterfalls.

Hurdle Rate and Clawback Provisions

Hurdle rate is a critical concept in waterfall calculations. It represents the minimum rate of return that must be achieved before GPs are entitled to carried interest. This rate varies but is commonly set at 8%.

Clawback provisions, on the other hand, act as a safety net. If the GP receives more carried interest than they should due to overestimating future profits, clawbacks kick in. They require GPs to return excess carried interest to the fund.

Why waterfall automation software too often fails

The pain and frustration many CFOs express about waterfall automation is understandable. Many of the ‘out-of-box’ solutions currently in the marketplace don’t fulfill their promise, for a number of reasons:

- Systems lack the flexibility to cope with the intricacies and individuality of each LP agreement, forcing teams into an unsuitable workflow.

- Solutions often only support an aspect of the waterfall rather than the entire structure, in which case teams can’t use it to replace their existing system and it only adds complexity.

- Teams try to build their own solution but underestimate the R&D required to both get the project off the ground and then keep it up to date. Plus, with no ability to query, they have to work with imported files, which then have to be adapted to fit the solution.

PE funds need a configurable, automated solution that can cope with dynamic calculations for different workflows—and cash flows—in order to create a risk-averse process and eliminate the need for cumbersome spreadsheets.

What makes Allvue’s waterfall automation solution different

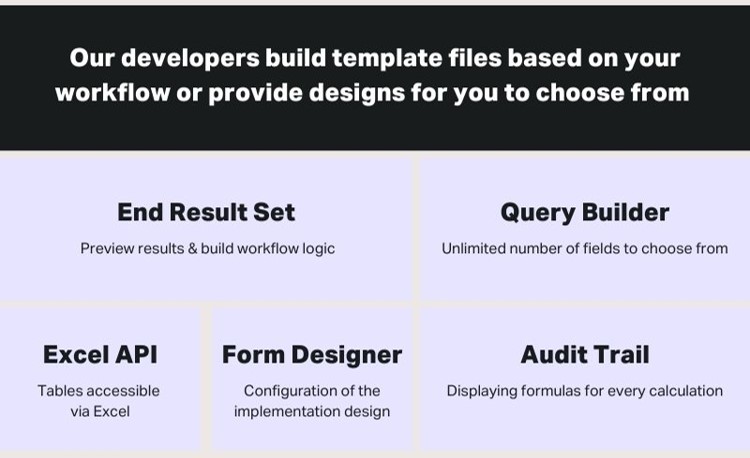

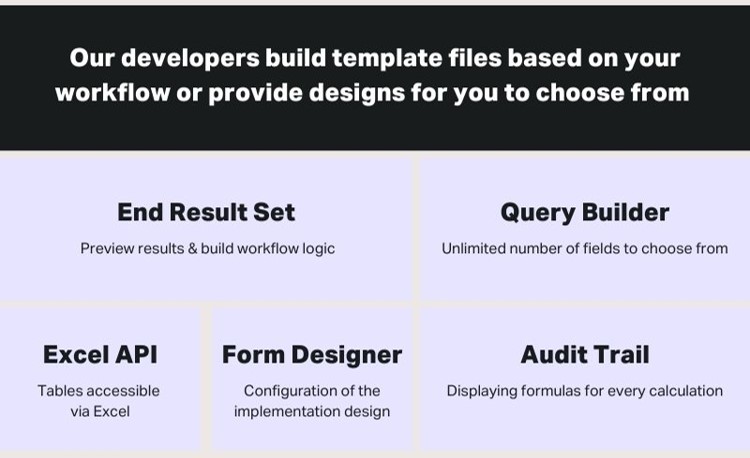

Allvue’s solution to the waterfall distribution is unique because it recognizes the above challenges and takes a different approach.

Far from being left to your own devices, our teams work closely with you to implement your waterfall within our fund accounting software framework. Therefore, any workflow can be accommodated within our proprietary technology.

The real game-changer is the form designer, which auto-generates code that turns an Excel form into a dynamic one. Fitting your workflows into a dynamic template then feeds a portal you can log into to run your report based on the data you select.

Finally, true distribution waterfall automation is a reality

Not only will PE funds benefit from faster, more reliable and accurate workflows, they will also reduce risk and operational expenses while enjoying simplified scalability.

It’s time to move away from manual processing and workarounds and embrace the benefits and cost savings of automating waterfall calculation processing. Discover the power of Allvue’s Fund Accounting software solution.

More About The Author

Manuel Villavicencio

Consulting Director

Manuel is a Consulting Director at Allvue. Manuel has worked with private equity clients and other leading asset management firms and fund administrators for over 17 years, leading various business consulting and technology implementation projects. Prior to joining Allvue’s predecessor, AltaReturn, Manuel was a Senior Manager in Ernst & Young’s Asset Management advisory practice where he spent six years advising clients on operational improvement initiatives and vendor selections. Manuel has spoken at a number of industry conferences and has authored whitepapers focused on trends in private equity operations. He is a licensed CPA with a Bachelor of Accounting from Florida International University and a Master of Business Administration from Columbia Business School.