By: Kimberly Kale

Head of Product - Back Office

January 10, 2023

Our primer on private equity fund accounting breaks down what fund accounting is and how it differs from other accounting methods.

What is Fund Accounting?

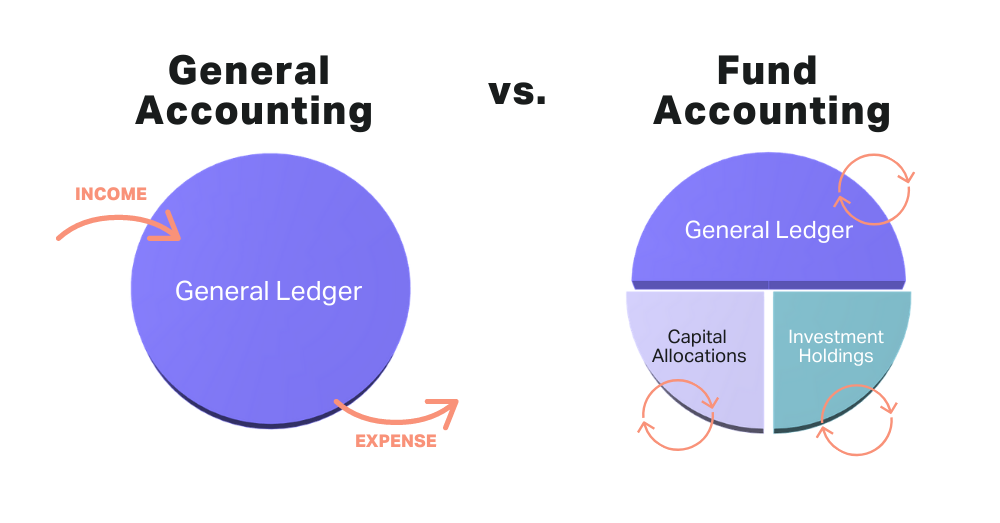

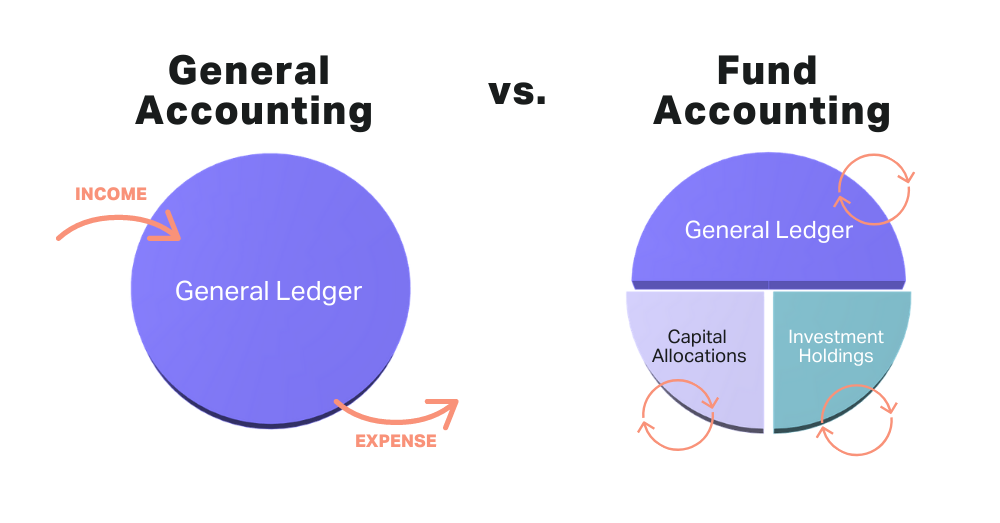

Fund accounting, in reference to alternative investments, refers to the methods of accounting used by investment funds. Some of the responsibilities of fund accounting in private equity overlap with traditional, corporate accounting – such as identifying income and expenses on an accrual basis and verifying accounting records against external sources – but others are unique to investment funds.

Unlike hedge funds, which often engage in extensive leverage and derivative trading, or venture capital firms that invest in early-stage companies, private equity funds typically invest in mature companies, employing different strategies and risk assessments. This necessitates distinct accounting approaches, particularly in terms of valuation and profit realization.

What makes private equity fund accounting different?

Every company – whether it’s a non-profit, pizza parlor, or private equity investment manager – must, in some way, track the financial inflows and outflows of their business. All businesses have to capture in some accounting ledger how many purchases they made, how much money came in, and other basic financial events.

DOWNLOAD OUR WHITEPAPER: 4 WAYS EMERGING MANAGERS CAN ACCELERATE GROWTH

What sets the accounting needs of private equity firms apart from other companies is that, while pizza parlors, for example, make purchases with their own funds, private equity firms make purchases with their investors’ funds. The accounting standards are the same, but the uses are different.

This is what gives fund accounting its other name – partnership accounting. General partners, the fund managers, raise funds from limited partners, the investors, in order to make investments. The complexities of this partnership, governed by a imited partnership agreement (LPA), include varied investment commitments and preferences of LPs, which significantly influence fund accounting practices. The LPA details roles, responsibilities, fee structures, and distribution policies, all of which have profound accounting implications. What further complicates this distinction is that not all investors make the same investment into the fund.

This is true on two levels – one rather straightforward, the other more complex.

The basics of fund accounting

LPs commit different amounts to a fund, resulting in varied ownership percentages. Simple allocation based on these percentages is straightforward. However, not all investors participate in every investment.

Investor A might commit $200,000 to Fund I while Investor B commits $300,000. Accounting for these differences is straightforward; to calculate what each investor owes for an upcoming capital call is as simple as calculating their percentage of the fund.

But investors also might choose to not invest in certain investments. Investor A, for example, might be an endowment at a university and have ESG requirements. So when the fund notifies its investors that it will be making an investment in oil, Investor A might opt to sit that investment out.

This gets to one of the key differentiators of private equity fund accounting: Allocation.

Allocation

In private equity fund accounting, transactions need to be tracked at the partner level so they can be allocated correctly according to partner levels of ownership, function, and responsibility.

But not all accounting activity will be allocated according to a simple ownership percentage. One common example is fund expenses and management fees. In some cases, the LP who contributes the most into a fund may negotiate a lower management fee percentage than other LPs. The concept of an allocation rule emerges, then, to accommodate these more nuanced fund-level characteristics.

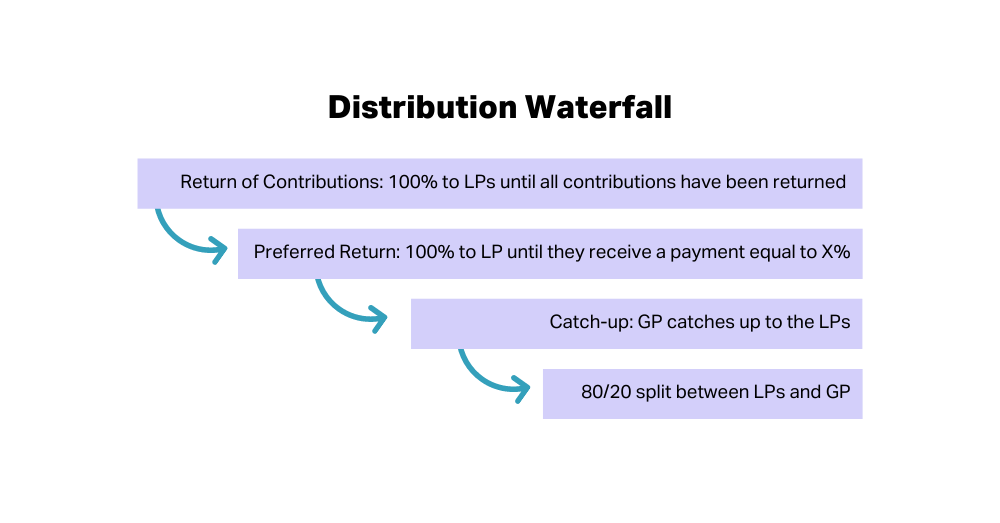

Similarly, distributing profits back to LPs after investments have been realized is more complex than a calculation based on a simple percentage-based commitment. As discussed further below, distribution waterfall calculations can take on dizzying complexity and eat up hours of an accountant’s time.

These complexities extend to adhering to accounting standards like GAAP or IFRS, especially in preparing financial statements that accurately reflect the fund’s activities and financial position. The need for specialized reporting, such as balance sheets and income statements tailored to the fund’s structure, is a key aspect of private equity fund accounting.

The unique characteristics of private equity fund accounting give rise to unique challenges – and make clear the need for fund accounting software designed specifically for the alternative investment market. Before discussing these specific challenges, though, it is worth examining the business-related processes that make up the bulk of fund accounting activities.

CASE STUDY: How Polaris, an industry-leading private equity firm, launched a new fund and strategy without increasing headcount

Private equity investment & capital activities

The business process related to private equity fund accounting can broadly be grouped into two buckets: investment activities and capital activities.

What are investing activities?

Private equity investment activities, as the name suggests, concern those cash flows between the fund manager and their investments (e.g., portfolio companies, funds, real properties, land, etc.). Broadly speaking, these fall into two buckets, cash flows from the GP to the investments (funding purchase), and cash flow from the investments back to the GP (divestments, realizations, etc.).

Partial list of Investment Activities:

| Name |

Category |

| Security Conversion |

Corporate Activity |

| Stock Split |

Corporate Activity |

| Business Operations |

Generic Allocation |

| Elimination Entries |

Generic Allocation |

| Equity Pickup |

Intercompany |

| Interest Accrual |

Interest Income |

| Interest Payment |

Interest Income |

| Investee Commitment |

Investee Commitment |

| Bond Acquisition |

Purchase |

| Direct Purchase |

Purchase |

| Investee Funding |

Purchase |

| Investee Cash Distribution |

Purchase |

| Direct Sale |

Sale |

| Investment Write Off |

Valuation |

| Valuation |

Valuation |

Capital activities concern those cash flows between the fund manager (GP) and investors (LPs). Again, broadly speaking these fall into two buckets, cash flows from the LPs to the GP (capital calls, including management fee expenses), and cash flow from the GP to the LP (cash and stock distributions).

Partial List of Capital Activities:

| Name |

Category |

| Investor Capital Call |

Capital Call/Distribution |

| Investor Cash Distribution |

Capital Call/Distribution |

| Investor Commitments |

Commitment |

| Investor Unfunded Commitment Adjustment |

Commitment |

| Management Fee Expense |

Generic Allocation |

| Carry Allocation |

Generic Allocation |

| Investor Transfer |

Interest Transfer |

| Investor Reallocation |

Investor Reallocation |

| Investor Sub Close P&L True Up |

True Up |

The specific details for these different activities will vary, in some cases substantially, between types of funds, but they will all generally fall into these two categories.

INFOGRAPHIC: How to Complete a Capital Call in 10 Minutes with Allvue

Challenges of private equity fund accounting

The unique characteristics of private equity funds bring about distinct challenges. These include managing complex distribution waterfalls due to customized LP agreements, subsequent closings to accommodate new investors, and equity method accounting for incorporating profits and losses from lower-tier entities into the financial statements of upper-tier entities.

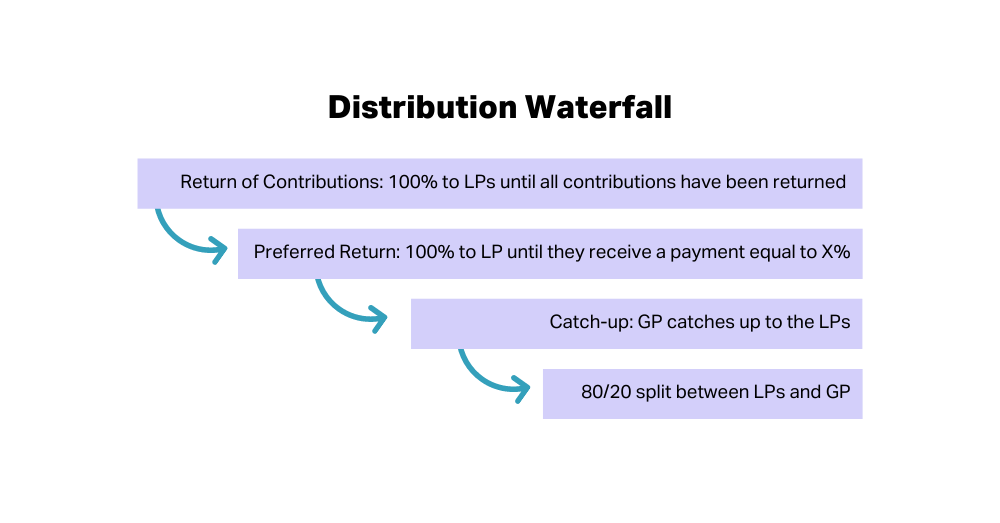

Distribution waterfall calculations

Waterfall calculations are one of the most notoriously complex aspects of fund accounting. Customized LP agreements often lead to a wide variety of waterfall structures, and the calculating of distributions becomes even more complicated once one factors in tiers, catch-up calculations, and other one-off subtleties – eating up valuable hours and opening the door for errors.

The solution seems simple: automate the process. But the complexity of waterfalls has long made it a challenge to do so, especially in any way that would add true value.

Now, though, true the process has been greatly simplified.

Subsequent closings

Subsequent closings – that is, any closing that happens after the initial closing date, most often to accommodate a new investor – are similar to other fund accounting challenges: the concept itself is straightforward, but the devil is in the details.

Tracking subsequent closings and calculating equalizations and equalization interest can quickly become challenging, especially as accountants accommodate multiple capital calls and closings across multiple funds. The right technology, though, can help simplify and de-risk the process.

Equity method accounting

Equity method accounting is used to pull profits and losses up from lower tier entities into upper tier ones. Doing so allows one to properly reflect unrealized gains and losses in quarterly statements and other investor reports – and, thus, to show the accurate value of one’s portfolio.

Unfortunately, many systems aren’t built to handle this methodology. Accountants are too often forced to manually key GL entries for each entity during a financial close, adding a significant amount of time and risk to the process. With Allvue, though, it’s possible to significantly streamline equity method accounting processes.

The future of private equity fund accounting

Fund accounting, like much of private equity, is constantly evolving and changing. One of the key drivers of that change is advances in fund accounting software. Advancements in fund accounting software are expected to bring more automation and analytical capabilities, simplifying processes like equity allocations and waterfall calculations. This technological evolution will likely shift focus towards more strategic and analytical considerations in fund accounting.

“We’re expecting to see more automation, especially more automated responses through equity allocation and waterfalls to investors,” predicts Travis Broad, Manager at Lionpoint Group. As automation streamlines more processes, it should free up teams for higher value work.

“There will be a shift towards more analytical-minded considerations once people have this freedom to not worry about data inputs,” Broad predicts.

READ MORE: In Conversation with Lionpoint Group: The Future of Fund Accounting

Fund accounting and fund administrators

To outsource or not to outsource – that’s often the perennial question for fund managers when considering back-office operations like fund accounting. Choosing between in-house accounting, outsourcing to fund administrators, or opting for co-sourcing involves considering factors like fund complexity, desire for control over financial data, and the need for specialized accounting expertise. Each option comes with its own list of pros and cons:

Having an in-house back-office

Pros:

- Complete control over and visibility into the process

- Data stays in-house, making it easier to share relevant performance data with your deal team, IR team, and LPs

- You can ensure customer service isn’t impacted by a third-party being added to the workflow

Cons:

- Proper back-office operations require a significant investment, and become more complex as your company grows

Outsourcing to fund administrators

Pros:

- Leverage the expertise of a team solely focused on back-office operations

- Gain time and resources back

Cons:

- Introducing a third-party into your process can add risk, damage customer service, and complicate other processes, such as communicating between your back-office and other teams

- Some managers feel the need to maintain a “shadow copy” of records – for audit and record purposes – leaving them in the position of playing catch-up with their fund administrator and adding work back into their own processes

Co-sourcing with fund administrators

There is a third option – co-sourcing – which has been gaining more popularity recently. With co-sourcing, your administrator enters and updates your fund’s financial activities directly on your fund accounting system.

There are a number of benefits to the co-sourcing model, for both fund managers and administrators:

Co-sourcing benefits for Fund Managers

|

Co-sourcing benefits for Fund Administrators

|

| Keep it together

With your key back-office data now back in your domain, co-sourcing enables you to share relevant performance data with your deal team to aid in follow-on investment decisions, with your IR team and externally with LPs when fundraising. |

Less is more

Simplify by de-leveraging your technology and vendor risk – no more playing middleman between your client and your technology vendor, being blamed for things you can’t control. With co-sourcing you can focus on what you do best, servicing your client’s needs. |

| Golden record

A single golden record, with no need to maintain your own shadow copy, forever trying to stay in sync with your admin. With co–sourcing your record is the very same one your admin accesses and keeps up-to-date in real-time. |

You can sleep at night

Managed costs and improved performance – co-sourcing mitigates the need to add additional client assets onto your own technology instance. |

| Better safe than sorry

Control your risk and reputation. With co–sourcing you’re both working off the exact same secure system, protected and out of reach from bad actors. |

Go Beyond

Giving your client the choice of where their fund and investor financial data resides means that with co-sourcing you can differentiate your offering based on your exemplary service, while your competitors continue to cling to the traditional model. |

DOWNLOAD OUR WHITEPAPER: Co-Sourcing: The next frontier in Fund Administration

How Allvue streamlines fund accounting workflows

Allvue Systems offers fund managers true general ledger fund accounting software designed specifically for the needs of the alternatives market. Built to handle the most complex fund structures and partnership accounting requirements, Allvue’s Fund Accounting software solution combines into one fully-integrated platform:

- Detailed financial statement reporting

- A multi-currency general ledger

- Cash management

- Integration with waterfall calculations

- Workflow standardization

- And much more

Download our Fund Accounting brochure to discover how our cloud-based solution, built within Microsoft’s enterprise framework, can help empower superior investment decisions.

More About The Author

Kimberly Kale

Head of Product - Back Office

Kimberly is responsible for back office product management at Allvue. She joined Allvue’s predecessor, AltaReturn, in 2009 and has over 25 years of software management, including 18 years servicing the alternative investments industry. Prior to joining AltaReturn, Kimberly spent seven years with FIS/Investran, first in New York, and then transferring to London to manage the EMEA implementation team. She began her career at KPMG Public Services practice in Washington, DC, and moved on to implement ERP solutions for various insurance and healthcare clients. Kimberly holds a Bachelor’s degree from Vanderbilt University and is currently based in Allvue’s Miami headquarters.