February 24, 2022

Like most industries, correspondence from fund managers has evolved over the last three decades, from fat envelopes carried by the USPS to email replete with cumbersome attachments. Email has been the preferred source of communication for many years, but with increasing concerns around data security, it’s become too risky of a method through which to disseminate sensitive information. Enter the investor portal software solution.

What is investor portal software?

An investor portal is a web-based interface that allows GPs to publish documents and other investment information directly to investors through a secure platform. It provides numerous benefits and has been well received by both the general partners and limited partners communities.

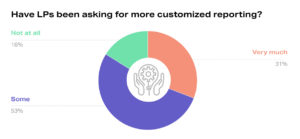

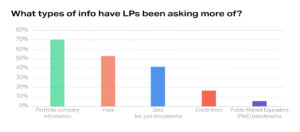

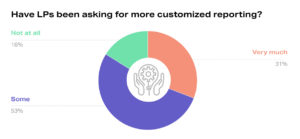

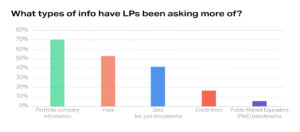

A recent survey of general partners revealed that nearly 85% of their LPs have been asking for more customized investor reporting, and investor portals allow for more advanced private equity reporting through a more secure, easier-to-manage platform.

Why do LPs prefer portal solutions for reporting?

Investor portal software is designed to streamline communications between GPs and their LPs. It provides a central, cloud-based platform where LPs can search for and download documents and account information when they need it.

Other advantages of the investor portal solution for LP reporting include (but aren’t limited to):

- Time: Limited partners can access needed information (such as statements, cash flow analysis, K-1s, and more) at the click of a mouse. They no longer need to request information and wait for a response. Everything they need is readily available.

- Organization: Portals can provide an organized and highly configurable system, with intuitive methods for data retrieval.

- Security: A browser-based portal is more secure than email and one of the top reasons GPs have been quickly adopting this solution.

READ MORE: LP Communications: Investor Portals Creates a Win-Win Solution

What are Virtual Data Rooms (and why are they insufficient)?

What is a VDR?

Early iterations of investor portals were dubbed Virtual Data Rooms or (VDRs), which are still used occasionally as an email substitute. As the definition implies, they are a digital place to store data, providing a more secure option than physical document storage that also provides greater access for a wider number of stakeholders. Also called “deal rooms,” they were initially conceptualized for M&A purposes, when distinct entities needed a secure place to swap sensitive information.

As LP expectations for data management and communication with their GPs has evolved rapidly, however, VDR technology is often not up to the task.

VDR limitations for LP reports

LPs have been pounding the table for more transparency from their alternative investment managers, and this is where the typical VDR (and other file-syncing applications like Box and Dropbox) fall short. These solutions, while adequate for uploading large files securely, do not give LPs tools with which to glean insights into their investments, nor do they provide the ability to independently download data. And these shortcomings are a problem.

As the CIO of a large insurance company recently told us: “Being able to download data right from a chart or table in a portal is much more helpful to us than having to download a document and then re-entering the data in our system. [That’s] a complete waste of time.”

Moving PDFs to a file system in the cloud has been a step in the right direction when compared to email, but there are still numerous problems with sharing information with investors via documents only.

When digital documents are presented as a whole, it’s natural to skim the information, which can cause LPs to overlook critical detail. The VDR method also forces LPs to “re-key” sensitive and intricate information like cash flows and valuations into their own spreadsheets or systems, sacrificing time and accuracy.

How Allvue streamlines the LP reporting process

It seems both GPs and LPs agree that email as an LP reporting tool has passed its shelf life. VDRs, while incrementally better, also seem to have run their course. With security and transparency always top-of-mind, investors can be excused for being a bit nervous and inquisitive. For GPs, staying ahead of the communication curve in the coming years is going to be increasingly important.

Once LPs begin to have access to the type of reporting tools normally reserved for their marketable securities, one can imagine document-centric VDRs will start to become passed over for the type of experience an LP can have with a full-featured investor portal. Providing a custom-branded analytical and data-centric LP reporting platform can fuel investor goodwill, and subsequently, GP growth.

In addition to providing a better experience for LPs, an investor portal is an important tool for GPs as well. It’s a scalable way to manage investor communications and can significantly reduce not only risk but also the time needed to produce, organize, and distribute information.

Reach out to learn more about how Allvue’s Investor Portal software can help your funds grow and scale successfully while keeping your LPs engaged and informed.