By: Jared Kreutzer

Product Manager, Investor Relations

April 10, 2024

In the private equity space, investor portal technology has become table stakes for managing communications and investor reporting challenges between general partners and their investors.

In this article we breakdown the benefits of investor portals, explain the common challenges that investor relations (IR) teams face when dealing with investor relations, and detail how Allvue’s investor portal software solution is de-risking and streamlining investor communications.

WATCH: A 2-MINUTE DEMO OF THE ALLVUE INVESTOR PORTAL

The need for an ongoing LP communications plan has never been greater

The private capital space has faced a challenging investment environment over the last few years, and while a certain level of relief has been predicted for this year, private equity deals and exits have remained stubbornly slow. For example, 2023’s venture capital industry saw a 38% year-over-year decrease in startup funding, its lowest level since 2018. In private equity, 2023 saw a 28% decrease in exit volume from 2022.

Given this environment, it is essential that GPs develop an ongoing communication plan between themselves and their investors. Managers must be proactive in reaching out to their investors and ready to quickly and accurately respond to any inbound inquiries. How that information is transmitted between GPs and LPs, though, is another story.

The default tool most GPs turn to is, of course, email. But, obviously, for LPs this is less than ideal for a number of reasons. It’s not uncommon for a pension fund to have 50-100 private capital GPs in their portfolio on which they need to track and report. With an inbox full of letters, updates, statements, agreements and the like, the onus is put on the LP to manage their GPs’ communication and it is, to say the least, significant.

But what if a GP could employ a private equity reporting tool that not only helps them organize their investor communications but also helps their LPs in doing the same? This is the promise of an investor portal.

What are the benefits for GPs of using an investor portal?

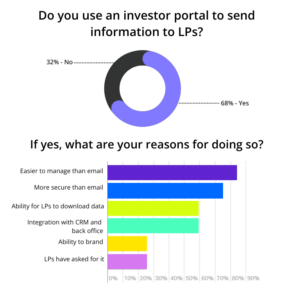

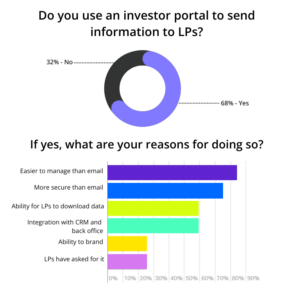

Our survey of CFOs showed that over two-thirds of GPs surveyed use an investor portal to manage LP communications for a variety of reasons. But, clearly a few reasons rose to the top.

Investor portals are easier to manage than email

The efficiencies GPs gain by using an investor portal are significant. Portals can help GPs to save time and resources by automating many of the tasks associated with managing LP communications, such as sending out reports, tracking document requests, and managing questions and follow ups. This, subsequently, can free them up to focus on other vital tasks, such as sourcing and executing investments.

Investor portals are more secure than email

Cybersecurity is a massive issue today for companies of all shapes and sizes, but the significant capital that flows through private equity attracts special attention.

In fact, it is estimated that the average mid-market private equity fund grapples with over 10,000 cybersecurity attacks per day.

By moving sensitive information out of email, GPs can significantly increase their cybersecurity and better protect their LPs data.

Investor portals allow LPs to self-service

Now more than ever, LPs are requesting access to detailed reporting and information. Some portals, if equipped with the functionality, can allow LPs to directly access data, allowing them to run their own reports and analysis. This benefit is two-fold. For one, it obviously reduces the workload on the GP. But just as meaningfully, it increases transparency – and thus builds trust – with LPs.

An investor portal provides a centralized location for LPs to access all relevant information, such as performance reports, investment updates, and financial statements. Seeing the data clearly and openly collected helps to improve transparency and accountability, while reducing the time GPs must spend fulfilling requests.

Investor portals allow GPs to have a fully-integrated tech stack

If the investor portal solution integrates with the other tools in a GP’s tech stack, fund managers can significantly streamline their processes and reduce errors. They can connect their accounting technology with their portal to seamlessly initiate capital calls or to send out statements leveraging a single-source of truth data, without having to worry about duplicate entry and the time-consuming, fat-finger errors that often come with it.

Investor portals provide insight into LP usage

Another advantage of LP portals is the visibility they give GPs in knowing which investors have accessed information that’s been shared and when.

If, for example, you are in the process of calling capital, it would be critical to make sure that every investor has seen the communication, particularly if under a time constraint. Knowing which investors have read the communication and which haven’t can help IR be more proactive in getting sign offs and following up. Such visibility into LP interaction with posted information can be invaluable for IR teams and will make investor management significantly easier.

What are the benefits for LPs of using an investor portal?

LPs enjoy many of the same benefits from investor portals that GPs do as well as a few others:

- Ease of use: Just as for GPs, investor portals give LPs easy and convenient access to all the information they need about their investments, including performance reports, investment updates, and financial statements. This centralized repository helps LPs to make informed investment decisions and to monitor their investments more effectively.

- Increased security: LPs are subject to cyberattacks too. The enhanced security of a portal not on provides peace of mind but can sometimes help LPs meet regulatory requirements as well.

- The ability to self-service: If investors can dig directly into the data themselves, they not only are able to accomplish their own processes faster, but they give their fund managers back time to help them identify new opportunities and manage their portfolio.

- Improved communication: Investor portals allow LPs to send updated information such as wire instructions or communication preferences through secure channels to eliminate the need to send sensitive information via e-mail or risk data issues caused by manual entry.

A successful investor portal experience requires the right technology

Overall, investor portal technology offers a number of benefits for both GPs and LPs. But, of course, those benefits – for both GPs and LPs – can only be achieved if the underlying technology offers certain features, such as:

- A portal solution must be scalable, as well as intuitive and easy to manage for GPs, while being easy to use for their LPs.

- Ability to configure a fully white-labeled website that accurately reflects your brand

- Proper administrative and internal reporting functionality to provide the proper level of insight into LP activity and access on the portal

- Direct integration to your CRM and fund accounting software solution so that both investor-specific and fund-specific data and reports can be generated and posted quickly to the portal to address LP’s information requests

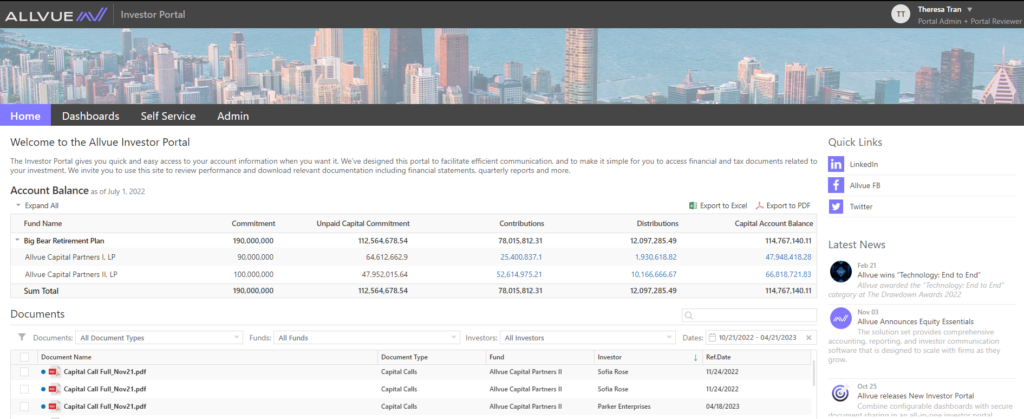

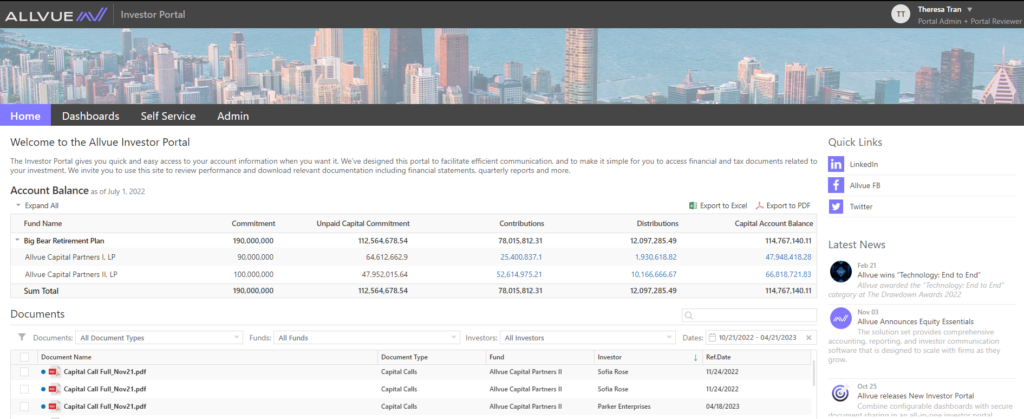

Allvue’s investor portal offers a powerful, flexible software solution

Allvue System’s Investor Portal software solution combines the best of all worlds: highly configurable, feature-rich dashboards, the ability to securely share K-1s, notices and other documents, and best-in-class LP communication tools to allow your investors to update their information directly in the system.

Our Investor Portal has a handful of distinct features that set it apart from the competition:

- We are built on Microsoft, which allows us to offer a cloud-based, intuitive environment that, unlike many of our competitors, doesn’t require costly upgrades.

- Our solution is available preconfigured, as opposed to many of our competitors who have lengthy and costly implementation processes.

- We integrate with PowerBI, enabling a “self-service” experience for your LPs. They can customize their dashboards and data views, boosting user satisfaction and cutting down on ad-hoc data requests to your team.

- Our solution integrates seamlessly with our industry-leading platform. Allvue offers award-winning back-office solutions, including our best-in-class fund accounting software system. Our investor portal offers an entry-point into that ecosystem so that users can easily scale their tech stack along with their firm.

Reach out today to learn more about our stand-alone and fully-integrated investor portal options, and to find out why Allvue’s Investor Portal is already accessed by over 90,000 users from the world’s leading institutional investors.

More About The Author

Jared Kreutzer

Product Manager, Investor Relations

Jared Kreutzer is the product manager for Investor Relations covering portals and CRM. He joined AltaReturn, a predecessor to Allvue, in 2012 and has worked with hundreds of clients globally in adopting and improving Allvue’s products. He holds an MPA in International Development from the London School of Economics and Political Science. He is based in the San Francisco bay area.