By: James DiCostanzo

Sales Director

January 23, 2023

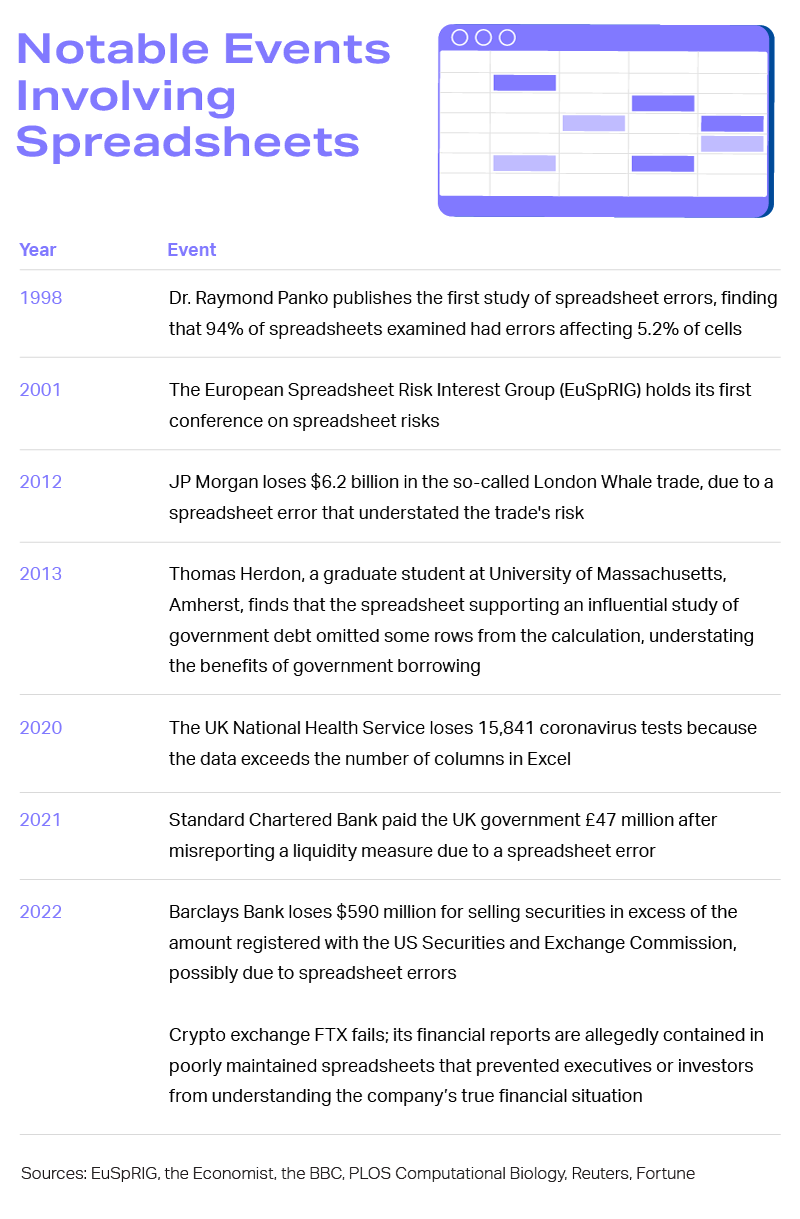

Spreadsheets are fantastic for organizing and presenting data. They revolutionized finance, but they have a lot of limitations because they weren’t built for purpose. Many investment management firms start out keeping records in spreadsheets because it’s cheap and easy—at first. As the firm grows, spreadsheets can’t keep up. Excel often makes for clunky processes that are very likely to have errors. Excel errors may be as small as a typo in a header or so large as to put the entire firm at risk. Both errors make general partners look unprofessional in a competitive market.

Academic research consistently finds that almost all spreadsheets have errors. This article looks at errors in the use of spreadsheets, errors within spreadsheets, and the information security risks inherent in such a flexible application. Allvue offers an alternative to spreadsheets to improve the workflows and processes of private capital firms.

Errors in the Use of Spreadsheets

Researchers classify problems with spreadsheet design as “errors in the use of spreadsheets.” For example, best practices in spreadsheet design include putting variable inputs aside in a separate section and keeping formulas simple. These reduce errors and make it easier for another user to follow what’s happening. And yet, too many spreadsheets have lengthy formulas with hand-coded variables. Spreadsheet creation is both an art and a skill, and not everyone who builds or edits a spreadsheet brings the same approach and same level of understanding to the task.

Microsoft Excel and Google Sheets have built-in templates and design tools that make spreadsheets easier to use, but the capabilities are limited. It’s easy to find a pre-made template for wedding planning, but much more challenging to find one for managing capital calls. The standard templates aren’t designed for complex financial services companies, and the built-in layout tools take some skill to use properly. Less-experienced users aspiring to a nice-looking spreadsheet may try such shortcuts as making extra-long equations rather than breaking down the steps, increasing the risk of error and making it hard to follow the computational process.

Errors Within Spreadsheets

It isn’t enough for a spreadsheet to have good design and documentation. Researchers have found that a typical spreadsheet has errors in 1.79% of cells. After all, even the best spreadsheet designer is a human being. It’s so easy to transpose a number or mistype an equation operator. The London Whale spreadsheet error involved dividing a number by the sum of two numbers rather than the average, making a trade look half as risky as it was. These mistakes are very human—and very common.

The big spreadsheet packages have autocorrect and other capabilities to help reduce human error, but this can lead to other issues. Dates entered incorrectly become numbers. Street names in other countries become changed into English versions. The autocorrect problems become more complicated if users working in different languages are sharing a single workbook. Excel allows users to choose both a display language and a proofing language. A user may change a display language and accidentally change a proofing language at the same time, causing havoc down the line.

Spreadsheets are incredibly useful for analyzing data, testing calculations, and preparing presentations. They become less useful as they become more critical to the organization, because the tendency for errors increases with the number of users and numbers of processes embedded in them. Big, complex workbooks sometimes have hidden cells and layered pages that make Excel errors harder to find. Moving a column may leave behind a blank cell incorporated into an equation. Some users will hardcode a cell to get rid of a circular error, a short-term fix that corrupts the spreadsheet.

Spreadsheets Create Security Risks

Spreadsheets can be used on any computer. They can be moved or copied from desktop systems to web-based applications, moved to a thumb drive, or emailed outside of the organization. In fact, when data is stored in spreadsheets, it often must be shared through email or other unsecured channels because there is no secure repository.

The open and flexible nature of spreadsheet packages creates another security risk: spreadsheets are subject to key employee risk. An employee may build a critical spreadsheet and then move to another company. The knowledge of how the spreadsheet works goes with them. Another employee could change a single equation to a hardcoded number, affecting a series of dependent equations, and other uses might never discover it.

DOWNLOAD WHITE PAPER: THE RISK OF SPREADSHEETS FOR PRIVATE CAPITAL MANAGERS

Allvue Offers More Power than Spreadsheets

Spreadsheets are useful for many tasks, but they were not designed to support the operations of a sophisticated, growing private investment partnership. They are flexible and error-prone, easy to use and hard to secure. The more workbooks and worksheets, the more complex the workflows and more difficult it is to attest to the results. You need spreadsheets to do your work, but you should not rely on them for mission-critical processes or for securing sensitive information.

Consider distribution waterfalls. Many firms calculate these by hand, on multiple spreadsheets, a process that takes days and burns out the accounting staff. Allvue automates the process, avoiding both human and Excel errors.

Allvue is a true alternative to spreadsheets. Private capital managers can put their core business data into a single repository. Our end-to-end solution supports fundraising, investment management, and investor reporting, among other functions, for multiple funds, currencies, and asset classes. It’s already designed for your business now—and where your business is headed.

More About The Author

James DiCostanzo

Sales Director

James DiCostanzo is a global sales leader with over 20 years of experience in the financial, private equity and SaaS industries. He is currently the Global Head of Growth Equity Sales at Allvue Systems, a leading provider of investment management solutions. He joined Allvue Systems in March 2020 as the Head of Sales for the East Region, after working at Thomson Reuters for nearly two decades in various roles, including Head of Solution Specialists, Data & Analytics and Global Business Director. He has a bachelor’s degree in Business/Managerial Economics from SUNY Oneonta. He is based in the New York City Metropolitan Area and can be found on LinkedIn at https://www.linkedin.com/in/jamesdicostanzo/.