By: Allvue Team

September 8, 2020

Introduction

The COVID crisis is unprecedented and has stressed systems and capacity throughout the world. Over the past months, we saw our public infrastructure such as hospitals and testing capabilities overwhelmed by the peak demands caused by the crisis. In the same way, the crisis has stressed and sometimes overwhelmed private equity infrastructure and exposed inefficiencies in their existing systems and processes.

When the COVID crisis struck, the demand for information hit an all-time high. Our clients (GPs) and their investors (LPs), were confronted with a dramatic market shift which challenged their current investment model and resulted in an urgent need to understand investments through the new lens of the COVID pandemic. Both GPs and their investors required insightful information to understand their investment risks and opportunities to make better decisions at a time of crisis.

However, GPs that did not have the right systems were soon overwhelmed by the demand for information. The traditional solutions that GPs had long relied on to serve their investors and their internal stakeholders were no longer effective. As firms take a step back and analyze what happened, they will find the root of the problems were due to multiple systems and lack of a holistic data strategy.

The weaknesses that were exposed are due to:

- lack of common workflows to support gathering, approving and distributing data and reports

- no single source of data to draw information from, as a result of the utilization of multiple point solutions

- difficulties with data reconciliation

- multiple systems to manage different asset types

Not having the proper tools to visualize and report data to satisfy the needs of internal deal teams and LP investors suddenly made the reporting burden on GPs even more difficult.

The Structure of an End to End Workflow Solution

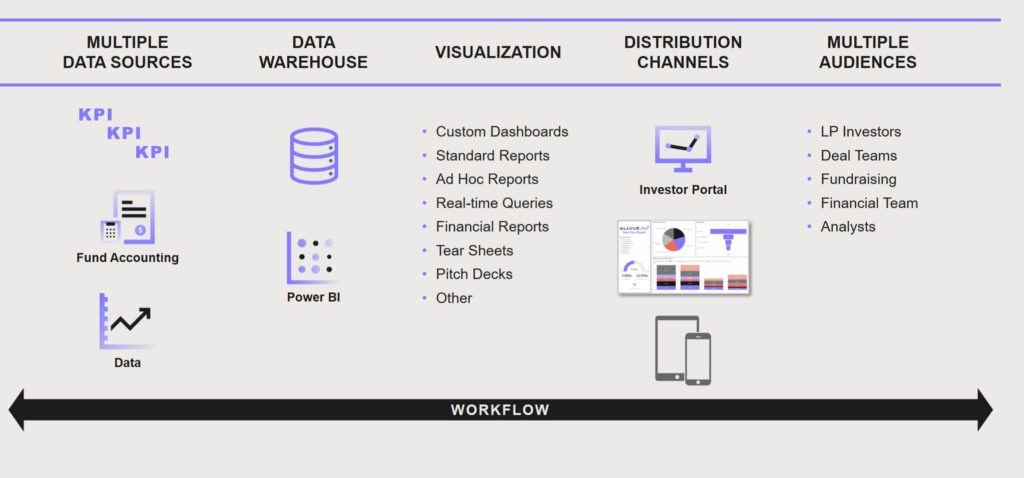

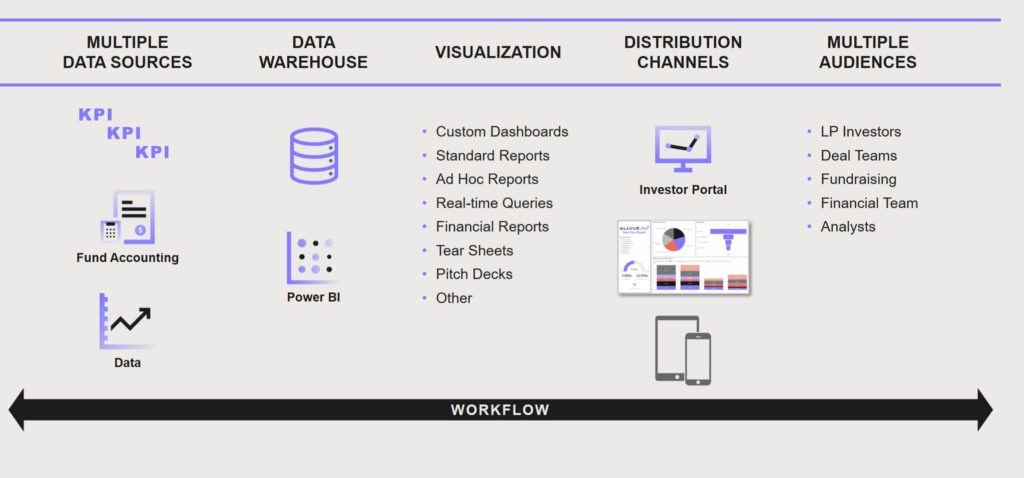

In order for GPs to successfully mitigate these challenges, they require a holistic solution which enables them to distribute information to investors and stakeholders, and allows their clients to manage and monitor investments. Ideally, a single technology instance will help keep GPs on track and facilitate their ability to scale up when needed. This solution should provide the following components:

Data Warehouse to consolidate data from multiple systems and sources

Aggregating information of all types in one place, including enhanced information from additional sources such as accounting, GPs are able to see the bigger picture at a single glance, and marry data from both the Equity and Credit sides of their business in a single instance.

Workflow Engine to capture and manage portfolio company reporting

Capturing portfolio company information and managing a standardized workflow process allows team members in multiple locations to stay connected, and it ensures that all teams are on the same page, saving GPs time and effort.

Business Intelligence tools to aid in bespoke report generation

Automating the process by which both standardized and bespoke reports can be scheduled with business intelligence solutions and provided on-demand allows LPs to take charge of their information.

Visualization capabilities to create dashboards and provide easier access to data

Providing a flexible data presentation layer lets users visualize the data through dashboards and queries with drill down capabilities, enabling a deeper dive into the data.

Mobile Access to support data distribution everywhere

Distributing data through web browsers, mobile devices, tablets, and investor and fundraising portals results in more informed, satisfied investors.

Investor portal integration to support LPs via custom reporting and dynamic dashboards

Letting LPs access information on demand via dynamic dashboards and self-service capabilities mitigates the increased demand for bespoke and standardized report generation.

Scalability potential that doesn’t require additional resources

Implementing scalable technology solutions without adding bottom line costs or increasing head count gives GPs an effortless way to offer customized services to LPs.

Allvue integrates all of these features in a single front-to-back private equity software solution enabling the aggregation of multiple data sources, as well as the visualization and distribution of information to multiple audiences. Our goal is to eliminate the boundaries between systems, information, and people, helping decision makers get the information they need – when they need it.

Benefits of a Holistic Solution

- Improves IRR – A holistic solution can help fund managers improve business performance by increasing capital efficiency

- Facilitates better decision making – Data can be turned into actionable information with customized inputs and reports

- Allows for more responsive investor support – LPs are able to access portfolio company information, cash flow analyses, and generate ad hoc reports on demand and on their own timeframe

- Enables LP self-service – LPs can update their information directly into the system, sharing documents and information easily

- Reduces errors and manual efforts – Streamlining the collection, management, and reporting of data decreases the probability of errors and lets teams focus on high level tasks

- Provides more timely information – Seamless integration of data amongst teams allows them to work in sync and access information in real time

- Supports agile and dynamic environments – Solutions that scale ensure that a company’s needs are met at each step along the way as their business grows

- Empowers internal and investor stakeholders – Access to aggregated and normalized qualitative and quantitative information allows internal and investor stakeholders to quickly and easily communicate and share data