Equity Essentials Solution Set

Software designed to help emerging VC and PE firms grow

FIND OUT MOREMarket uncertainty and mixed outlooks on the odds of a pending recession have made for a confusing time in the private markets as we all wait for clearer signs of what’s ahead. But for a flexible and resilient asset class like private debt, 2023 looks to be a promising new year with new, albeit different, growth compared to what we saw in 2022.

Read on for the top private debt trends we expect to play out in 2023.

Some have wondered whether private debt’s rapid growth over the last decade is a bubble, but private debt as an asset class still has room to grow, especially when compared to the size of private equity and venture capital. And in times of market uncertainty – even with an increased risk of middle market loan default – private debt can be an ideal option, offering low volatility with returns dependably above those of the public markets.

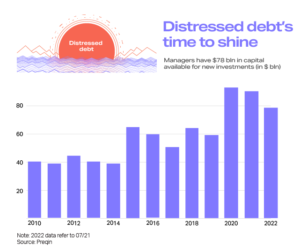

With interest rates climbing and mixed feedback on the emergence of a recession, distressed debt looks particularly attractive to many investors. If more market turmoil is ahead, the market could be ripe with potential distressed deals, and higher borrowing rates raise the possibility of particularly high returns for investors willing to stomach the risk.

There is clear consensus that private market investors and managers alike are bought in on ESG. And as a still-developing asset class, especially when compared to a giant like private equity, private debt has a rich opportunity to build in an ESG focus early on to reap the benefits of established standards and processes down the road. In 2023, we expect to see a closer focus on ESG as managers evaluate potential borrowers during the due diligence process, as well as borrowing rates that correspond with this discovered ESG risk.

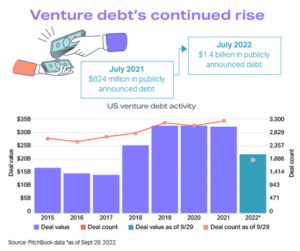

While venture debt has been on the rise for a few years now, it will likely hit its prime in 2023. As venture capital investments have slowed amid disappointing tech valuations, startups are on the hunt for capital in some form or another. Combine this with the fact that many larger private debt managers are entering the venture debt space with floating rate-forward funds – indicating strong returns for investors – and this niche strategy seems poised to offer a win to all involved parties.

Study up with the rest of our 2023 trend content:

Learn more about how Allvue can help your business break down barriers to information, clear a path to success and reach new heights on the investment landscape. Fill out the form below and we’ll reach out to talk more about how we can help your business.

At Allvue, we’re committed to harnessing technology and expertise to tackle the biggest challenges facing the private capital space. Our Resources hub, offering blog articles, whitepapers, case studies, videos, and more, shares industry best practices and reflects the experience and learnings of top Allvue experts and our partners motivated to see this industry continue to grow and thrive.

Our goal is to provide guidance as well as food for thought for anyone interested in the private equity, venture capital, private debt, and public credit spaces – whether you’re learning the fundamentals or getting ready to raise your fifth fund. Many of our articles contain links to trusted third-party resources to support our takes, and all our content is regularly reviewed and updated to keep current with the fast pace of alternative investment innovation.