By: James DiCostanzo

Sales Director

April 25, 2022

Headlines were clear throughout 2021: It was a record-shattering year for private equity overall and venture capital specifically. As the search for yield continued, interest in the alternatives market picked up. This prompted the launch of new funds and new venture capital startups, eager to participate in the opportunity within a thriving industry.

But what will 2022 hold for emerging managers? Continued upward momentum, or a rockier environment amidst surging M&A activity?

The five charts below provide an interesting assessment of the current landscape and represent trends that may be valuable for emerging managers to follow.

DOWNLOAD OUR WHITEPAPER: 5 Steps Emerging Private Equity & Venture Capital Firms Can Take to Accelerate Growth

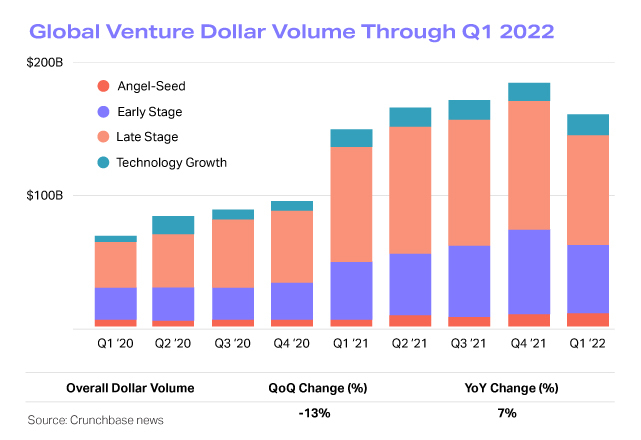

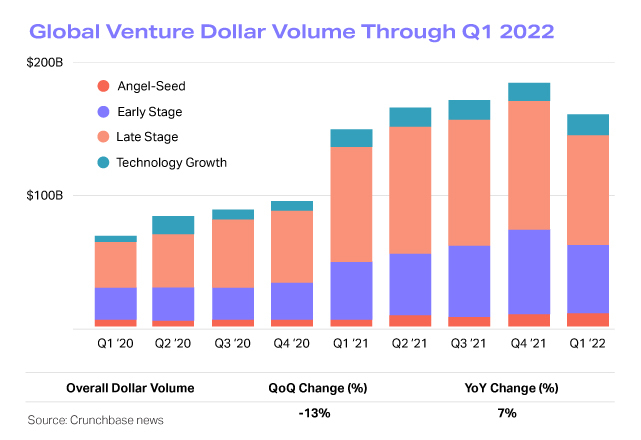

1. Global funding remains strong, but is slowing

Venture capital funding totaled $160 billion in the first quarter of 2022. While this was the first quarterly decline over the past five, funding is still notably strong and well above any quarter in 2020, which is good news for emerging managers.

Seed funding was the one stage that continued to grow, at $10.3 billion versus $10.1 billion in the fourth quarter of 2021 and up 45% year over year. Early-stage funding, meanwhile, reached $51.9 billion, up year over year by 21% despite an 18% drop from the fourth quarter.

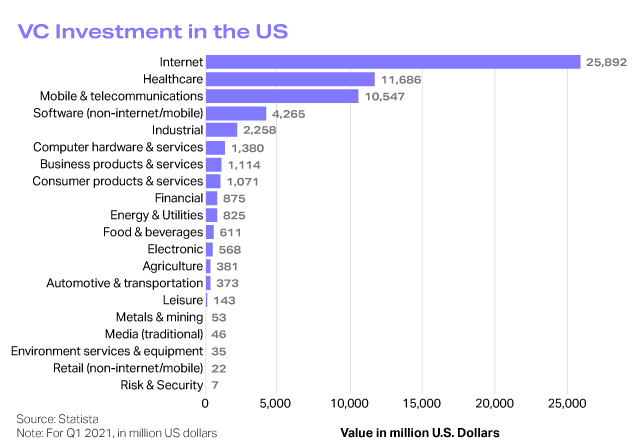

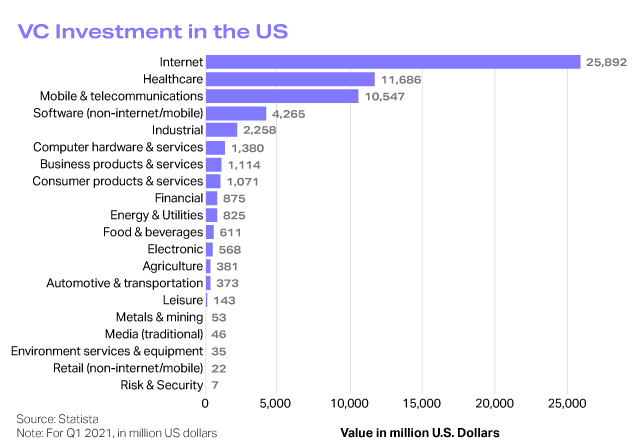

2. The most popular sectors are no surprise…

Coming out of the pandemic, it’s no surprise that internet, healthcare, and telecom are the most-funded industries. But the venture capital space is far from narrowly focused. The industrial, business products/services, financial, energy, and food and beverage sectors are also getting some attention.

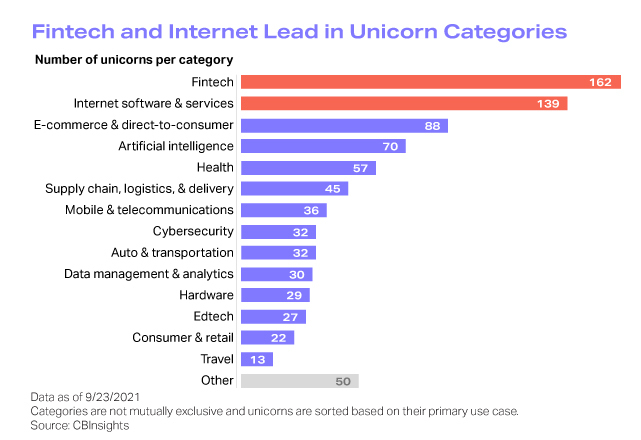

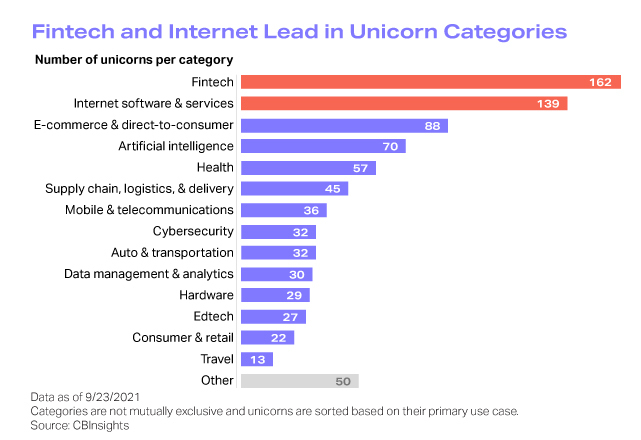

3. …and Unicorns are no different

Recent data from CBInsights illustrates that fintech is the sweet spot for unicorns, followed by internet software/services, e-commerce, artificial intelligence, and health. It’s no surprise that tech is king. What is interesting is the dispersion of unicorns across so many sectors.

Meanwhile, the raw number of newly minted unicorns has fallen slightly, in parallel with VC spending slowdown. Hitting 129 in the first quarter of 2022, this number, while impressive, is a drop from 146 in Q4. But it’s also notably higher than any quarter in 2020 (which saw the creation of 22, 36, 44, and 66 new unicorns, respectively).

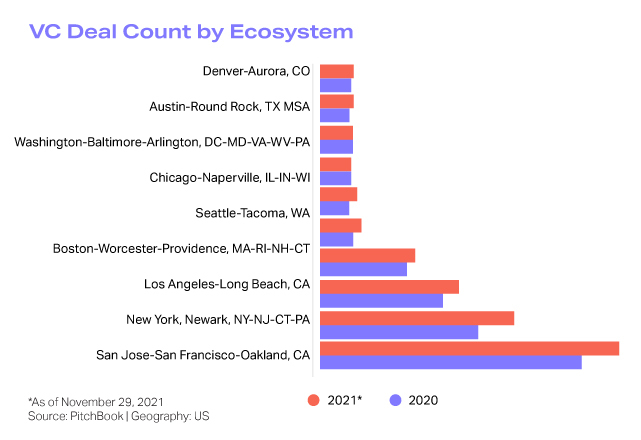

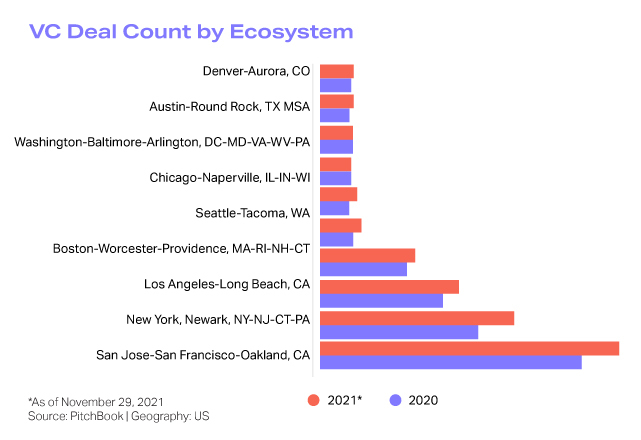

4. A Silicon Valley presence is no longer a given

From 2014 to 2020, the percentage of VC funding based in Silicon Valley decreased from 26% to 22.4%, according to PitchBook. While this decline might seem modest, the trend is clear and was exacerbated by the realities of the pandemic: startups can work from anywhere, and so can venture capitalists. While the San Jose/San Francisco region is still the primary hot spot, the New York metro area is gaining momentum, along with L.A., Boston, Seattle, Philadelphia, and Chicago.

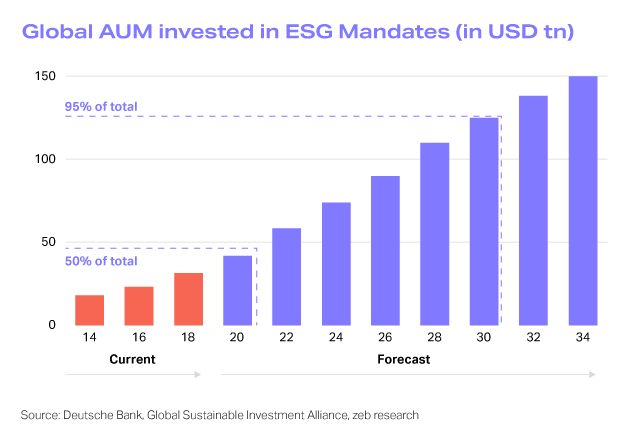

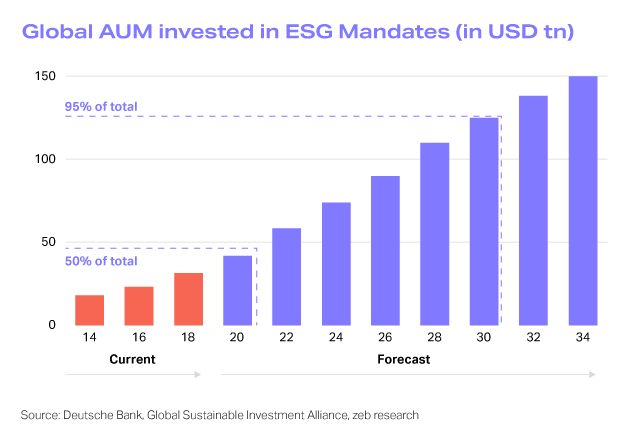

5. ESG investments show no signs of slowing down

There is no shortage of data indicating that today’s limited partners are focused on ESG and DEI initiatives. Emerging managers who can prioritize these efforts as they launch their first funds may have a definite advantage over those who can’t. According to a Deutsche Bank forecast, ESG investments are expected to keep growing exponentially over the next decade or so, reaching $150 trillion by 2034.

READ MORE: ESG Due Diligence: What It Is and How to Get Started

Learn how Allvue helps emerging managers supercharge their growth

If you’re an emerging managers looking to scale your business efficiently in this time of rapid growth, our Venture Capital Essentials and Private Equity Essentials solutions can help you streamline your accounting, reporting, and investor communication workflows with best-in-class software designed for companies in growth mode.

Learn more or request a demo to discuss a solution that’s right for you.

More About The Author

James DiCostanzo

Sales Director

James DiCostanzo is a global sales leader with over 20 years of experience in the financial, private equity and SaaS industries. He is currently the Global Head of Growth Equity Sales at Allvue Systems, a leading provider of investment management solutions. He joined Allvue Systems in March 2020 as the Head of Sales for the East Region, after working at Thomson Reuters for nearly two decades in various roles, including Head of Solution Specialists, Data & Analytics and Global Business Director. He has a bachelor’s degree in Business/Managerial Economics from SUNY Oneonta. He is based in the New York City Metropolitan Area and can be found on LinkedIn at https://www.linkedin.com/in/jamesdicostanzo/.