By: Allan Parks

Product Manager, Portfolio Monitoring

March 31, 2022

As ESG took hold of the institutional investment space in the last decade, private equity and venture capital managers did not see the same rate of adoption as their liquid market counterparts. However, driven by advancing regulatory and investor awareness, there’s been increasingly widespread adoption of ESG in private equity. In fact, 41% of private equity managers say investor pressure is a leading driver of ESG activity, and more than 4,000 firms have signed an agreement to adhere to the Principles for Responsible Investment’s six core ESG guidelines.

For private equity and venture capital managers, this new embrace is sure to bring pressure to evolve their fund operations on multiple fronts, including portfolio monitoring. Evolving ESG requirements demand deeper transparency into many facets of fund and portfolio company data. Managers will be expected to live up to transparency expectations by having access to thorough ESG analytics with extensive reporting capabilities.

As ESG becomes more integrated and commonplace in private markets, here are three trends private equity and venture capital managers can expect to encounter.

DOWNLOAD: Infographic: 2022 Investor / GP Trends in ESG for Alternative Investments

Regulators will put more weight on ESG analytics

Globally, regulatory bodies are turning attention both to ESG issues and to private capital funds. This joint focus is likely to bring material change to the way managers are used to managing their data, especially since disclosures and data reporting are common places to start with ESG regulation. This heightened regulatory attention is daunting for many, including investors – according to PwC, 89% of private capital managers and investors are concerned about compliance with ESG regulation.

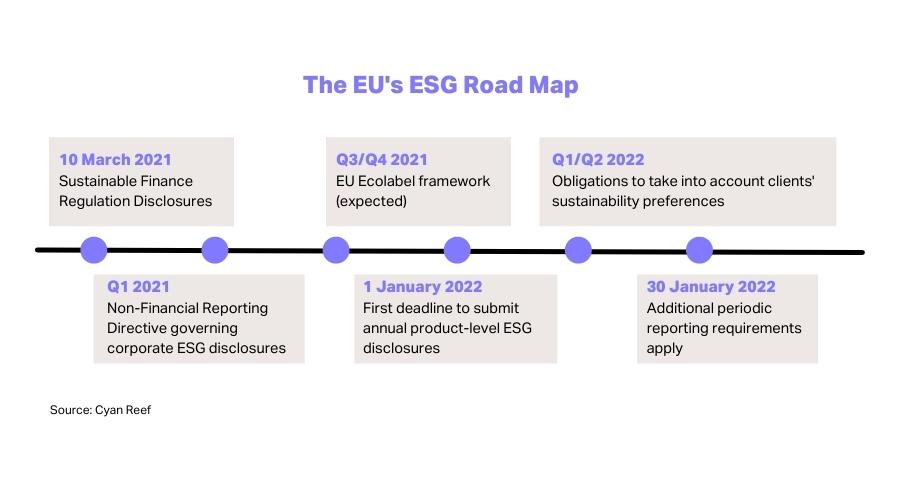

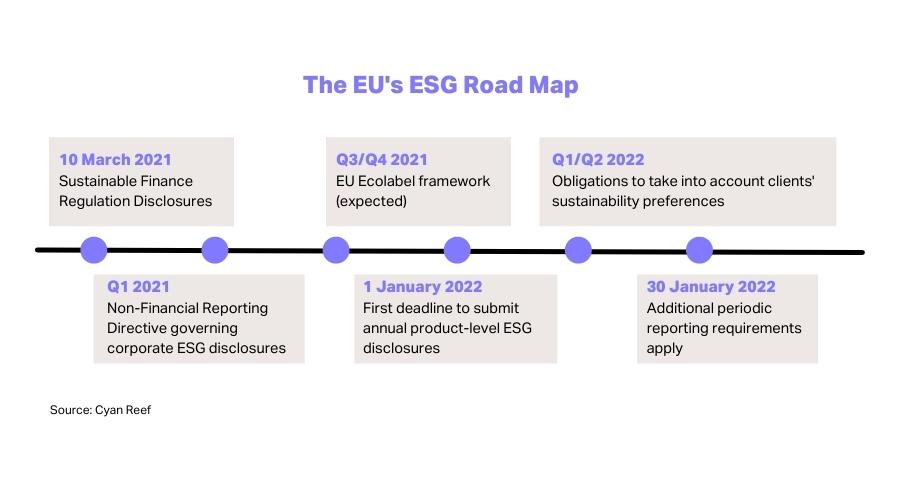

As far as existing ESG regulation, the European Union is the most advanced region globally, with several years’ worth of enacted regulations targeted at financial institutions participating in ESG investing, including through the Sustainable Financial Disclosures Regulation and Taxonomy Regulation.

While the US and APAC are lagging behind the EU’s framework development progress, ESG has been a target for their own local regulators. In fact, the US Securities and Exchange Commission announced in 2021 that it was turning special focus to ESG disclosure practices, signaling that proposed ESG rules could be on the horizon for US market participants.

Ultimately, ESG regulatory requirements will revolve around disclosing and tracking key fund metrics. And private equity and venture capital managers with complex global portfolios will need powerful portfolio monitoring and data gathering solutions that allow them to track all assets and seamlessly extract key portfolio metrics to comply with a web of regional ESG requirements as global regulations advance.

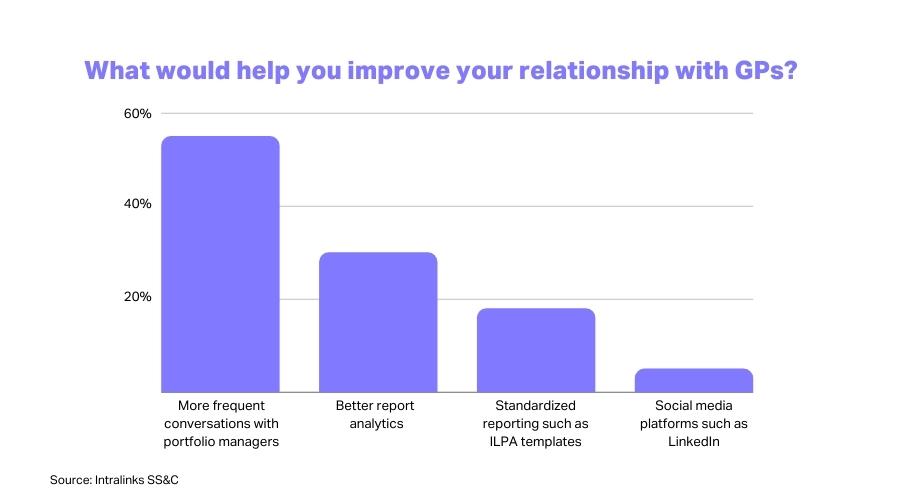

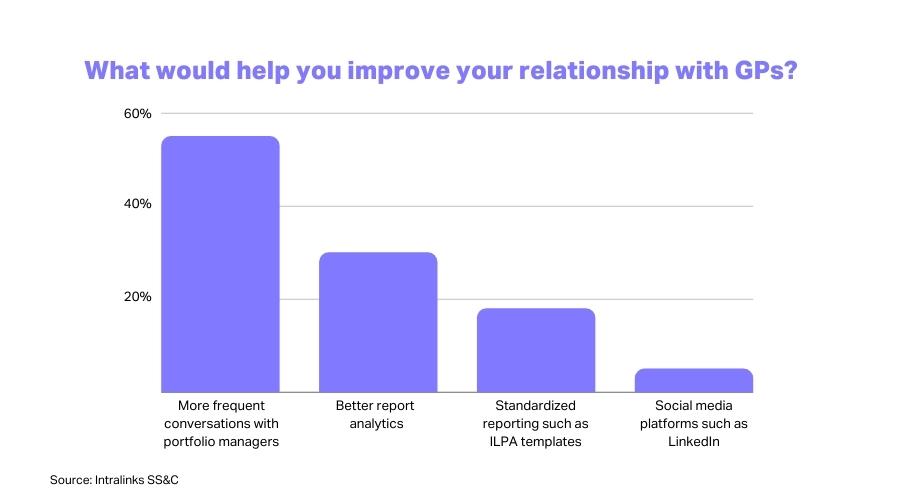

LPs will make even more one-off portfolio monitoring data inquiries of their GPs

LPs are frequently taking the lead on forming their own internal ESG policies, fueling them to reach out to their GPs seeking information on how their current holdings stack up to their ESG portfolio goals. In turn, GPs must be prepared to handle a continued influx of ESG data requests from current investors, as well as field additional portfolio monitoring and ESG analytics questions from prospective investors.

To keep current investors satisfied and win over new ESG-conscious investors, managers will want to be able to promise high-end ESG analytics reporting without committing manual team effort in living up to the promise.

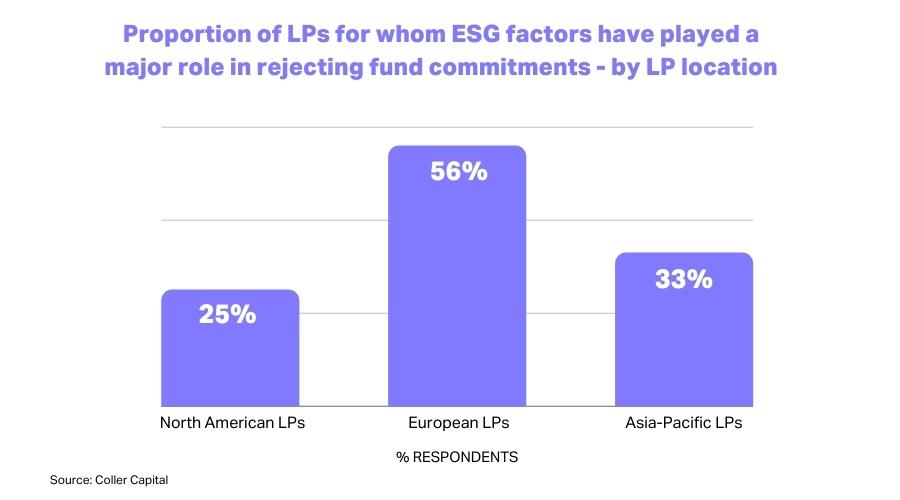

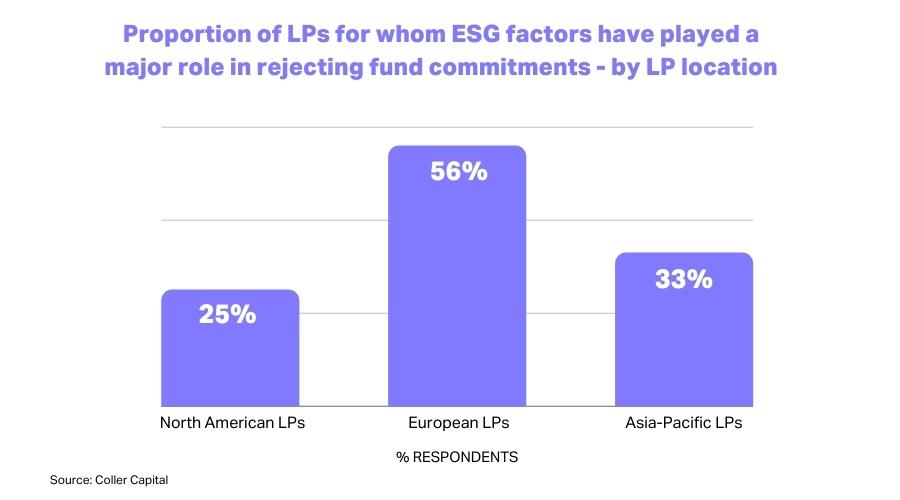

GPs will face greater investor pushback and manager competition

The number of venture capital managers and private equity managers has grown significantly in the last decade. As a result, GPs are finding themselves facing stiffer competition not just over deals but also for new investors, even as demand for private investments has kept growing. Per the figure below, many investors, particularly in Europe, are happy to reject fund commitments if ESG efforts do not live up to their expectations.

As ESG is a top factor to investors, backing up fund performance with strong ESG analytics can serve to set oneself apart from a vast field of competing private equity and venture capital managers.

READ MORE: How Private Markets are Catching up on ESG

Managers will feel the pressure to enhance portfolio monitoring tools

This emphasis on ESG has taken hold as data expectations of private equity and venture capital managers were already mounting. Transparency is also a core element of ESG, and not only should managers be able to monitor key ESG metrics; they should also be able to communicate and share that data cleanly and seamlessly.

Faced with these pressures, managers will need a portfolio monitoring tool that can empower them to meet and exceed these expectations.

Allvue’s Fund Performance and Portfolio Monitoring solution is designed to help private equity and venture capital managers do just that. It provides them with powerful analytics and benchmarking for dozens of custom KPIs, including ESG metrics, while empowering them to report on these metrics to internal stakeholders, as well as to key external stakeholders like investors and regulators.

To learn more about how Fund Performance and Portfolio Monitoring can ease the ESG portfolio monitoring challenges that your firm faces, reach out today.

More About The Author

Allan Parks

Product Manager, Portfolio Monitoring

Allan Parks, Product Manager of Fund Performance and Portfolio Monitoring Solution joined Allvue in 2021. Previously, he was a Product Manager of Portfolio Construction Services at Capital Group, and prior to that, a Portfolio Advisor at Merrill Lynch’s Private Banking and Investment Group where he led Private Capital (Alternative Assets) portfolio allocation for a $5Bn AUM team serving foundations, family offices and UHNW. He is a graduate of University of San Diego, he holds an MBA from Thunderbird School of Global Management (ASU), and he is a CFA Charterholder.