November 21, 2022

Venture capital trends for 2023 reflect one thing: uncertainty. Expectations for 2022 were high and quickly dashed by war, inflation, and geopolitical upheaval. Numbers looked worse because of tough comparisons. CB Insights reports that global venture capital in Q3 2022 had the lowest funding recorded, $74.5 billion, since the $60.2 billion reported in Q2 2020.

Despite significant headwinds, the uncertainty in the market may yet resolve itself during 2023, as many of the fundamentals of the sector still remain strong. VCs have dry powder, even if fundraising levels decline, and there is never a shortage of good ideas for new businesses.

As managers look to overcome those hurdles and drive new venture activity, these are some of the key trends we expect will dominate the conversation.

Venture capital funding in 2023

VC funding has fallen sequentially throughout 2022, and the volume of deals and dollars is likely to be down when the year wraps up. Much of this is driven by falling valuations, because the decline in number of deals is smaller than the decline in total funding. The froth is settling, but good ideas will find investors.

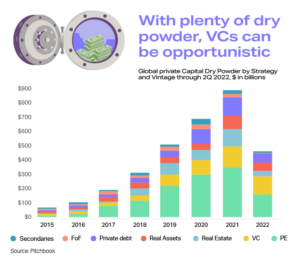

Venture capital dry powder in 2023

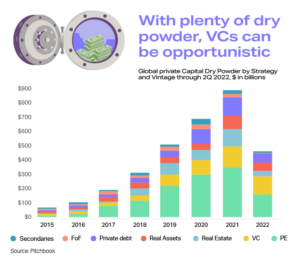

Dry powder levels remainC high, in part due to falling funding levels. Pitchbook reported that private capital investors had $564.2 billion in dry powder as of August 2022, which could make for a strong 2023 even without additional fundraising.

Investors are always looking for uncorrelated returns, even in uncertain markets, but the dry powder ensures that venture capitalists can take advantage of opportunities even if limited partner interest in the segment fades.

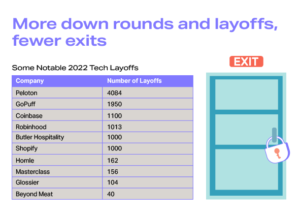

Venture capital exits and layoffs in 2023

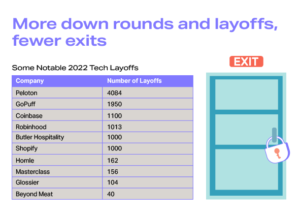

Down rounds have been declining, but the trend has turned. Higher interest rates, greater economic uncertainty, and the moribund IPO market has put pressure on exits. Startups are cutting back, and buzzy tech startups have had rounds of layoffs to extend their runway, with 42,000 employees let go by October in the US alone. Even still, founders that need additional capital may have to accept down rounds as part of the cost of doing business in 2023.

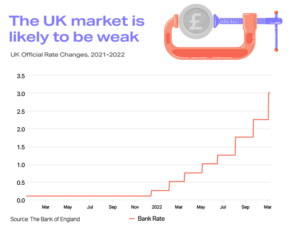

UK’s venture capital market in 2023

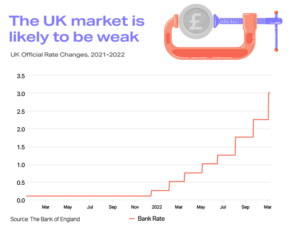

While uncertainty is a global phenomenon, it is particularly pronounced in the UK—one of the global centers of venture capital. CB Insights reports that funding to UK companies was 4.63% of 2021 global venture activity. That share increased to 5.98% for the first three quarters of 2022. The trend is likely to turn, and hard. In the third quarter of 2022, the UK changed both its head of state and its head of government. King Charles III has emphasized continuity. Liz Truss proposed major changes to fiscal policy that have led to increased interest rates, a declining exchange rate, and uncertainty about direction of the UK economy over the next year. She then resigned, becoming the shortest-tenured UK prime minister, and adding to the uncertainty in this market. The new Prime Minister, Rishi Sunak, has his work cut out for him.

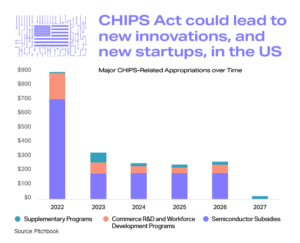

The U.S. Chips Act in 2023

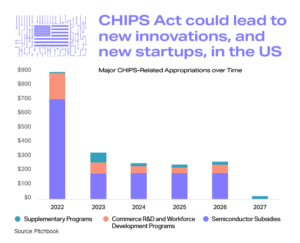

In July of 2022, President Biden signed the CHIPS Act into law, with the goal of expanding the semiconductor business in the United States. It provides $52 billion in funding to support chip development and manufacture within the nation’s borders. Venture capital firms may find opportunities investing alongside the government or in businesses that emerge through the research funded under the law. This may lead to more US tech VC deals in 2023 and beyond.

LPs’ VC outlook in 2023

The lawsuits that accompanied Elon Musk’s acquisition of Twitter brought to light texts between him and several venture capitalists, and the correspondents weren’t always professional. The fallout from the failure of cryptocurrency exchange is raising questions about the quality of investor due diligence at some of the largest venture capital firms.

Investors want assurance that their money managers are acting professionally. Accounting firm BDO maintains a checklist for emerging managers that includes the importance of clear and consistent reporting.

One of the biggest challenges new and emerging managers face is getting professional client reports out on time. Getting a K-1 out is tough in any market. In a volatile market, investors push for quick turnaround on data requests and timely, professional updates. Allvue offers an end-to-end alternative investment platform that helps venture capitalists stay on of their business and their investor relationships. Our Investor Portal lets venture capital firms give their investors access to data and reporting to navigate uncertain market trends.

“Once an emerging fund manager is up and running it is important to address fund performance and clearly establish communication frequency, format, and content with limited partners. For ongoing performance reporting to limited partners, it is fundamental for the emerging manager to have the technology in place to sustain a repeatable outcome.”

– BDO United States

Want to know more about what to expect in the new year?

Study up with the rest of our 2023 trend content: