By: David Neiterman

Account Executive

February 15, 2024

As we entered 2024, the private equity industry harbored hopes for increased activity in terms of fundraising, deals, and investment exits. But one key element remains stubbornly unchanged – private equity dry powder levels.

The private capital industry closed out 2023 with a new dry powder record of $3.9 trillion globally. With 41% of managers expecting better fundraising for 2024 according to Allvue’s 2024 GP Outlook, dry powder levels aren’t set to see material decreases soon. While 48% of managers do expect a better private equity deals environment in 2024, competition for quality deals is sure to be fierce with so much committed capital waiting on the sidelines.

DOWNLOAD: PRIVATE EQUITY TEAR SHEET TEMPLATE

What is “dry powder” in private equity?

At venture capital and private equity firms, “dry powder” is cash that’s been committed by investors but has yet to be “called” by investment managers in order to be allocated to a specific investment.

Where does the term “dry powder” come from?

This term dates back to the 1600s, when it referred to stashes of reserved (and still-dry) gunpowder that could be accessed during combat. In the sense of private equity, this reserved gunpowder is compared to investors’ committed capital – it’s there for the taking when private equity managers have a demonstrated reason (rather than battle, an investment with exciting potential to generate returns for the manager and their investors) to access it.

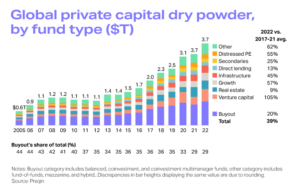

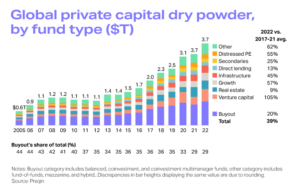

Comparing the current dry powder levels with those of the past decade reveals a significant increase, largely driven by a surge in global fundraising activities and demand for private capital holdings by institutional investors. The rise from $2 trillion in 2015 to nearly $4 trillion at the close of 2023 highlights the growing investor confidence in private equity and other private capital strategies.

Is private equity dry powder included in a manager’s AUM?

Even though dry powder sits with investors until it’s called by private equity managers and deployed into an investment, as committed capital, dry powder is included as part of a private equity manager’s assets under management.

How much private equity dry powder is there?

Dry powder across all global private capital strategies now sits at $3.9 trillion as of the end of 2023, per PwC and Preqin. Private equity firms accounted for $2.4 trillion of that total.

The rare appealing deal will attract intense competition from bidders. In 2022, 65% of North American buyouts involved multiple bidders or a formal auction process. With a dearth of appealing deals hitting the market, dry powder levels remained stubbornly high throughout 2023, and likely will through 2024 as well – though it’s possible a friendlier deal environment could slow its growth or even drop it.

Meanwhile, in the venture capital industry, dry powder levels clocked in at $321 billion – another figure that is likely to remain high as startup demand for capital has outpaced supply by 2.1x. In recent years, capital has not come as cheap as it once did, and the growth-at-all-costs outlook is no longer widely embraced in venture capital, according to Pitchbook. This shifting dynamic lends itself to better investor terms for the VC managers with high dry powder levels, with those benefits also trickling down to their LPs.

Dry powder levels

How do private equity managers balance dry powder?

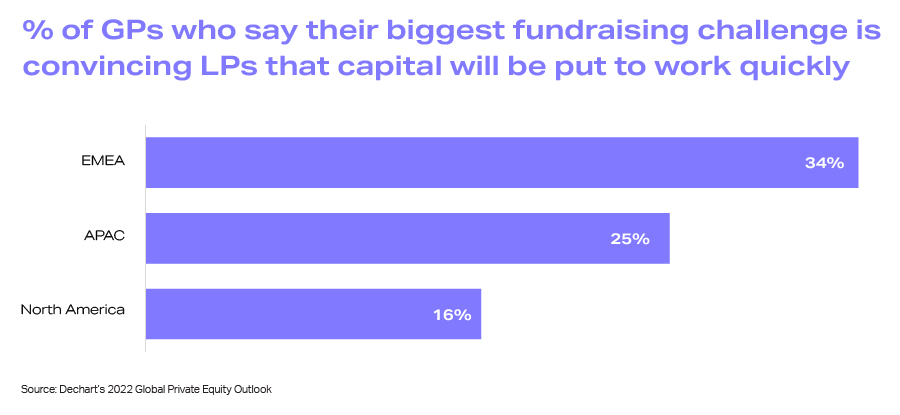

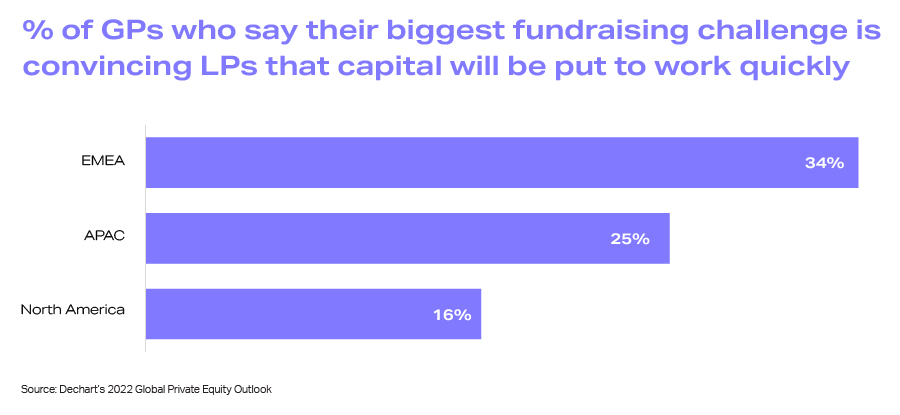

While dry powder represents possibility, it also signifies pressure. Limited partners expect their investment to be committed in a timely manner, and with trillions of capital on the sidelines, competition to find the next unicorn is tougher than ever.

General partners face the delicate balancing act of meeting their LPs’ timing expectations while still performing ample due diligence for any investments. Also, the risk of holding too much uncommitted capital and not being able to deploy it is always present – especially now, in our current environment of stubborn inflation, questions of a recession and action by monetary policy bodies worldwide.

The impact of macroeconomic factors like inflation and potential recessions is profound. Historically, high inflation rates have led to more cautious investment strategies, with firms holding onto dry powder for longer periods. The uncertain threat of a recession also influences the allocation of dry powder, as firms become more selective in their investments, prioritizing sectors with recession-proof qualities.

Private equity managers’ resources for managing dry powder

Needless to say, GPs have their work cut out for them in managing their active deals against their dry powder reserves. In addition to the regular fundraising needed to keep dry powder levels steady, deal management and portfolio monitoring must be precise. Along the way, strategic LP communications are essential to address any concerns that funds are lying fallow. One GP’s “dry powder” can quickly become an LP’s “missed opportunity,” especially as LPs already face a precarious balance of their own by overseeing their private equity pacing models and cash management activities.

DOWNLOAD: 2022 ESG Survey – Picking the Lock to ESG Data

Automated workflows through private equity software can streamline processes to save time, reduce risk, and ensure committed capital is being managed efficiently. The right tools can also help alleviate stress on valuable employees during a time when talent retention is a challenge.

No matter how mature your PE firm is—whether you’re just getting started or have over $1B in committed capital – Allvue has solutions to help manage the front-to-back-office workings of your firm.

- For emerging managers, Allvue’s Private Equity Essentials set is a comprehensive package that helps streamline accounting, reporting, and investor communication efforts.

Reach out to learn more about how Allvue solutions can help your firm make superior investment decisions.

More About The Author

David Neiterman

Account Executive

David Neiterman is an account executive on Allvue’s Enterprise Equity Solutions team. He partners with executives at some of the largest PE and VC firms, as well as family offices and fund of funds, to improve back-office efficiency, automate reporting processes, and reduce risk. Prior to joining Allvue Systems, he worked as an account executive for SS&C Technologies, and led all sales and marketing activities for Smartleaf, Inc. David is a graduate of Tulane University, where he earned a degree in finance & legal studies.