By: Allan Parks

Product Manager, Portfolio Monitoring

November 12, 2021

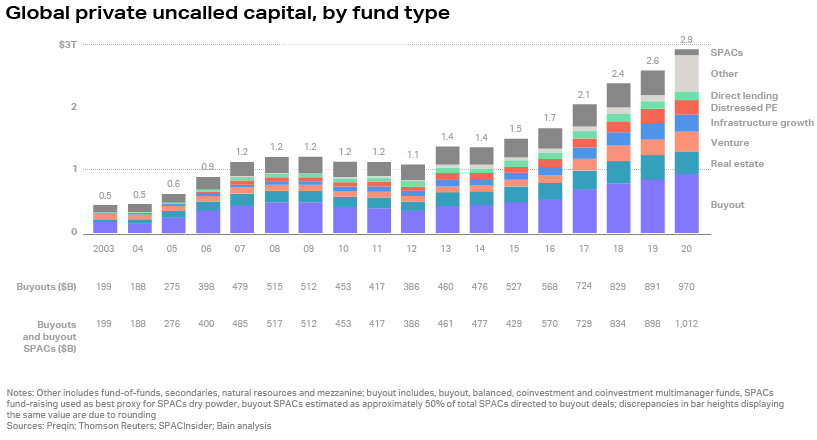

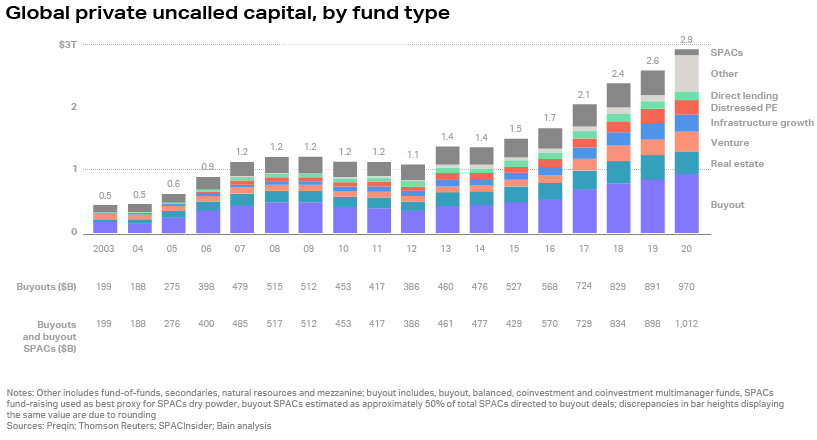

The fundraising market is white hot

Fundraising is the highest it’s been over the last five years, due to a partially vaccinated population, high investor confidence in the equity markets, frenzied demand for high yield debt, and the regulatory nature of the current administration.

According to PWC, US private equity dry powder is at $150.1B; the first 5 months of 2021 saw private equity deal volume increase 21.9% over the same period in 2020. The result was 2,346 new deals.

With so much activity, how can GPs best take advantage of this market and what tools do they need to be successful?

[Source: Bain, Global Private Equity Report 2021]

What can GPs do to capture their share of the deal flow?

Putting together deals is a time-consuming process for GPs. With competitors clamoring for the same deals, GPs need to find a way to differentiate themselves. Manual processes overseen by rooms full of analysts is the “old school” way, and LPs are increasingly looking for GPs who can provide them with the information they need, quickly and efficiently.

In order to do that, it will be critical for GPs to leverage scalable, cloud-based, state-of-the-art technology that can allow them to bypass manual tasks, scale their business quickly, and handle the complexity of managing multiple industries and strategies in their portfolios. GPs need to be ready to compete for the best deals, and doing that may require them to begin monitoring industry-specific KPIs (such as health care or real estate), or add ESG KPIs to fulfill the mandates of certain LPs.

GPs need a solution that can classify and differentiate the information they receive from multiple sources and keep pace with the large number of deals they engage in.

[Source: EY]

Automation of portfolio monitoring tasks is the key

The degree of automation required depends somewhat on strategy, as some firms collect more data than others, as well as how diverse investments are, since the number of KPIs that are collected may increase drastically based on the number of types of investments.

Future scalability will also present an issue to GPs as the size and complexity of their portfolios increase. For example, insurance company deals have captured the eye of PE firms as a way to enhance returns. But at the same time, these types of deal can add more complexity to a portfolio due to deal structure and regulatory issues, etc.

Regardless, all firms must generate reporting to stakeholders, whether board members, internal colleagues, or LPs. This holds true regardless of how many companies GPs hold in their portfolios. Therefore, ultimately, automation will be important to all GPs.

When considering whether automation is truly needed, firms should conduct an internal cost analysis, asking themselves these questions:

- Can the collection of manual processes we currently use scale as quickly as a single solution that can provide one source of data from front to back office?

- How many hours does our deal team spend chasing numbers and inputting them into spreadsheets?

- What’s the hidden cost of slower processes and possible manual error?

- What’s the dollar value of time spent on manual processes, versus the implementation of an automated solution?

Repeatable processes and workflows create more lucrative opportunities

Calculating ROI for automation can provide a clearer picture. For portfolio management teams, access to accurate data and real-time visibility into portfolios will help them maximize performance and minimize risk.

But without repeatable processes and workflows, normalizing and aggregating data makes it more difficult to conduct analysis and make better investment decisions. For IR teams, the calculation needs to include manual tasks, i.e., how much time is spent building slide decks for fundraising purposes, or assembling and printing investor reports? If an IR team is struggling to get data in front of investors, the GP is certainly missing out on lucrative opportunities.

If time spent on manual tasks could be eliminated, how much would it be worth in added revenue?

“[I]intelligent automation in private equity can lend greater visibility into the transactions taking place at each portfolio company, equipping private equity CFOs and performance management teams with insights that can shape decisions at the fund management level.”

[Source: Deloitte, Intelligent automation and analytics in private equity]

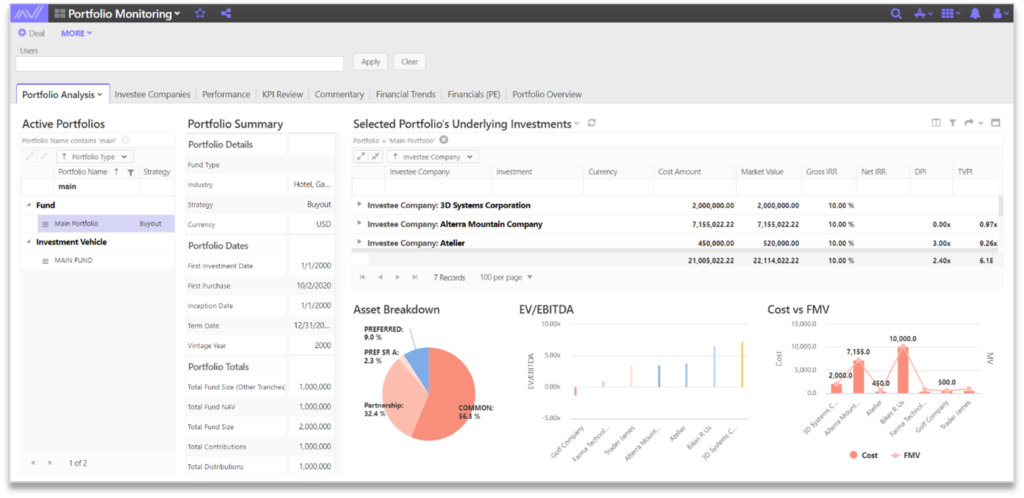

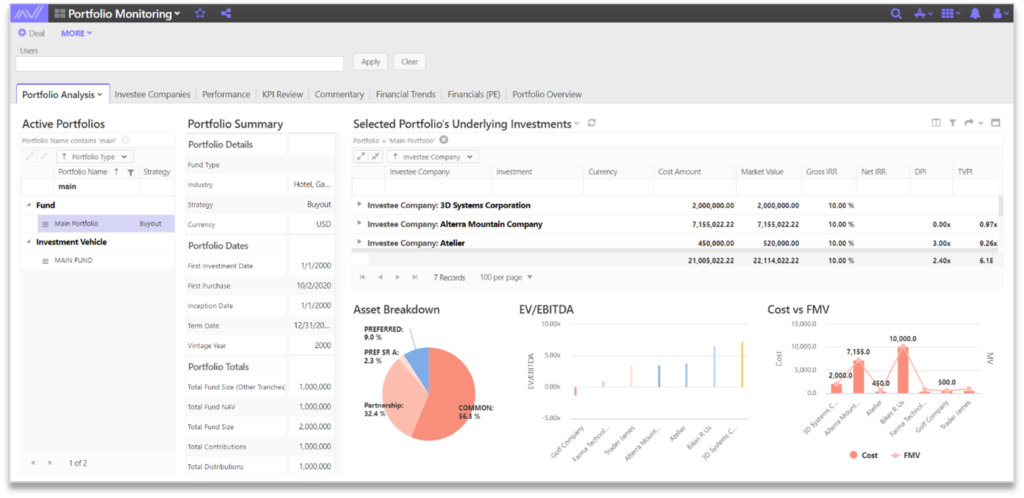

How Allvue Systems’ Fund Performance and Portfolio Monitoring solution can help

By utilizing Allvue’s Fund Performance & Portfolio Monitoring solution, GPs can quickly and easily collect, analyze, report, and share key port co and fund data both internally and with their investors. Our portfolio monitoring solution utilizes a cloud-based, intuitive platform that gives GPs:

With Allvue, spotting trends at the company or fund level is just a click away.

More About The Author

Allan Parks

Product Manager, Portfolio Monitoring

Allan Parks, Product Manager of Fund Performance and Portfolio Monitoring Solution joined Allvue in 2021. Previously, he was a Product Manager of Portfolio Construction Services at Capital Group, and prior to that, a Portfolio Advisor at Merrill Lynch’s Private Banking and Investment Group where he led Private Capital (Alternative Assets) portfolio allocation for a $5Bn AUM team serving foundations, family offices and UHNW. He is a graduate of University of San Diego, he holds an MBA from Thunderbird School of Global Management (ASU), and he is a CFA Charterholder.