By: Allvue Team

February 28, 2023

The Republic of South Africa is the heart of Africa’s investment business. With a large economy, large per-capita GDP, and stable democracy, South Africa has plenty of domestic investment capital. It also attracts funds from investors looking to participate in its growth. Because of its sophisticated financial sector, South Africa serves as a base for investors looking to invest elsewhere in Southern Africa.

There’s a significant catalyst, too. The African Continental Free Trade Area agreement (AfCFTA) started in 2019 to replace several regional agreements. All African states have signed the agreement and 44 of them (including South Africa) have ratified it. This is the largest free trade agreement in the world by number of countries, and it will greatly improve economic activity when it is running in full swing. The intention is to improve trade, develop cross-continental supply chains, and increase economic activity. This will create more investment opportunities for private equity and venture capital, with South Africa as the beneficiary.

Like many countries, South Africa faces enormous challenges in the next decade, but it also has enormous opportunity. This article will look at the South African opportunity and the current state of its private equity and venture capital industries.

There’s steady private equity fundraising in the region

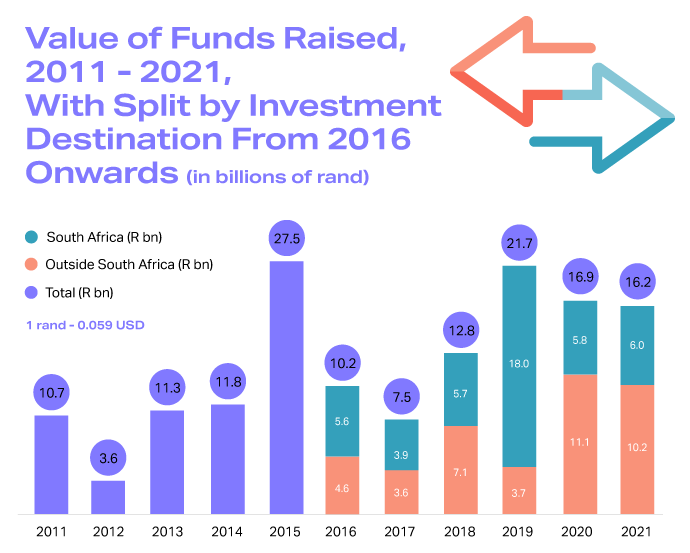

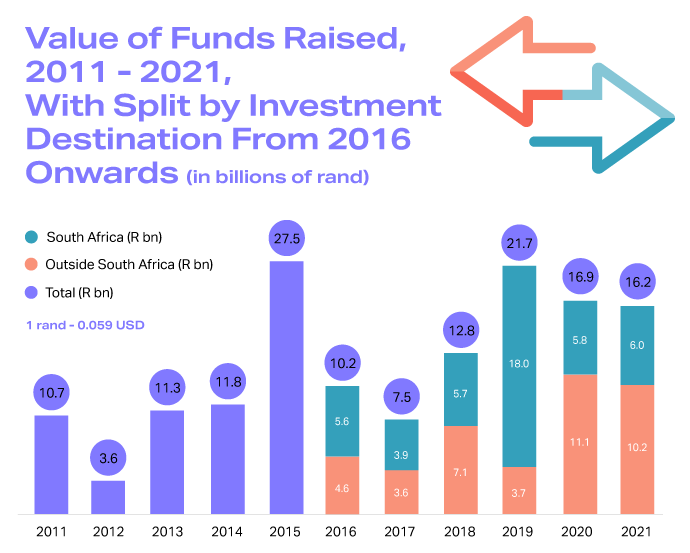

The allocation of funds to the region has increased over the last decade. The Southern African Venture Capital and Private Equity Association reports that in 2021, 69% of funds raised for private equity in South Africa came from within the country. The remaining 31% was raised mostly from Europe and the UK.

Most of the South African money came from pension funds, while the international sources were primarily from governments, aid agencies, and Development Finance Institutions. Total private equity fundraising in South Africa that year was $601.8 million USD. An additional $354.0 USD million was raised for investment elsewhere in Southern Africa (Angola, Botswana, Eswatini, Lesotho, Mozambique, Namibia, Zambia, Zimbabwe.) Total private equity AUM currently stands at $12.2 billion US.

Source: Southern Africa Venture Capital and Private Equity Association

The sectors attracting the most money in South Africa are services, financial services, and energy. Elsewhere in Southern Africa, the energy and infrastructure sectors are the largest recipients. This reflects South Africa’s more developed economy.

Source: Southern Africa Venture Capital and Private Equity Association

Many multinational corporations have established their regional headquarters in South Africa, creating a strong manufacturing and trading base. There is a network of financial, legal, and administrative services in place to support future economic growth. Many private capital LPs, especially those interested in private equity and private debt, are affiliated with aid agencies and international development programs. Some investors want to invest directly into the management company; the largest private capital firm in the country, Johannesburg-based Ethos, is being acquired by the Rohatyan Group.

Source: Preqin Pro

Venture capital in South Africa is small but mighty

South Africa’s venture capital sector is considerably smaller than its private equity sector, in part because much venture funding is seed capital. Venture AUM in 2021 was $479.7 million USD, with 1021 active deals. Captive corporate funds hold 25.8% of funds, captive government funds hold 22.7%, and independent funds have another 44.4%.

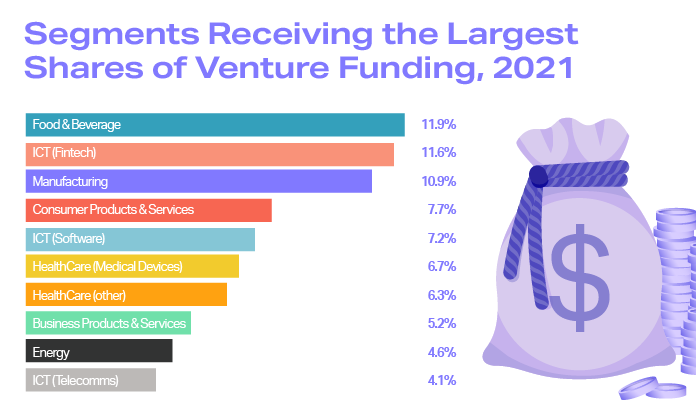

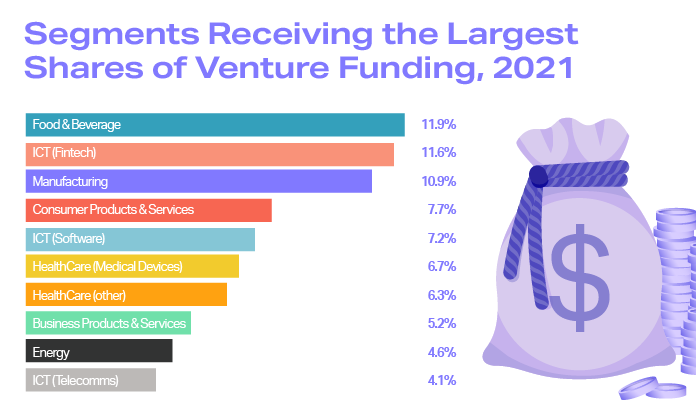

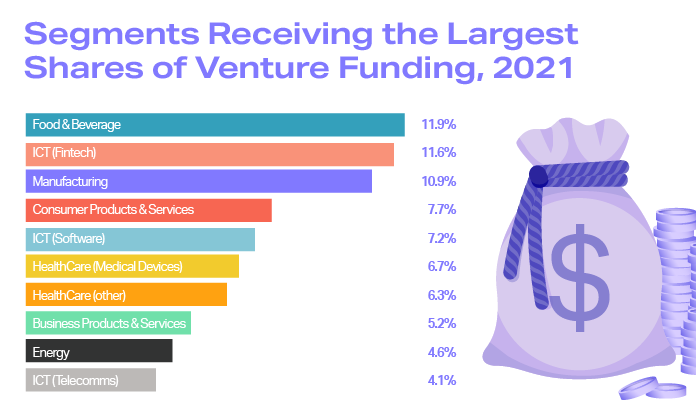

In 2021, $73.4 million was invested in 129 different business, mostly to seed and early-stage rounds. The food and beverage, fintech, and manufacturing sectors received most of the money.

Source: Southern Africa Venture Capital and Private Equity Association

Allvue’s technology supports the investors driving growth in South Africa

To run an effective fund operation in a growing, competitive market, fund managers need world-class investment systems. Allvue’s Equity Essentials solution set takes our best-in-class software, used by some of the biggest managers in the world, and makes it accessible to new and emerging managers. Growing managers in South Africa can take advantage of it as they position to for the free trade opportunity.

“A back-office system is increasingly valuable once you begin to have numerous funds and strategies. The first fund can be supported by the few back-office resources you will have anyway, but soon there will be a trade-off between adding more people or implementing an IT system. However, the latter has the added benefits of automation, high data security and consistency, and minimizing key man reliance.”

Joachim Satchwell, Associate Director at Polaris

From smaller start-ups and boutiques to the world’s largest asset managers, Allvue offers access to a world-class accounting, reporting, and investor communications platform through our Equity Essentials package. Allvue’s cloud-based software is purpose-built to address the needs of private capital investors, facilitating operational efficiency, improved accuracy, and providing a superior investor experience across multi-asset class and multi-currency portfolios. We have experience helping funds of all sizes accelerate their growth.