By: Megann Freston

Director of Product Marketing

January 22, 2024

Private equity is a notoriously complex asset class for many reasons, namely its lack of frequent and transparent valuations and its inherent illiquidity.

These factors intersect to make a private equity pacing model crucial for investors. The illiquid, closed-end nature of these investments mean that investors are afforded little go-with-the-flow ability if they hope to plan accordingly for their cash needs while minimizing risk and meeting allocation and return requirements for their private market portfolios. Instead, they must rigorously plan for hitting each target at the right time via a pacing model.

What is a private equity cash flow model?

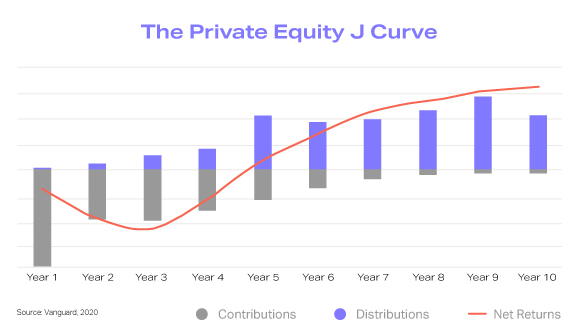

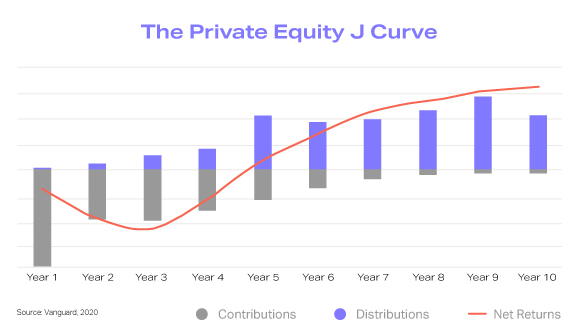

A private equity pacing model – or cash flow model – plans for future cashflows to and from investors’ alternative investment stakes, as well as models the evolution of the values on these investments overtime. Often, when charted out, this takes form in a “J curve”, where the value of their stake in a private investment fund dips in the first few years as capital is being called and as the investment manager is initiating deals before they begin to see returns on the back-end of the fund’s lifetime.

Many in the fund managers in the private equity industry lean on the Takahashi Alexander pacing model, originally laid out in a 2001 paper by Dean Takahashi and Seth Alexander titled “Illiquid Alternative Asset Fund Modeling”. The methodology models the cash flows of private capital funds based on the age of the fund and the capital still to be called, as well as “the rate of capital contribution, a factor describing changes in the rate of distribution over time, annual growth rate, and yield,” as put by a Financial Risk Group paper.

Ultimately, private equity cash flow forecasting and pacing models are hugely important to investor operations because adjusting allocations as needed is not straightforward or easy to do. If they overshoot their allocation goals, selling off a piece of their investment isn’t a simple task, and taking it to the secondary market likely results in selling at a discount. Meanwhile, scaling up to quickly achieve a higher allocation isn’t realistic either, as investing in private capital managers is a steady and intentional process involving long vetting timelines. The struggles associated with these options demonstrate why a cash flow model is so important for institutional investors engaged in the private markets.

Introduction of advanced PE modeling techniques

Financial modeling is a cornerstone in private equity investment, enabling fund managers to simulate various investment scenarios. A robust financial model includes detailed cash flow forecasts and projections that inform strategic decision-making. This model is particularly crucial in assessing the long-term viability and potential returns of private equity investments.

Recent advancements in private equity cash flow modeling have led to the evolution of more sophisticated techniques. A notable example is the modified Takahashi and Alexander model. This model incorporates periodic growth rates, allowing for more realistic valuations that are responsive to short-term market movements. This refinement addresses the limitations of earlier models that were less sensitive to market fluctuations.

Comparative analysis of cash flow modeling approaches

In private equity, various cash flow modeling approaches are employed, each with its strengths and challenges. The choice of cash flow modeling approach can significantly impact the outcomes of private equity investments. Different models offer varying levels of insight into the expected returns and risks, shaping the investment strategy and ultimately influencing portfolio performance. Understanding these differences is crucial for investors to choose the model that best fits their investment strategy and risk profile.

Macro market factors and economic principles

The macroeconomic environment plays a significant role in shaping the cash flow models in private equity. Factors such as market volatility, economic growth rates, and interest rate trends can significantly impact the performance of private equity investments. An understanding of these macro factors is essential for investors to make informed decisions and to anticipate potential market shifts that could affect their portfolios.

Common pacing challenges that private equity investors face

One of the key objectives for PE fund managers is optimizing portfolio performance. This involves carefully managing cash flow models to balance risk and return, a task made more challenging by the inherent complexities of private equity investments.

PE fund managers face unique pacing challenges in managing private equity investments, particularly when aligning investment timelines with cash flow requirements. Pacing models are essential in addressing the complexities of a private capital portfolio, but they also come with their own challenges. The following are some of the biggest struggles institutions face when plotting out the pacing of their private market portfolios.

#1: Meeting goals while not overshooting them

Pacing allocation for private investments is a delicate balance – it’s key that investors meet their goals but it’s also a rare case where they do not want to overshoot them either. Keeping this balance in check allows them to maintain ideal cash management operations and portfolio allocation goals.

Certain institutions such as pension funds likely feel additional pressure to stay on target given they face particular scrutiny over their allocations as opposed to other classes of institutions, such as family offices.

#2: Scaling allocations

Institutions are leaning on alternatives more than ever within their portfolios, and most have plans to continue scaling up allocations. While many have targets in mind of where they’d like to get their alternatives allocations, reaching that target is typically a years-long process, as it takes plenty of time and resources to vet managers and wait for the right opportunities to make investments.

Though an institution knows where it would like to see its alternatives allocation go, knowing how and when it will reach that point creates challenges for interpreting a current cash flow model.

#3: Moving past memories of 2008 and 2020

We all remember those panicky first few months of the COVID-19 pandemic. Markets plummeted, sending investors scrambling for liquidity, and the long stretch of uncertainty that followed led to then-unprecedented levels of dry powder – $976 billion in September 2020. Additionally, many in the industry still remember the financial crisis of 2007 and 2008, where similar panic unfurled.

These nagging memories can have institutions second guessing whether to act on private investment opportunities. Their fear and instinct to hold onto cash for the possible emergence of another downturn will naturally butt up against staying true to their portfolio goals. But if your pacing model is dependent on the right data, it is designed to help you factor in the potential for a market downturn and plan for having the cash on hand in those situations.

Tackling pacing model challenges

A good pacing model should look at a number of factors, such as current deals being evaluated, current allocations, where an institution hopes to take their allocations to, risk appetite, diversification between strategies and geographies, and potential for market downturn. By taking all these points into account, an institution will be able to see how a current set of deals they’re evaluating will affect pacing – including diversification, risk, and overall allocation – years down the line.

More About The Author

Megann Freston

Director of Product Marketing