By: Allvue Team

February 8, 2023

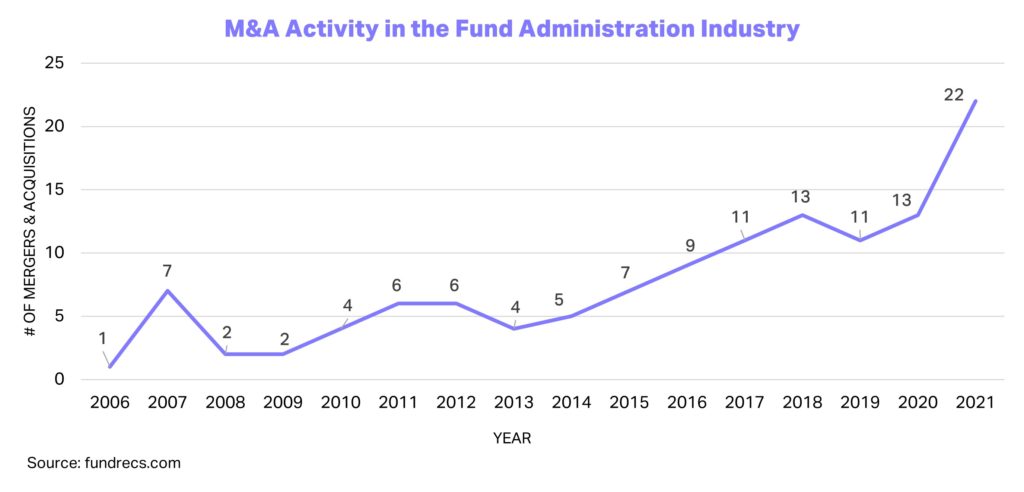

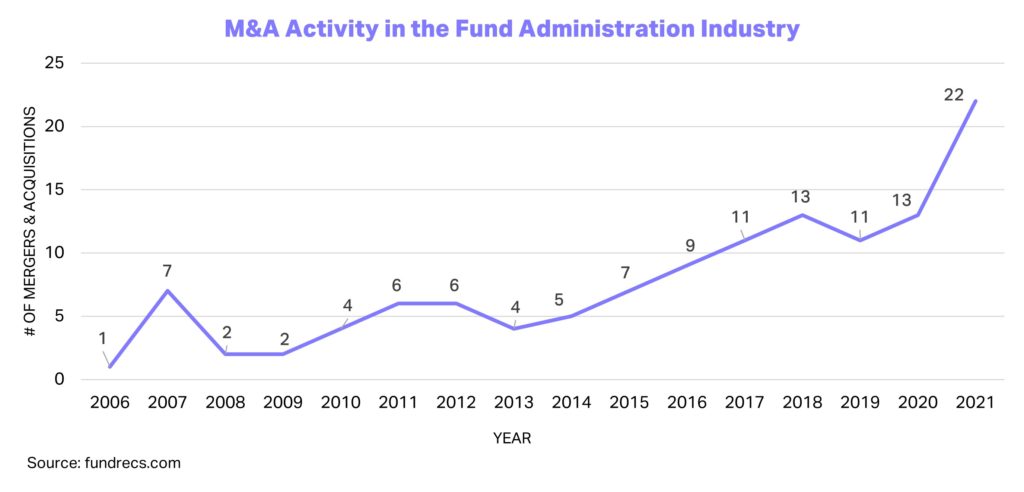

In the past several years, there has been a persistent trend toward mergers and acquisitions among fund administration firms around the globe. These few headlines from the past several years illustrate this consolidation trend:

But even as the biggest fund administrators strive to scoop up their smaller rivals, smaller firms are setting up shop with enviable agility and the ability to offer service to burgeoning fund managers. Industry pundits believe a shift is coming, where there will be a handful of top fund administrators (similar to the “Big Four” in traditional accounting) along with niche fund administration firms that cater to specific geographies, general partner needs, or fund types.

We will keep this page refreshed as we learn about pending and completed merger or acquisition deals in the fund admin industry; please note that news is subject to change. If you have a tip or an update, please let us know! And if you’re a fund administration firm, we invite you to learn about how Allvue solutions – such as our Fund Accounting and Investor Portal software – can help you streamline and future-proof your business.

READ OUR PRIMER: WHAT IS FUND ADMINISTRATION?

Fund Administration Mergers & Acquisitions, 2020-2023

2023

Date: January 23, 2023

Assets under administration: $71.4 billion

About: The acquired business is known as Bank of America Custodial Services (Ireland) Limited, or BACSIL. It is a depositary solution for onshore and offshore funds servicing UCITS, alternative investment funds, and different offshore fund structures.

Press: Apex Group to Acquire Bank of America Irish Depositary Business

Date: January 17, 2023

Assets under administration: €20 Billion

About: ALFI Partners, based in Luxembourg, promotes a selection of leading international asset management firms to qualified investors. The acquisition will be rolled into Apex’s FundRock Distribution subsidiary.

Press: Apex Group to Acquire Luxembourg’s ALFI Partners

Date: January 11, 2023

Assets under administration: $1 trillion

About: Pacific Fund Systems, or PFS, is a fund administrator that offers a core specialist accounting and administration solution known as PFS-PAXUS. The acquisition will increase the services that Apex offers its customers.

Press: Apex Group Enhances Technology Offering with PFS Acquisition

2022

Date: December 5, 2022

Assets under administration: $2 trillion

About: Complete Financial Ops, also known as CFO Fund Services, is a Colorado based fund administration firm that is unlike its competitors that specializes in work for private equity firms and family offices. The deal adds 25 clients and eight employees to SS&C’s roster.

Press: SS&C Acquires Complete Financial Ops, Inc.

Date: November 9, 2022

Assets under administration: €900 billion

About: European Investment Group, also known as EFA, offers fund administration services to asset managers, banks, insurance companies, wealth managers, family offices, and institutional investors from offices in Luxembourg, France, and Sweden.

Press: Universal Investment Group Completes Acquisition of EFA

Date: November 3, 2022

Assets under administration: €4.5 billion

About: Darwin Depositary Services is based in the Netherlands and works with hedge funds, real estate, debt, infrastructure, renewable energy, and private equity funds in the Netherlands and outside the EU.

Press: Apex Group Closes Acquisition of Darwin Depositary Services

Date: September 12

Assets under administration: $3B

About: Global financial services provider Apex Group continued its geographic expansion with the purchase of Implemented Investment Holdings, which operates two administration platforms in New Zealand. InvestNow is a retail investment management platform, and Implemented Investment Solutions works with international managers looking to enter New Zealand. This is Apex’s second acquisition in that country.

Press: Apex Group set to acquire InvestNow and Implemented Investment Solutions

Date: September 8

Assets under administration: $28B

About: Global financial services provider Apex Group increased its North American presence with the acquisition of Prometa, a Canadian company that administers funds based in Bermuda, Canada, and the US. The transaction gives Apex Group a new office, in Winnipeg.

Press: Apex Group acquires Prometa

Date: September 7, 2022

Assets under administration: $500 million

About: JGM provides tax and fund administration services to US real estate and private equity alternative asset managers. The acquisition expands IQ-EQ’s US presence.

Press: IQ-EQ Expands Its US Business with the Acquisition of JGM Fund Services

Date: September 1

Assets under administration: $11B

About: Global financial services provider Apex Group acquired Mainspring, which provides fund administration and custodial services to small and medium-sized venture capital funds in the UK.

Press: Apex Group to buy UK fund administrator Mainspring

Date: August 15

Assets under administration: $30B

About: Global financial services provider Apex Group acquired SandsPoint Capital Advisors, which handles fund administration, advisory, and consulting services for real estate investors. The transaction expands Apex Group in the US.

Press: Apex Group acquires US real estate services firm

Date: August 1

Assets under administration: $1.5T

About: Global financial services provider Apex Group acquired Sanne Group, which itself grew through acquisition. The transaction nearly doubles Apex Group’s assets under administration and adds several new markets.

Press: Apex Group closes £1.5bn acquisition of Sanne

Date: July 12

Assets under administration: Not available

About: Aduro Advisors, which provides services to venture capital and private equity firms, acquired VMS Fund Services, which specialized in services for venture capital firms. In addition, the transaction gives Aduro an increased presence on the East Coast.

Press: Aduro Advisors acquires VMS Fund Administration

Date: June 15

Assets under administration: $20B

About: Global financial services provider Apex Group acquired Malta-based ZAS, a specialist provider of regulatory compliance and risk management services. The acquisition expands Apex’s footprint in the Malta market.

Press: Apex acquires ZASMalta

Date: April 28

Assets under administration: Not available

About: Global specialist ZEDRA acquired Curaçao- and US-based Atlas Fund Services. The acquisition grows ZEDRA’s global footprint in fund administration services, expanding from its existing presence in European and Asian markets into LATAM and the US.

Press: ZEDRA Expands Global Foothold in Fund Administration Services Industry With Acquisition of Curaçao and US Based Atlas Fund Services

Date: April 28

Assets under administration: Not available

About: Global asset management firm Suntera acquired New Jersey-based Socium Funds Services as Suntera looks to grow and expand its international footprint in the US market. The acquisition adds to Suntera’s existing network in the Bahamas, the Cayman Islands, Hong Kong, the Isle of Man, Jersey, Luxembourg, Malta, and Switzerland.

Press: Suntera Global expands to US market through Socium acquisition

Date: March 30

Assets under administration: $1T

About: Global asset management firm Waystone acquired Centaur Group, based in London and with offices in Dublin, North America, and elsewhere. It represents a major expansion of services for Waystone.

Press: Centaur set to become part of Waystone

Date: January 13

Assets under administration: Not available

About: Global asset management firm Waystone acquired Nottingham, England-based T. Baily Fund Services (TBFS). By acquiring the independent fund admin, Waystone hopes to bolster its UK presence and supplement its offerings with a fully hosted authorized corporate director (ACD) service. Together, the firms will have more than £10B in ACD-related assets under oversight.

Press: Waystone to acquire T. Bailey Fund Services

2021

Date: December 16

Assets under administration: ~$400B

About: Cincinnati, Ohio-based fund administration and accounting firm Ultimus acquired Philadelphia-based FD Fund Administration, an independent provider of accounting and administrative services. The combined company will represent more than 1,500 funds.

Press: Ultimus Fund boosts private fund administration footprint with latest deal

Date: December 16

Assets under administration: Not available

About: JTC extended its reach in the US with the acquisition of New-York-based Essential Fund EFS, a top provider of fund accounting to the Insurance Dedicated Fund (IDF) industry with $5.5 billion in AUA. A JTC spokesperson noted that the States is an important growth market for the fund admin services sector, as there are fewer service providers in America compared to Europe.

Press: JTC buys US fund services business Essential Fund Services

Date: December 6

Assets under administration: Not available

About: Delaware-based CSC offered more than $2 billion to acquire Netherlands-based fund solutions firm Intertrust. CSC has been growing rapidly over the last two decades, making 25 strategic acquisitions since 2002.

Press: CSC offers $2B to acquire Dutch competitor

Date: November 16

Assets under administration: Not available

About: Investor services group IQ-EQ, which already has 24 global locations, expanded its footprint with the acquisition of US-based compliance solutions provider Greyline Partners, LLC. Included in the transaction was Greyline subsidiary GCM Advisory (an outsourced CFO launched in 2021). Prior to this acquisition, IQ-EQ oversaw more than $500 billion in AUA.

Press: Fund administrator IQ-EQ buys US-based Greyline

READ MORE: Allvue Systems Selected as Technology Partner for IQ-EQ Private Debt Services Launch

Date: November 12

Assets under administration: $500 billion

About: SEI hopes this acquisition will help toward its goal of expanding SEI’s Enhanced CIO Platform’s data management and analytics capabilities.

Press: SEI Acquires Novus Partners in Bid to Target In-House Investment Teams

Date: October 26

Assets under administration: Not available

About: Pennsylvania-based SEI acquired Finomial, a Boston-based software developer focused on cloud-based client lifecycle management solutions. Finomial clients represent roughly $500 billion in AUA, adding to SEI’s roughly $1.3 trillion in AUA and AUM.

Press: SEI buys Finomial

Date: October 6

Assets under administration: $180 billion

About: JTC Group – a firm with offices around the globe but headquartered on the island of Jersey – entered a definitive agreement, reportedly worth up to $236 million, to acquire SALI Fund Services. SALI is a US provider of services for the Insurance Dedicated Fund (IDF) and Separately Management Account (SMA) market segments. This move further broadened JTC’s reach in the US, which was also the goal of its previous acquisitions of NES Financial and Segue Partners.

Press: JTC buys SALI Fund Services to accelerate US expansion

Date: September 21

Assets under administration: $180 billion

About: Specialty fund administrator JTC announced plans to expand into Ireland with the acquisition of Ballybunion Capital, a boutique asset manager and provider of regulatory oversight for investment funds, as well as management company and outsourced alternative investment fund manager services.

Press: JTC Group buys Irish ManCo provider for US business push

Date: September 16

Assets under administration: $180 billion

About: As part of its growing effort to expand within the US and bolster its venture capital coverage, global fund JTC Group acquired St. Louis-based Segue Partners, a fund services provider with clients in 10 US States and Canada.

Press: JTC strengthens US fund service presence with Segue Partners acquisition

Date: September 7

Assets under administration: Not available

About: In a move that makes it the world’s leading provider of asset serving, State Street acquired BBH for $3.5 billion in cash. Going into the deal, BBH has $5.4 trillion in AUC in addition to State Street’s $31.9 trillion.

Press: With $3.5B acquisition, State Street makes clear it’s not going anywhere

Suntera Global acquires Reference Financial Services SA

Date: August 25

Assets under administration: Not available

About: Global asset management firm Suntera acquired Luxembourg-based Reference Financial Services SA. Suntera’s acquisition of the boutique fund administration and corporate services firm strengthens Suntera’s presence in the EU markets in order to better support the firm’s growth strategy.

Press: Suntera Global has acquired Reference Financial Services

Date: August 16

Assets under administration: $260 billion

About: Jersey-based provider of administration and fiduciary services Ocorian purchased Guernsey-based Trust Corporation International (TCI), a firm specializing in wealth administration and corporate services. Already a global firm, Ocarian expanded its reach into the Channel Islands with this acquisition.

Press: Ocorian buys Guernsey trust company

Date: August 2

Assets under administration: $600 billion

About: Through the acquisition of Denver-based Stone Pine, New-York-based PE fund administrator Gen II expanded further into the Western US and increased its head count to roughly 750. Stone Pine offers tailored services to various private equity fund structures.

Press: Gen II Fund Services Acquires Stone Pine

Date: July 28

Assets under administration: $600 billion

About: This acquisition will increase Sanne’s presence in the European private equity market as well as the listed funds sector. The deal adds more than 80 employees and £25 billion in assets under administration.

Press: Sanne to acquire PraxisIFM fund admin business in European private equity expansion

Date: July 8

Assets under administration: $41.7 trillion in AUA, $2.2 trillion in AUM

About: Roughly a year after New York-based BNY and Boston’s Milestone aligned to create a product suite of asset manager and owner services, the pair entered into a definitive buyout agreement. Through the acquisition, BNY will gain digital capabilities as well as OCIO services and cash allocation solutions.

Press: BNY Mellon to acquire Milestone Group to accelerate digitization of services

Date: July 1

Assets under administration: $1.4 trillion

About: Apex won a bidding war for Australia-based Mainstream Group with its final offer of (€1.78) per share, or €263 million. The deal will bring Apex’s workforce to nearly 5,000 employees in 50 offices worldwide.

Press: Apex sees off SS&C in Mainstream acquisition battle

Date: June 3

Assets under administration: Not available

About: CSC added New Jersey-based PEF Services to its roster, citing the latter’s “deep expertise in fund administration” – including compliance and reporting solutions – as a complement to CSC’s existing business, legal, and tax services.

Press: CSC acquires boutique investment firm servicer

Date: May 18

Assets under administration: Not available

About: Apex’s acquisition of fund admin services company Tzur – with offices in New York and Tel Aviv – adds 90 employees and $13 billion in AuA to Apex’s growing business.

Press: Apex Group acquires Israeli fund services provider

Date: April 8

Assets under administration: €150 billion

About: TMF Group continued to expand into North America with the purchase of Venture Back Office, a third-party provider of fund administration and investor services solutions. Venture Back Office is also one of the few companies to offer ASC 820 Fair Value Measurement services.

Press: TMF Group expands US private markets business with acquisition of Venture Back Office

Date: April 7

Assets under administration: Not available

About: With acquisition of Dallas-based STRAIT, Sanne added more than 50 employees, roughly 60 new client groups, and more than $20 billion in AUA. Sanne paid $32 million upfront for the deal, plus an earn-out component in cash and shares, worth up to $13 million.

Press: Sanne to buy Texas-based STRAIT for up to $45m, raise £80m in placing

Date: February 15

Assets under administration: $130 billion

About: JTC purchased UK-based INDOS and its subsidiaries for a maximum value of £12.5 million (including potential deferred compensation). INDOS specializes in the alternative assets market, offering depository and other services, as well as technical expertise that strategically complement JTC’s portfolio.

Press: JTC brokers deal to buy alternative fund services expert INDOS Financial

Date: January 12

Assets under administration: $1 trillion

About: In its continued strategy to expand US operations, Alter Domus acquired Salt Lake City-based Strata, a provider of back- and middle-office services for the PE and VC sectors. The deal, for Strata’s $140 billion in AUA and more than 200 employees, places Alter Domus among the top-three largest private asset services for US alternative asset managers.

Press: Alter Domus acquiring Strata Fund Solutions

READ MORE: Allvue Featured in “Technology Special Issue” of Sensus Magazine

Date: January 5

Assets under administration: Not available

About: Sudrania, a cloud-computing-enabled fund admin firm, acquired the primary assets of Philadelphia-based Triple Leo Consulting (TLC). TLC is a fund administrator specializing in crypto and digital assets. As part of the agreement, TLC founder and CEO joined Sudrania in a consultive role, while the remainder of TLC’s staff joined the Sudrania team.

Press: Sudrania Completes Acquisition of Triple Leo Consulting

2020

Date: December 23

Assets under administration: €100 billion (AuM)

About: Link Group acquired the Luxembourg-based Casa4Funds, a UCITS Management Company and Alternative Investment Fund Manager, from Banor Capital. The deal enables Link to further expand into Luxembourg, an important destination for the investment fund business.

Press: Link Group to acquire Casa4Funds

Date: December 23

Assets under administration: $1 trillion

About: Apex continued its growth spurt by acquiring Mauritius-based Gfin, with 130 employees and $18 billion in AUA.

Press: Apex Group bolsters Mauritius reach with GFin Corporate Services purchase

Date: December 21

Assets under administration: Not available

About: Alter Domus expanded its East Coast presence with the acquisition of Boston-based IPS Fund Services, which has $9 billion in AUA. Headquartered in Luxembourg, Alter Domus’s central US office is in Chicago.

Press: Alter Domus ramps up US presence with IPS Fund Services takeover

Date: December 17

Assets under administration: Not available

About: With its acquisition of Metzler Ireland Limited (MIL), Universal-Investment moves into the Irish market. At the time of the deal, Metzler brings 20 employees and roughly €2.8 billion in assets under management.

Press: Universal-Investment Group expands into Irish fund market

Date: December 14

Assets under administration: Not available

About: London-based Crestbridge expanded its footprint in the US by acquiring New Jersey-based Ovation Fund Services to open its seventh global office. Ovation specializes in fund administration, accounting, and reporting services.

Press: Crestbridge expands in US with acquisition

Date: December 7

Assets under administration: Not available

About: In an effort to broaden its reach to Denmark and Sweden, Sanne offered €27 million in shares and cash for PEA, with a potential performance bonus of up to €3.25 million. The Danish fund services provider comes with 55 employees and more than €27 billion in AUA.

Press: Sanne to acquire Scandinavian Private Equity Administrators

Date: October 28

Assets under administration: $1 trillion

About: Apex’s acquisition of the Banco Modal unit adds almost $12 billion in AUA and 75 employees to Apex’s Americas headcount, in addition to offices in Sao Paulo and Rio de Janeiro.

Press: Apex to buy Banco Modal’s alternative fund administration business in Brazil

Date: October 15

Assets under administration: ~$1 trillion

About: Apex’s acquisition of FundRock (headquartered in Luxembourg) brings the former’s AUA close to the $1 trillion milestone. The deal will also strengthen Apex’s ManCo capabilities across Europe.

Press: Apex reveals FundRock acquisition

Date: October 14

Assets under administration: Not available

About: International asset manager MJ Hudson acquired Ireland-based Bridge Group, a provider of compliance and risk services to the funds industry. Bridge has 27 full-time employees serving 100 asset managers and more than €120 billion in AUA. MJ Hudson’s CEO noted the acquisition is a “key milestone … as Brexit approaches,” as it extends its reach to all UK and European fund centers.

Press: MJ Hudson acquires Bridge Group

Date: August 31

Assets under administration: Not available

About: Amsterdam-based Intertrust agreed to acquire the corporate services business of New Delhi-based Sameer Mittal. The two firms have a previous relationship, as Mittal was Intertrust’s corporate services partner in India since 2016.

Press: Intertrust to expand footprint in India with acquisition of leading corporate services provider

Date: April 2

Assets under administration: $130 billion

About: JTC offered an initial buyout price of $40 million in shares and cash – with up to $116 million after earn-out potential – for Boston-based NESF, a provider of fund administration and treasury services and technology solutions. The deal complements two of JTC’s strategic goals: expanding further into the US and growing its technological capabilities.

Press: JTC acquires leading US fund administration business NES Financial

Date: February 18

Assets under administration: Not available

About: In a continued pursuit toward growth within the US private equity and hedge fund business, IQ-EQ acquired Blue River, a provider of back-office services for the alternatives sector. Blue River has 180 employees across seven US-based offices.

Press: IQ-EQ takes over Blue River Partners

Date: January 29

Assets under administration: Not available

About: Sanne inked an agreement to acquire Inbhear Fund Service Limited and Inbhear Management Services Limited for up to €14.4 million (€6.6 million upfront with a potential earn-out capped at €7.8 million over three years). Inbhear is a fund administration platform based in Dublin with a strong additional `presence in the Cayman Islands.

Press: Sanne to shore up Irish operation with Inbhear acquisition; delivers double digit growth in 2019