By: Allvue Team

June 30, 2023

Many private investment partnership executive teams have found that outsourcing fund administration to a specialist firm improves operating efficiency and LP relationships. Allvue Systems works with firms that do their own fund administration, with those that outsource, and with those that co-source their back-office functions.

In this article, we’ll cover what fund administration is, what a fund administrator does, and how Allvue’s technology gives fund administrators a competitive edge. This will help you understand the field better to make a smart decision that fits your organization.

Fund administration explained

What is Fund Administration?

Fund administration involves collecting data from investment activities and using it to create reports used by investment managers, investors, and regulators to make decisions, calculate taxes, and ensure regulatory compliance.

As a business function, fund administration involves collecting data from the ongoing investment activities and then creating financial reports used by investment managers, investors, and regulators to make decisions, calculate taxes, and ensure compliance with regulations.

Fund administration processes, by nature, are detailed. Back-office teams maintain the books and records of an investment management firm. It is imperative that the data is accurate and that reports are filed on time. A general partner needs good data to manage the fund, a limited partner needs good data to evaluate the investment, and regulators and other overseers expect that everything will be transparent.

Given the importance of data to fund administration, technology becomes an essential part of back-office workflows. Whether a fund’s team chooses to handle fund administration in-house, outsource it, or establish a co-source relationship, the right fund accounting software can help automate processes, standardize data, and streamline private equity reporting.

What is the difference between fund accounting and fund administration?

Fund accounting is sometimes confused with fund administration, but the two are not the same. Fund accountants prepare operating audits, profit and loss reports, and calculate taxes. They ensure that investment reporting meets applicable standards such as the CFA Institute’s GIPS. They also report the investment portfolio values to general partner’s executives.

Fund administrators, by contrast, handle back-office responsibilities on behalf of the fund’s general partners. They prepare books, records, and financial statements, and they ensure that everyone involved receives the necessary reports to do their jobs. This frees fund managers to focus on investments.

The work of a fund administrator

Fund administrators take on many tasks, ordinary and extraordinary. They track performance on a fund and general partnership level, manage the rules of any complex tax structures, calculate management fees and carry amounts, arrange for capital calls, and ensure that agreements in any LP side letters are met. Their reports help portfolio managers analyse their risk exposure.

In addition to the fundamentals of fund accounting, other common fund administration responsibilities include:

WATCH: How we helped Standish Management

Benefits of fund administration

Fund administration offers strategic advantages beyond operational efficiency. It enables fund managers, especially first-timers, to navigate today’s competitive market with enhanced compliance and reporting capabilities. A robust fund administration partnership not only ensures regulatory adherence but also instills confidence in LPs by maintaining transparency and accuracy in financial reporting. This support is crucial in scaling investment firms and achieving long-term success.

The in-house vs. outsource debate

An ongoing debate in the industry is whether back-office operations should be handled in-house, outsourced, or executed through another arrangement. There’s no one right answer; different funds have different needs, different priorities, and different capabilities. Below are a few of the factors to think through when considering which option best meets your firm’s needs.

Fund administration comparison

|

In House |

Outsource |

Co-Source |

| Software |

Developed |

Licensed |

Licensed |

| Staff |

Internal |

External |

External |

| Cost |

High |

Low |

Medium |

| Complexity |

High |

Low |

Low |

| Control |

High |

Low |

High |

Why outsource fund administration

Outsourcing fund administration offers several key benefits, particularly in areas of specialized knowledge and operational efficiency. Fund administrators provide expert services tailored for specific client types, such as hedge funds or private equity firms. They may offer limited services like performance monitoring or comprehensive, integrated administration programs.

One significant advantage of outsourcing is the alleviation of back-office responsibilities from a team’s existing workload. By entrusting accounting and reporting to a capable third party, fund managers can dedicate more time to portfolio management and nurturing client relationships.

In addition to these operational benefits, fund administrators play a crucial role in audit support and compliance. They ensure that funds comply with evolving regulatory standards, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. Their expertise in handling complex financial audits and maintaining stringent compliance measures protects the fund from legal and financial risks, enhancing investor confidence.

However, outsourcing does come with considerations. Operations moved offsite can potentially slow down certain processes. For instance, in times of market turbulence, investors might urgently reach out to their General Partners (GPs). If accounting and reporting are managed by an administrator, the GP might face delays in responding while coordinating specific reports from their fund administrator. To mitigate this, capable fund administrators establish close, synchronous relationships with their GP clients, often employing advanced communication technologies. Despite these measures, some fund managers opt to keep back-office operations in-house, weighing the pros and cons of outsourcing versus maintaining control over these crucial functions.

READ MORE: What is Shadow Accounting?

Why keep accounting and reporting in house

By choosing not to go with a fund administrator, fund managers are able to maintain complete control over their data. They can quickly answer those ad hoc questions from investors, they can fully integrate their back office workflows into their other processes and leverage end-to-end technology to streamline processes and reduce risks, and they can avoid the concerns of having to one day switch administrators and undergo a significant data migration process.

But, as many fund managers well know, back-office operations can be extremely costly, manual, and error-prone, especially as a firm grows. Many managers who handle processes in house initially find their workflows buckling by their third or fourth fund. This often leads them to onboard fund accounting software and other technologies that can streamline those processes and supercharge their growth rather than restrain it.

For those managers that prefer to avoid the distraction of back-office operations but wish to avoid losing control of their data, a third option exists: Co-sourcing.

Co-Sourcing: A common ground for fund managers and administrators

Co-sourcing combines aspects of in-house operations and outsourcing to offer compelling benefits for both fund managers and fund administrators. With co-sourcing, a fund administrator leverages the fund manager’s technology platform to complete their accounting and reporting. This way, the data stays with the fund manager, but the administrative burden stays with the fund administrator. In fact, many GPs for whom the benefits of co-sourcing remain untapped practice shadow accounting, duplicating the work of their fund administrator so that they have their back-office data on hand immediately or as a check on their fund administrator.

What is shadow accounting?

Shadow accounting is the practice of keeping a second set of financial records to verify information in the primary books or to make management decisions that are not supported by the general ledger.

To make co-sourcing work effectively for both parties, it is essential to have a technology solution that can facilitate the arrangement rather than hamper it. Allvue’s co-sourcing solution is revolutionizing the industry, offering unrivaled flexibility and scalability through cutting-edge functionality that allows fund managers and administrators to easily share access to data within a single platform.

READ MORE: The Ultimate List of Fund Administration Mergers and Acquisitions

Choosing a fund administrator

Selecting the right fund administrator requires careful consideration of your fund’s structure, complexity, and your own expertise. Questions to ponder include the number of funds managed, the level of accounting experience in-house, the extent of portfolio analysis required, and the scope of reporting for LPs. This decision is crucial for ensuring that your fund‘s financial operations align with both internal capabilities and external market expectations.

Why Allvue’s technology gives fund administrators a competitive edge

As private equity firms grow and mature, their back-office operations become increasingly complex. As such, fund administration becomes an increasingly important aspect of their continued success. But efficient and effective accounting and reporting requires capable, powerful software.

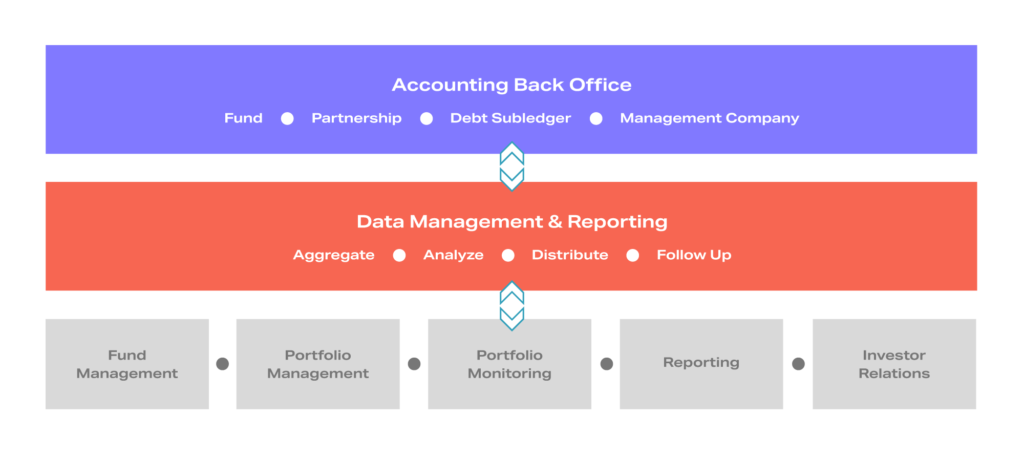

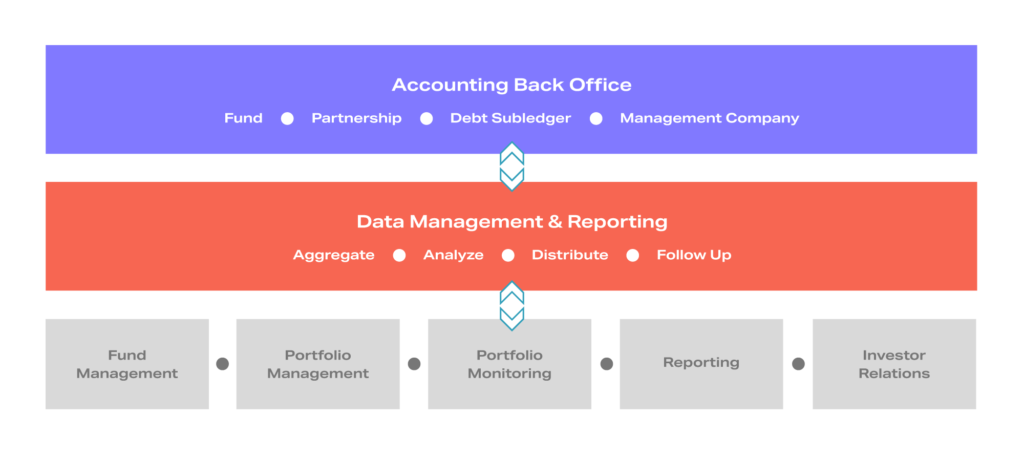

Whether fund managers choose to go in-house, outsource, or co-source their fund administration, Allvue offers a complete solution. Our best-in-class platform includes:

- A true general ledger system designed specifically for the private capital industry

- An end-to-end fully integrated system to that leverages a single source of data to ensure accuracy

- Cutting-edge technology built on Microsoft’s enterprise framework

Allvue’s technology enables superior investment decisions. Our integrated product suite supports fund administrators and meets the needs of demanding GPs—and the demanding LPs who allocate to them. Fund administrators can use Allvue’s Fund Accounting solution, reporting capabilities, and Client Hub to hone a competitive edge and serve their clients better. Our integrated system ensures data accuracy, and our engineering team keeps our products on the industry’s forefront.

Optimal timing for engaging a fund administrator

The ideal time to engage a fund administrator is early in the fund’s lifecycle, preferably 6-12 months before the first fund closes. Early integration of a fund administrator allows for a seamless fundraising process and establishes a strong foundation for financial management and investor relations. This proactive approach ensures that your fund is well-positioned to meet investor expectations and navigate the intricacies of fund management from the onset.

Interested in learning more about how Allvue’s software has helped other fund administrators? Check out our case studies.

“It was clear that, based on the flexibility of the platform combined with the enterprise-grade structure, Allvue was the right choice.”

Mike Trinkaus. CEO and Co-Founder

DOWNLOAD THE CASE STUDY

|

“Allvue saves us days – I’m not even talking hours, it saves us days.”

Susan Gillick, President

DOWNLOAD THE CASE STUDY

|

Request a demo below to discover how our cloud-based solution, built within Microsoft’s enterprise framework, can help empower superior investment decisions.