By: Kamil Godlewski

Product Manager

June 3, 2023

The equity method of is used in private equity to pull profits and losses from lower–tier entities up to upper–tier entities. This way, unrealized gains and losses can be accurately reflected in quarterly statements and other financial reporting, offering an accurate value of the investing company’s portfolio.

DOWNLOAD NOW: PRIVATE EQUITY REPORTING TEMPLATES

What is equity method accounting?

Equity method accounting is a process used to value one company’s equity investment in another company, especially when one company has a considerable amount of influence over the other. In private equity specifically, it’s often used when a private equity fund has considerable influence over an investee company – usually defined as an investment of between 20% and 50%, with representation on the board of directors, or both – but not control over it.

Because of the considerable influence (but not complete control) the fund has over the investee company, the relationship can be thought of as akin to a parent/child one. The parent is considered as the investor in the child and sends money to the child, recording an investment on their books. The child, subsequently, records the receipt of a contribution.

The influence between them connects them from a financial perspective. So, when any future profit and loss activity occurs that is specifically associated with the carrying value of the investment, it will need to be recorded on both books. Transactions that affect the “child”/investment need to be sent up the structure to the “parent”/fund for reporting purposes, so that the fund can make the appropriate adjustment in its books.

What is an equity pickup?

the process of making this adjustment. To do so, the P&L from lower-tier entities is pulled up to the upper-tier ones in order to accurately reflect the latter’s value. This includes calculating equity method investments in the context of financial statements.

Watch: Streamlining the Equity Pick-Up Process

Learn More

Equity method accounting example

Like many fundamentals of private equity fund accounting, standalone instances like this are relatively straightforward to account for. For example, if a portfolio company earns a certain amount of money over the course of a year, the private equity fund will need to show its percentage of that profit, calculated based on its percentage stake in the company, as a line item on its income statement.

But, also like many things in fund accounting, as fund structures become more complex, so do these sorts of calculations. The equity method of accounting must also consider other factors like cash flow and equity security, and executing the calculation across varying currencies and complex fund structures quickly becomes a logistical nightmare.

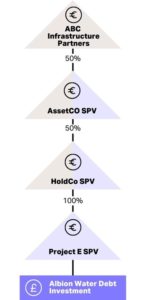

For example, consider the following fund structure:

- ABC Infrastructure Partners is based in EUR and has a 50% ownership in the AssetCO SPV

- AssetCo is based in EUR and has a 50% ownership in the HoldCo SPV

- HoldCo is based in EUR and has a 100% ownership of Project E SPV

- Project E SPV is based in GBP and has the direct link to the Albion Water debt investment

Pulling P&L for a complicated fund structure like this, involving multiple currencies, quickly becomes a tedious and error-prone exercise. Trying to manage these workflows in legacy tools like Excel can simply exacerbate the issue and add operational risk.

Fund accounting teams need a better solution.

How Allvue streamlines equity method accounting for fund accounting teams

Allvue’s Fund Accounting software meaningfully streamlines workflows like the equity pickup process and equity method accounting. Our platform eliminates the need to manually key in GL entries for each equity method investment during a financial reporting close, saving teams a significant amount of time and reducing risk in the process.

Allvue is a fully integrated, end-to-end platform, so financial asset data is able to seamlessly flow across stages of the alternative investment life cycle and across processes and workflows. Consider, for example, the complicated fund structure listed above.

Because the entities are connected in the system through a capital call chain, creating a ledger activity at one level kicks off a single continuous and automated process that generates corresponding ledger activities at each level in the structure, based on correct ownership percentages.

When interest income comes in on the lowest level (the Albion Water debt investment example), Allvue’s solution can automatically create entries that need to be posted at each level of the structure for review and approval.

Additionally, Allvue allocates the comprehensive income based on the correct currency – for example, listing the transaction generated at the AssetCo level in EUR, based on the GBP of the Albion Water holding – and provides full transparency into the target company at this level, which helps facilitate look-through reporting with a consolidated financial statement.

Equity method accounting doesn’t need to slow down your workflows or create added risk.

DOWNLOAD: THE BIGGEST PRIVATE EQUITY DEALS OF THE YEAR SO FAR

Learn how Allvue’s Fund Accounting software solution can help empower superior investment decisions.

More About The Author

Kamil Godlewski

Product Manager

Kamil Godlewski is a product manager at Allvue Systems, a leading provider of investment management solutions. He has over 15 years of experience in finance and sales, working with various clients in the alternative investment space with an emphasis on private equity. He has a MBA in finance from Indiana University's Kelley School of Business and is a previous CPA license holder.