By: Alex Lambiotte

Senior Product Specialist

October 11, 2023

As the alternative markets exploded in the last decade, fund financing – that is, the providing of credit to private funds – emerged alongside as an increasingly important revenue generator for banks and other non-bank lenders. But as issuance of these facilities grows, it poses unique challenges that traditional risk management infrastructure is ill-equipped to support.

In this primer, we break down the history of fund finance, explore the opportunities and challenges the growing, maturing market presents, and explain how purpose-built fund finance software will become increasingly essential as lenders scale up fund financing and, with it, their data management needs.

What is fund finance?

Fund finance refers to the class of credit extended by institutions to alternative asset managers to capitalize their funds. These facilities supplement investor capital to increase the manager’s dry powder or help manage liquidity. Within the fund finance universe, common facilities include subscription lines, net asset value (NAV) lines, and leverage lines.

Common fund finance facilities

The broad term fund financing encapsulates a handful of similar but ultimately different products. The most common types can be grouped in two buckets: subscription lines, which entail lending to a GP’s fund against capital commitments from its investors; and more general asset-based lines, which typically provide leverage or liquidity to a GP based on the value of the fund’s collateral – be it a stake in a privately owned business or a pool of middle market loans. Both facility types utilize a borrowing base mechanism to determine availability, which usually results in strong collateral coverage and the perception of safety.

Subscription lines

Subscription lines are lines of credit or loans secured against the future – but yet unrealized – capital commitment of LPs to GPs. They enable GPs to execute on fund investments on their own timetable and increase returns during the pre-funding period. Though typically considered low risk, lenders still need to be wary of the creditworthiness of LPs when extending subscription lines to a GP.

Leverage lines

Leverage lines are a type of Asset-Based facility that use a borrowing base calculation to determine availability based on the value of the fund’s underlying holdings, which serve as collateral. For leverage lines, that line of credit is used by GPs to increase their dry powder above the equity invested in the fund. Importantly, these facilities are typically secured by the full holdings of the fund rather than a single asset, lowering the risk profile of the loan.

NAV-based lines

NAV-based lines, another subset of Asset-Based lines, are secured by the underlying cash flows and distributions that flow up to the fund from its underlying portfolio investments. They are most common in the secondaries market, where collateral will take the form of LP interests that the secondaries fund holds in different vehicles, or in the private equity world, where security is provided by the fund’s equity stake in its portfolio companies. Whereas the principal goal of leverage lines is to increase the dry powder available, the primary purpose of NAV lines is to provide liquidity at the fund level when it is not being produced at the asset level.

Hybrid facilities

There are also hybrid facilities which combine elements of both subscription and NAV lines into a single, comprehensive facility, although usually at a slightly higher cost given the added complexity.

A brief history of fund finance

A Decade of Growth in Alternatives

Following the 2008 global financial crisis, the banking sector either left or steeply pared back many business lines that had historically been profit centers but carried high risks. Due to either outright regulatory bans or higher capital requirements, banks had to cede ground to unregulated entities across a broad spectrum of once-lucrative lending markets. They were pushed to find new, safer income sources elsewhere.

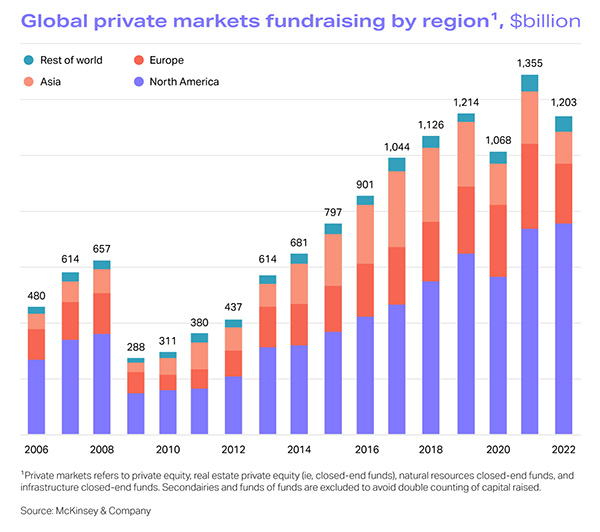

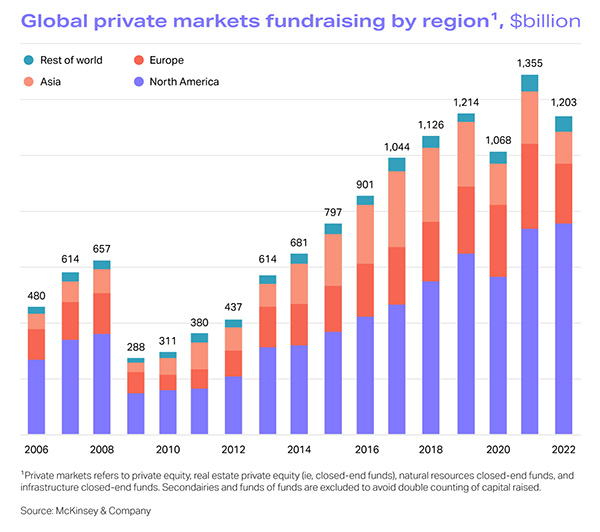

During this same period, alternatives fundraising boomed, as investors sought uncorrelated and attractive risk-adjusted returns against the backdrop of record low yields. According to a McKinsey report, over $11 trillion dollars has poured into private markets since 2010, a marked increase in overall AUM and a significant outpacing of the public markets over the same period.

And with that growth, banks with the balance sheet and necessary institutional relationships were able to find a new revenue stream in providing liquidity to this quickly expanding world of alternative fund vehicles – in other words, via fund financing.

The rise of private markets

Private market headwinds require more flexibility

While private markets continue to outperform public ones, recent headwinds have hit both hard and have required many GPs to pivot – both in terms of managing portfolios and in terms of financing options.

In private equity, secondaries are a key example. The 2008 financial crisis also played a key role in the development of this transaction type – giving birth to GP-led secondaries, as fund managers were desperate to lengthen investment periods amidst a down market. The headwinds of the last few years have similarly increased appetite for continuation vehicles and secondaries.

The flexibility granted by fund financing and hybrid facilities have, as a result, also boomed. In addition to the need to extend the lifespan of funds, GPs have leveraged these facilities to finance add-on amendments and, in today’s higher interest rate environment, access additional liquidity for portfolio companies.

As Dave Philipp, a partner at the fund liquidity solutions group at Crestline, explained to Private Funds CFO: “As fund finance has evolved over the last decade, the market has gone from niche product to a true portfolio management tool.”

READ MORE: OUR GUIDE TO SECONDARIES

The benefits of fund finance

The rapid growth of fund finance is propelled not only by market opportunity but also by the benefits of the lending facilities:

- The risk to lenders is relatively low: On the supply side, banks view these loans as being well-collateralized, and they carry lighter capital reserve requirements, which makes them an attractive alternative to riskier forms of lending with similar yields.

- It diversifies the lending portfolio: Fund financing gives lenders another tool with a unique risk profile to further diversify their lending portfolio beyond traditional loans.

- It creates cross-selling opportunities: Fund financing reaches a sophisticated and sometimes new client base to whom lenders can offer treasury services, foreign exchange, or risk management solutions.

- The regulatory oversight is less burdensome: Given the initial use case for fund financing, a lending option that sidestepped the increased regulatory burden following the Global Financial Crisis, historically the regulatory oversight for these transactions is often not as onerous. Though, as regulation continues to increase across the industry, fund finance could likely be affected as well.

The biggest challenge facing fund finance lenders

The challenges facing fund finance lenders vary, of course, per lender and situation, but in general they tend to revolve around one primary theme: data management.

This is because lenders rely on information from their borrowers or agent banks – information which is often received via disparate spreadsheets and in various formats. The aggregation of that data in a clean, accurate, and scalable way quickly becomes a significant challenge.

And yet, being able to aggregate and analyze that data is essential. If lenders can’t do so, they are unable to assess their exposure and, as a result, unable to manage risk.

For example, a single subscription line may appear well-diversified by LP exposure, but may overlap significantly with other lines held by the bank or exposure to an overall parent entity. Thus, the lender needs to be able to look across exposure to its aggregate collateral pool – regardless of GP counterparty or facility – to get the full picture. This creates a disconnect between the borrower and collateral, and lenders will need to address their data and risk management processes to ensure the proper guardrails are in place.

Here is an abridged list of the challenges brought on my insufficient data management processes:

- Lenders can’t see their exposure to specific investors across multiple subscription lines, or to specific companies or industries across NAV/ABL facilities.

- Lenders are unable to verify borrowing base calculations – often extremely complex calculations that rely on a litany of data points being reported by the borrower.

- It becomes difficult for lenders to facilitate questions around the availability to borrow for specific transactions.

- Lenders need the ability to view how historical collateral or borrowing base data has trended or changed period over period or over time.

Real-time analysis is also an important factor here. Data must be continually monitored and standardized as changes to the quality of collateral could have an impact to the terms of the credit facility or the bank’s broader portfolio. Real-time tools also help facilitate and update the trove of reporting requirement that comes with these facilities.

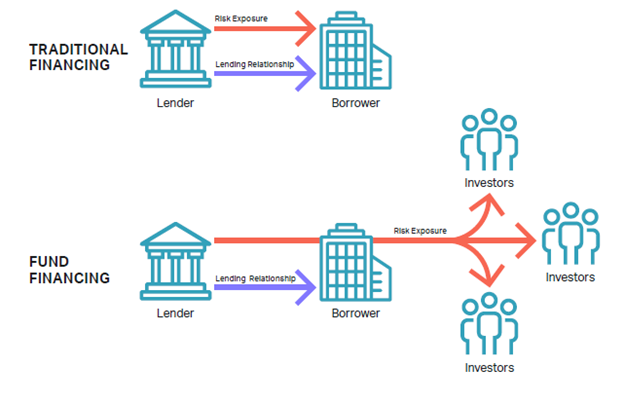

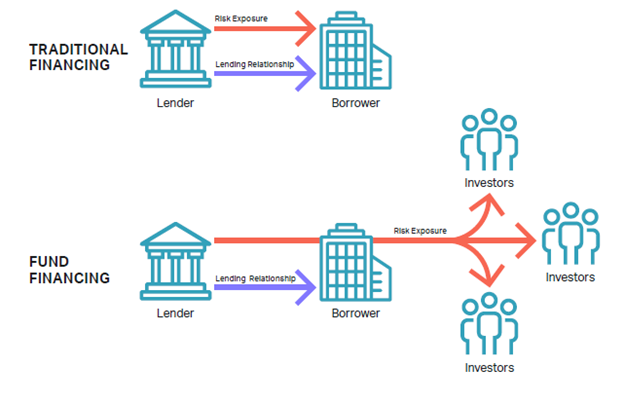

The one-to-many relationship of fund finance

One of the unique aspects of fund finance – and in many ways the culprit of the data management challenges it creates – is the one-to-many relationship it creates between lenders and the underlying collateral backing these facilities.

Unlike traditional lending relationships, counterparty exposure alone is insufficient to gauge portfolio risk. That’s because the lending relationship sits with their borrowing counterparty, but their collateral exposure sits with their borrower’s investors or fund holdings, which may overlap across facilities and counterparties.

The one-to-many nature of fund finance collateral complicates how banks measure risk. They must look deeper into the underlying collateral being used across facilities, and ensure that they are not over-exposed to any one asset or investor. This is especially pertinent for asset-based lines, where the individual holdings can be risky and move widely in value between reporting periods or facility draws.

As mentioned above, though, digging into that collateral creates significant data management challenges. A single leverage facility is relatively manageable for a lender, but analyzing collateral data across a portfolio of leverage facilities quickly becomes complicated. There may be inconsistencies in naming conventions of the underlying assets, and the sheer volume of data makes aggregation and comparison challenging. Whereas a traditional corporate lending desk is focused on the credit risk of its borrowers, a fund finance desk is responsible for tracking potentially tens to hundreds of end points across each facility, and comparing them at the portfolio level. Clearly, traditional front-office systems will be ill-equipped to handle the complex nuances of these facilities.

Fund finance lenders need purpose-built tools to meet their bespoke needs

The needs faced by fund finance lenders are unique to their specific lending facility, but too often they are met with traditional tools designed for other purposes. At Allvue, we have recognized this challenge and developed purpose-built software for managing the entire lifecycle of fund finance facilities, from origination to monitoring.

Our platform features a robust integration layer that allows fund finance lenders to import and normalize information from their borrowers to better and more easily form a single source of truth. As a result, lenders can finally assess exposure in a detailed and accurate way across their portfolio.

Similarly, with Allvue, fund finance lenders can leverage a powerful engine to calculate and check borrowing base calculations, validating the information provided by the borrower and allowing them to easily model what/if scenarios around market events and the potential impacts of draws.

Lastly, Allvue allows for deal management and tracking, supporting the investment lifecycle from sourcing deals, through the ongoing management of reporting requirements and deal monitoring.

Reach out today to discover how Allvue’s Fund Finance solution allows lenders to better gain a holistic understanding of their financing portfolio – and in the process better mitigate portfolio risk and compliance errors.

More About The Author

Alex Lambiotte

Senior Product Specialist

Alex is a senior product specialist leading the solutions engineering team for Allvue's credit solutions. He has been at Allvue Systems for 6 years. Alex focuses on building out the existing client base and use cases of Allvue's credit capabilities, working closely with the sales and engineering teams. He is a graduate of Northeastern University, with a BS in Industrial Engineering.