By: Kamil Godlewski

Product Manager

September 14, 2023

For a variety of reasons, private equity secondaries have boomed in recent years. In this primer, we break down this complex and varied asset class, lay out its benefits and risks, examine what might be behind its substantial recent growth, and assess where the private equity secondary market might be headed in the near future.

What are private equity secondaries?

Private equity secondaries are pre-existing investor commitments or fund interests that are re-sold, either directly from one investor to another or via a secondaries fund.

Type of private equity secondaries

Since the first secondary fund was launched in 1984, secondaries have evolved significantly, in response to market motivations as much as investor innovations. Broadly, they can currently be bucketed into two distinct categories: LP-led secondaries and GP-led secondaries.

LP-led secondaries

LP-led secondaries are the original form of secondaries and, while their edge has slipped, still usually claim the lion’s share of the private equity secondary market.

In their most traditional instance, LP-led secondaries involve a distressed limited partner usually with an urgent need for liquidity. As such, they’re willing to sell their asset – usually at a discount to the net asset value (NAV) – in order to free up liquidity. This is sometimes known as a “forced sellers” situation, where the need for liquidity overrules the longer-term value of the asset.

It’s not surprising, then, that the rise and fall of secondaries is tied closely to periods of market turbulence. Distressed markets may make it more challenging for LPs to make capital calls, motivating them to free up liquidity in order to do so. And, when this is a discrepancy between various markets – caused, for example, by public markets falling more quickly than private markets – the denominator effect can also spur LPs to consider selling.

What is the denominator effect?

The denominator effect is when one portion of an investor’s portfolio has a significant change in value, thus materially altering the overall allocation of the portfolio. As, for example, when public markets fall dramatically and more quickly than illiquid private market assets, investors may find themselves significantly overallocated to private markets.

This denominator effect is a common driver of secondary transactions. Even if, perhaps, investors would still prefer to hold the investment, their portfolio allocation may be determined by investment committees or other agreements that require them to rebalance. The illiquidity of private capital makes this a more challenging process, pushing LPs to consider secondaries.

PRIVATE EQUITY DEALS: THE BIGGEST TRANSACTIONS OF THE YEAR SO FAR

GP-led secondaries

Global financial crises have affected secondaries in other ways too – they have, for example, given rise to GP-led secondaries.

As Pitchbook explains in their “Evolution of Private Market Secondaries,” GPs with funds nearing their end during the global finance crisis were in a bind. Many did not want to sell when markets were suppressed and valuations were at their lowest, but many were required to do exactly that by their LPAs. There were mechanisms in place for them to be able to extend the life of their funds – for example, by buying assets from a previous fund with a new fund – but those methods were hardly free of conflicts of interest and, as such, a cause of concern for many LPs, even those that might also not want to have their investment realized in times of distress.

To resolve this, GPs brought in a third-party – a secondaries buyer who can then allow the GPs to roll the investment into a continuation vehicle and grant LPs the opportunity to exit, roll their existing stake over, or roll their investment over and expand on it.

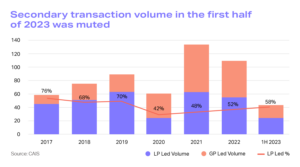

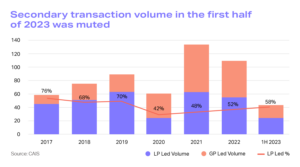

GP-led secondaries first appeared in the wake of the GFC but have significantly increased in popularity since then. According to Jefferies, they reached a peak in 2021, accounting for 58% of the secondaries transaction volume that year. LP-led transactions have reclaimed their lead since then, but GP-led secondaries remain a major investment opportunity.

Private Equity Secondaries Annual Transaction Volume

Perhaps in response to that increase in popularity, the SEC’s Private Fund Advisor ruling takes aim in part at GP-led secondaries, mandating that they are required to obtain a fairness opinion from an independent opinion provider and disclose any associated material relationship. Intended to prevent a conflict of interest when structuring these transactions, it will be interesting to see how, if the rule stands in its current state, it effects the secondaries market.

DOWNLOAD: CAPITAL CALL TEMPLATE

Key drivers behind the growth of the secondaries market

“Growing interest in secondaries funds represents an opportunity for GPs to expand their investment platform and bring an additional product offering to their clients.”

– Jonathan Broch, Executive Director, Lionpoint Group

Yes, secondaries dipped in 2022 compared to the record high of 201. And yes, some of the exuberant expectations about the banner year that 2023 would be for secondaries have not panned out exactly as expected (at least so far).

But undeniably, the asset class has ballooned in popularity over the last half decade – giving GPs a truly exciting additional arrow in their quiver. As Jonathan Broch, Executive Director at Lionpoint Group, put it to us: “Growing interest in secondaries funds represents an opportunity for GPs to expand their investment platform and bring an additional product offering to their clients.”

So, what’s driving the growth?

As with anything as complex as secondaries, a variety of factors are at play, many of them intricately connected:

- The denominator effect: As mentioned above, turbulence in public markets have thrown more than a few asset allocations into disarray, forcing LPs to rebalance. One of the key levers for doing so has been secondaries.

- The drying up of distributions: With the IPO and M&A markets slowing and/or even stopping as GPs, in search of an adequate return, hold onto investments for longer, LPs have found themselves in a situation where capital calls are outpacing distributions. The need for liquidity has pushed LPs to accept the price of liquidity – selling to the secondary market at or below NAV.

- The evolution of the asset class: As secondaries have evolved from the traditional, LP-led flavor to encompass GP-led deals as well, the market opportunity has opened up.

READ: IS A CLOUD MIGRATION RIGHT FOR YOUR FIRM? ALLVUE AND LIONPOINT WEIGH IN

The appeal of private equity secondaries

Secondaries have become a pivotal part of the broader private equity landscape because they hold multiple benefits to a variety of stakeholders.

- Secondaries provide liquidity for existing investors: As mentioned above, this factor was the key driver in the creation of the original secondary opportunity and has, from that beginning, continued to play a pivotal role in the growth of the asset.

- Forced sellers create cheaper prices: The discount to NAV that is traditionally offered by secondaries is, of course, one of the largest appeals to new investors.

- Secondaries give GPs an approved, accepted continuation vehicle: GP-led secondaries allow GPs to avoid selling down when they might not want to via an investment vehicle that LPs trust and that give them ample opportunity to proceed as they wish.

- Buyers already know what’s in the portfolio: Unlike the black box that so often represents investing in private equity funds, with secondaries buyers already know what the portfolio holds, and thus can conduct significantly more in-depth due diligence.

- Secondaries have multiple layers of due diligence: Not only do secondaries allow for more due diligence, but by nature more due diligence is built into the process. A buyer of secondaries knows that the original PE firm conducted due diligence on the original investment, the initial LP conducted due diligence on the GP, and the secondaries manager conducted due diligence as well.

- Secondaries provide more investment diversification: Because secondaries funds are composed of investments from multiple GPs, the offer exposure to different investment strategies, industry focuses, geographic targets, vintages, and more in a single fund.

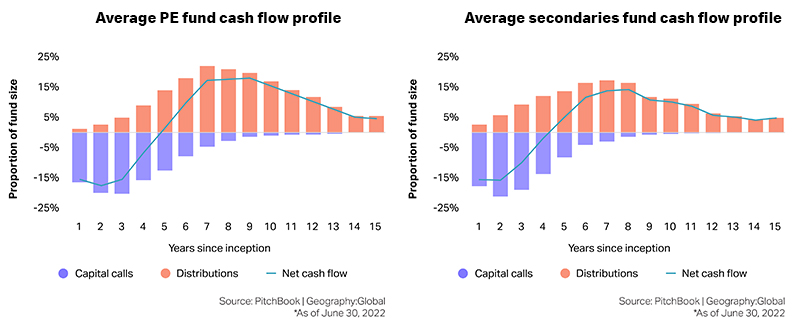

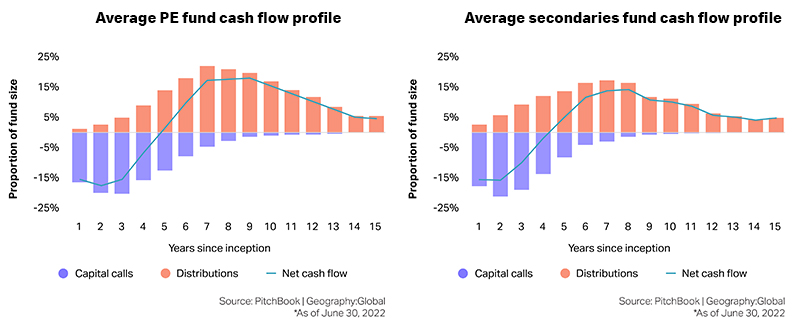

- Secondaries provide J-curve mitigation: Again, the very nature of secondaries helps provide a balance to a traditional private equity portfolio. Since they are by definition further along in their investment lifecycle, secondaries typically have a quicker cash flow timeline, reaching net positive cash flow a year earlier than PE funds, according to PitchBook.

The J-curve for PE fund and secondaries

The challenges of private equity secondaries

Of course, their appeal aside, secondaries bring with them their own unique challenges.

- They are still illiquid: While secondaries might help investors solve some of the liquidity challenges created by their private equity investments, they are still illiquid compared to public assets. Once invested in a secondary, it can be challenging to exit the investment before the fund’s completion.

- Valuation is complex: In general, the lack of public market pricing can make valuing private equity assets a complex, challenging process, and secondaries are no exception to this.

- Cash flows can be lumpy: In GP-led secondaries, which often are comprised of a much smaller set of assets, cash flows can be much more uneven.

The future of private equity secondaries

After predicting that 2023 would be the year secondaries boomed, Pitchbook assessed that a “valuation disconnect” was preventing secondaries from realizing their full potential. In general, it seemed as if the factors that had made the recent environment so challenging for private equity – record levels of dry powder caused by the exit freeze, fundraising challenges caused by illiquidity – would prime the secondaries market to boom again as it had in 2021.

Time will tell if the second half of 2023 can make up for the slower first half – it seems, if not likely, then at least certainly possible. But other structured solutions are popping up as well that could either detract from secondaries of further along their continual evolution.

For example: NAV lending. As Fokke Lucas, partner at 17Capital, explained to Buyouts, while the majority of allocation challenges – the denominator effect – can be solved through traditional secondaries sales, “we are also seeing situations where LPs need to manage exposure but don’t want to take that hit and don’t want to give up the relationships they have invested in with sponsors.” This is spurring NAV lending, where a loan is made based off the NAV itself.

It seems certain that, if the current liquidity challenges remain, the secondaries market will expand – if not vertically, then at least horizontally.

Complex investments require purpose-built solutions

As Jonathan Broch, Executive Director at Lionpoint Group, explained to us, the growth in the secondaries market represents real opportunity for fund managers – but only if they’re in a position to seize it.

“Growing interest in secondaries funds represents an opportunity for GPs to expand their investment platform and bring an additional product offering to their clients,” Broch said. “To execute on this opportunity, GPs need to ensure their operating model, data strategy and tech stack are equipped to support the nuanced characteristics of investing in secondaries and the reporting required by investors, firm leadership, and regulators.”

“GPs need to ensure their operating model, data strategy and tech stack are equipped to support the nuanced characteristics of investing in secondaries.”

– Jonathan Broch, Executive Director, Lionpoint Group

At Allvue, we have built our industry-leading private equity platform on the premise that the complex, bespoke needs of private capital managers require powerful, purpose-built solutions. Our award-winning Fund Accounting software solution, in particular, is the only solution available that provides GPs with a true general ledger built specifically to handle the complex requirements of back-office PE teams.

As secondaries expand their foothold in private equity, and if the transaction type continues to evolve in new, unforeseen directions, Allvue’s software will be there to help GPs stay abreast of new market trends, rather than behind them.

More About The Author

Kamil Godlewski

Product Manager

Kamil Godlewski is a product manager at Allvue Systems, a leading provider of investment management solutions. He has over 15 years of experience in finance and sales, working with various clients in the alternative investment space with an emphasis on private equity. He has a MBA in finance from Indiana University's Kelley School of Business and is a previous CPA license holder.