By: James DiCostanzo

Sales Director

April 18, 2023

Starting a private equity or venture capital fund looks, to many, to be a challenging prospect in the current climate. After setting records for year after year, fundraising has slowed and the current outlook looks bleak. For many LPs, this means they’ll likely stick closely to well-known and vetted funds with a long history, rather than making a bet with an emerging manager. As reported by Pitchbook, first-time fund count dropped from 119 in 2021 to a mere 42 in 2022.

But that doesn’t mean there aren’t still opportunities for emerging managers or that they aren’t able to leverage specific advantages not available to larger GPs. Their small size and nimbleness allow them to explore niche markets that are too narrow for larger firms to take invest in. As Chris Smyth, EY’s Americas PE leader puts it:

Steps for starting a private equity fund

As the private equity space continues to swell in terms of both participants and dry powder, the number of ambitious fund managers has followed suit. And beyond the decisions involved in starting a firm itself – hiring or outsourcing partners and consultants, buying supplies and setting up a workspace, securing registration, insurance, and licenses, and more – there are practical rites of passage needed to bring a fund to an established state where fundraising can begin.

1. Write a business plan

Much of a new fund’s business plan should mirror that of any start-up business. Cash flow projections, including fixed and variable costs, a working budget, and a projected timeline are important considerations. Strategies for marketing to facilitate growth and then managing for that growth may also be concluded as part of an initial plan. This will show consultants and potential investors that you are serious and committed.

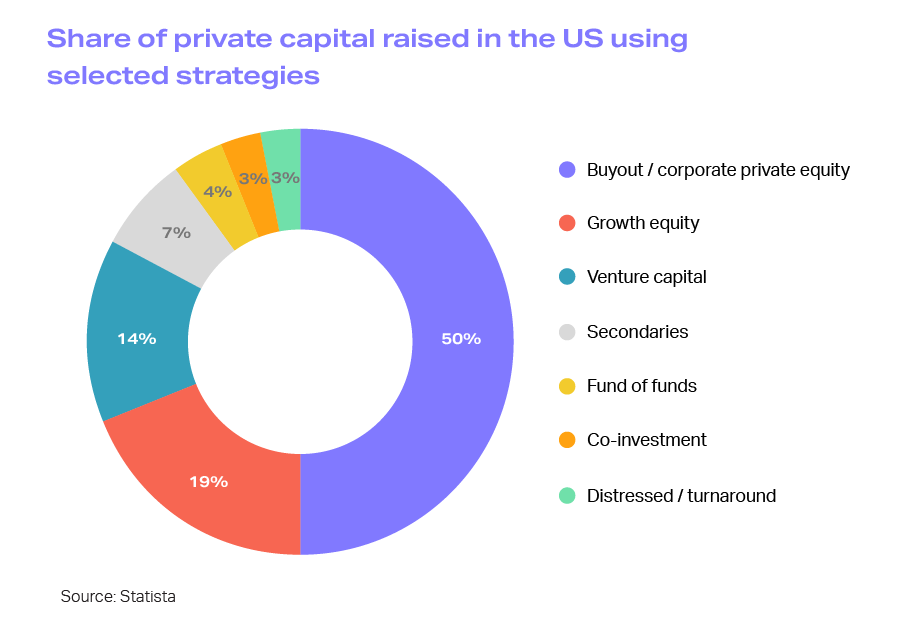

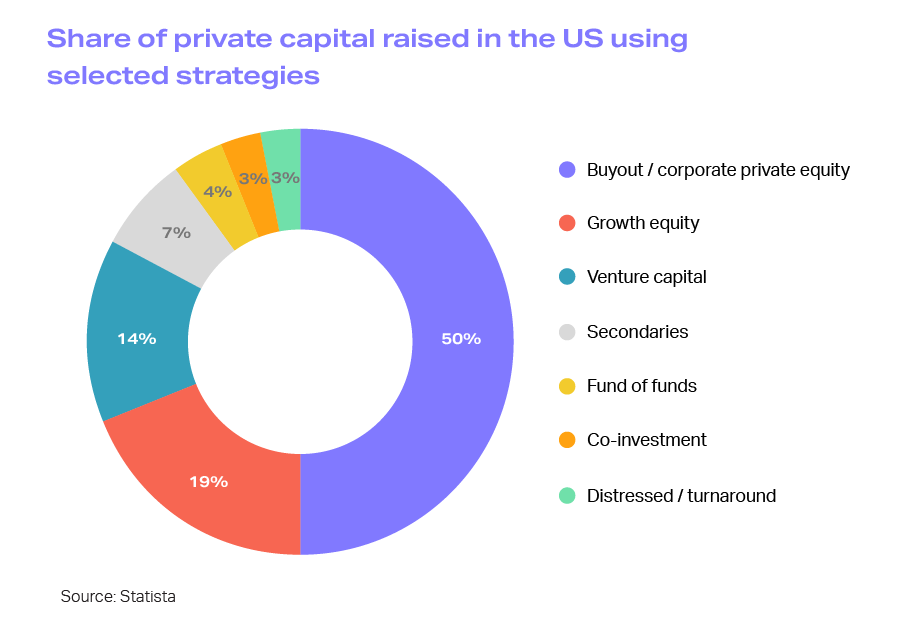

Central to a fund’s business plan is the investing strategy. A firm grasp on the long- and short-term fundamentals of a specific industry, along with market sentiment toward that industry, provides a foundation for all-important research into potential portfolio companies. If an emerging manager has experience with and passion for a particular niche, that will be apparent to potential investors. In parallel with the industry is the investment type: growth equity, management or leveraged buyouts, venture capital, etc.

2. Work out the legal details

In the US and Europe, most funds are established as either limited partnerships or limited liability firms. New funds can work with their attorneys to complete the necessary paperwork for this and other operating agreements, like articles of association and the limited partnership agreement (LPA).

Emerging managers can also lean on their legal consultants to help vet potential LPs through a due diligence and know-your-customer (KYC) process. Lawyers can help establish guidelines for cybersecurity and disaster recovery processes, too.

Additionally, lawyers, accountants, and other third-party consultants can help new funds complete and file key documentation that may include but not necessarily be limited to the following:

- Offering Memorandum

- Subscription Agreement

- Partnership Agreement/ Operating Agreement

- Investment Management Agreement

- Due Diligence Questionnaire

- Compliance and Risk Guidelines and Manuals

- Custody Agreements

- Counterparty Risk Agreements

- Valuation Policy

- Code of Ethics

- Form ADV

READ MORE: Advice to my 2nd-Fund Self, with Osage Venture Partners

3. Calculate fee structure

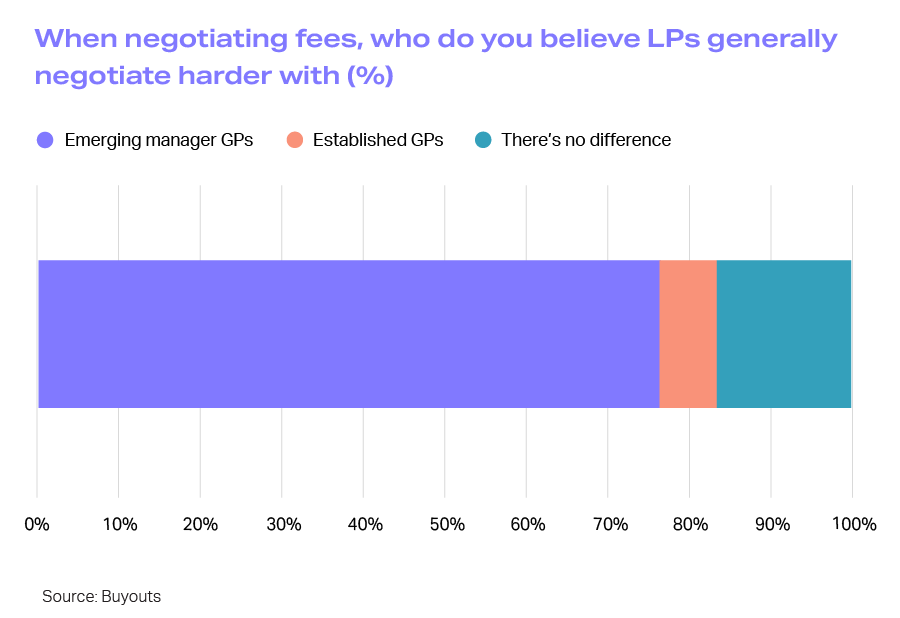

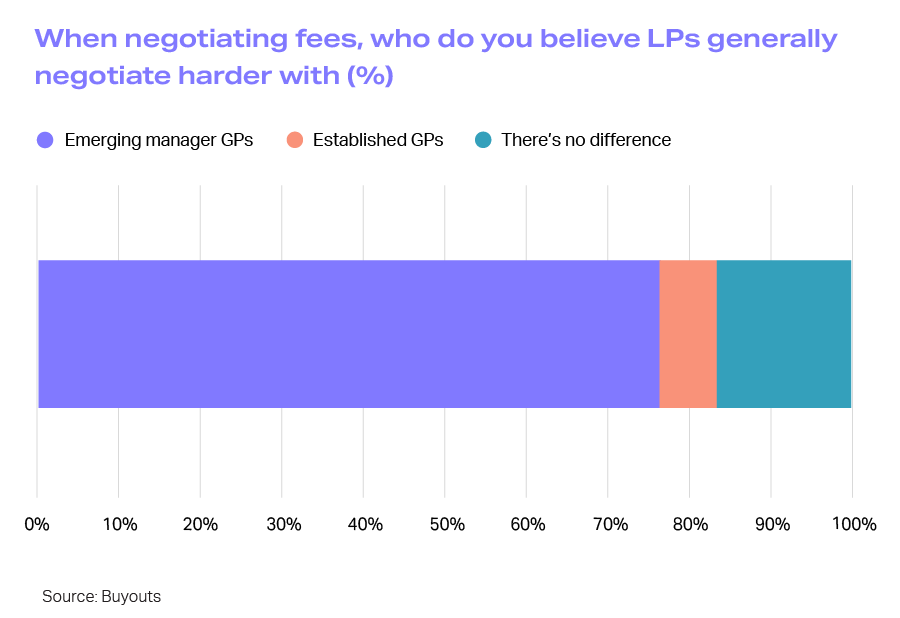

Another perceived advantage of emerging managers is lower fees, or at least emerging GPs that are willing to negotiate. While many GPs are more flexible in the early stages of their business, they also need to fairly consider their financial needs as they begin to invest in people and technology.

- Management fee: The industry standard is for GPs to receive 2% of committed capital (so for every $5M raised, the manager collects $100,000 in annual compensation). As noted, emerging managers may want to lower this threshold as a negotiating point. It can always be adjusted down the road for new investors.

- Hurdle rate: Intended to measure performance, this is also known as the minimum acceptable rate of return. Investors and managers use this projection to evaluate opportunities – the higher the anticipated risk, the higher the hurdle rate.

- Carried interest: A common threshold for carried interest is 20% above the set return level (or hurdle rate). Once this return is achieved, GPs and LPs split returns at a 20/80 ratio.

Once you’ve settled on these terms, you may want to create a simple but professional-looking sell sheet that can be distributed to prospects digitally or handed off in person. The sheet can describe a fund’s strategy and fees, along with other information like minimum required capital commitment, anticipated capital raise and closing period, and any other terms specific to the fund.

4. Find prospective limited partners

The barriers to launching a first fund are high, and the most critical step is finding investors who are willing to wager on an unproven commodity. This step is challenging, but not impossible, and there are starting points to consider:

“Not all emerging managers will succeed. The bar has been raised and only the very best will survive to shake off their emerging manager label.”

– Amy Carroll, Buyouts Emerging Manager Report, Sep. 27, 2021

Family offices are among the most receptive to pitches from first-time managers – in fact, 37% of capital committed to emerging managers came from this source, more than any other. Targeting outperformance over risk avoidance, they may also be drawn to the startup nature and shared values of new fund managers versus larger institutional investors.

Some large institutions, such as the Los Angeles Fire & Police Pensions and the New York State Common Retirement Fund, have established emerging manager programs. These organizations have committed to allocating some of their resources to underserved or newly formed firms in an effort to diversify their holdings and potentially benefit from new and novel strategies. Here’s a list of emerging manager programs that might be helpful.

Fund of funds may also be willing investors in early-stage managers, especially ones targeting the lower middle market.

Finally, first-time fund managers may also find success using placement agents or consultants that vouch for their work and put them in touch with appropriate LPs.

How technology can help emerging managers

Across the global private equity space, investment in new technology has steadily grown over the last five years and is expected to keep doing so. Specifically, global spending on enterprise resource planning solutions is projected to surge from $30 billion in 2021 to $49 billion by the end of 2025. Investment in cloud security software is expected to see similar demand.

Every free moment helps first-time fund managers, who are typically juggling multiple tasks and wearing several hats. And even in the early stages of growth with minimal resources, firms are expected to deliver polished client communications and meet increasing demands from their prospective and current LPs. Leveraging technology to stay organized and automate key processes can save precious man-hours and reduce the risk of errors.

Allvue created the Venture Capital Essentials and Private Equity Essentials solution sets with the emerging manager in mind. This space has unique technology needs, so we leveraged our existing best-in-class venture capital software and private equity software – designed for the world’s largest enterprise firms – to create a more accessible and scalable solution. These comprehensive sets of accounting, reporting, and investor communication tools allow firms to streamline processes, deliver high-quality client service, and discover efficiencies that will prepare your company for continued growth.

Are you a first-time or emerging manager ready to launch a new fund? Discover how Allvue’s solutions can help supercharge your growth now and scale with you in the future.

Sources:

Buyouts Insider. Buyouts Emerging Manager Survey 2021: Seven Takeaways. https://www.buyoutsinsider.com/buyouts-emerging-manager-survey-2021-seven-takeaways/

GeekWire. Tech Investment Sets New Records While Cloud Software Growth Continues. https://www.geekwire.com/sponsor-post/tech-investment-sets-new-records-while-cloud-software-growth-continues/

PitchBook. Emerging Managers 2023. https://pitchbook.com/news/articles/emerging-managers-2023

PitchBook. Emerging Managers Fundraising. https://pitchbook.com/news/articles/emerging-managers-fundraising

S&P Global Market Intelligence. Private Equity Fundraising Sentiment Bleak in 2023. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-fundraising-sentiment-bleak-in-2023-74283997

More About The Author

James DiCostanzo

Sales Director

James DiCostanzo is a global sales leader with over 20 years of experience in the financial, private equity and SaaS industries. He is currently the Global Head of Growth Equity Sales at Allvue Systems, a leading provider of investment management solutions. He joined Allvue Systems in March 2020 as the Head of Sales for the East Region, after working at Thomson Reuters for nearly two decades in various roles, including Head of Solution Specialists, Data & Analytics and Global Business Director. He has a bachelor’s degree in Business/Managerial Economics from SUNY Oneonta. He is based in the New York City Metropolitan Area and can be found on LinkedIn at https://www.linkedin.com/in/jamesdicostanzo/.