By: Kamil Godlewski

Product Manager

September 14, 2023

As private equity reaches higher-than-ever dry powder levels, the leveraged buyout remains perhaps the most familiar class of private equity transactions. While many associate leveraged buyouts with a ruthless 1980s business culture, take-private leveraged buyouts actually make up the majority of the most recent and largest private equity deals. Leveraged buyout analysis shows that these transactions can have varying degrees of complexity and size.

So what exactly is a leveraged buyout? What are the upsides and downsides? Read on for our Allvue’s full guide.

Defining Leveraged Buyout (LBO)

The term “leveraged buyout” describes the acquisition of (or the purchase of a majority stake in) a company in which the acquirer – typically one or more private equity managers – largely uses debt (leverage) to finance the transaction. That debt is placed on the balance sheet of the acquired company with its assets and future cash flows serving as collateral for the significant leverage. LBO model calculations usually factor in these future cash flows and assets to determine the viability of the buyout.

In the case of a private equity manager conducting the deal, the goal of the firm is to acquire a company as an investment and eventually exit the investment – often via an IPO, sale, or merger with another company – in order to create a return on behalf of their firm and investors.

Origins and Evolution of the LBO

Leveraged buyout origins

The leveraged buyout transaction first gained traction in the 1950s. But perhaps the most notable deal from the dawn of the leveraged buyout strategy involved Orkin, the pest control company that’s still successful today. In 1964, Rollins Broadcasting, a $9 million business, acquired Orkin Exterminating Company for $62 million. The purchase was financed solely via debt, an early example of leveraged buyout financing.

The golden age of leveraged buyouts

Thanks to the foundation laid in the 1960s, leveraged buyouts really boomed in the 1980s. It was in this decade that the largest-ever LBO took place, when KKR financed the takeover of RJR Nabisco. Investigative journalists Bryan Burrough and John Helyar wrote a book about the LBO transaction called “Barbarians at the Gate”.

After some less-successful hostile takeovers of the 80s, LBOs’ momentum slowed in the 1990s but rebounded again in the early 2000s. However, with the onset of the 2008 financial crisis, LBOs slowed again, and several large in-process deals fell apart thanks to the dramatic economic downturn.

How leveraged buyouts are used today

Post recession, leveraged buyouts slowed initially due to investor caution and new lending regulations, but then rebounded with appealing interest rates. They again fell in number in the later 2010s and 2020s post-pandemic as rates rose again, but according to Pitchbook, they’re poised to make a new comeback. Leveraged buyout analysis has become increasingly sophisticated, helping to identify deals that make strong financial sense. There are a couple key reasons why the leveraged buyouts resurged as the economy recovered.

- Low interest rates – After the financial crisis, rates were slashed as low as possible and remained there for years as the economy proved its recovery. For qualified participants, borrowed funds became easier to obtain, enabling more LBOs to take place. Just as monetary agencies across the globe showed a willingness to start raising rates again, the Covid-19 pandemic market stress forced more rate drops. Low interest rates over this amount of time have created easy access to debt – a key element in LBOs. While interest rates began to climb to decade highs as pandemic economic recovery and inflation advanced, they remain historically low.

- Bigger appetite for risk – As institutions recovered from recession-powered volatility and private capital showed its resiliency even through the toughest economic times, investor and PE firm appetite for risk grew, making investors more willing to make larger investments in private equity buyout funds, and investment managers more willing to seek out these kinds of deals.

- Better access to credit – Post-recession, banks were forced to be more stringent about who they offered credit to and how much. Private credit firms filled in to meet demand, and as the private credit industry grew over the following years, banks began to scale up their lending operations again. We’re now at a point where both banks and private credit are filling the need for loans in the LBO space, making the transactions easier to access.

- Low valuations – As companies emerged from the financial crisis, their valuations were considerably lower than in the past. These lower valuations were attractive to PE managers, who knew they would be able to scoop up investment targets for a better price than in years past, create value, and exit later on with a healthy return.

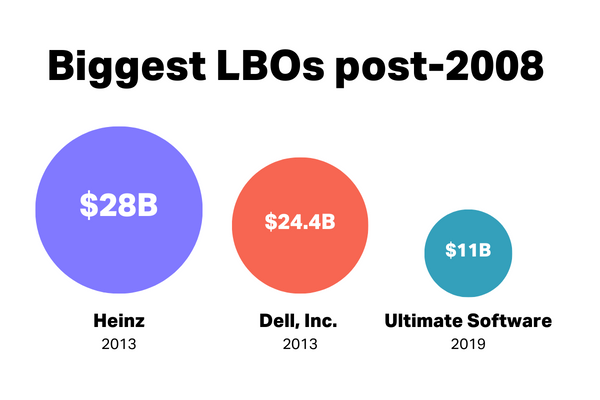

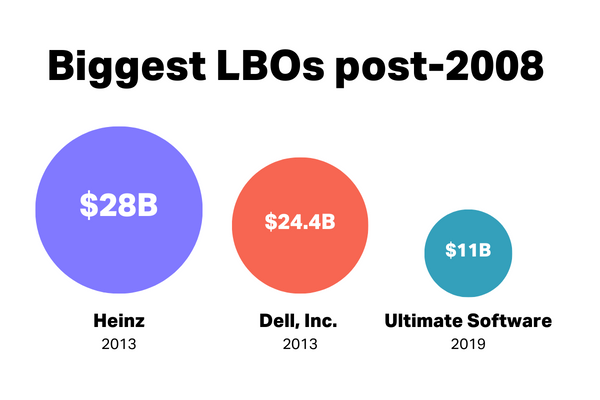

Some of the biggest LBOs post-recession include:

- Dell, Inc. – In 2013, Silver Lake Partners and Michael Dell struck a deal to take Dell private for $24.4 billion.

- Heinz – Also in 2013, Berkshire Hathaway and 3G Capital acquired H.J. Heinz in a deal valued at $28 billion.

- Ultimate Software – Hellman & Friedman acquired Ultimate Software for approximately $11 billion in 2019.

Components of a Leveraged Buyout

In the average leveraged buyout, there are generally three main parties taking part in the transaction.

- The buyer, which is typically a private equity manager, or a group of PE managers, looking to make an investment and a return on behalf of their investors, or limited partners (LPs). The PE manager will make an initial equity investment in the target company, and use borrowed capital to finance the rest of the purchase.

- The investment target, or the company that the PE manager has identified as one they want to purchase a controlling stake in. The target company may be a private or public company. In the case that it’s a public company, the leveraged buyout would convert the company into a private one.

- The lenders who provide capital to the PE firm to complete this transaction. These lenders are typically investment banks, such as Goldman Sachs or Deutsche Bank, or they make be private debt managers, whose investment strategy revolves around making loans with investor capital and gaining a return by charging interest over the life of their loans.

Throughout the process of a leveraged buyout, each party uses a variety of third-party services, including law firms, due diligence teams, and advisory firms.

Benefits of Leveraged Buyouts

As a common private equity deal, leveraged buyouts are a tried-and-true investment move that offer great outcomes for private equity managers and investors when the conditions are right. With appropriate financial planning, the rewards can be significant. There are several key benefits for the parties involved in a good deal:

- Risk sharing among parties – As stated, LBOs are large transactions. Because of this, LBOs are often taken on with a group of investment firms and several different lenders. With so many parties involved in the deal, this can help to spread the risks of the transaction, making it more appealing for parties to engage and help pull it off.

- Value creation and long-term growth – When done right by their acquirer, companies acquired in a leveraged buyout should see greater efficiency, better operations, and higher cashflows and profitability in the long run. They were acquired because the PE manager saw the potential for better value in the organization, and if value is created in the right way, that will come to fruition to benefit shareholders, employees, and potentially even the company’s whole industry.

- Potentially high investment return – If the private equity firm can complete the leveraged buyout, create value over the years they hold it, and then find a good exit opportunity when it comes time to wind down their private equity fund, they can count on bringing in a windfall for their firm and their investors.

- Positive reputation – Leverage buyouts are big undertakings for private equity managers. From finding the right target, to arranging all due diligence, financing and assuming control of the company once the deal goes through, the full lifecycle is a high-stress marathon. For managers who successfully pull off an LBO and come out on the other side with a well-operated company and, further down the road, a successful exit, their investment reputation will benefit greatly and they’re likely to see higher interest from investors and investment targets.

Risks and Challenges in LBOs

While an extremely common transaction in private equity, there are still risks to be aware of so that the investment managers carrying out the investment don’t get burned or burn their own investors or investment target in the process.

Here are the most common risks and challenges that private equity managers might encounter in the leveraged buyout process.

- Overleverage – Per the transaction’s name and definition, LBOs involve a significant degree of leverage, or debt. If the parties financing the transaction aren’t careful to balance the debt they take on with the cash flow generated by their acquired company, the investment won’t offer a favorable return.

- Interest rate environment – In an environment with rising interest rates or economic downturn, it can become challenging to meet interest payments since loans are a fundamental element for LBOs. This can lead to default on the debt and potentially bankruptcy.

- Operational overhaul – LBOs often involve restructuring and cost-cutting measures to improve the target company’s profitability. They also typically include the overhaul of the company’s leadership. Implementing these many changes successfully can be challenging and may disrupt operations, leading to employee morale issues and potential customer or supplier problems.

- Legal and regulatory scrutiny – Depending on the size and nature of the leveraged buyout, regulatory approvals may be required from government agencies or antitrust authorities. If a deal proceeds for some time before being deemed illegal by the government, all parties involved could see an unfortunate waste of time, costs, and resources.

- Exit coordination – Eventually, the private equity manager will most likely want to exit the investment in the company they bought out. However, market conditions and the performance of the target company may not align with the desired exit timeline, potentially resulting in a less profitable or even unprofitable exit.

Steps in Executing a Leveraged Buyout

LBOs involve several steps, and the specific process can vary depending on the deal’s complexity and size. An important part of this phase is to secure financing for the deal, often involving a mix of equity from investors and borrowed funds from financial institutions. Here are the general steps involved in a leveraged buyout:

- Identifying an investment target – The first step is to identify a suitable target company for the LBO. The target should have strong cash flows, assets, or potential for improvement, making it an attractive acquisition candidate.

- Assembling an acquisition team and secure financing – The acquirer or private equity firm assembles a team of professionals, which may include investment bankers, lawyers, accountants, due diligence experts, and other advisors. This team will help structure and execute the LBO. The PE firm must also secure the necessary financing to fund the acquisition. This typically involves obtaining loans from banks or other private capital firms, issuing bonds, and contributing equity capital from the investors.

- Conducting due diligence and negotiating purchase price – In-depth due diligence is essential to evaluate the target company’s financial health, operations, legal and regulatory compliance, and potential risks. This step helps identify any issues that could affect the deal’s success. Based on these findings, the PE firm negotiates the terms of the purchase agreement with the target company’s management or shareholders. This includes the purchase price, financing terms, and other conditions of the deal.

- Structuring the deal – The LBO is structured to maximize the use of debt financing while minimizing the equity contribution from the investors. This often involves creating a new holding company to acquire the target. The debt will then be placed on the acquired company’s balance sheet, and the company’s assets will be deemed collateral for the high degree of leverage.

- Obtaining regulatory approvals and finalizing deal – Depending on the industry and the countries involved, the deal may require regulatory approvals or antitrust clearance. This step ensures that the acquisition complies with all relevant laws and regulations. Once all conditions are met, the deal is closed. The target company becomes part of the PE fund’s portfolio, and the agreed-upon purchase price is paid to the target’s shareholders.

- Implementing operational changes in the acquired company – After the acquisition, the PE firm typically implements operational and financial changes to improve the target company’s performance and increase its value. These changes may include cost-cutting measures, restructuring, or growth initiatives.

- Servicing the debt – The debt used to finance the LBO must be serviced regularly with interest payments and, eventually, principal repayments. The cash flows from the target company are often used to cover these obligations.

- Monitoring and exiting the investment – The private equity firm should closely monitor the performance of the acquired company and work to enhance its value. The ultimate goal is to exit the investment at a profit, which can be achieved through various means, such as selling the company, taking it public through an IPO, or recapitalizing it.

It’s important to note that leveraged buyouts can be highly complex and may take several years to complete. The success of an LBO depends on various factors, including the performance of the target company, the efficiency of the financial structure, and the ability to generate returns for investors. Additionally, LBOs can have significant financial and operational risks, so thorough planning and due diligence are critical to their success.

Technology’s Role in Streamlining LBOs

As technology’s role in private equity advances, the lengthy and challenging LBO process stands to see new efficiencies emerge.

Particularly, advancements in data, machine learning, and AI pose improvements for previously highly manual processes. Data is collected, pulled, and changed hands countless times throughout the leverage buyout lifecycle, from deal origination, to valuations, to due diligence, all the way through to the holding of the portfolio company and the exiting of the investment.

For private equity managers who pursue leveraged buyout investments as part of their investment strategy, Allvue’s product suite can ease the middle- and back-office operations that your teams take on.

From tracking portfolio company progress with Fund Performance and Portfolio Management to performing accounting and reporting via our Fund Accounting and Investor Portal modules, Allvue’s technology is purpose built to help private equity managers with the day-to-day operations that go into their funds.

Want to learn more about Allvue’s software for private equity managers? Request a demo below or check out our solutions in action.

More About The Author

Kamil Godlewski

Product Manager

Kamil Godlewski is a product manager at Allvue Systems, a leading provider of investment management solutions. He has over 15 years of experience in finance and sales, working with various clients in the alternative investment space with an emphasis on private equity. He has a MBA in finance from Indiana University's Kelley School of Business and is a previous CPA license holder.