By: Allan Parks

Product Manager, Portfolio Monitoring

May 25, 2022

Venture capital has had an impressive decade. But all through the climb, industry voices have been questioning – is this a bubble that is ready to pop?

It will take a few more quarters to know if venture capital’s yearslong winning streak is truly coming to an end, but Q1 2022 numbers indicate that it’s possible. A dip in average startup valuation wouldn’t necessarily be the worst thing for the industry and could in fact serve as a “healthy recalibration period”, as Pitchbook put it.

DOWNLOAD: Tear Sheet Templates for Venture Capital Managers

No matter what recent venture capital figures mean or where they’re headed, managers will want to be prepared for what’s ahead, especially if it requires a shift in strategy or creates new valuation or reporting challenges.

A decade of growth against the odds

In the venture capital world, valuations and deal sizes have ticked upward for essentially a decade even through times of chaos or uncertainty. Throughout the 2010s, we witnessed unicorns enjoying massive growth fueled by hearty injections of capital based on eye-popping valuations. But underneath the reliable growth, there have always been hiccups that have caused venture capital leaders to wonder if the industry has peaked.

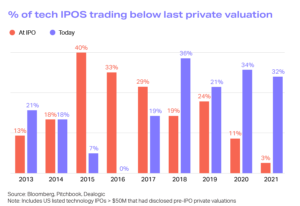

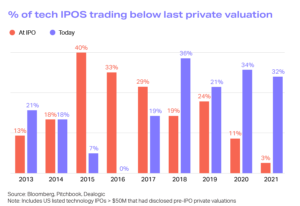

Some of the biggest unicorn names went on to hit major bumps in the road to an IPO – such as Uber and WeWork – if not completely implode before the public eye, like Theranos. Even for tech companies that did IPO at exciting valuations, some fail to see that original valuation carried over onto the public market, even years after going public. Roughly a third of the companies that went public through IPOs during the past four years are trading below their previous private valuations as of March 2022.

When the Covid-19 pandemic unfolded in Q1 2020, many feared the possible effects on the private markets, including venture capital, as heightened uncertainty for the future made it hard to see how it was possible to proceed with deals. But as it became clear that technology was helping us carry on with life and work remotely, the broader venture capital industry enjoyed an additional jump.

Now as the world opens back up and we settle into a new normal while managing the fluctuating risk of Covid, projections for venture capital may signal a new phase for this space.

What does the future hold for venture capital?

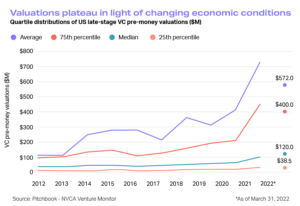

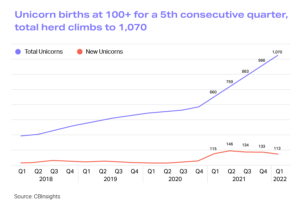

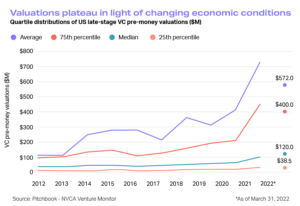

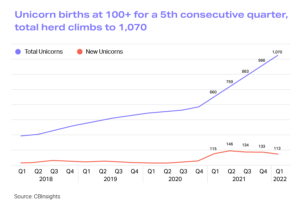

As Q1 2022 venture capital numbers have rolled in, we get a glimpse of what could be ahead for the industry. While the change in direction is subtle, some metrics show a slight dip in activity. Reacting to poor public market performance, late-stage valuations and deal sizes are shrinking and IPOs are starkly down compared to 2021. The rate of new unicorns emerging so far in 2022 has not kept pace with previous growth.

“VC market adjustments trickling down from the public markets are likely to hit late-stage companies first, while it may take longer for early-stage companies to feel the brunt. Some companies are adopting a wait-and-see approach and hoping that multiples will bounce back.”

Pitchbook Venture Monitor, Q1 2022

Ultimately, it’s too soon for us to know if the venture capital market can count on a continuation of the sky-high performance it has seen over the last few years. But if we are facing an upcoming phase of lackluster venture capital market performance, managers will face the need for considerable adjustments – to their strategies, to their operations, and to how they communicate with their investors.

Pressured to create returns in a downturn, managers will have to vet deals even more carefully and potentially rebalance their portfolios. Many may find themselves needing to shift into more of a “value-creation mindset” after becoming accustomed to turning over a full portfolio of early-stage companies in a 24- or 48-month timespan and naturally reaping returns while benefitting from the up-and-up nature of past markets. Under new conditions, they may not be able to get away with holding such early-stage companies for such a short time and instead need to turn to holding onto more mature companies and for longer time horizons.

As the duration of those investments lengthens, and as those investments skew more toward mature companies rather than early stage, reporting requirements become more complex. Early-stage startups do not allow for deep data reporting simply because there likely isn’t much to report on yet, unlike with mature startups. Investors know this and may be satisfied with receiving just 10 metrics quarterly on early-stage holdings. But when it comes to mature companies, it’s typical to report on as many as 280 metrics monthly.

Additionally, made anxious by industry-wide performance data, investors may be more frequently reaching out to their managers, requesting additional data points or custom reporting, which can strain team productivity even further without the right workflows in place.

All this requires modern data management infrastructure – a key pain point for many managers in the private capital space.

DOWNLOAD: Client Reporting Template Kit for Start-up VC and PE Funds

Harness data to thrive through venture capital volatility

The right data management infrastructure lightens the operational burden on venture capital managers, allowing them to act more efficiently and gain access to business intelligence metrics in real time. With Allvue’s Fund Performance and Portfolio Monitoring, VCs can access a single unified reporting system and interactive dashboards that are also available to investors so they can quickly and easily access accurate, updated portfolio data, as well as extensive reporting capabilities to seamlessly extract actionable insights. Having these insights on demand is especially useful as investors increasingly request data surrounding their holdings and how they compare to industry-wide trends.

As is key for this era of venture capital, Allvue can go beyond KPI collection and basic reporting by providing GPs the ability to oversee the performance of investments more accurately and down to the asset-level, as well as easily build customized visualizations and reports. Our solution also provides the full front-to-back-office view including fund accounting and financing data in order to monitor potential risks and trends, giving stakeholders across the firm better business insights to speed up deal-making.

Ultimately, venture capital managers are accustomed to a landscape where they’ve been forced to rely on siloed and underperforming monitoring solutions that have caused an information lag and slowed down the investment decision making process. They can’t afford to do so anymore, and – if they hope to thrive through a potentially protracted VC market – they’ll need to turn to technology to access a better understanding of their portfolios and where to deploy capital.

More About The Author

Allan Parks

Product Manager, Portfolio Monitoring

Allan Parks, Product Manager of Fund Performance and Portfolio Monitoring Solution joined Allvue in 2021. Previously, he was a Product Manager of Portfolio Construction Services at Capital Group, and prior to that, a Portfolio Advisor at Merrill Lynch’s Private Banking and Investment Group where he led Private Capital (Alternative Assets) portfolio allocation for a $5Bn AUM team serving foundations, family offices and UHNW. He is a graduate of University of San Diego, he holds an MBA from Thunderbird School of Global Management (ASU), and he is a CFA Charterholder.