By: Allan Parks

Product Manager, Portfolio Monitoring

June 22, 2023

According to Allvue data, data challenges are a top struggle for venture firms of all shapes and sizes. Established firms, amidst shifting global venture capital headwinds, are managing increasingly complex portfolios containing companies situated across industry verticals and at widely different stages of maturity. This requires managers to measure their portfolio companies against a wide variety of benchmarks via disparate KPIs.

Emerging managers, for their part, often have to aggregate a wide variety of performance metrics, and in multiple formats with only a limited amount of manpower in an increasingly complex environment.

As if it weren’t challenging enough to have to collect, organize, and evaluate qualitative metrics from early-stage startups – where, often, this information is especially critical – managers often have to do so by relying on single-point solutions and manual, time-consuming workflows that sometimes require them to replicate siloed data between systems. As a result, GPs’ data aggregation processes are bogged down, their analysis ends up outdated and behind the curve, and they are opened up to unnecessary errors at multiple points.

GPs’ data aggregation processes are bogged down, their analysis ends up outdated and behind the curve, and they are opened up to unnecessary errors at multiple points.

Allvue offers GPs a way to automate their data aggregation workflows, to leverage scalable data collection templates and configurable KPIs, allowing for faster data collection. Here’s how:

DOWNLOAD NOW: FREE VENTURE CAPITAL TEAR SHEET TEMPLATES

Automating processes through a data collection portal

For GPs that are looking to achieve standardization and build a repeatable, automated process around data collection, Allvue provides a data collection portal where portfolio companies can directly submit their financials and KPI metrics.

The portal presents each portfolio company with a configurable template. There, KPIs can be filled out through the front end or, alternatively, imported into the portal. These personalized templates are fully customizable by the GPs. To streamline and simplify the process, the system allows managers to first create a master template where they can add in financial line items, KPIs, and calculated fields and then lets them filter that master template down to quickly and efficiently create personalized templates for each portfolio company.

Video: Simplifying Data Collection

LEARN MORE

Accommodating the need for ESG metrics

Venture capital has, historically, lagged behind other industries in adopting ESG practices, but that’s changing quickly. More investors are demanding ESG due diligence as part of their process and more managers are recognizing the return potential of ESG investments.

As a result, GPs are seeing an increased need for ESG metrics – one Allvue can help meet. In addition to financials, GPs can leverage Allvue to create custom non-financial and ESG templates or leverage the standard ESG templates that come with the system, built out for every GICS industry. And we provide GPs with a standard set of industry-specific ESG KPIs, as well as the ability to create new KPI data fields.

DOWNLOAD NOW: A COMPLETE LIST OF ESG KPIs BY INDUSTRY

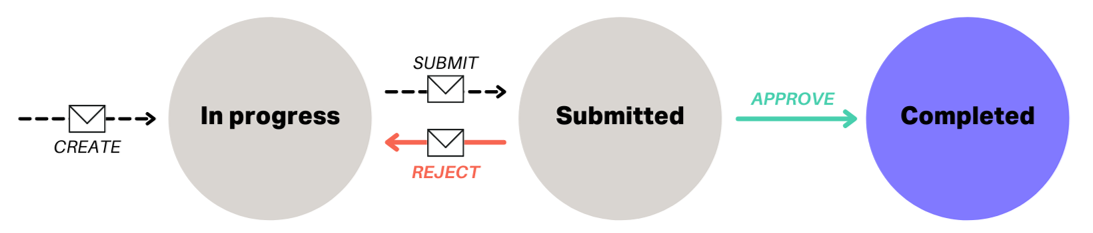

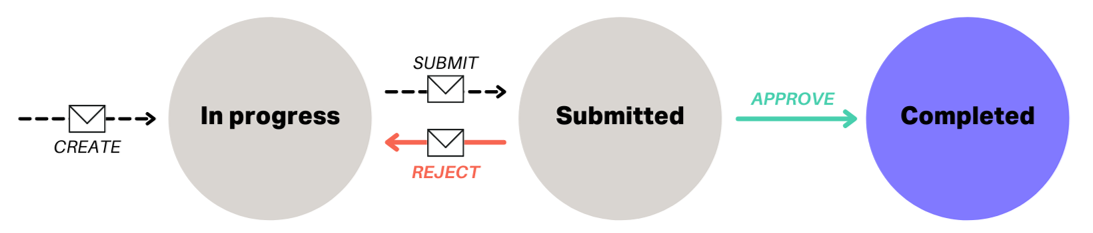

Easily tracking approval workflows

At Allvue, we know that the actual step of inputting data doesn’t represent the complete data collection process – and that managing that whole process can be a challenge in and of itself.

Therefore, to help further drive standardization and create process, our system also allows GPs to build approval workflows and automated notifications for each template. Every participant in this workflow receives a secure link to review and approve the data before it is sent into the analytics platform.

Streamline approval workflows with Allvue

Allvue helps streamline the reporting process as well, allowing you to distribute standard and custom investor reports to LPs, and even provide access to supplemental financials and portfolio information at the fund level. GPs can configure reporting levels to each investor for self-service without requiring any additional manual work on the part of internal teams.

Handle ad hoc data ingestion needs

Finally, for many firms, the most tedious data ingestion challenges are those that happen on an ad hoc, non-recurring basis.

For these less standardized data collection processes, Allvue provides an Excel mapping wizard, allowing users to easily scrape a spreadsheet and load disparate data directly into the analytics platform, rather than having to key in data manually.

DOWNLOAD INFOGRAPHIC: FUND PERFORMANCE & PORTFOLIO MONITORING

Collect portfolio company KPIs more easily with Allvue

Allvue offers GPs data collection capabilities that can be customized, can streamline existing workflows through automation, and can easily plug into a fully-integrated suite of solutions. Discover how our solutions can help you focus on value-added work and spend less time on manual data aggregation processes:

Our Fund Performance & Portfolio Monitoring solution provides GPs with comprehensive views and unmatched insights.

Additionally, Allvue provides both established venture capital managers and new and emerging venture firms with a robust suite of tools designed to meet their specific needs and help them supercharge their growth.

More About The Author

Allan Parks

Product Manager, Portfolio Monitoring

Allan Parks, Product Manager of Fund Performance and Portfolio Monitoring Solution joined Allvue in 2021. Previously, he was a Product Manager of Portfolio Construction Services at Capital Group, and prior to that, a Portfolio Advisor at Merrill Lynch’s Private Banking and Investment Group where he led Private Capital (Alternative Assets) portfolio allocation for a $5Bn AUM team serving foundations, family offices and UHNW. He is a graduate of University of San Diego, he holds an MBA from Thunderbird School of Global Management (ASU), and he is a CFA Charterholder.