DOWNLOAD THE PRIVATE EQUITY REPORTING TEMPLATES

Private equity reporting is a vital part of the fund lifecycle. Not only does it document the performance of the fund, but it’s essential to defining your investor reporting experience in a time when investors are leveling up their expectations for data access, even when it comes to their most complex and illiquid holdings.

The fund’s accounting team – whether they insource the work, outsource to a fund administrator, or co-source – drives the private equity fund reporting. For a breakdown on private equity fund accounting, check out our in-depth primer here.

Read on to learn the ins and outs of the private equity reporting process, including sample private equity report templates.

How often do private equity funds report?

Most private equity managers value and report on their fund performance and portfolios on a quarterly basis, though delayed by one to two quarters. In Q1, they will produce the previous fiscal year’s reporting.

However, in recent years, LPs have become increasingly eager for additional fund data, often reaching out on off times from the typical private equity fund reporting cycle to ask that ad hoc data be pulled. They’re also eager to receive deeper data insights, and many have turned to the ILPA reporting standards, asking that their GPs provide additional information on elements like underlying portfolio company performance and ESG. As a result of this reporting data emphasis, 70% of GPs name routine and ad-hoc LP reporting activities as their top operating challenges, per Allvue’s recent data report, “Meeting the Marketing Moment: Probing Top GP Challenges Amid New Volatility“.

As this trend for deeper private equity reporting continues, it’s essential for managers to have seamless access to their back-office data and be able to quickly and easily pull the insights they need in order to maintain a positive investor experience.

Top private equity report types

When communicating about fund performance and operations with investors, there are a few private equity reports that firms use most often:

Capital call notices

A capital call notice requests committed capital – also known as dry powder – from investors. In the event of a capital call, the private equity manager has found an opportunity or deal it would like to pursue with the fund’s committed capital and alerts investors with a capital call notice so that they understand how much capital to supply and some details around the potential deal.

Distribution notices

A private equity distribution notice is sent out to investors to alert them of a “liquidity event” — when the private equity fund exits one or more of its holdings. The returns resulting from that event are delivered to the investor after management fees are taken out, as detailed in the distribution notice document.

PCAP statements

A PCAP statement – or partner’s capital account statement – is customized to each limited partner’s proportionate share in the private equity fund. It is typically sent on a quarterly basis alongside the fund’s financial statement, briefing investors on how the fund is performing.

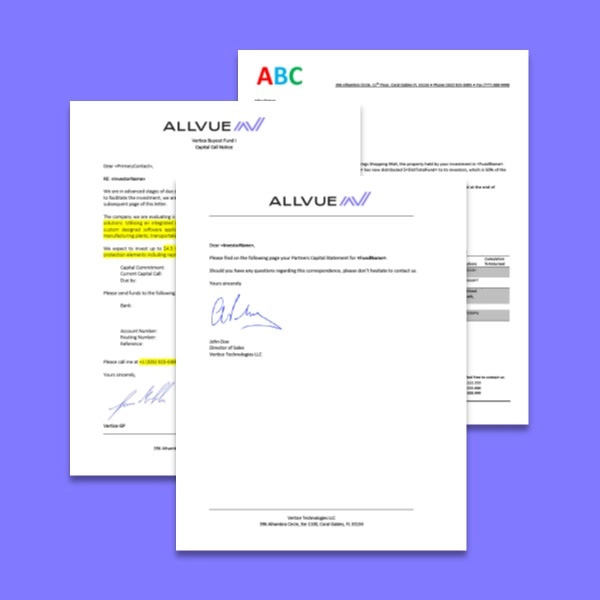

Private equity reporting templates

Download our .ZIP file which includes private equity reporting samples, including a capital call notice, a distribution notice, and a PCAP statement. These private equity reporting examples are meant to help private equity and venture capital managers put high-quality notices and statements in front of their investors quickly and efficiently.

With Allvue’s Fund Accounting software – a cloud-based, multicurrency general ledger – managers can produce these professional investor-ready private equity reports in just minutes. For more information, you can:

- Visit our Fund Accounting page

- Watch Allvue Fund Accounting in action via a 2-minute mini demo

- Request a live demo