By: Kamil Godlewski

Product Manager

April 20, 2022

Data is paramount to success for any business. For the private markets, data is now the foundation for everything, from capital raising to investment management, to fund accounting and other back-office tasks. But collecting it doesn’t need to be the manual and arduous task it once was.

“Advanced capabilities … have made it possible to quickly analyze various massive data sets in a tightly time-bound deal context. PE firms now have the opportunity to implement sophisticated methods of analyzing data to uncover value both pre- and post-deal.”

–KPMG, “The emergence of data science in PE”

A KPMG survey of private equity firms found that the majority was still in the information-gathering stage when it comes to solutions for processing big data, while less than one-fifth had moved on to implementation. The firms that are first to learn how to process private equity data effectively and accurately are likely to have a significant advantage over those who lag behind.

Turning raw data into useable information

Competition for limited partners and portfolio companies is steeper than ever, and GPs need to be able to monitor every stage of their business and pivot accordingly – and quickly. The rubber meets the road where quantifiable raw data is transformed by technology into qualifiable, relevant insights.

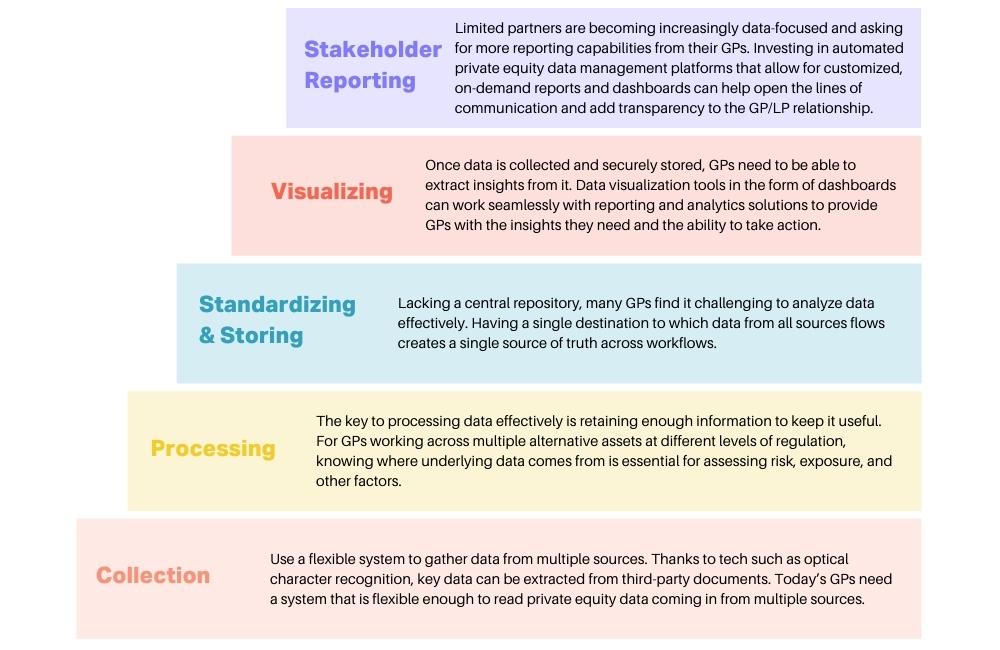

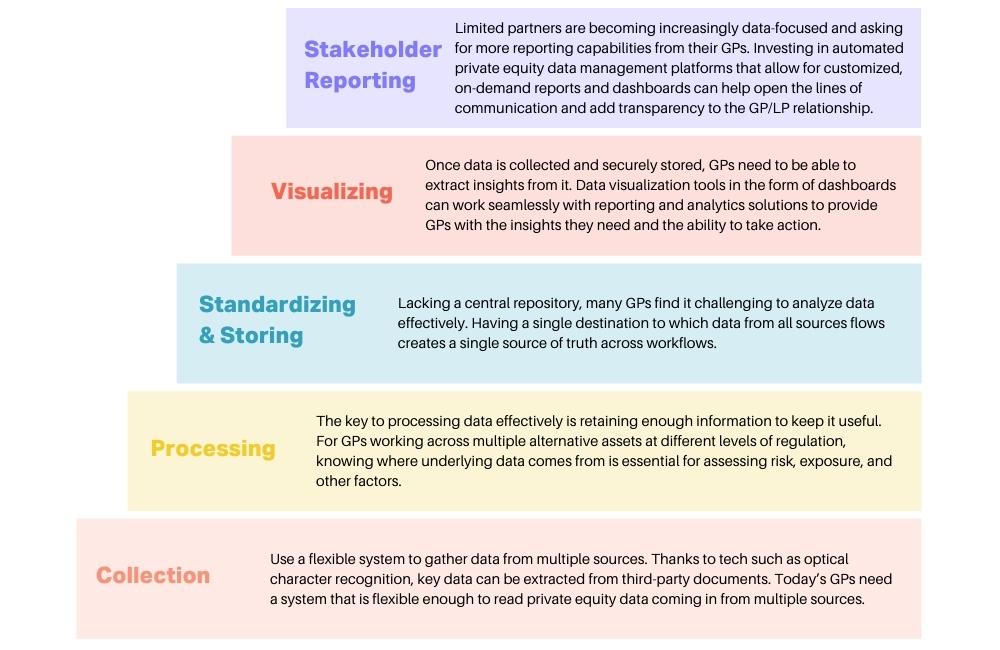

Allvue’s Chief Product Officer, Yuriy Shterk, recently detailed the five steps needed to make this happen:

How Allvue simplifies data collection

Allvue allows for customizable KPI tracking

Allvue’s data collection tools can help clients collect and analyze the key performance indicators (KPIs) most germane to them. Our advanced, completely customizable portal allows general partners to achieve standardization and build a meticulous process around data collection for each of its portfolio companies.

WATCH: Allvue in Action: Simplifying Data Collection

As a result, fund managers can standardize and more efficiently monitor company KPIs in one place. Each portfolio company page can be customized with its own template, where unlimited KPIs and calculated fields can be filled out through the front-end platform or inputted directly into the system. These KPIs can track hundreds of specific metrics to drill down on assets, liabilities, stockholders’ equity, operating expenses, cost of services, and more.

Allvue can simplify ESG reporting

In addition to these standard financial KPIs, the Allvue platform lets clients track a variety of non-financial factors and environmental, social, and governance data points. To meet the growing demand for ESG metrics, the system comes pre-loaded with standard ESG templates for every GICS industry that can be tailored to each specific company’s needs. Some of the trackable metrics in this section include demographic makeup of the board of directors, customer success scores, and labor costs as a percentage of revenue.

READ MORE: ESG Due Diligence: What It Is and How to Get Started

Allvue streamlines teammate approval

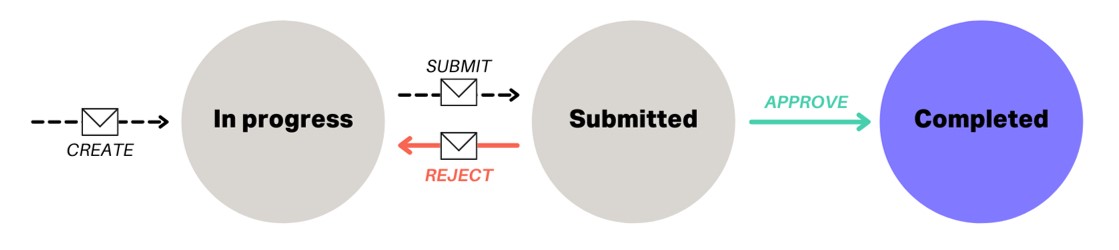

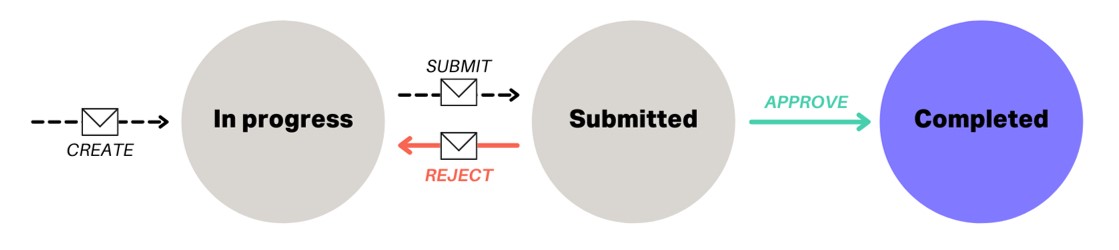

To help standardize processes further, the system also allows clients to build approval workflows and create automated notifications within each port co template. As the workflow progresses, every participant receives a secure link containing data to review and approve before it is ultimately sent to the analytics solution.

Even when all attempts to standardize have been implemented, data ranging from industry benchmarks to social media data can stream in on an ad hoc basis from disparate systems.

The Allvue system has a solution for these very scenarios – an Excel mapping wizard. This allows fund managers to scrape a spreadsheet for data and load it directly into the analytics platform, without any manual effort.

Allvue simplifies the challenge of data management

Regardless of where information is coming from – third-party vendors, disparate systems, ad-hoc data dumps – Allvue makes it possible to corral it into one system. Having it consolidated in a single silo means it’s easier to analyze and act on.

Ready to learn how Allvue’s best-in-class technology can help keep your firm on the cutting edge? Request a demo of our platform to see how to make tedious, error-prone data collection activities a thing of the past.

More About The Author

Kamil Godlewski

Product Manager

Kamil Godlewski is a product manager at Allvue Systems, a leading provider of investment management solutions. He has over 15 years of experience in finance and sales, working with various clients in the alternative investment space with an emphasis on private equity. He has a MBA in finance from Indiana University's Kelley School of Business and is a previous CPA license holder.