The private equity investment lifecycle is about playing the long game, and it all culminates with a private equity exit. After years of holding a portfolio company and intense searching for the right timing and opportunity, the time will come to sell the asset and hopefully achieve a healthy return to pass onto investors.

What goes into such high-stakes process? Read on for our breakdown of the private equity exit.

What is a private equity exit?

A private equity exit represents the sale or other means of letting go of an asset to realize a return for the fund and its investors. In the world of private equity, managers typically hold onto their assets – generally portfolio companies – for five to seven years, and in some cases up to 10. Over that time, they are aiming to grow value in that asset by making operational changes, streamlining a company’s product or service line, restructuring the organization, and more.

With what is hopefully a higher-value asset on their hands after all that work and strategy, the manager then looks to part with the asset through a sale, IPO, or other means.

What are common private equity exit strategies?

When considering private equity exit opportunities for a portfolio company, private equity managers typically look to a few common strategies. These strategy classifications make up the majority of the private equity exits we see in the industry.

IPO

One popular but work-intensive way to exit a portfolio company is to file for an initial public offering (IPO) so that the organization can be listed as a publicly traded company on a stock exchange. A valuation team determines what the company should debut at on the chosen stock exchange, and a price per share is given depending on how many units of stock are issued.

Strategic Sale

In a strategic sale, the GP sells the company – typically in full – to a buyer who hopes to build the offering into its own business. For example, a PE firm may sell an email marketing platform to a larger marketing automation company looking to build out its capabilities.

Secondary buyout

In a secondary buyout, the private equity manager sells its stake in the portfolio company to a different investment manager, keeping the company in the world of private equity. The PE buyer then starts its own approach to creating value in the asset. In secondary buyouts, deal terms are often kept undisclosed.

READ MORE: Our Guide to Private Equity Secondaries

Management buyout

When a private equity manager exits an investment via the management buyout (MBO) route, they sell the company or their stake in it to the company’s management team, often via a leveraged buyout financing model.

READ MORE: What Is a Leveraged Buyout?

Partial exit

When taking the partial exit route to exit a portfolio company, the private equity manager can cash in for a return by selling off part of their stake in the business, typically via a secondary sale. This strategy offers the ability to continue shaping value in the asset while also reaping some return on the investment up front.

Top private equity exits from 2023

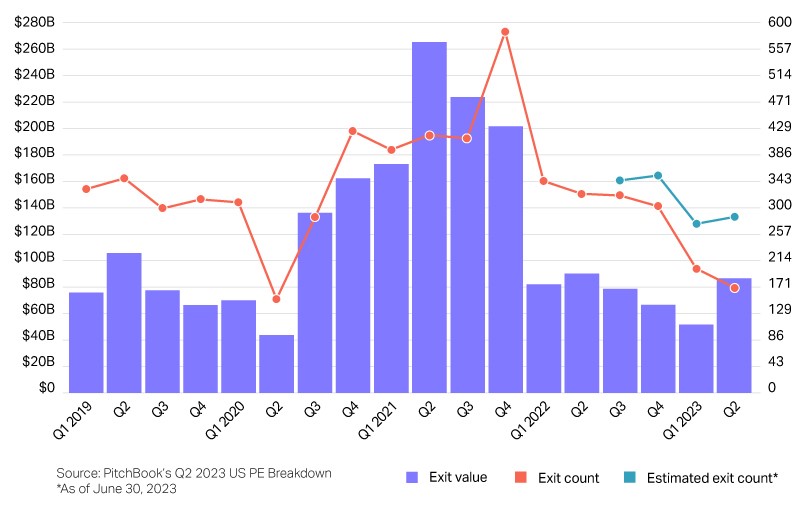

This year got off to a slow start for private equity exits, but both exit count and exit volume ticked up in Q2. See below for some of 2023’s biggest exit transactions and download the list for your own reference and analysis.

Kodiak Gas Services

Firm: EQT

Private equity exit strategy: IPO

Portfolio company valuation at exit: $1.2B

Date of exit announcement: June 29, 2023

ODDITY

Firm: L Catterton

Private equity exit strategy: IPO

Portfolio company valuation at exit: $2.3B

Date of exit announcement: July 19, 2023

Adenza

Firm: Thoma Bravo

Private equity exit strategy: Strategic sale

Portfolio company valuation at exit: $10.5B

Date of exit announcement: June 12, 2023

Nextracker

Firm: TPG Rise Climate

Private equity exit strategy: IPO

Portfolio company valuation at exit: $638M

Date of exit announcement: February 9, 2023

Savers Value Village

Firm: Ares Management

Private equity exit strategy: IPO

Portfolio company valuation at exit: $4B

Date of exit announcement: June 29, 2023

Apptio

Firm: Vista Equity Partners

Private equity exit strategy: Strategic sale

Portfolio company valuation at exit: $4.6B

Date of exit announcement: June 26, 2023

The Snowfox Group

Firm: Mayfair Equity Partners

Private equity exit strategy: Strategic sale

Portfolio company valuation at exit: $621M

Date of exit announcement: June 13, 2023

ASPEQ Heating Group

Firm: Industrial Growth Partners (IPG)

Private equity exit strategy: Strategic sale

Portfolio company valuation at exit: $418M

Date of exit announcement: May 1, 2023

ECM Industries

Firm: Sentinel Capital Partners

Private equity exit strategy: Strategic sale

Portfolio company valuation: $1.1B

Date of exit announcement: May 18, 2023

Simply Self Storage

Firm: Blackstone

Private equity exit strategy: Strategic sale

Portfolio company valuation: $2.2B

Date of exit announcement: July 24, 2023

Worldwide Flight Services

Firm: Cerberus Capital Management

Private equity exit strategy: Strategic sale

Portfolio company valuation: $2.4B (€2.2B)

Date of exit announcement: April 3, 2023

Private Equity Exit Values

The importance of data in a private equity exit

Exiting an investment in private equity is a momentous, high-stakes event for the GP, its LPs, and the portfolio company itself. After a marathon journey of holding an asset for multiple years, creating new value in that asset, and then seeking out the right buyer at a fair valuation, private equity teams are yearning to see payoff of this work in a healthy return on the investment (ROI).

For all the patience and hard work that goes into flipping an asset in this manner, it pays to have an integrated technology suite supporting the day-to-day operations of the private equity fund. Allvue’s middle- and back-office solutions are purpose built for private equity, helping your teams stay in the loop on portfolio monitoring, fund accounting, and investor reporting, carrying you through the fund lifecycle smoothly.

Don’t forget to download our biggest exits list below. To see our software in action, request a demo.