By: Allvue Team

March 19, 2022

Investors have long recognized the need for technology that helps them automate manual elements of the private equity investment process — particularly when it comes to aggregating data. This need for replicable, automated processes and systems has always been critical to PE investors but has been pushed to the forefront amid continued remote work and an increased interest in the asset class among private capital investors.

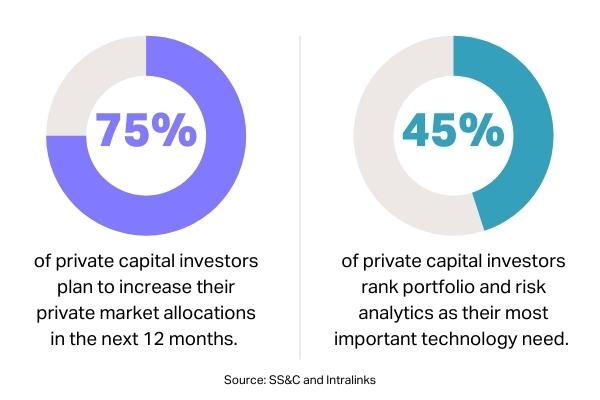

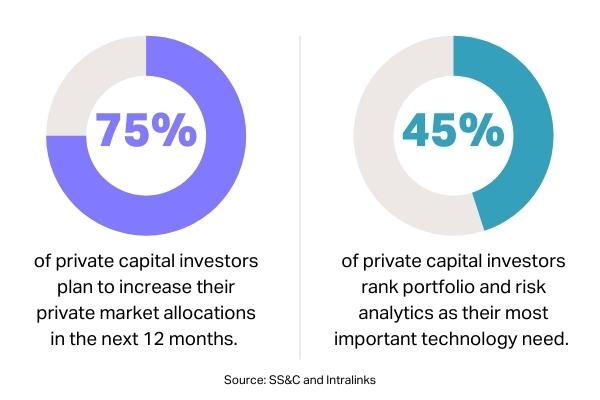

Despite this need, many large, sophisticated investors still rely on manual or one-off processes which must be duplicated and — each time reporting requirements are updated — adjusted to fit the output needed. What’s more, information derived via manual tasks often lacks uniform standards. This ultimately makes it difficult for PE investors to effectively track the risk and exposure in their portfolios – a technology need that more than 40% of investors ranked as most important.

For the small number of investors that have a handful of homogeneous funds, a manual approach to the private equity investment process may be workable at present. Still, manual data input and reconciliation processes take time, constrain resources, and can open investors up to costly errors. And now that many are turning to more diversified investments — private debt, private equity, real estate, and infrastructure — in an effort to increase portfolio returns and mitigate risk, the automation of processes and systems has assumed greater importance. Automation lets PE investors optimize their processes, from deal flow and contact management to workflow management and deal tracking, and ultimately leads to standardization across all functions.

But process overhaul is never a simple project. While time and resource investments are well worth the efficiencies that PE investors will reap in their front- to back-office operations, the journey takes plenty of planning and cohesion amongst internal teams.

Given these challenges, let’s break down the overarching considerations PE investors should take into account as they begin to reshape their processes to become more automated.

Get PE investor teams on the same page

Thanks to a larger-than-ever remote workforce, communication between teams is even more complicated. What’s more, as allocations to alternatives grow to include multiple asset classes and multiple currencies, so will the number of activities performed to reconcile investments, increasing the risk of errors. The assurance of reliable, replicable private equity investment processes can help investors respond quickly to even the most anomalous situations.

The realities of remote work make can make manual processes even riskier. PE investor teams across the front, middle, and back office are responsible for making investments, analyzing portfolio risk and performance, and accessing and processing large numbers of documents and multiple data streams; it’s critical that everyone has access to the most up-to-date information in real time.

Functions throughout the private equity investment process such as CRM, deal tracking, portfolio management and analysis, reporting, and investment accounting, are all deeply susceptible to a break in the information chain if teams are relying on front-to-back manual processes – and their investment outcomes will suffer for it.

DOWNLOAD WHITEPAPER: Benchmarking Private Asset Portfolios

Audit back-to-front private equity investment processes

With a handle on automated private equity investment processes and cloud technology, investors can begin to turn their attention towards higher-value tasks. Resources can be directed where they’re needed most, and not wasted on manual reconciliations or risk mitigation tactics. From front to back office, automated processes let each internal function within the firm stay connected via consistent workflows, dashboards, and custom-generated reports.

- Front-office processes – With the right private equity investor software solution, front-office teams can rely on automated processes to quickly understand and track overall investment exposure, even within multi-asset class and multi-currency portfolios. These process improvements allow portfolio managers to make more informed portfolio decisions faster and achieve greater accuracy when calculating total portfolio exposure or evaluating the impact on their portfolio over a chosen period.

- Middle-office processes – For middle-office teams, automated private equity investment processes make it vastly easier to synchronize data across risk and performance groups, permitting them to effortlessly gather data and analytics on portfolio performance and risk. By relying only on manual processes, they subject themselves to extra reconciliation work and risk for error.

- Back-office processes – Back-office teams can benefit from automated processes aimed at helping them meet increased demand. When new investment types are added to a portfolio, distinct processes are required to collect information relevant to each investment type. Manual processes require scaling up staff and resources — not so with automated processes. Smooth back-office operations depend on workflow management tools to ensure that documentation is properly reviewed and the information is validated. Again, processes that are integrated and automated can facilitate the swift completion of these tasks.

Entrust private equity investment processes to the cloud

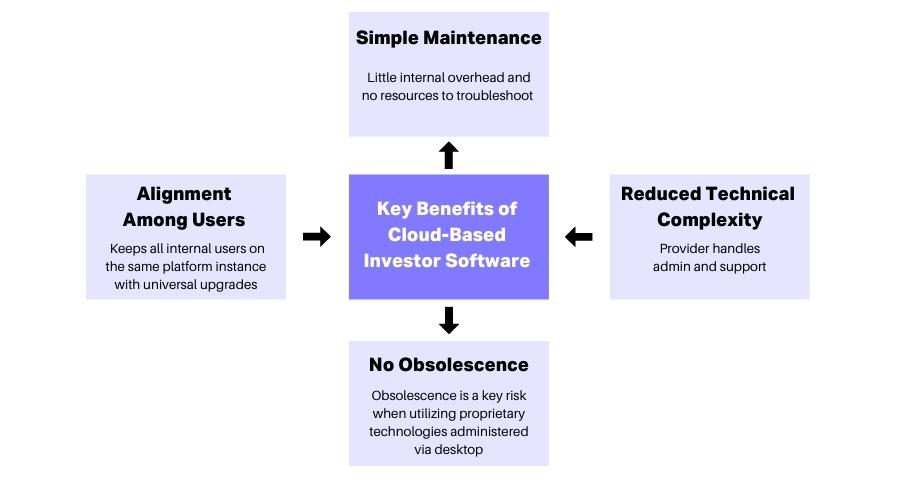

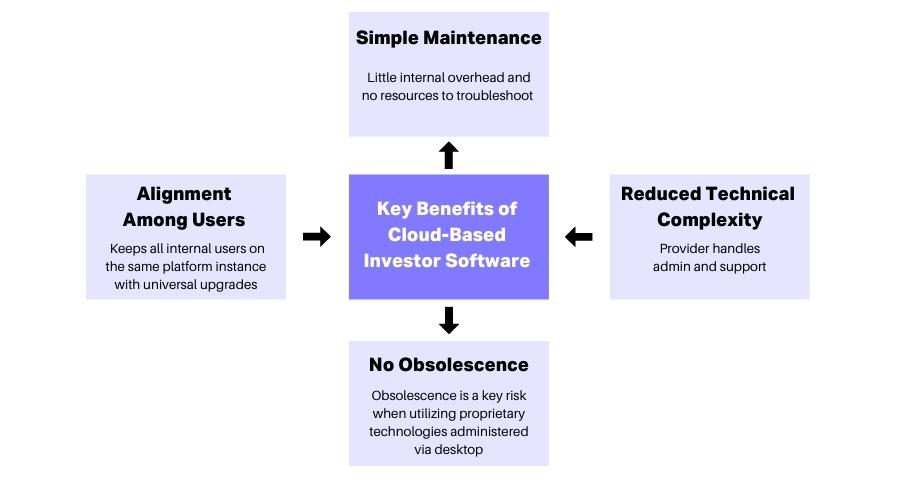

Once a PE investor has made the decision to implement automated processes across the board, they should consider a secure infrastructure that can be accessed remotely by all team members across geographies and time zones.

A cloud-based system of automated processes ensures easy access for all teams across all functions. The advantages of housing automated processes and systems on a cloud-based private equity investor software platform are not insubstantial.

For PE investors, the adoption of both automated processes and cloud technologies will be key moving forward. The move toward technology-based portfolio management will help to enhance decision-making by weeding out inefficiencies and placing teams on more solid footing in terms of revenue generation.

READ MORE: 5 Reasons Why Private Capital Firms Are Moving to the Cloud

Implement the right private equity investment software

PE investors that want to boost their response to fast-changing markets, oversee complex private portfolios, or focus on core competencies need the right private equity software intended specifically for investors. The ideal cloud-based solution is built to service all forms of private capital investments along the entire investment lifecycle, from front to back office.

As private investments grow their footprint in the average institutional investor’s portfolio, a purpose-built solution aimed at the asset class becomes a requirement, and the liabilities of manually managing operations via Excel or through a generic solution become too great.