By: Allvue Team

July 14, 2023

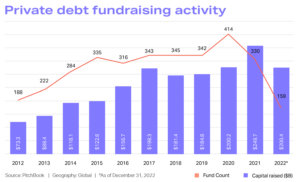

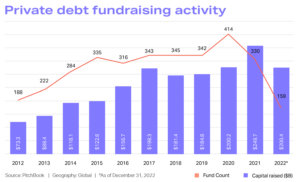

It may not be the largest private capital strategy, but private debt has seen an exciting jump in popularity in the last few years. In 2022, private debt funds raised $200.4 billion, up from $184.8 billion in 2019.

So what is private debt, and what’s behind its growth in the institutional investing space? Let’s break down private debt’s definition, fund structure, recent growth, and more.

Private debt definition

Private debt – also known as private credit – is a private capital strategy in which investment managers and institutions invest by making private, non-bank loans to companies. These loans are not available via publicly traded markets, and they generate returns for investment managers and their private debt fund investors via interest payments.

DOWNLOAD: Allvue’s 2022 ESG Survey

The evolution of private debt as an investment strategy

Private debt emerged as a prominent investment strategy in the aftermath of the Global Financial Crisis in 2008. This period marked a significant shift in the lending landscape, with traditional banks tightening their lending standards and reducing exposure to riskier loans. This gap in the market paved the way for private debt funds to become a key player in providing alternative sources of lending. Private debt has now established itself as a distinct asset class, offering a diverse range of lending options and attracting a substantial investor base.

How do private debt funds operate vs. private equity funds?

Private debt funds have much in common with other private capital strategies such as private equity and venture capital. For example, it’s a highly illiquid investment with long lockup times for investors’ capital. However, private debt as a strategy is seen as slightly less risky than equity investments, partially due to capital structure and due to the ability to highly customize the risk profile of a private debt investment.

The lifecycle of a private debt fund is quite similar to private equity, but fundamental differences do exist. In the fundraising stage, private debt managers typically target institutions like pension funds, university endowments, or family offices. However, some high-net-worth individual investors are also drawn to the asset class. The average-sized private debt fund in 2022 raised $964 million.

Once fundraising has closed and the fund enters the investment period, the private debt manager seeks out investment opportunities and calls investor capital when it finds the right deals. Rather than buying equity in the portfolio companies they target, private debt funds instead make an investment by setting up a loan.

Just as with a private equity fund, a private debt fund’s lifespan averages around seven to 10 years, and investors can count on the high illiquidity that accompanies such a timeframe. In the final few years of the fund, winddown begins, and the private debt manager will stop seeking new investments while letting their various investment repayment periods run out. At the closing of the fund, final returns are paid out and investors recover the full liquidity of their investment.

Diverse strategies and capital sources in private debt

Private debt funds adopt a range of investment strategies to cater to various investor needs. These strategies include direct lending, venture debt, and special situations. Each strategy offers unique risk and return profiles, aligning with different investor objectives. The capital for these funds is sourced from various channels, including Collateralized Debt Obligations (CDOs), Business Development Companies (BDCs), and hedge funds. These sources provide the necessary liquidity and financial backing, allowing private debt funds to offer tailored lending solutions to their clients.

Risk and return in private debt strategies

The allure of private debt investments lies in their diverse risk/return profiles. Strategies like direct lending generally offer lower risk but also lower returns, making them attractive for conservative investors. On the other hand, ventures like mezzanine debt carry higher risk, potentially leading to higher returns. This variety allows investors to choose strategies that align with their risk tolerance and investment goals. Understanding these profiles is crucial for investors to navigate the private debt landscape effectively and make informed investment decisions.

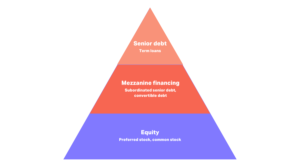

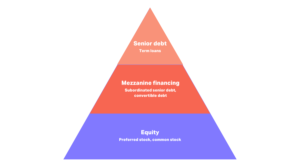

Private debt and the capital structure

Debt sits above equity in the private capital structure. This means that if a company were to declare bankruptcy, its debts are paid out before equity, making it less risky of an investment overall. Within each level of debt in the capital structure, there are a variety of debt vehicles and different levels of distress/risk as well as different loan terms based on the borrower’s status.

Private debt in the capital structure, visualized

Senior debt

The term “senior debt” describes loans that are prioritized as first to be repaid in the event of the borrower’s bankruptcy. Since senior debt has the highest priority, it is therefore the lowest risk. As a result, senior debt typically offers lower interest rates, aka a lower return profile for the investor – but also a lower risk profile since the borrower is seen as favorable. Senior debt is most often secured, meaning that it’s tied to certain assets as collateral in the case that the company cannot make repayment.

Mezzanine debt (or junior debt)

While still sitting above equity, mezzanine or junior debt describes credit investments that have a higher risk profile than its senior debt counterpart. In the event of the borrower’s bankruptcy, it is paid out after senior debt. Because of this, its higher risk could mean a higher reward for the lender in the form of higher interest rates and more stringent loan terms. Mezzanine financing is increasingly popular with mid-marketing companies in recent years.

What are common types of private debt?

Private debt loans can take many forms, but a few of the most common loan structures are as follows.

- Term loan – A term loan provides a borrower with a one-time lump sum of cash up front attached to certain borrowing terms, including a set repayment schedule and either a fixed or floating interest rate.

- Revolving credit facility – A revolving credit facility allows the borrower to borrow up to a set limit and pay back that money on a continuous basis.

- Convertible debt – A convertible debt arrangement stipulates that the money the borrower receives from the lender will be repaid in the form equity. Hence the name, the investment is ultimately converted from debt to equity.

What are some real-world examples of private debt?

Part of the reason private debt is experiencing a surge in popularity over the last several years likely can be attributed at least in part to its varying classifications and types. With many options to choose from, there is a private debt niche that works best for every institutional investor.

With the many structures and vehicles of private debt that are available, private debt managers and their investors have many different applications for carrying out their private debt investments. Here are some of the more common private debt scenarios that market participants rely on.

- Leveraged buyouts (LBO) – A leveraged buyout involves the acquisition of a company with borrowed money. The acquiree’s assets are then designated as collateral for the loan. Some of the largest leveraged buyout deals include H.J. Heinz in 2015, Hilton Worldwide in 2007, and R.J.R. Nabisco in 1988.

- Collateralized loan obligations (CLOs) – CLOs describe a collection of separate loans that are pooled together and packaged into a security for purchase to investors by CLO managers. The loans are often poorly rated, but investors can benefit from the diversification across the full pool of the loans.

- Venture debt – Venture debt describes loans made to small, early-stage businesses, usually in tandem with equity arrangements. Often, venture loans are constructed with specific benefits to the portfolio company in mind, such as by protecting the equity ratio as the company grows or by helping the young company establish a credit track record.

- Real estate debt – A real estate debt fund is typically set up by a private debt manager and backed by their investors. The fund then makes loans to real estate developers for the purpose of building or purchasing real estate properties. The property itself serves as collateral to a senior debt asset.

- Infrastructure debt – An infrastructure debt fund is set up with the intention of loaning money to finance the building of essential societal and economic needs, such as roads, bridges, airports, power plants and beyond. Infrastructure debt is seen as a relatively stable and lower-risk form of private debt, with lower default rates than corporate debt.

How has private debt grown?

Private debt as an asset class has exploded since 2000. But market factors have shifted significantly over the past few years – thanks to Covid-fueled economic instability, global conflicts, climbing interest rates and beyond. Through all of it, private debt, just like private capital in general, has seen its impressive growth sustain. There are several factors behind its continued growth.

Why investors are turning to private debt

Private debt has become increasingly popular among investors for several compelling reasons. Its reputation as a low-risk investment relative to other alternative asset classes makes it a preferred choice for many. Additionally, private debt offers attractive risk-adjusted returns, especially in low-interest-rate environments. Investors value the portfolio diversification it provides, along with its low correlation to public markets. These characteristics, combined with the potential for predictable and contractual returns, make private debt a lucrative and strategic investment option in the diverse world of private capital.

Larger private debt deal sizes

While the number of private debt deals carried out has shrunk, the average size of deals has grown considerably. The U.S. has seen over $50 billion in unitranche loans sized at $1 billion or larger since September 2019.

Customizable nature of private debt

Private debt hit its stride as we entered a nearly 15-year period of extremely low interest rates and investors sought investments that would provide the returns they needed at an acceptable risk level. Even as interest rates are climbing again, private debt’s flexibility and differing levels of risk and return by class of debt offers permanent appeal. There’s always a debt strategy that fits the market conditions, whatever they may be.

Interest rate flexibility

As rates rise, interest in private debt doesn’t necessarily dissipate since managers can turn to a floating interest rate. While this raises costs for borrowers, it does raise the potential for higher returns for investors.

Continued private debt adoption in Europe and Asia

Private debt first took hold in the U.S., but has been seeing increased adoption in Europe and Asia recently. One-fifth of all private debt deal activity since 2019 has occurred in Europe, and APAC’s private debt AUM has grown 195% over the last five years.

Industry trends in the private debt space

With all the growth the private debt space has seen in the last few decades, exciting developments are on the horizon for this industry. What are some of the key private debt trends to watch for?

Less market share for banks

Tightened regulations are keeping banks away from leveraged loans, pushing companies of all sizes to private debt as an attractive alternative to bank financing. Between 1994 and 2020, banks saw an 80% drop in loan market participation.

Larger deals and funds

Private debt has encroached on the bank dominated broadly syndicated loan market, with several headline-grabbing $1 billion+ deals throughout 2021. And as deal sizes balloon, fund sizes are growing alongside them, with the average fund size surpassing $1 billion in the first quarter of 2021.

Rising popularity for venture debt

Venture debt emerged as a major alternative source of financing for high-growth startups that have traditionally opted to solely finance through equity VC. More than $20 billion has been loaned to VC-backed companies in the US during each of the past three years.

What do private debt managers need to succeed?

As the private debt and direct lending industries continue to expand, many fund managers find themselves lacking the proper infrastructure and processes to scale their businesses. Allvue offers an award-winning suite of solutions meant to support a private debt manager at every turn of the investment lifecycle, including the following challenges:

For more on Allvue’s private debt solutions, reach out for a live demo below.