By: Allvue Team

April 17, 2023

The Nordic private equity market has seen significant growth over the last few years, with the region becoming an attractive destination for both investors and entrepreneurs. The region’s stable economy, highly skilled workforce, and supportive business environment have all contributed to the growth of the private equity market.

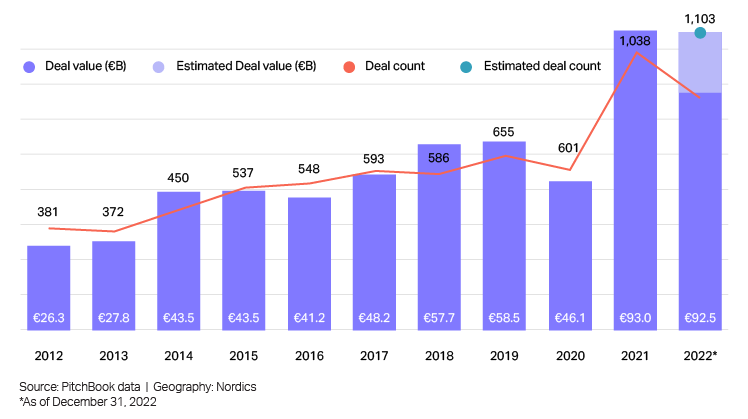

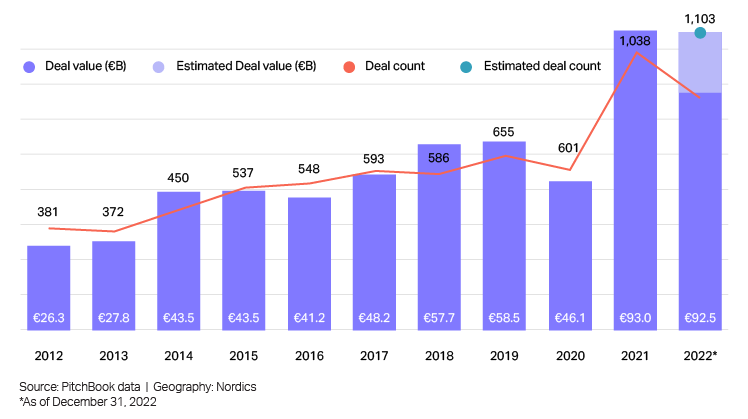

According to Pitchbook, Nordic private equity saw deal count continue to tick up 6.2% in 2022 after a record breaking 2021. This growth has been driven by a number of factors, including the increasing number of startups and growing interest from international investors.

Nordic Private Equity Deal Activity

In this article, we break down the trends and sectors driving this continued growth in private capital in the region.

DOWNLOAD: WHITEPAPER: 4 WAYS EMERGING MANAGERS CAN ACCELERATE GROWTH

#1: ESG: “A Nordic Silicon Valley of Sustainability”

One of the key trends in the Nordic private equity market is the increasing focus on sustainability ESG factors. Nordic investors have long been focused on sustainability, and this trend has only intensified in recent years as the region has made meaningful strides in commercialized sustainability.

According to a survey conducted by the Nordic Private Equity and Venture Capital Association (NVCA), 99% of the Nordic companies surveyed state that they currently have an ESG policy in place and 60% believe that the value of their investments have increased as a result of their ESG efforts.

A recent McKinsey & Company report highlighted the opportunity for green projects to add up to one million jobs and €130 billion in GDP and drove home the centrality of sustainability to the investment space:

“Nordic companies are uniquely positioned to lead the world in combating climate change, potentially creating a Nordic Silicon Valley of sustainability.”

-McKinsey & Company

DOWNLOAD: A COMPLETE LIST OF ESG KPIS BY INDUSTRY

#2: Healthcare and Life Sciences: The largest exit of 2022

Another trend in the Nordic private equity space is the increasing interest in healthcare and life sciences. The region has a strong healthcare system, and there are a number of innovative healthcare startups emerging in the region. Private equity firms are increasingly investing in these companies, which are focused on developing new treatments and technologies to improve healthcare outcomes.

In fact one such company accounted for the largest exit of 2022 – Chr. Hansen merging with Novozymes – at €11.8 billion, according to Pitchbook.

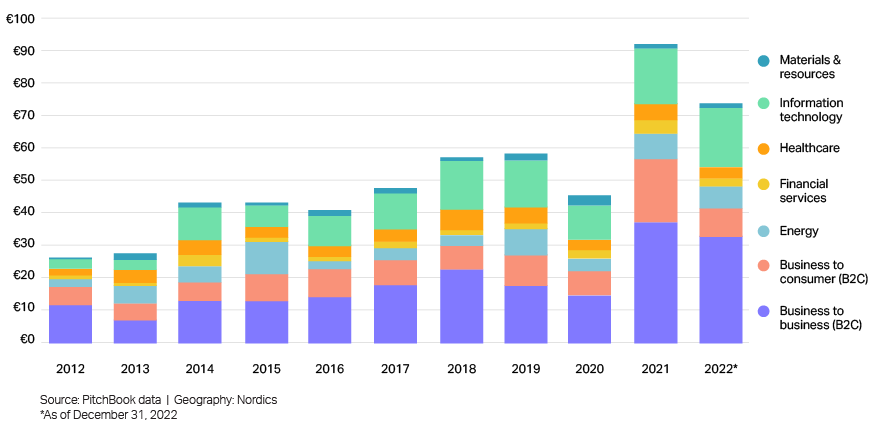

#3: Tech: The dominant sector in the region

The tech sector continues to attract significant investment in the Nordic private equity space. The region has a thriving startup ecosystem, with a number of successful tech companies emerging in recent years.

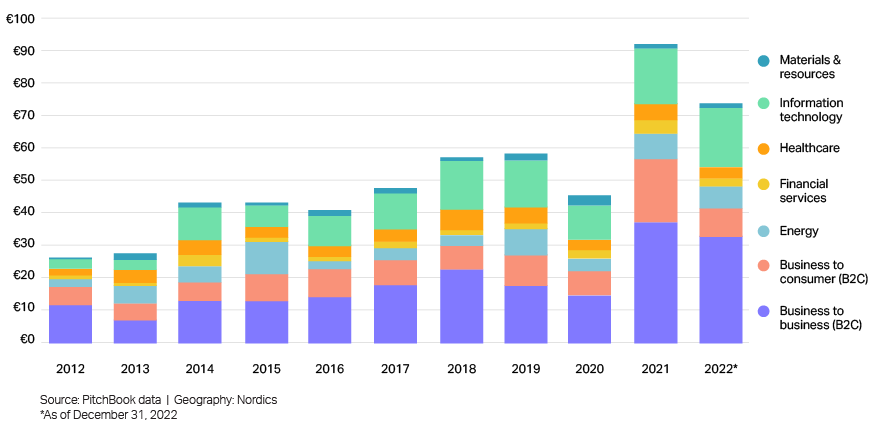

In fact, since 2016, tech has been one of the largest sectors in private equity by deal value. 2022 was a record year, with deal value reaching €18.2 billion, representing on its own a quarter of the region’s deal value.

Nordic Private Equity Deal Value by Sector

#4: A change to the “Norway model”?

Despite having one of the highest GDP’s per capita in the region and the second largest sovereign wealth fund in the world, Norway has long lagged behind other Nordic countries in private equity deal value. This in large part can be attributed to the fact that SWF, the so-called Oil Fund, has an emphasis on risk aversion and passive investing, and thus has often avoided private equity.

But the “Norway model” may be evolving soon, as the SWF kicked off 2023 with a letter to the Ministry of Finance exploring the possibility of investing in private equity. Doing so would mean Norway might catch up to its neighbors in PE investment and provide a major boost to the regions private capital investment overall.

Navigating Nordic Private Equity

- Is Nordic Private Equity Different?: The Nordic region is unique in its approach to private equity. Unlike its counterparts, it places a strong emphasis on sustainability. ESG (Environmental, Social, and Governance) factors are woven into the very fabric of investments. This shift towards responsible investing is not just a trend; it’s a paradigm shift.

- Focus Sectors: As with any successful journey, having a focus is essential. Nordic private equity firms are increasingly targeting specific sectors. Industries like industrial business services are experiencing a surge in investments. The region’s prowess in industrial innovation makes it a hotbed for private equity opportunities.

- Operational Improvement: Private equity isn’t just about investing; it’s about transformation. Nordic private equity investors understand this well. Operational improvement has become a cornerstone of their strategy. It’s not just about owning a company; it’s about making it better.

Allvue Sets Up Nordic Investors for Growth

The Nordic private equity market is experiencing strong growth, driven by the key factors mentioned above and more. But sustained growth requires robust and flexible infrastructure.

Allvue’s best-in-class end-to-end alternative investment management system can help position managers in the Nordics to streamline their front, middle, and back-office operations, reducing risk and cost in the process.

To meet the needs of emerging private equity and venture capital fund managers, Allvue has created the Equity Essentials solution set, which offers to new and growing managers the same powerful software solutions available to our industry-leading clients. Allvue’s platform sets itself apart from the competition through:

- A cloud-based environment that doesn’t require costly upgrades

- Solutions purpose-built to address the needs of private capital investors

- An industry-leading accounting platform

- A world-class investor experience easily accessible to a variety of stakeholders

Sign up for a demo today to learn how Allvue helps start-ups, boutiques, and the world’s largest asset managers better manage workflow, integrate investment data, and support investor reporting.