By: Kamil Godlewski

Product Manager

December 2, 2022

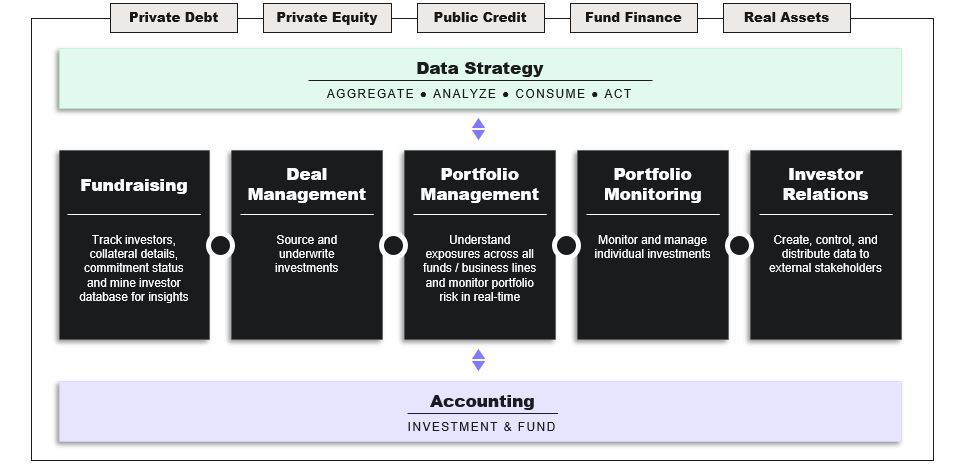

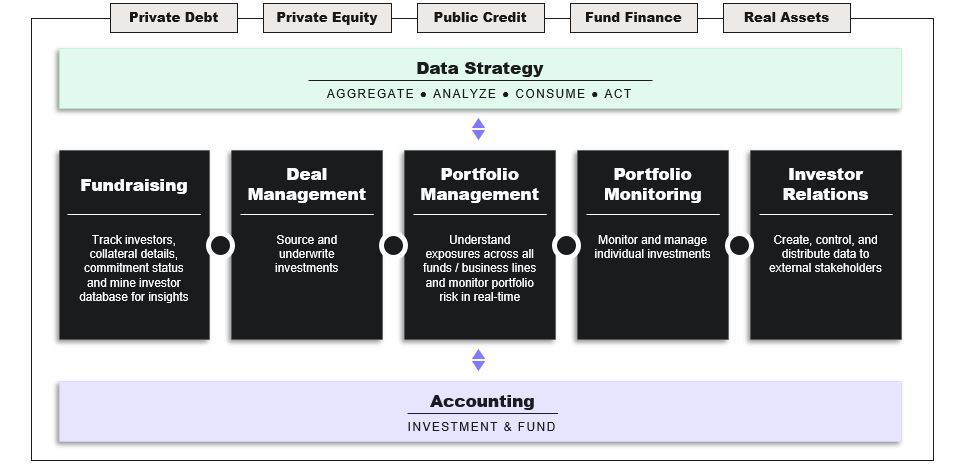

Alternative investment systems bring accounting and investment workflows and data analysis capabilities into a private capital firm’s front, middle, and back offices. These platforms streamline the mission-critical data management tasks of private equity, venture capital, and other alternative asset managers. This article will explain how an alternative investment system works and show the benefits of an end-to-end solution for your firm.

How does an alternative investment platform work?

An end-to-end alternative investment platform supports the operations of an alternative investment fund through every step of its lifecycle. It supports the workflows from inception and capital raising, to recurring investor reporting and cash distribution. Allvue’s alternative investment management system connects your firm’s front, middle, and back-office activities. It can handle multiple currencies, asset classes, and funds within a single management company.

The Front Office: Managing investors and deals

Before they can do anything else, fund managers need to raise capital and identify potential private equity deals. The work done here kicks off processes for the rest of the organization.

- Capital raising: At the capital raising stage, alternative fund managers need a CRM solution to track prospects, investors, and deal opportunities. Allvue’s Investor and Investment Management software integrates with our Fund Accounting and Investor Portal solutions, so the information collected at this stage is available to you throughout the life of the relationship.

- Deal sourcing and execution: Investing is data intensive, and an end-to-end alternative investment platform can help with both decision-making and recordkeeping. Allvue’s platform can track the pipeline of deals, handle research and trade order management, integrate with your current investment and trading tools, incorporate compliance workflows and tracking, and then connect the investment activities to the firm’s accounting system.

Middle Office: Putting money to work and arranging capital calls

The investment management business is the core of a private capital fund, and the necessary functions will vary depending on types of assets managed. Many of these processes involve proprietary valuation and trade execution models, but others are industry standards.

- Investment management: This tracks the internal pre-investment workflow and the trade order entry, which can then be integrated into the back-office system.

- Performance, portfolio monitoring, and attribution: Allvue’s Fund Performance and Portfolio Monitoring is another key component of a complete alternative investment solution. In times of volatility, staying on top of changes in investments and explaining the drivers of performance to LPs builds credibility.

- Fund finance: The Fund Finance solution supports debt investors with standard reports for borrowers and lenders.

- Business intelligence: With easy portfolio tracking, detailed performance attribution, and sophisticated business intelligence through Microsoft Power BI, fund managers can stay on top of portfolio companies and management company business metrics.

Back Office: Reporting and Running the business

The core component of Allvue’s alternative investment system is a single, true general ledger that contains all the firm’s financial information. Accounting is a critical back-office function, and Allvue has applications for equity and debt alternative portfolios. The general ledger at the core of the system helps all parties—portfolio managers, deal teams, financial managers—see both the state of the business and the portfolio companies. This data can inform investment decisions, no matter what asset classes make up your portfolio, making the entire firm stronger.

- Fund accounting: A true, multi-currency general ledger that combines partnership accounting, detailed financial statement reporting, cash management, and workflow standardization for carried interest waterfall calculations and other complex processes.

- Investment accounting: For debt portfolios, Allvue’s Investment Accounting application tracks and accounts for all credit investment types, including broadly syndicated loans, private debt loans and bonds, CLO debt, and equity—in any currency.

- Corporate accounting: Handles accounting for the management company with integration at the strategy, fund, or deal level. Accommodates chargeback activities, A/R, A/P. budgeting, fixed assets, and financial statement reporting.

- Investor Portal: Feature-rich dashboards, customized with your branding and logos, allow you to share documents and communicate easily with limited partners.

For management companies operating both debt and equity portfolios, Allvue’s Combined Back Office capability integrates both fund accounting and investment accounting, simplifying reporting and management company accounting.

Understanding the true benefits of an end-to-end solution

When the middle office integrates with the front and back office in a single golden record, the firm’s workflows are seamless. Capital calls, waterfalls, and K-1 reporting involve information captured at the front end, produced in the middle office, and accounted for at the back end. Information is encrypted and maintained in accordance with SEC and GDPR standards.

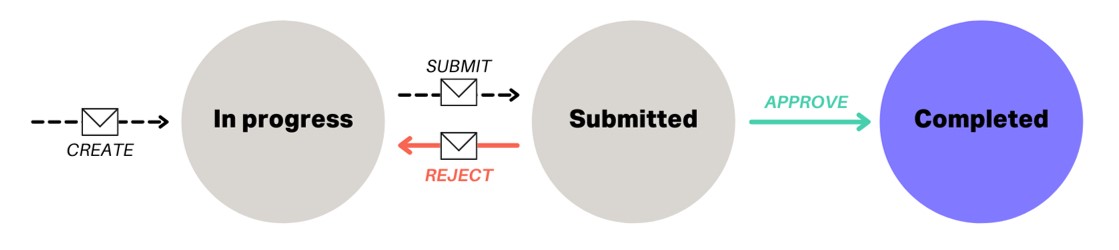

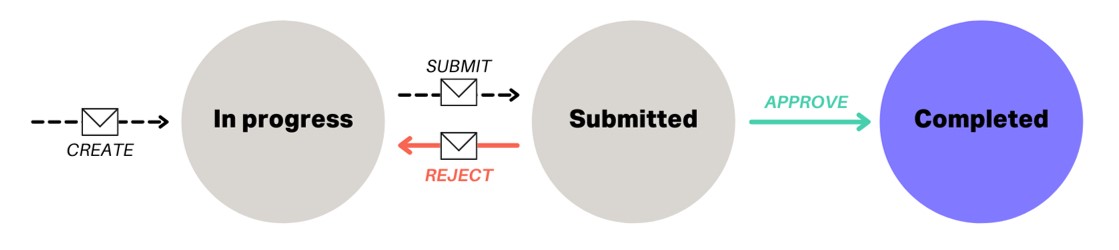

Streamlined workflows

Having one place for the data eliminates duplication of effort. Fund companies can build approval workflows and create automated notifications within each portfolio company template. As the workflow progresses, every participant receives a secure link containing data to review and approve before it is ultimately sent to the analytics solution.

The Allvue platform allows users to scrape a spreadsheet for data and load it automatically into the analytics platform. Our new clients report that preparing K-1 reports for investors takes minutes rather than days.

Using powerful analytics

Competition for limited partners and portfolio companies is steeper than ever, and GPs need to be able to monitor every stage of their business and pivot accordingly – and quickly. The rubber meets the road where quantifiable raw data is transformed by technology into qualifiable, relevant insights. Using Microsoft Power BI, investment managers can evaluate risk and return, investors can see their current performance, and compliance officers can monitor activity. The raw data held in the system becomes information for investment and business decision making, in formats that stakeholders can understand and apply to their work immediately.

A futureproof platform

Report generation isn’t only about simplicity, but scalability. As funds grow, it becomes harder to maintain efficiency without increasing headcount (which in and of itself has issues). By using software designed for your business processes, you ensure that the information stays with you and the work gets done as you grow and as the people in the organization change.

Allvue technology grows with your business, freeing up time and resources while improving the quality of analysis and reporting for the quarter and beyond. It integrates into the investment research and trading platforms that you use now and those you will use in the future.

In addition to superior scalability, Allvue is built in the cloud with many components based on the Microsoft Dynamics Business platform. Our clients are free from the hassles of upgrades and system maintenance.

DOWNLOAD: ACCOMPLICE CASE STUDY

The Power of Integration: Why your firm needs an end-to-end alternative investment platform

Private capital firms of all sizes look to Allvue for their alternative investment solution. Allvue’s front, middle, and back-office systems accommodate multiple assets, currencies, and investment strategies. Allvue’s solutions are engineered to simplify workflows, making higher-quality data more accessible so that you can manage your business.

In fact, Allvue was awarded the “Technology: End to End” category at The Drawdown Awards 2022. This award recognizes firms that display excellence in the provision of end-to-end software solutions with special importance on client and revenue growth, as well as innovations and product or brand development that demonstrates new thinking.

Alternative investment management is challenging, especially in a volatile market. Upgrading the technology that underpins the onboarding, investment management, accounting, and reporting processes can improve relationships with LPs, eliminate busy work for the accounting team, and free up resources for better investment decisions. Find out more about how Allvue’s approach to alternative investment systems can support your private equity or venture capital firm’s growth.

More About The Author

Kamil Godlewski

Product Manager

Kamil Godlewski is a product manager at Allvue Systems, a leading provider of investment management solutions. He has over 15 years of experience in finance and sales, working with various clients in the alternative investment space with an emphasis on private equity. He has a MBA in finance from Indiana University's Kelley School of Business and is a previous CPA license holder.