By: Kimberly Kale

Head of Product - Back Office

August 19, 2022

K-1 reporting is a mission-critical hassle. Whether the markets go your way or turn in strange directions, LPs need accurate reports and the IRS requires them. While preparing K-1s is always a challenge part of investor reporting, the process can be made easier with an integrated technology platform.

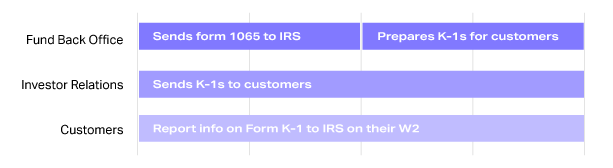

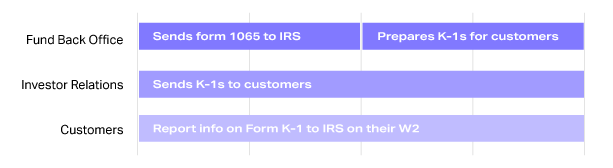

There are three main processes to deliver K-1 statements to investors:

- a system to calculate and generate the document,

- a way to keep track of investors and contacts, and

- a mechanism to securely deliver the statements.

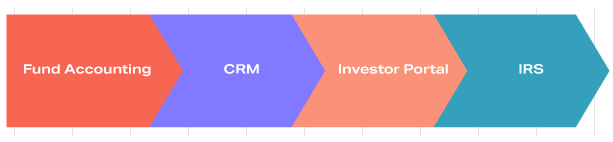

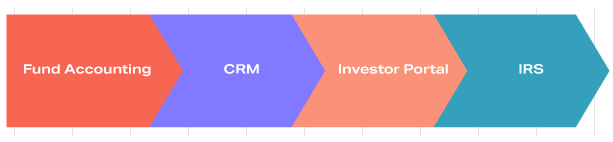

We have seen so many ways that GPs and fund administrators have configured this process over the years. There is no one right approach, as several pieces of technology play a part. As long as the applications can integrate the fund accounting, investor relations, and form delivery, clients will have the information they need for their tax filings.

READ NOW: OUR GUIDE TO INVESTOR REPORTING

Generating K-1s from the Accounting System

For many years, Excel has been the de facto fund accounting tool. It stores data and runs calculations to generate cap calls, distribution notices, and K-1s. It’s cheap and quick, so many funds set up their private equity reporting in Excel when they are in start-up mode. Excel works well – for a while. When GPs grow their assets and double and triple their investor base, Excel begins to break down as a fund accounting and reporting tool. Errors not only accumulate but accelerate whenever faulty cells are copied or numbers are transposed. Creating client reports involves manual processes, and time to completion begins to increase. In no time, funds find themselves with millions of dollars in AUM, hundreds of investors, and slipped deadlines because they are trying to generate critical documents in a cheap spreadsheet app.

As they outgrow Excel, some firms opt for industry-agnostic accounting packages like QuickBooks or Sage. These put data into a structured format. However, these systems are not designed for the private capital industry, so they cannot handle all the specific processes needed to generate K-1s and related forms, even with bespoke configuration. The data is more trustworthy than it is in a spreadsheet, but the K-1 reporting process continues to take up time and other resources.

Excel is cumbersome and error prone. Off-the-shelf accounting systems cannot handle all K-1 processes.

To add to the challenge, investor relationships come in a range of legal structures. Some folks need a K-1, but others don’t. An off-the-shelf system that can’t differentiate will lead to extra work as fund structures become more complex.

Accurate K-1 Reporting is a Key Component of Investor Management

Producing K-1s is only half the battle for GPs. The next step is to get the right K-1 to the right LP so that the LPs can meet their reporting requirements. Fund managers often have hundreds of investors across numerous funds and vehicles. Some funds still stuff envelopes and take them to the post office, but there are more modern approaches. Some GPs use email tools such as Outlook to manage investor communications, which still involves manual processes to ensure that hundreds of investors receive their unique form so that they can meet their tax-filing obligations.

CRMs are a significant improvement over email tools. They have far more features for K-1 reporting customization and workflows, but not all CRMs are equal. Key differences are in how they integrate with the other processes and solutions, most notably in the use of an investor portal. An end-to-end system can ensure that the date is correct and that the right reports go to the right person. For example, Allvue’s maker-checker functionality allows one person to create reports and another person to review them, in the same platform, making it easy to ensure accuracy in a complex environment.

Delivering Accurate Information to Investors

Before GPs realized the full benefits that an investor portal can bring to both GPs and LPs, Virtual Data Rooms (VDRs) were used to documents to investors. Originally designed for M&A, VDRs were re-purposed for fund managers to send cap calls, distribution notices and tax statements to their LPs. However, VDRs lack many important features offered by a dedicated investor portal. In particular, VDRs lack integration between the report generation (fund accounting) and Investor management (CRM) processes.

READ MORE: What does the future of LP reporting look like?

Why is integrating the three processes described here so important for tax and other types of reporting?

- The data sharing ability between various applications (and processes) drives efficiency in both the back office and IR.

- If Excel is used to export, map, and import data between systems, repots will be delayed by broken links and errors.

- The more investors, entities, and funds a manager has, the more complexity and reporting volume. A siloed application infrastructure, where data cannot be passed easily from one system to another, will certainly struggle to keep pace.

See How Allvue Can Streamline Your Reporting Obligations

With the number of responsibilities that the back office has, particularly these days, fund managers are looking to automate as much of their reporting as possible. K-1 and investor reporting are no exception. Request a demo to find out how Allvue Systems’ Fund Accounting solution can simplify your back-office workflows and ensure that LPs and the IRS get the information they need when they need it.

More About The Author

Kimberly Kale

Head of Product - Back Office

Kimberly is responsible for back office product management at Allvue. She joined Allvue’s predecessor, AltaReturn, in 2009 and has over 25 years of software management, including 18 years servicing the alternative investments industry. Prior to joining AltaReturn, Kimberly spent seven years with FIS/Investran, first in New York, and then transferring to London to manage the EMEA implementation team. She began her career at KPMG Public Services practice in Washington, DC, and moved on to implement ERP solutions for various insurance and healthcare clients. Kimberly holds a Bachelor’s degree from Vanderbilt University and is currently based in Allvue’s Miami headquarters.